- Home

- Cryptocurrency

- COINSPACE Crypto Exchange Review - Safety, Fees, and How It Stacks Up

COINSPACE Crypto Exchange Review - Safety, Fees, and How It Stacks Up

COINSPACE Crypto Exchange Risk Calculator

COINSPACE is an unregulated cryptocurrency exchange that claims to offer "free" services but may impose hidden fees. This tool helps assess the risks involved in using such platforms compared to regulated exchanges.

Risk Assessment Results

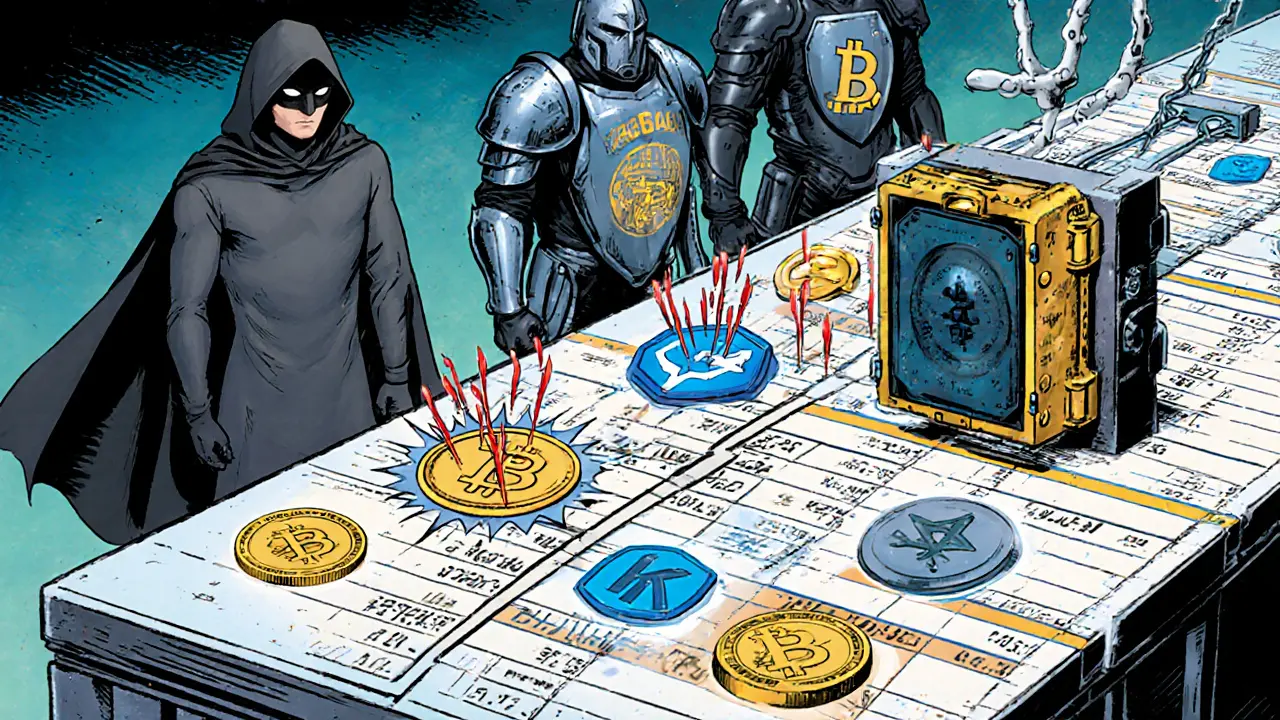

When you hear the phrase COINSPACE crypto exchange review, you probably wonder if the service lives up to its “free‑forever” promises. COINSPACE is a cryptocurrency wallet and exchange platform that markets itself as a free‑to‑use solution for storing and trading digital assets. The company operates under several brand names-including “Coin Space Wallet” and “Coinspace Ltd”-which adds a layer of confusion about its corporate structure and regulatory status.

