- Home

- Blockchain

- What Are Gaming NFTs? A Clear Guide to Digital Ownership in Video Games

What Are Gaming NFTs? A Clear Guide to Digital Ownership in Video Games

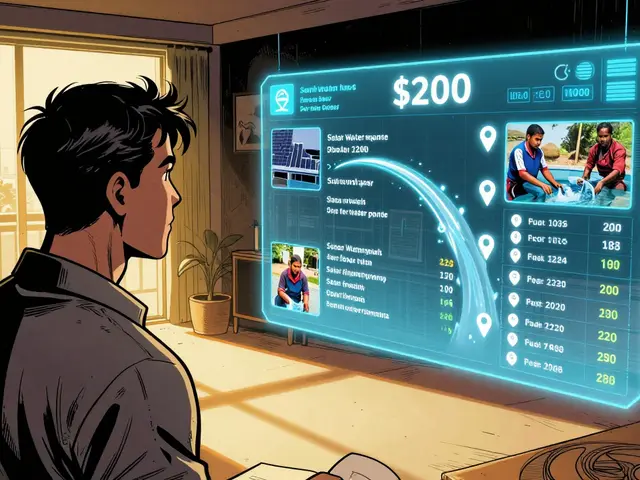

Play-to-Earn NFT Game Earnings Calculator

How Much Could You Earn?

Calculate potential earnings from play-to-earn NFT games based on your playtime. Note: These are estimates only and actual earnings vary significantly.

Estimated Earnings

Note: Earnings can fluctuate based on market conditions. High volatility is common in NFT games.

Important Considerations

These estimates include typical gas fees (0.001-0.01 ETH) and assume:

- Consistent playtime

- Current market conditions

- No major price drops in game currency

What This Means

$0.00/hour

Equivalent to $/hour job

Based on average US minimum wage of $15.20/hour.

Imagine owning a sword in a video game that you can sell to someone else-outside the game-and actually make money from it. Not just a copy, not just a license you lose when you stop playing, but a real, verifiable digital item that belongs to you, no matter what happens to the game. That’s what gaming NFTs are. They’re not just pixels or textures; they’re unique digital assets recorded on a blockchain, giving players real ownership over things like weapons, skins, characters, and even virtual land.

What Exactly Is a Gaming NFT?

A gaming NFT is a non-fungible token tied to something inside a video game. Unlike Bitcoin or Ethereum, which are interchangeable (one Bitcoin is the same as another), each NFT is one-of-a-kind. Think of it like a signed limited-edition trading card, but digital. It has a unique digital fingerprint stored on a blockchain-usually Ethereum, Polygon, or Solana-that proves who owns it, when it was created, and every time it’s been traded.

These tokens can represent almost anything in a game: a rare dragon skin in a shooter, a legendary sword in an RPG, a plot of land in a virtual world, or even a special ticket to an in-game event. The key difference from traditional games? In most games, you don’t own your items-you’re just borrowing them. The game company can delete them, change them, or shut down the server and take everything away. With NFTs, your items exist on a public ledger. Even if the game disappears, your NFT still exists. You can hold it, trade it, or sell it elsewhere.

How Do Gaming NFTs Work?

Gaming NFTs run on smart contracts-self-executing code on a blockchain. When you buy a weapon in an NFT game, the smart contract handles the transfer automatically. No middleman. No company approval needed. Once the transaction is confirmed, the NFT is yours. You can store it in a crypto wallet like MetaMask, which holds your digital assets securely.

Most gaming NFTs are built on blockchains that support smart contracts. Ethereum was the first and still handles most NFT traffic, but it’s expensive and slow. That’s why many newer games use alternatives like Polygon or Solana. These chains are faster and cheaper-sometimes costing less than a cent per transaction. This matters because if every time you traded a sword cost $50 in fees, no one would play.

The NFT itself doesn’t live inside the game. It lives on the blockchain. The game just connects to it. So if you own a rare helmet as an NFT, you could, in theory, use it in multiple games-if the developers agree. That’s called interoperability, and it’s one of the biggest promises of NFT gaming: your stuff isn’t locked in one game anymore.

