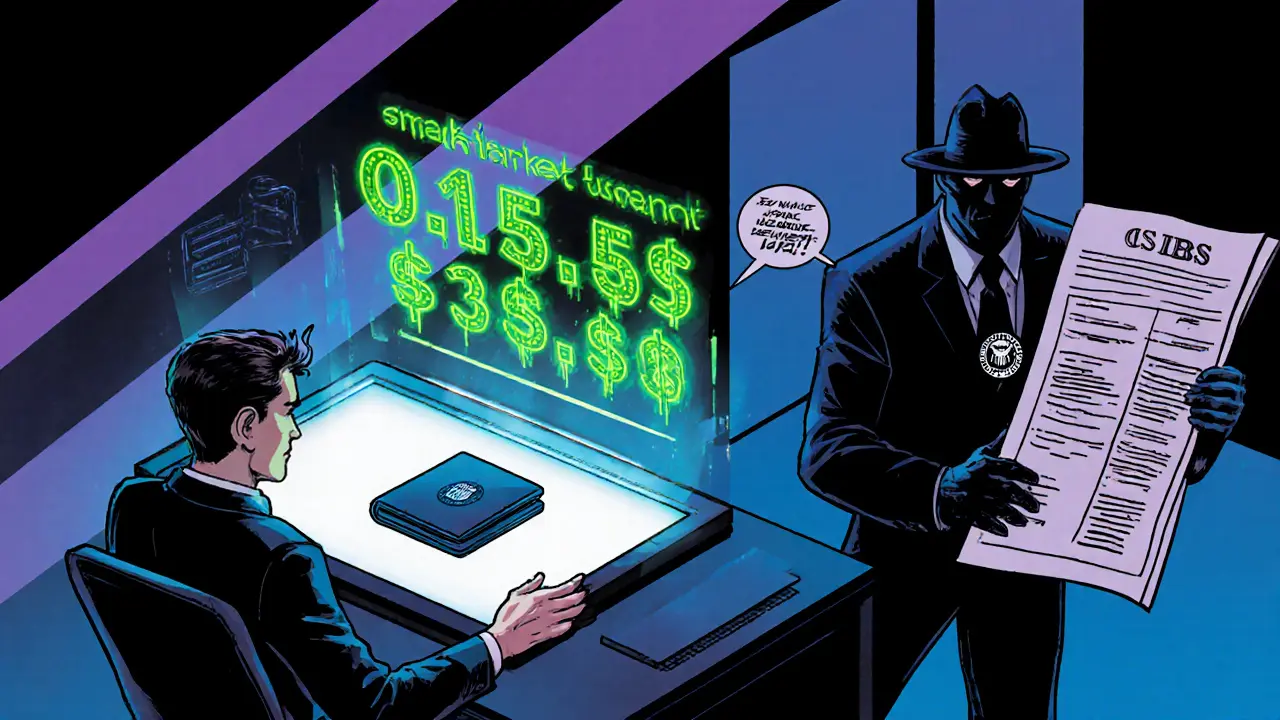

Cryptocurrency Staking Tax: What You Need to Know

When dealing with cryptocurrency staking tax, the set of rules that require you to report income earned from staking digital assets. Also known as staking tax, it matters for anyone who earns passive rewards by locking up coins on a proof‑of‑stake network. In most jurisdictions the tax authority treats those rewards as ordinary income at the moment they are received, and then as a capital asset when you later sell or trade them. Ignoring this can lead to penalties, so understanding the basics saves you headaches and money.

Key Concepts That Shape Your Staking Tax Obligations

First, staking rewards, the tokens you earn for helping secure a network are counted as taxable income the day they are credited to your wallet. The fair market value in your local currency at that moment becomes the taxable amount. Second, tax reporting, the process of filing a tax return that includes crypto income requires you to keep detailed records: dates, amounts, and the price of each reward. Third, when you eventually dispose of those staked tokens – whether you sell, swap, or use them – capital gains, the profit or loss from the change in value between acquisition and disposition come into play. Many taxpayers miss this second tax event and end up under‑reporting.

These three entities interact in a clear chain: staking rewards generate taxable income, tax reporting captures that income, and capital gains capture any subsequent price movement. For example, if you earned 100 XYZ tokens when each was worth $2, you report $200 as income. If a year later you sell the 100 tokens for $3 each, you have a $100 capital gain that must also be reported. The tax authority sees the whole lifecycle, so you need to track both events. That’s why a good spreadsheet or a dedicated crypto tax tool becomes essential – it lets you link the reward date to the later sale date without guessing.

Regulatory environments differ, but most major economies follow a similar pattern. The United States treats staking rewards as ordinary income under IRC § 61, while the United Kingdom classifies them as “other income” for self‑assessment. In the EU, each member state adapts the EU directive on crypto‑asset taxation, often labeling staking income as “miscellaneous income.” Knowing the specific rules in your country helps you pick the right reporting form – for instance, the US Form 1040 Schedule 1, the UK Self‑Assessment SA100, or the Australian ATO capital gains schedule. If you’re unsure, a tax professional familiar with crypto can prevent costly mistakes.

Now that you’ve got the core concepts, the next step is to apply them to your own portfolio. Below you’ll find a curated set of articles that walk through real‑world examples, compare tax software, break down country‑specific rules, and share bookkeeping tips. Whether you’re a casual staker or run a large validator operation, these resources give you actionable insights to stay compliant and keep more of your earnings.