- Home

- Cryptocurrency

- Binance JEX Review: What Happened to the Derivatives Exchange?

Binance JEX Review: What Happened to the Derivatives Exchange?

Binance JEX Timeline & Features Explorer

Key Takeaways

- Binance JEX ceased operations on Dec 1, 2021

- Shutdown was due to regulatory pressure in China

- Platform lacked proper licensing and regulatory oversight

- Users had no recourse for lost assets

Modern Alternatives

- Bybit - Licensed in multiple jurisdictions

- Binance Main - Partially licensed globally

- Both offer robust security and transparency

- Higher leverage options available

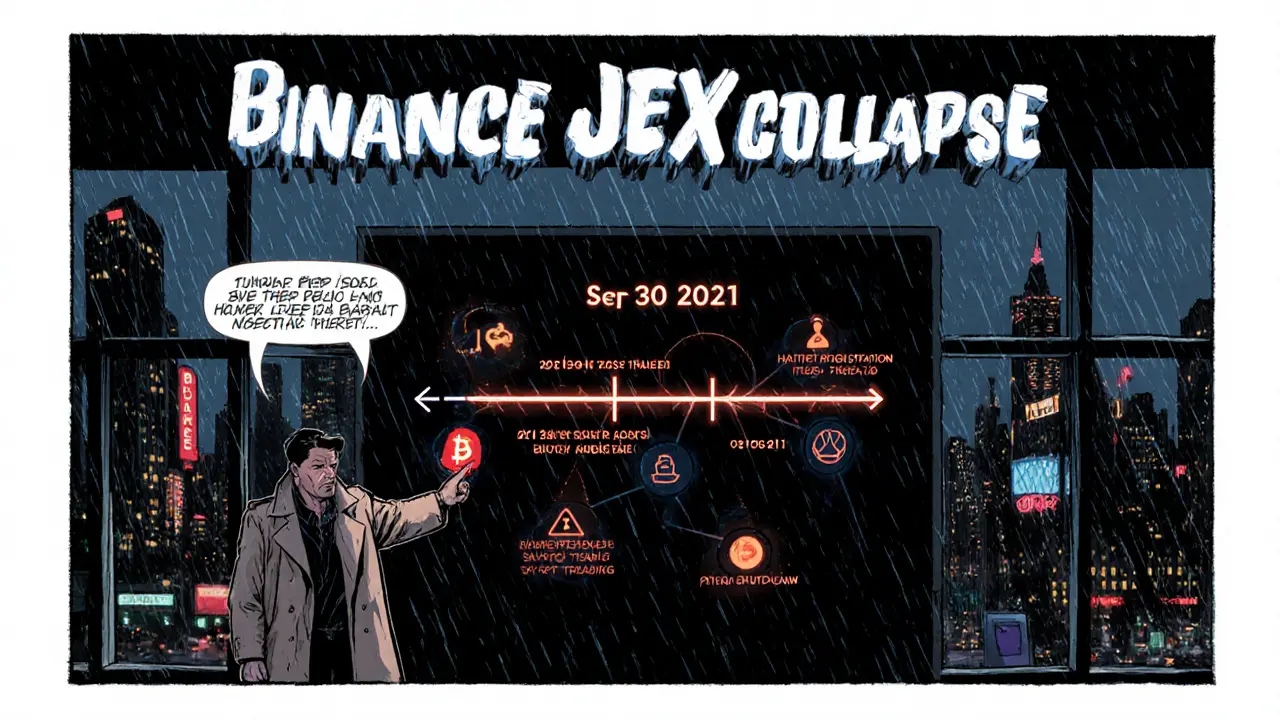

Binance JEX Shutdown Timeline

September 30, 2021

New user registrations and KYC verification halted for mainland China users.

November 21, 2021

Spot-trading functions disabled, all futures contracts auto-settled at market prices.

December 1, 2021

Platform officially ceased all operations and user accounts closed.