Play-to-Earn: The Big Promise

The most talked-about feature of gaming NFTs is play-to-earn. In traditional games, you spend hours grinding for loot that has no real-world value. In NFT games, you can earn tokens or NFTs that you can sell. The most famous example is Axie Infinity. In 2021, players in the Philippines and Venezuela were earning $10 to $50 a day just by playing, sometimes enough to replace their day jobs.

How? Players breed, battle, and collect Axies-digital creatures represented as NFTs. Each Axie is unique. Some are rare. Some sell for hundreds or even thousands of dollars. Players earn Smooth Love Potion (SLP), a cryptocurrency, by winning battles. They can trade SLP for real money on exchanges.

But here’s the catch: this model only works if people keep buying. When the price of SLP dropped in 2022, the economy collapsed. Daily active users fell from 2.8 million to under 400,000. Play-to-earn isn’t a magic money printer. It’s an economy. And like any economy, it can crash.

Why So Much Controversy?

Gaming NFTs have faced fierce backlash. Critics call them scams, bubbles, or just bad games with extra steps. In 2022, Steam banned NFT games entirely, saying they “undermine the artistic integrity of games.” Ubisoft launched its own NFT platform, Quartz, in late 2021-but after fan outrage, they shut it down in 2023.

There are real problems:

- High costs: Getting started means buying crypto, setting up a wallet, paying gas fees. For many, it’s too confusing.

- Volatility: An NFT you bought for $200 could be worth $20 a month later.

- Scams: Rug pulls-where developers vanish with investors’ money-are common. Over $1.7 billion was stolen in crypto scams in 2022.

- Environmental concerns: Ethereum used to consume about 707 kWh per transaction. While it’s switched to a greener model since 2022, the damage to its reputation stuck.

And yet, players keep joining. Why? Because for some, the chance to own something valuable in a game is worth the risk. Especially in countries where traditional jobs pay poorly, NFT games offer real income.

Are NFTs Actually Changing Games?

Some game studios are trying to make NFTs work without the hype. Instead of pushing speculation, they’re focusing on utility. For example, a character NFT might unlock exclusive quests or give you voting rights in the game’s future updates. Some games now let you use your NFTs as collateral for loans or rent them out to other players.

Platforms like Immutable X are seeing real growth-over 12 million monthly users in 2023-because they’ve built games where NFTs enhance play, not replace it. Gartner predicts that by 2026, 10% of major game studios will have integrated NFT systems. That’s up from less than 1% in 2022.

What’s changing? The focus. Early NFT games were mostly about flipping tokens. Now, developers are asking: How do we make this fun to play? How do we give players real value? The answer isn’t just “sell your sword.” It’s “own your sword, use it in more games, earn rewards, and help shape the world.”

What You Need to Get Started

If you want to try gaming NFTs, here’s what you need:

- A crypto wallet: MetaMask is the most popular. It’s free and works on desktop and mobile.

- Crypto to pay fees: You’ll need Ethereum (ETH), Polygon (MATIC), or Solana (SOL), depending on the game. Buy it on Coinbase, Kraken, or Binance.

- A game: Start simple. Try Gods Unchained (a card game) or Splinterlands. Both let you play for free and earn NFTs over time.

- Patience: Learning the system takes 8-12 hours for experienced users. For beginners, it can take 20+ hours.

And never share your wallet’s private key. Ever. If someone asks for it, they’re trying to steal your stuff.

The Future of Gaming NFTs

The hype cycle is over. The wild price swings are slowing. And that’s actually good. What’s left are real projects trying to build sustainable games with real ownership.

Look at what’s happening: new standards like ERC-6551 let NFTs own other NFTs. Imagine owning a character NFT that also owns a weapon NFT and a house NFT-all linked together. That’s the next step.

Big companies are still watching. Electronic Arts says they’re “not convinced.” But they’re also not ignoring it. The blockchain gaming market hit $4.6 billion in 2022, and while it dropped 63% after the crypto crash, it’s stabilizing. The players who stayed aren’t here for speculation. They’re here because they believe in digital ownership.

