- Home

- Cryptocurrency

- Argentine Peso Instability Fuels Crypto Adoption

Argentine Peso Instability Fuels Crypto Adoption

Dollar Purchase vs. Stablecoin Calculator

Currency Conversion Comparison

Calculate how much value you'd preserve by using stablecoins versus official dollar purchases in Argentina.

Results

Calculated atOfficial Dollar Purchase (Max): Up to $0.00 at the official rate

Official Dollar Purchase (Actual): $0.00 (capped at $200.00)

Stablecoin Value (Blue Rate): $0.00

Savings potential:

$0.00 lost to restrictions

Why Stablecoins Win in Argentina

Monthly Limit

Official Dollars: $200.00 (capped)

Stablecoins: Unlimited (subject to exchange KYC)

Exchange Rate

Official Dollars: Fixed rate

Stablecoins: Market-driven (near blue dollar rate)

Transaction Speed

Official Dollars: Days for bank processing

Stablecoins: Seconds to minutes

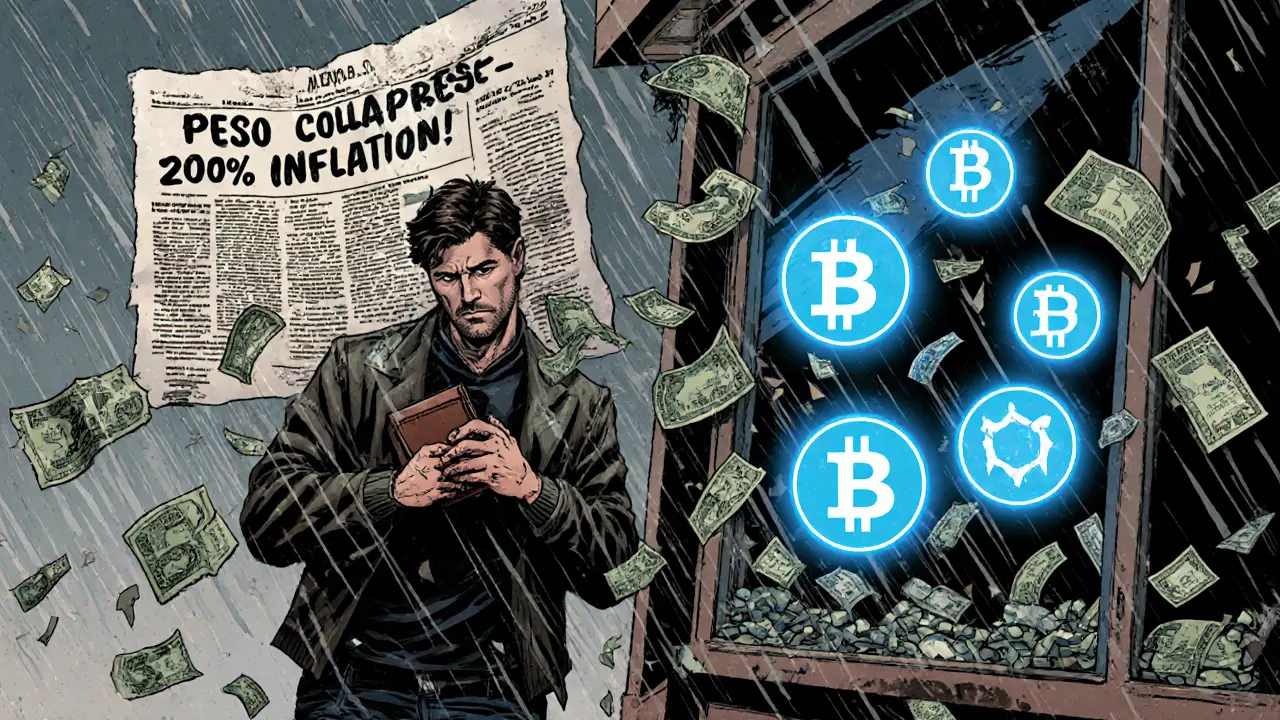

When the Argentine peso is a managed currency that has faced hyperinflation and sharp devaluation since 2022, many Argentines have turned to digital alternatives. The peso’s exchange rate now swings between 948 and 1,475 per US dollar, and the central bank has burned through more than $1 billion trying to steady the market. If you’ve ever tried buying groceries with a currency that loses half its value in months, you’ll understand why the search for a steadier store of value feels urgent.

