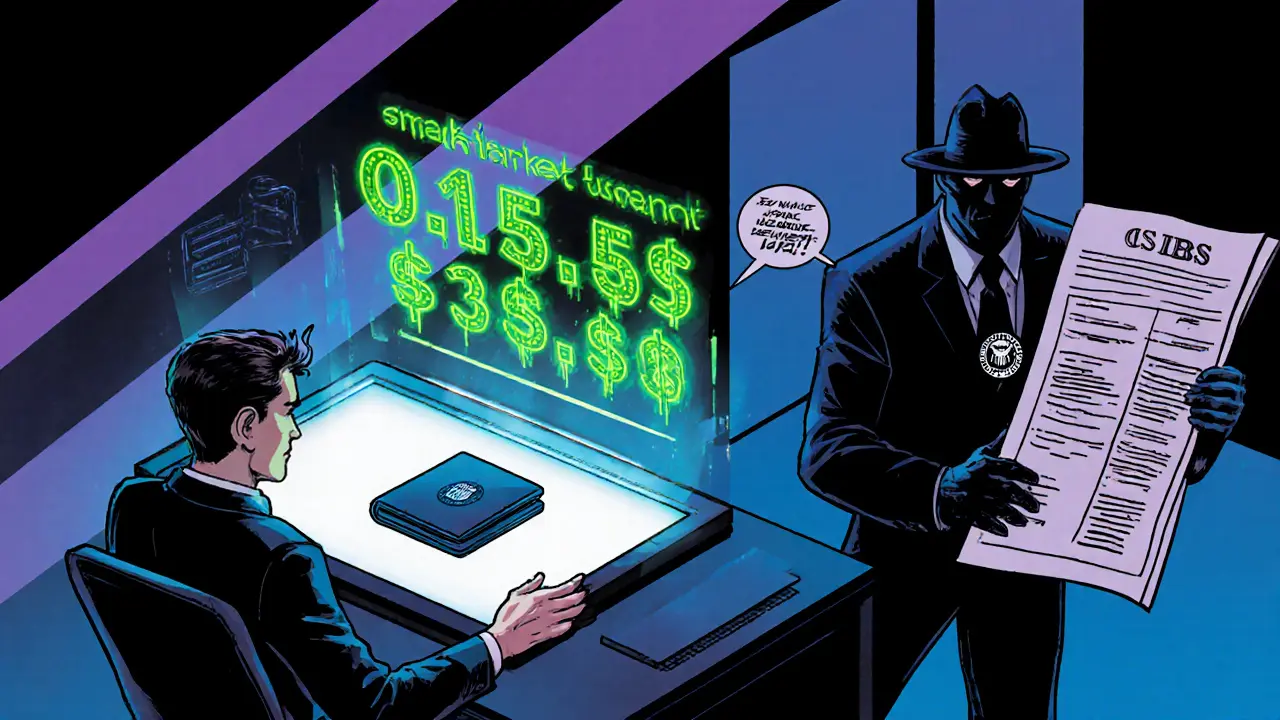

IRS Staking Guidance: Navigating Crypto Tax on Staking Rewards

When dealing with IRS staking guidance, the set of rules the Internal Revenue Service uses to tax staking income from cryptocurrency. Also known as crypto staking tax rules, it helps you understand when and how to report token rewards. IRS staking guidance is a must‑read for anyone earning passive crypto income, because the tax treatment can differ from a simple capital gain. The guidance covers three core ideas: staking creates taxable income, the income is usually ordinary‑income‑type, and the timing of recognition follows when you gain control of the rewards. In practice, this means each time a validator or protocol credits you with new tokens, you have a reporting event. The IRS treats that event much like earning interest on a bank account – you owe tax in the year of receipt, not when you later sell the tokens. That simple rule drives most of the compliance work for DeFi participants.

Key Concepts Behind Staking Taxation

Understanding the tax impact starts with Staking, the process of locking crypto assets to support network operations and earn new tokens in return. Staking can happen on proof‑of‑stake blockchains like Ethereum 2.0, Cardano, or on layer‑2 solutions that offer higher yields. Each protocol has its own reward schedule, and the IRS does not differentiate between them – every token you receive counts as ordinary income at its fair market value at the moment you can control it. Next, Tax Reporting, the act of filing the appropriate forms with the IRS to declare your crypto earnings comes into play. Most users will need to fill out Schedule 1 (for “Other Income”) and possibly Form 8949 if they later dispose of the tokens. The key is keeping accurate records: note the date of reward, the blockchain address, the token symbol, and the USD price at that time. Many tax software platforms now integrate directly with wallets, pulling this data automatically, but you still need to verify the numbers. Finally, DeFi, decentralized finance ecosystems that enable staking, lending, and yield farming adds complexity because a single transaction can trigger multiple taxable events. For example, a liquidity‑mining reward might be immediately auto‑staked, creating a back‑to‑back income event and a later cost‑basis adjustment when you finally sell. The interaction between staking rewards and other DeFi activities forms a web of taxable moments that requires careful tracking.

The practical side of IRS staking guidance is all about three semantic connections: the guidance encompasses tax reporting requirements, staking generates ordinary income, and DeFi platforms influence how and when rewards are realized. When you follow these connections, you can avoid the most common pitfalls – under‑reporting, missing the fair market value snapshot, or double‑counting the same reward. Many users mistakenly treat staking rewards like capital gains, timing the tax event to the eventual sale. That approach can lead to penalties because the IRS expects the income to be recognized at the moment of receipt. By treating each reward as a separate income line, you also simplify the calculation of later capital gains when you finally dispose of the tokens – the cost basis becomes the fair market value recorded at the staking event. This method aligns with the IRS’s “constructive receipt” doctrine, which has been applied in several tax court cases involving crypto.

Below you’ll find a curated collection of articles that dive deeper into each of these areas. From step‑by‑step claim guides for airdrops (which share many reporting similarities with staking rewards) to detailed analyses of global crypto regulations, the posts give you actionable insights to stay compliant. Whether you’re a casual staker, a DeFi power user, or a professional managing client portfolios, the resources on this page will help you translate IRS staking guidance into real‑world tax filing strategies.