Argentine Peso (ARS): Inflation, Exchange Rates & Crypto Alternatives

When talking about Argentine peso, the official fiat money of Argentina, identified by the ISO code ARS. Also known as ARS, it has faced high inflation and volatile exchange rates for years. Fiat currency a government‑issued money not backed by physical commodities works hand‑in‑hand with monetary policy, while cryptocurrency digital assets that use blockchain to secure transactions has emerged as a hedge against local price spikes. Stablecoin a crypto token pegged to a stable asset, often the US dollar bridges the gap, giving Argentinians a way to store value without leaving the digital world.

Why the Argentine Peso Matters

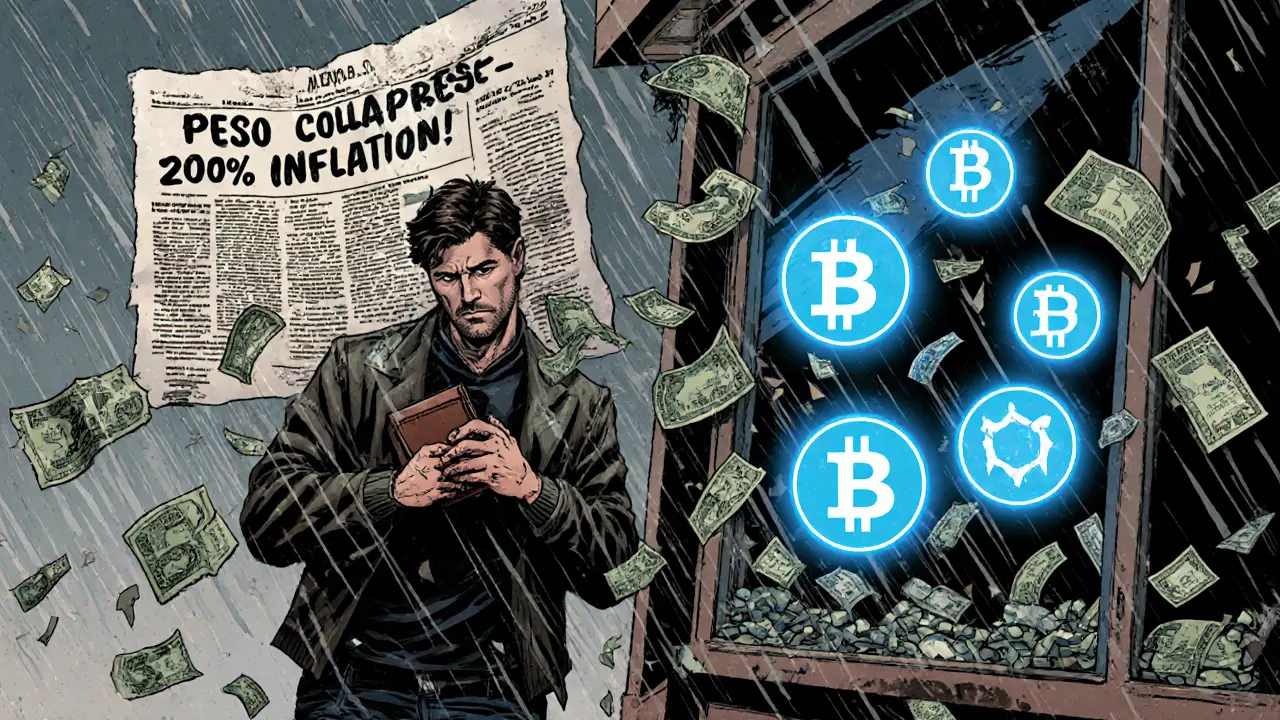

The Argentine peso encompasses inflation pressures that erode purchasing power daily. Inflation drives people to seek alternatives that preserve savings, and the exchange rate becomes a daily headline: the peso often loses value against the US dollar within hours. This environment forces the central bank—another key entity—to intervene with interest‑rate hikes, currency controls, and occasional devaluations. Each policy shift influences both the local fiat market and the appetite for crypto assets, creating a feedback loop where higher inflation fuels greater crypto adoption.

Understanding the exchange rate is crucial. The peso‑dollar pair is constantly monitored by traders, businesses, and everyday shoppers. When the rate spikes, import prices surge, and even basic groceries become more expensive. This volatility prompts many Argentinians to turn to cryptocurrency as a quick way to move money across borders without hefty fees. Platforms that support quick conversions to stablecoins like USDT or DAI become popular, because they let users lock in dollar‑level value while staying inside a digital wallet.

Regulation shapes the landscape as well. The Argentine government has introduced tax rules for crypto gains, while also exploring a digital version of the peso—an official Central Bank Digital Currency (CBDC). A CBDC would be a state‑backed digital token, blending the trust of fiat with the speed of crypto. Until such a system rolls out, private stablecoins fill the void, offering faster, cheaper transactions for remittances and online purchases.

Crypto adoption isn’t just about avoiding inflation. It also opens doors to decentralized finance (DeFi) services that were previously inaccessible. Yield farming, staking, and peer‑to‑peer lending let Argentinians earn interest on assets that would otherwise sit idle in a low‑yield savings account. This potential for higher returns further fuels interest in cryptocurrency and stablecoins, especially among younger investors looking for alternative income streams.

On the practical side, many local exchanges now list stablecoins paired with the Argentine peso, providing a familiar trading environment. Users can deposit ARS, purchase a stablecoin, and instantly hedge against local price swings. These exchanges also offer tools to track real‑time exchange rates, inflation indices, and crypto market data, all in one dashboard. This integration simplifies the decision‑making process for anyone weighing the pros and cons of swapping pesos for digital assets.

However, it’s not all smooth sailing. Crypto markets bring their own risks: price volatility, regulatory uncertainty, and the potential for scams. While stablecoins aim to stay pegged to the US dollar, not all maintain that peg perfectly, especially during market stress. Understanding tokenomics, reserve audits, and platform security is essential before committing funds.

For businesses, the exchange rate volatility affects pricing, payroll, and supply chain costs. Some firms have started invoicing in stablecoins to lock in dollar value, reducing the need for constant currency conversion. This practice also eases cross‑border payments, cutting out traditional banking delays and fees.

In summary, the Argentine peso sits at the intersection of high inflation, exchange‑rate turbulence, and a growing crypto ecosystem. The interplay between fiat, stablecoins, and regulatory moves creates a dynamic environment where each entity influences the others. Whether you’re a consumer protecting savings, an investor seeking returns, or a business navigating costs, understanding these connections is key to making informed choices.

Below you’ll find a curated collection of articles that dive deeper into each of these topics— from detailed guides on how to buy and store stablecoins, to analyses of Argentina’s monetary policy and its impact on crypto markets. Explore the posts to see practical steps, real‑world examples, and the latest trends shaping the Argentine peso’s future.