Why the crisis is a catalyst for crypto adoption

Inflation topped 200 % in 2023, and official channels only let residents buy $200 worth of US dollars each month at the official rate. Anything beyond that pushes you into the “blue dollar” market, where the exchange rate can be double the official one. This bottleneck creates a perfect storm: people need a way to keep their money from eroding, but the legal system won’t let them do it easily.

Enter cryptocurrencies. They offer two things the peso system can’t: (1) a hedge against inflation, and (2) borderless, instant movement of value. For most Argentines, the first step is swapping pesos for a digital dollar‑pegged token rather than a physical one.

Stablecoins dominate the scene

Data from Chainalysis shows that 89 % of all crypto activity on centralized exchanges in Argentina goes straight into stablecoins. That makes Argentina the second‑largest stablecoin market in Latin America, right after Colombia, which sits at 99 %.

The three king‑size stablecoins are USDT the Tether token, pegged 1:1 to the US dollar, USDC USD Coin, backed by fully audited reserves and DAI a decentralized, collateral‑backed stablecoin built on Ethereum. Users love DAI because its collateral ratios are posted on‑chain, giving a transparency that traditional banks lack.

On September 14 2024, Lemon, a home‑grown exchange, reported its highest daily stablecoin volume ever-an unmistakable spike that lined up with a week of political turbulence.

Bitcoin’s growing role as a long‑term hedge

While stablecoins are the go‑to for day‑to‑day transactions, Bitcoin is carving out a niche as a wealth‑preservation tool. Lemon’s latest figures show more Argentines now hold Bitcoin than any other crypto‑dollar token on the platform, signaling a shift from short‑term payments to a genuine store of value.

Bitcoin’s supply cap and global acceptance make it attractive when the peso feels like a sinking ship. Users report that even if the price swings wildly, the upside over years far outweighs the loss from a depreciating peso.

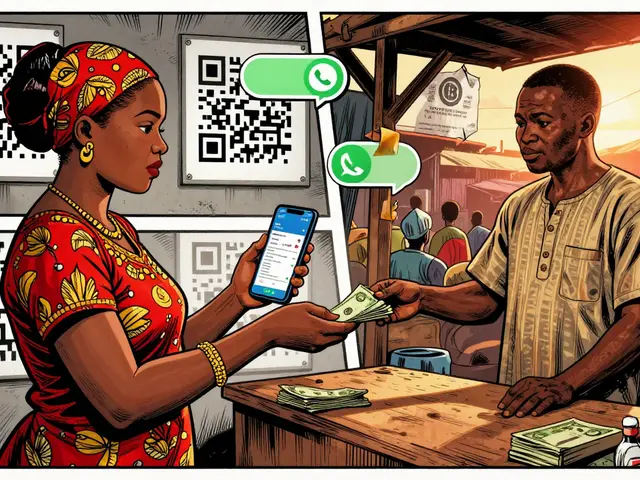

How real people are using crypto

- Everyday purchases: Small merchants accept USDT via QR codes, letting customers pay for coffee without touching the bank.

- Remittances: Families receiving money from abroad use stablecoins to bypass costly wire fees and the blue‑dollar spread.

- Business operations: Importers pay Brazilian suppliers through cross‑border payment apps that settle in stablecoins, avoiding conversion fees.

- Saving against inflation: Households move a portion of their salary into DAI every payday, preserving purchasing power over months.

Reddit threads from Argentine users repeatedly mention “instant transactions” and “no limits” as the biggest wins. The downsides-regulatory uncertainty and occasional exchange hacks-are noted, but most users treat crypto as essential infrastructure, not a speculative gamble.