Gaming NFTs aren’t the future of every game. But they are the future of some games. And for players who want to own what they play, they’re already here.

Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

Popular Articles

32 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

bro i just bought a dragon skin for $30 and sold it for $200 in 3 days. no cap. this is the future. 🚀

I appreciate the breakdown of how NFTs work technically, but I still can't get past the fact that most of these games feel like gambling with extra steps. The art is cool, but the intent? Not so much.

America built the internet and now we're letting some guy in India make money off pixel swords while we pay gas fees? This ain't progress this is surrender

The concept of digital ownership is fundamentally flawed when the underlying asset is entirely dependent on the whims of a decentralized protocol. It is neither ownership nor property; it is a speculative ledger entry.

eh idk man

Start with Gods Unchained. Free to play. No wallet needed until you want to sell. Easy.

i tried to get into splinterlands but kept messin up my metamask and lost 20 bucks in gas fees lmao. still think its cool tho. maybe i just suck at tech

I get why people are scared of this stuff. I was too. But once I saw a kid in Manila buy his mom a fridge with SLP earnings... it clicked. This isn't just crypto. It's opportunity.

THIS IS THE REVOLUTION. Imagine your character from your favorite game being worth more than your car. Imagine owning a piece of the world you love. This isn't gaming. This is legacy.

NFTs are the phoenix rising from the ashes of corporate greed. They're not just tokens - they're FREEDOM. You think EA gives a damn about you? Nah. But your NFT? That's YOURS. BURN THE SYSTEM

If you dont understand blockchain you shouldnt be playing these games. Its not hard just google it

You people are delusional. The UK invented video games. Now we're letting Americans and Indians turn them into crypto casinos. Pathetic.

This is just westerners trying to sell us snake oil again. We saw this in 2017 with ICOs. Same script different actors

The real question isn't whether NFTs have value - it's whether human perception of ownership is obsolete in the digital age. We are not owners. We are custodians of data. And data is never truly owned.

Why do people think this is new? We had virtual items in EverQuest 20 years ago. Same thing just with blockchain hype

To everyone saying this is a scam: You're not wrong - but you're also not seeing the bigger picture. This is infrastructure. The first versions always look broken. The second wave will fix it. Stay in the game.

I've seen 3 NFT games collapse in under a year. The only thing being owned here is the illusion of value. Don't be the last one holding the bag.

It's funny. We spent decades fighting for digital rights. Now we're trading them like baseball cards. I wonder if we're really winning or just getting better at distraction.

I started playing Splinterlands with my niece. We both love it. No money involved. Just fun. NFTs are cool but they don't have to be the point.

The aesthetic degradation of digital art through commodification is not innovation - it is the final stage of late-stage capitalism's colonization of play.

I'm from the Philippines. My cousin plays Axie and sends money home. I don't care if it's blockchain or magic beans - if it helps people eat, it's worth it.

I bought a sword that looks like a banana 🍌 and sold it for 10x. Life is weird. Game on.

They're using this to track us. Blockchain = government surveillance. They want to know what you own so they can tax it. This is the end of privacy. Wake up.

Real Americans don't trade digital junk. We build things. We don't let some app tell us what our property is worth.

lol @1147 you think your credit card history isn't tracked? blockchain is more transparent than your bank

Also @1171 you're not bad at tech. Metamask is confusing. Try Rabby or Coinbase Wallet - way smoother.

@1181 you're right about the collapses. But look at Immutable X. They're not chasing pumps. They're building tools for devs. That’s the real shift.

@1145 your point is the only one that matters. Technology is only as good as the humanity it serves.

@1148 you think the American Dream was built by owning factories? Nah. It was built by people who owned ideas. Now we own pixels. Same spirit.

@1174 pixels don't feed families. Factories did. And they still do. You're romanticizing a scam.

@1148 I get it. But what if the factory is gone? What if the job doesn't exist anymore? Then the pixel sword is the only thing keeping someone alive. That's not romantic. That's real.

I got a banana sword. My kid draws on it. We call it Mr. Banana. It's worth $2000 now. I don't care how it works. It made my kid smile.