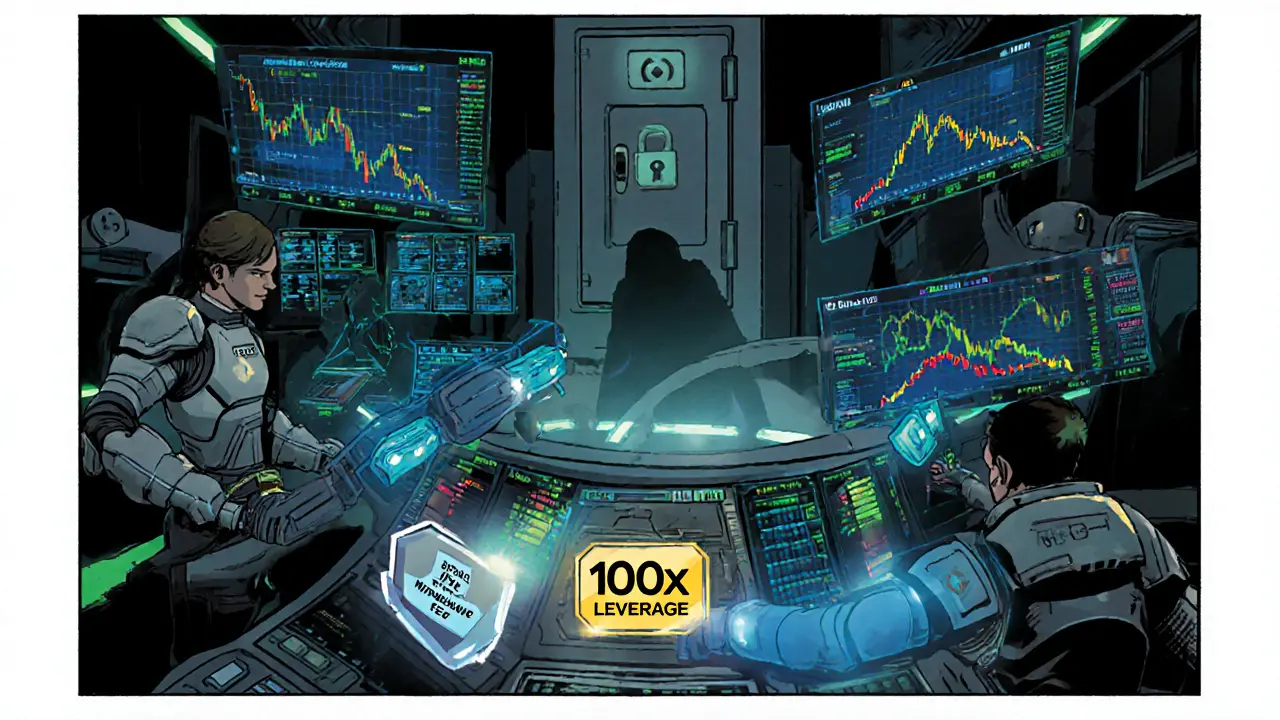

Core Features While Active

Futures Contracts

Perpetual & standard futures on BTC, ETH, LTC, USDT

Leverage Options

Up to 100× on select contracts

Fee Structure

No withdrawal fees (only blockchain fees)

Security & Risk Profile

Risks

- Market manipulation due to unregulated environment

- Unclear auto-settlement procedures during shutdown

- No legal recourse for lost assets

Security

- Basic 2FA implementation

- Cold-storage practices unclear

- Periodic reserves audits

Comparison With Modern Exchanges

| Feature | Binance JEX | Bybit | Binance (Main) |

|---|---|---|---|

| Regulatory Status | Unlicensed | Licensed | Partially Licensed |

| Leverage Options | Up to 100× | Up to 200× | Up to 125× |

| Supported Derivatives | Perpetual & standard futures (BTC, ETH, LTC, USDT) | Futures, options, index contracts (20+ assets) | Futures, options, perpetuals (100+ assets) |

| Withdrawal Fees | No platform fee (network fee only) | Flat fee + network fee | Network fee, discount with BNB |

| Security Measures | Basic 2FA, unclear cold-storage policy | 2FA, hardware-wallet integration, proof-of-reserves | 2FA, SAFU fund, cold-storage of >95% assets |

When BinanceJEX first appeared, traders expected a powerful add‑on to the Binance empire that would specialize in futures and options. Fast‑forward to today, the name lives only in archives because the platform stopped trading on December1,2021. This review breaks down why BinanceJEX vanished, what it offered while it lasted, and which exchanges you should consider for crypto derivatives now.