Stablecoins vs. official dollar purchases: a side‑by‑side look

| Feature | Stablecoins (USDT/USDC/DAI) | Official Dollar Purchase |

|---|---|---|

| Monthly limit | Unlimited (subject to exchange KYC) | $200 per person |

| Exchange rate | Market‑driven, often near blue‑dollar rate | Official rate only |

| Transaction speed | Seconds to minutes on blockchain | Days for bank processing |

| Accessibility | Smartphone app, minimal technical skill | Bank branch or online portal |

| Regulatory risk | Evolving VASP licensing, but operational | Fully regulated but capped |

The table makes it crystal clear why, when the peso wobbles, stablecoins become the default choice. They give Argentines the freedom to hold a dollar‑equivalent without waiting for a bank clerk.

Regulation and the sandbox approach

The Argentine government isn’t blind to the shift. It introduced a regulatory sandbox in 2023 and now grants licenses to VASPs (Virtual Asset Service Providers). This move gives platforms like Lemon a legal foothold while still leaving room for innovation.

Industry voices, such as Ignacio Gimenez from Lemon, argue that “electoral uncertainty is driving Argentines to seek refuge in currencies stronger than the peso, such as the crypto dollar.” At the same time, the Milken Institute warns that if inflation continues above 100 % annually, crypto could become a parallel financial system rather than a side hobby.

Future outlook: will the trend stick?

Analysts agree on one thing: as long as the peso remains volatile, crypto adoption will keep climbing. Predictions for 2026 suggest stablecoin transaction volume could surpass $120 billion, overtaking Brazil’s fiat‑crypto mix.

Potential game‑changers include:

- Cross‑border payment bridges: Brazil’s PIX system is already being integrated into Argentine fintech apps, letting tourists pay in stablecoins without conversion fees.

- Institutional VASP growth: More licensed exchanges mean greater consumer confidence and easier fiat on‑ramps.

- Policy shifts: If the central bank succeeds in capping inflation, the urgency to move money off‑shore could wane-but that seems unlikely in the short term.

In short, crypto in Argentina is less a speculative craze and more a practical response to an entrenched economic problem.

Quick takeaways

- Hyperinflation (>200 % in 2023) and strict capital controls push citizens toward digital dollars.

- Stablecoins account for 89 % of crypto exchange volume, making Argentina a regional leader.

- Bitcoin is gaining ground as a long‑term store of value.

- Regulatory sandbox and VASP licenses are bringing legitimacy to the market.

- Future growth hinges on continued peso instability and cross‑border fintech integration.

Why do Argentines prefer stablecoins over buying US dollars at the official rate?

Official美元 purchases are capped at $200 per month and lock you into a fixed exchange rate that often lags the market. Stablecoins let you convert any amount of pesos instantly, at rates close to the parallel “blue dollar,” and they have no monthly limits.

Which stablecoin is most popular in Argentina and why?

USDT leads the pack because it’s widely accepted on local exchanges and has deep liquidity. DAI is a close second for users who value on‑chain transparency of collateral.

Can I use crypto to pay for everyday items like groceries?

Yes. Many small merchants accept USDT via QR codes or payment apps. Transactions settle in seconds, so both buyer and seller avoid the peso’s volatility.

What are the main regulatory risks for Argentine crypto users?

Regulators are still shaping VASP licensing rules. While licensed platforms operate legally, future policy shifts could affect fees, tax reporting, or even restrict certain tokens.

Is Bitcoin a better hedge than stablecoins?

Stablecoins keep you pegged to the US dollar, which already outperforms the peso. Bitcoin adds upside potential because it can appreciate against the dollar, but it also brings higher price volatility.

Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

Popular Articles

16 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

The peso's collapse makes stablecoins the obvious alternative for everyday transactions. With official dollar limits, people are forced to look elsewhere.

Argentina's monetary policy, with its relentless printing, has driven citizens to seek refuge in crypto; the numbers speak for themselves, 89 % of exchange volume now flows into stablecoins, and the trend shows no sign of reversal. The central bank's attempts to shore up the peso are futile, and the market adapts accordingly.