What the Platform Says It Does

The official tagline reads: “to give the unbanked a chance to have similar financial rights and freedoms as the rest of the world does.” In practice, the service offers a mobile‑first interface where users can hold dozens of coins, swap between them, and send funds to external wallets without paying any listed transaction fees. The marketing copy repeatedly stresses that there are no hidden charges and that you “don’t need an additional cold storage wallet.”

Regulatory Red Flags

BrokerChooser a brokerage safety analysis firm has placed COINSPACE on its warning list, stating that the platform is “not regulated by a top‑tier financial authority.” The firm’s methodology relies on data from global regulator watch‑lists, meaning the warning is not merely opinion but based on official supervisory records. Without registration with a recognized regulator-such as the US SEC, FCA, or ASIC-users have limited legal recourse if their funds disappear.

Similarly, BitTrust.org a crypto review aggregator gives a composite rating of 4.09/5 based on 22 reviews. While the number looks decent, the small sample size and mixed sentiment suggest the rating should be taken with caution, especially when juxtaposed with the regulatory concerns highlighted above.

Fee Structure - The Fine Print

COINSPACE advertises zero transaction fees, but real‑world accounts tell a different story. A user named Paul (January2021) reported that outbound transfers were charged an extra 0.00258BTC over the network’s miner fee-a cost sufficient to buy a basic hardware wallet. This hidden markup directly contradicts the platform’s “free” claim and raises questions about how the service stays afloat without visible revenue streams.

In contrast, major regulated exchanges disclose clear fee tiers. For example, Coinbase a US‑regulated crypto exchange charges 0‑3.99% depending on the trade size; Kraken another regulated platform caps fees at 0.4%; and Binance US the US‑focused arm of Binance stays between 0‑0.6%.

Feature Comparison Table

| Feature | COINSPACE | Coinbase | Kraken | Binance US |

|---|---|---|---|---|

| Regulatory status | Unregulated (no top‑tier regulator) | Registered with US SEC & FINRA | Registered with US FinCEN & EU regulators | Registered with US FinCEN |

| Trading fees (taker) | Advertised 0% (hidden ~0.1‑0.2% observed) | 0‑3.99% | 0‑0.4% | 0‑0.6% |

| Withdrawal fee (BTC) | Variable - often above miner fee | Network fee + $0.99 | Network fee only | Network fee only |

| Supported assets | ~30 major coins | 235+ coins | 350+ coins | 158+ coins |

| KYC / AML | Basic email verification only | Full KYC (ID, address) | Full KYC | Full KYC |

Pros and Cons - At a Glance

- Pros

- Simple mobile UI that beginners find easy to navigate.

- Zero‑fee marketing attracts cost‑sensitive users.

- Supports a decent range of popular coins for a lightweight wallet.

- Cons

- Lack of regulation means no consumer protection or compensation scheme.

- Hidden withdrawal fees contradict the “free” promise.

- Limited transparency about corporate ownership and revenue model.

- Basic KYC can be a double‑edged sword - easy onboarding but also less security against fraud.

Real‑World User Experiences

Positive feedback focuses on the intuitive design. Gregory L. Fuller (Oct2020) praised the “universal service” and noted swift withdrawals without loss of funds. However, such anecdotes are outnumbered by cautionary stories. Paul’s fee complaint and other users reporting “unexpected extra charges” suggest a pattern of undisclosed costs.

Should You Trust COINSPACE?

If you value absolute security, a clear legal framework, and transparent pricing, the answer leans toward “no.” The platform’s unregulated status, inconsistent fee disclosures, and limited review coverage make it a high‑risk choice compared to the well‑established, regulator‑approved alternatives listed above.

That said, if you’re experimenting with small amounts, need a quick on‑the‑go wallet, and are comfortable accepting the risk of limited recourse, COINSPACE can serve as a lightweight bridge between holding and trading. Just keep the amount modest and be prepared for potential hidden fees.