What Was BinanceJEX?

BinanceJEX was a cryptocurrency derivatives exchange that operated under the Binance brand after Binance acquired the original JEX platform. It focused on futures and options contracts, letting traders take leveraged bets on major coins like Bitcoin, Ethereum, Litecoin, and Tether.

Timeline of the Shutdown

Regulatory pressure in China forced BinanceJEX to act quickly. The key dates were:

- September30,2021 - New user registrations and KYC verification for mainland China users were halted.

- November21,2021 - Spot‑trading functions were fully disabled and all futures contracts were auto‑settled at market prices.

- December1,2021 - The platform officially ceased all operations and user accounts were closed.

The phased approach minimized sudden losses, but it also highlighted the platform’s lack of regulatory backing.

Core Features While It Was Live

The exchange offered a fairly typical derivatives suite:

- Perpetual futures on Bitcoin (BTC) and Ethereum (ETH).

- Standard futures on Litecoin (LTC) and Tether (USDT).

- Leverage up to 100× on select contracts.

- No withdrawal fees - users only paid the blockchain network fee.

Fee structures were competitive, but the platform never disclosed a clear maker‑taker schedule, leaving traders to infer costs from spread and funding rates.

Security and Risk Profile

Because BinanceJEX operated without a recognized financial license, user protection was limited. The exchange did not offer deposit insurance or a regulated dispute‑resolution process. While the parent Binance chain employed two‑factor authentication (2FA), cold‑storage, and periodic proof‑of‑reserves audits, BinanceJEX’s security documentation was sparse.

Risk factors included:

- Potential market manipulation due to the unregulated environment.

- Limited transparency around how open positions were auto‑settled during the shutdown.

- No legal recourse for users if the platform failed to return assets.

How It Stacked Up Against Competitors

When you compare BinanceJEX to other derivatives‑focused exchanges that are still operating, the gaps become obvious. Below is a snapshot of three major players as of 2025.

| Feature | BinanceJEX | Bybit | Binance (Main) |

|---|---|---|---|

| Regulatory Status | Unlicensed, no oversight | Licensed in several jurisdictions (e.g., Labuan, Malta) | Partially licensed (21 approvals worldwide) |

| Leverage Options | Up to 100× | Up to 200× | Up to 125× |

| Supported Derivatives | Perpetual & standard futures (BTC, ETH, LTC, USDT) | Futures, options, index contracts (20+ assets) | Futures, options, perpetuals (100+ assets) |

| Withdrawal Fees | No platform fee (network fee only) | Flat fee on withdrawals + network fee | Network fee, discount with BNB |

| Security Measures | Basic 2FA, unclear cold‑storage policy | 2FA, hardware‑wallet integration, proof‑of‑reserves | 2FA, SAFU fund, cold‑storage of >95% assets |

Bybit and the main Binance platform both provide regulated pathways for traders, making them safer choices for anyone looking to trade derivatives today.

Lessons From the BinanceJEX Collapse

For a trader, the most practical takeaway is to prioritize exchanges that are transparent about licensing and security. A few safeguards can keep you from repeating the BinanceJEX experience:

- Check regulatory status. Look for clear licensing information on the exchange’s website or a reputable third‑party database.

- Assess security protocols. Verify that the platform offers 2FA, cold‑storage, and regular audits.

- Read the fine print on shutdown policies. A solid exchange will outline how it handles forced closures, asset withdrawals, and dispute resolution.

- Diversify where you keep funds. Don’t store all your capital on a single platform, especially one without regulatory protection.

Quick Checklist: Choosing a Derivatives Exchange in 2025

- License: Confirm at least one recognized financial regulator (e.g., FCA, ASIC, MAS).

- Leverage Limits: Choose a platform that matches your risk tolerance.