Yo, the crypto wave in Argentina is off the charts, and it's not just hype. People are dumpin' pesos for USDT and DAI like there's no tomorrow. The inflation numbers are cray, so they gotta protect their savings. Definately, this is more than a fad.

Relying on unregulated tokens is reckless. The state needs to step in.

Your post glosses over the real risk of exchange hacks.

I grew up watching my grandparents struggle every time the peso took a nosedive. When I finally got my first smartphone, I discovered stablecoins could be bought with a few clicks. The first time I paid for a coffee with USDT, the barista smiled and the transaction cleared in seconds. That moment felt like a tiny rebellion against a system that had been starving us for years. Since then, I allocate a slice of my paycheck to DAI every payday, watching the on‑chain collateral ratios for peace of mind. My sister, who runs a small import business, now settles invoices with Brazilian partners via stablecoins, cutting out the middleman banks. During the recent political turbulence, we all saw a spike in Lemon's stablecoin volume, confirming that crisis fuels adoption. Even my cousin, who was skeptical about crypto, now uses a QR code to receive USDC from his brother living in Spain. The speed of these transactions-seconds, not days-means I can buy groceries without worrying about the next inflation report. I also keep a small amount of Bitcoin as a long‑term hedge, trusting its capped supply to preserve wealth over the years. When the peso depreciates by 20 % in a month, that Bitcoin slice feels like a lifeline. Regulatory news about the sandbox doesn’t scare me; it actually gives confidence that platforms can operate legally. What worries me more is the possibility of future capital controls tightening even further. If that happens, the crypto ecosystem we’ve built will become even more critical for everyday life. In the end, crypto isn’t a gamble for me; it’s a practical tool to survive the economic roller coaster.

It’s clear that the peso’s volatility is pushing people toward digital assets; the data backs this up, and we can’t ignore the reality. Stablecoins provide the liquidity that the official market denies. Bitcoin adds a speculative edge, but its core value remains as a hedge.

I'm fascinated by how quickly the community adopted stablecoins, and the speed of transactions is impressive :) The use cases listed feel like a blueprint for financial resilience. It shows how technology can fill gaps left by failing fiat policies.

The formal adoption of VASP licensing marks a significant regulatory milestone, and it may encourage broader participation. Nevertheless, the underlying monetary instability persists, compelling users to seek alternatives. Consequently, crypto will likely remain a cornerstone of personal finance in Argentina.

From a fintech perspective, the surge in on‑chain liquidity mirrors a classic liquidity‑crunch mitigation strategy; indeed, the substitution rate of fiat‑denominated assets with algorithmic stablecoins is unprecedented, particularly within emerging markets-Argentina being a prime exemplar. The market‑making dynamics induced by decentralized exchanges, coupled with the arbitrage opportunities presented by the blue‑dollar spread, catalyze a feedback loop that reinforces adoption. Moreover, the compliance frameworks being introduced via the sandbox model align with AML/KYC best‑practice standards, thereby fostering institutional confidence. In sum, the confluence of macro‑economic pressure, technological readiness, and regulatory evolution creates a fertile environment for crypto to flourish.

The shift to stablecoins feels logical given the limits on official dollars. It’s just another adaptation to a harsh economy.

Looks like you’ve captured the excitement well; keeping an eye on the fundamentals will help newcomers navigate the volatility.

Oh sure, because trusting an unregulated token is exactly what you want when your savings are evaporating-yeah, right!!! The irony of calling it ‘stable’ when the peso is anything but stable is deliciously tragic.

While the concerns raised are valid, I must emphasize that the ethical implications of promoting unvetted financial instruments are serious; regulatory oversight must precede widespread adoption to protect vulnerable populations.

What most people don’t realize is that the push for crypto is backed by shadowy interests aiming to destabilize traditional banking; the narrative of financial freedom is a convenient smokescreen.

Your personal story illustrates the human side of this macro trend perfectly; it underscores why community education is essential for broader crypto literacy.