Quick Takeaways

- COINSPACE is an unregulated crypto wallet/exchange that markets itself as fee‑free.

- BrokerChooser and other safety analysts flag it for lack of regulator oversight.

- User reports reveal hidden withdrawal fees that can erode small balances.

- Compared to Coinbase, Kraken, and Binance US, COINSPACE lags on asset variety, security guarantees, and transparent pricing.

- Use only for low‑value testing; for serious trading, choose a regulated exchange.

Frequently Asked Questions

Is COINSPACE regulated in any country?

No. COINSPACE does not hold a licence from any top‑tier financial regulator such as the SEC, FCA, or ASIC. This means there is no official oversight of its operations or user funds.

What fees does COINSPACE actually charge?

While the platform advertises 0% trading fees, users have reported extra charges on withdrawals that exceed the blockchain’s miner fee-often around 0.1‑0.2% of the transferred amount. There is no published fee schedule, so costs can vary.

Can I recover funds if COINSPACE goes offline?

Recovery options are limited. Because the service is unregulated, there is no insurance or compensation scheme. Users should treat any funds on COINSPACE as high‑risk and keep only amounts they can afford to lose.

How does COINSPACE compare to Coinbase on security?

Coinbase is registered with multiple regulators, employs cold storage for the majority of user funds, and offers insurance on digital assets held in its custodial wallets. COINSPACE lacks such safeguards, relying solely on the app’s internal storage, which makes it less secure.

Is there a better free alternative?

For a truly free‑to‑use wallet, you can consider hardware wallets combined with decentralized exchanges (DEXs) like Uniswap, though transaction fees still apply on the blockchain. If you need an exchange with zero trading fees, look for promotional periods on regulated platforms rather than a permanently unregulated service.

Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

Popular Articles

22 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

Reading through the review, I can't help but reflect on the paradox of “free” services in the crypto world. The promise of zero fees often masks hidden costs, which reminds me of the old adage: if something sounds too good to be true, it probably is. While COINSPACE offers a sleek mobile interface, the lack of regulatory oversight introduces a philosophical dilemma about trust and responsibility in decentralized finance. Users should weigh convenience against the existential risk of losing control over their assets without any legal recourse.

Wow COINSPACE really thinks it can outshine the big boys? Look, if you value your money you should stay with exchanges that have actual oversight – not some rogue app that pretends to be "free forever" and then sneaks you fees like a thief in the night. The whole thing is a gimmick and anyone not reading the fine print ends up paying more than they'd expect.

Hey folks, just wanted to say that if you're experimenting with tiny amounts, COINSPACE can be a handy bridge. It's super easy to use, and for low‑stakes testing you probably won't notice the hidden fees. Still, keep most of your capital on a regulated platform where you get insurance and better support.

Listen, the moment you hand over control to an unregulated service, you open the door to potential surveillance and data harvesting. The "basic email verification" feels like a front‑row seat for anyone wanting to tap into user info. Plus, if the platform ever disappears, you won't have any legal protection whatsoever. It's a perfect storm for those who love drama but hate real security.

👍 If you decide to dip your toes, think of COINSPACE as a sandbox. Use it to learn the mechanics of swapping, but keep the bulk of your portfolio in a wallet with multi‑sig protection. The community vibe is nice, but remember the saying: "Never trust a free lunch unless you know who's cooking it."

From a cultural perspective, COINSPACE tries to position itself as the democratizer of finance, yet it overlooks the importance of consumer protection that many users expect. While the UI is friendly, the underlying risk profile puts users in a vulnerable position, especially those new to crypto.

Whoa, the hidden withdrawal fees are like a surprise party you didn't ask for-except it's your money disappearing. I've seen users post screenshots of extra charges that look like random numbers, and it adds up fast. If you're testing small trades, fine, but scale up and you might feel the sting.