- Asset Coverage: Ensure the exchange lists the contracts you need (BTC, ETH, alt‑coin futures, etc.).

- Fees: Compare maker‑taker spreads, withdrawal costs, and funding rates.

- Security: Look for 2FA, cold‑storage percentages, and public audit reports.

- Customer Support: Test response times before committing large capital.

Where to Trade Derivatives Now

If you liked the idea of BinanceJEX’s futures but need a safe, regulated home, the two top contenders are:

- Bybit - offers up to 200× leverage, robust risk‑management tools, and licenses in multiple jurisdictions.

- Binance (Main) - provides a massive liquidity pool, a broad set of derivatives, and a partially regulated framework, plus a dedicated SAFU insurance fund.

Both platforms support the same core assets (BTC, ETH, USDT, etc.) and have transparent fee tables, making the choice a matter of personal preference for UI, support, and leverage limits.

Frequently Asked Questions

Is BinanceJEX still operating?

No. BinanceJEX permanently shut down on December1,2021 due to regulatory pressure from Chinese authorities.

Can I still withdraw assets from BinanceJEX?

All withdrawals were closed before the final shutdown. Existing users were required to move their funds before November21,2021. If you missed that window, the assets are unrecoverable.

What made BinanceJEX different from the main Binance exchange?

BinanceJEX specialized solely in crypto derivatives-futures and options-while the main Binance platform offers a full suite of spot, margin, staking, and derivatives services. JEX also lacked the regulatory approvals that Binance later pursued.

Which exchanges should I use for crypto derivatives today?

Top choices in 2025 are Bybit and the main Binance platform. Both provide high liquidity, regulated licensing in several jurisdictions, and advanced risk‑management tools.

How can I avoid a similar shutdown with my chosen exchange?

Always verify that the exchange holds at least one reputable financial license, keep an eye on regulatory news in your region, and never keep more than you can afford to lose on a single platform.

Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

Popular Articles

18 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

Binance JEX’s shutdown is a reminder that trading on unregulated platforms can leave you exposed, so it’s wise to stick with exchanges that have clear licenses. It’s better to protect your assets than to chase every high‑risk offer.

When we constantly glorify the allure of opaque derivatives venues, we betray a collective moral failing that extends far beyond individual profit‑seeking; the JEX debacle illustrates how greed can eclipse common sense, and it is a stark indictment of our willingness to ignore regulatory warnings.

We must ask ourselves why we permit platforms that operate without oversight to thrive, merely because they promise sky‑high leverage and swift returns.

It is not merely a question of financial loss, but a deeper ethical crisis that erodes trust in the entire crypto ecosystem.

The narrative that “high risk, high reward” justifies any means is a dangerous myth that needs dismantling.

Every trader who chose JEX over a licensed exchange contributed, even unintentionally, to a system that lacks consumer protection.

Disregarding basic due diligence in favor of hype is a betrayal of the responsibility we owe each other as participants in a shared market.

Regulators in China acted for a reason, and dismissing their concerns as “political interference” is both naive and disrespectful.

Future investors should demand transparency, not just from the platforms but from the communities that celebrate them.

We owe it to those who suffered losses to speak out against such reckless platforms.

Let this serve as a cautionary tale: no shortcut can replace a foundation built on compliance, security, and genuine accountability.

Only by holding ourselves to higher standards can we hope to prevent another Binance‑JEX‑style collapse.

Indeed, the timeline you outlined shows a clear pattern of regulatory evasion, and it underscores the importance of choosing venues that adhere to jurisdictional standards.

From a risk‑management perspective, diversified exposure across licensed exchanges can mitigate the type of total loss experienced by JEX users.

Moreover, careful scrutiny of a platform’s licensing status should be a prerequisite before committing capital.

In short, due diligence remains the most reliable safeguard against unforeseen shutdowns.

Look, the whole JEX saga is just another example of hype‑driven adoption of leveraged contracts that never had a solid compliance backbone.

People were chasing 100× leverage like it was a free ticket to the moon, ignoring the fact that unlicensed venues leave you with zero recourse.

It’s practically a textbook case of “risk‑reward” being flipped on its head.

That’s a fair point, and honestly it’s a reminder to keep a level‑head when the market’s buzzing about big leverage.

Sticking to platforms with transparent policies can save a lot of headaches later.

Let’s be crystal clear: the moment you step onto an unregulated exchange you’re stepping into a legal minefield; you deserve better than vague “no withdrawal fees” promises!

Regulated platforms not only protect your funds but also offer clear dispute channels-something JEX utterly lacked.

Security isn’t optional; it’s a non‑negotiable baseline!

If you care about your capital, demand full licensing information before you deposit.

Don’t let slick marketing distract you from the underlying risks.

Honestly, the whole thing is just a textbook example of a market that rewards the reckless and punishes the naive.

People keep throwing money at these shadowy platforms because they think they’re getting a secret advantage, but they’re really just feeding a predatory machine.

The lack of oversight is not a feature; it’s a bug that anyone with a shred of common sense should notice.

And when the house collapses, it’s the little guys who get trampled, not the big sharks who already cashed out.

It’s a vicious cycle that will repeat until regulators finally step in and shut these wild west operations down for good.

Until then, expect more stories like this-full of hype, empty promises, and inevitable fallout.

Stop blaming the victims; they should have known better!

Unlicensed exchanges are a trap, and anyone who walks into them is asking for trouble.

One must question the intellectual rigor of those who applaud platforms like JEX while ignoring the fundamental principles of financial stewardship.

It is a lamentable display of myopic ambition, where the allure of leverage eclipses the sober assessment of regulatory legitimacy.

The narrative that “any platform that offers high leverage is worth your time” betrays a shallow understanding of market dynamics.

Such attitudes perpetuate a culture of reckless speculation that ultimately erodes the credibility of the broader crypto ecosystem.

Only by demanding stringent compliance can we begin to restore confidence among discerning investors.

Honestly, its not that hard to see the big picture here. JEX wuz a mess and the lack of clear rules made it a risky bet. Use a regulated exchange instead, its safer. Also, keep your funds spread out!

It is apparent that the unlicensed nature of the platform rendered it an untenable structure for any serious trader.

Such platforms, in my opinion, are inherently unstable and inevitably succumb to regulatory pressures.

Prospective investors would do well to scrutinize licensing before any capital allocation.

Failure to do so is a grave oversight that leads to inevitable financial loss.

Thanks for the clear reminder.

In the grand tapestry of financial innovation, the JEX episode serves as a poignant lesson on the perils of unregulated ambition.

It compels us to reflect on the philosophical underpinnings of trust, security, and the social contract between market participants and oversight bodies.

By aligning our strategies with platforms that embody rigorous compliance, we not only safeguard our capital but also contribute to the maturation of the ecosystem.

Let us, therefore, champion responsible trading practices and uphold the standards that foster long‑term sustainability.

Everyone’s acting like this was some grand conspiracy, but honestly it’s just a classic case of people ignoring red flags.

Unlicensed platforms attract troublemakers, not true investors.

Stay vigilant, don’t get swayed by hype.

I agree that diversification across regulated venues is essential.

It’s a prudent step to mitigate systemic risk.

While the JEX fiasco highlights glaring flaws, it also reveals the naïveté of many traders who ignore basic due‑diligence.

Regulation exists for a reason, and bypassing it is a recipe for disaster.

What most people fail to see is the hidden agenda behind regulatory crackdowns, often orchestrated by unseen powers seeking control over the narrative.

Such interventions are rarely about consumer protection; they’re about consolidating influence.

It’s essential to question the motives behind every sudden ban.

The persistent narrative that regulation is a benevolent force obscures a deeper reality: overseers frequently serve as instruments of centralized authority, subtly shaping market behavior to align with opaque interests.

When platforms like JEX vanish, it is not merely a failure of compliance, but an illustration of how power structures manipulate perceived legitimacy.

Thus, the pursuit of “safe” exchanges must be balanced against awareness of the political economy governing them.

Only through critical examination can participants avoid being pawns in larger schemes.

Otherwise, we merely exchange one form of vulnerability for another.