From an analytical standpoint, the platform's architecture appears to be a black box. No transparent fee schedule can be interpreted as an intention to obfuscate profit streams. In the ecosystem of regulated exchanges, COINSPACE's opacity is a red flag for risk‑averse participants.

Just a friendly heads‑up: if you love the simplicity but worry about fees, keep your trades tiny. I’ve been using it for a few weeks and haven’t hit any major surprises yet, but I stay cautious.

Hey everyone, I think it's great that COINSPACE tries to make crypto accessible, but the lack of regulation means we have to be more vigilant. Use it as a learning tool, not as a vault for large sums.

Agreed, the platform can be useful for quick swaps, but remember that the safety net you get from regulated exchanges is missing here.

In my view, the risk‑reward ratio tilts heavily toward risk. Unless you have a strong reason to choose COINSPACE over a regulated alternative, it's hard to justify the gamble.

One must ponder the epistemological implications of trusting a platform that resides in the shadows of regulatory frameworks. The allure of a frictionless experience may tempt the unwary, yet history is replete with cautionary tales of unregulated entities collapsing without a trace.

Bottom line: for small, experimental trades COINSPACE can work, but for anything serious you should stick with a licensed exchange.

It is incumbent upon each prospective user to interrogate the ethical dimensions of entrusting one's financial sovereignty to a platform that operates outside the ambit of any recognized supervisory authority. The rhetoric of "free‑forever" is, in reality, a seductive veneer that belies the underlying cost structure, which, as the evidence from user testimonies shows, manifests in hidden withdrawal fees that erode capital with a subtle yet inexorable creep. Moreover, the absence of a legal safety net translates into a precarious position wherein the user bears the full brunt of any potential malfeasance or operational failure. One must also consider the psychological impact of such uncertainty; the stress engendered by the knowledge that one's assets are not protected can impair rational decision‑making and foster a climate of anxiety. While the user interface may be lauded for its aesthetic simplicity, such superficial commendations cannot compensate for the profound risk exposure inherent in an unregulated ecosystem. In sum, the decision to employ COINSPACE should be circumscribed to the most modest of experimental forays, with a resolute commitment to promptly migrate any substantive holdings to a jurisdictionally compliant exchange, thereby safeguarding against the manifold perils that accompany the current model.

From a coaching standpoint, I would advise newcomers to keep their exposure on COINSPACE limited to negligible amounts. Should you desire robust protection and transparent fee structures, a regulated exchange is unquestionably preferable.

Honestly, the whole "free" narrative is just a marketing ploy. If you really want zero fees, look for promotional periods on the big players. COINSPACE just tries to ride the hype without delivering real value.

Just a gentle reminder: enjoy the convenience, but keep your risk low. A small test here, a solid exchange there, that's the sweet spot.

Listen! If you are thinking about using COINSPACE for anything bigger than testing the waters, STOP RIGHT NOW! The hidden fees are like a stealth tax that drains your balance slowly but surely! Stay safe and use regulated platforms! Your future self will thank you.

The veneer of openness that COINSPACE projects is, in effect, a meticulously crafted smokescreen designed to deter rigorous scrutiny. By eschewing any form of transparent governance, the platform inserts itself into a category of entities that thrive on opacity, thereby exposing users to a spectrum of latent liabilities that are neither quantifiable nor easily mitigated. In the broader context of market dynamics, such entities contribute to systemic uncertainty, eroding trust in the digital asset ecosystem at large.

Bottom line: avoid it if you care about your money.

In a formal appraisal of COINSPACE's operational paradigm, one must unequivocally acknowledge the conspicuous absence of regulatory endorsement, which inexorably precipitates a heightened exposure to fiduciary peril. The ostensibly "free" fee structure is, upon meticulous examination, a facade that obfuscates ancillary charges, thereby contravening the principles of transparent commerce. Consequently, it is incumbent upon discerning investors to eschew such platforms in favor of institutions adhering to established compliance frameworks.