- Home

- Blockchain

- What Are Layer 2 Solutions for Blockchain? A Clear Breakdown of How They Fix Scalability

What Are Layer 2 Solutions for Blockchain? A Clear Breakdown of How They Fix Scalability

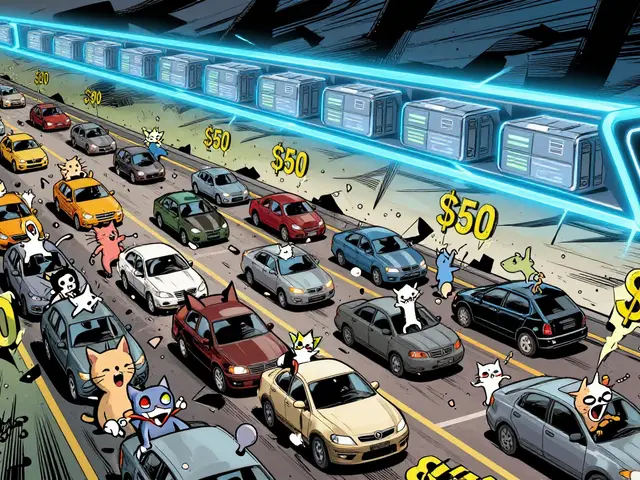

Blockchain networks like Ethereum were never meant to handle millions of transactions per second. Back in 2017, when CryptoKitties flooded the network, transaction fees spiked to $50. People couldn’t send basic payments. The network was stuck. That’s when Layer 2 solutions became the only real way forward. Today, over 75% of Ethereum’s transaction volume happens off-chain - not because users want to avoid Ethereum, but because it’s the only way to make blockchain usable at scale.

What Exactly Is a Layer 2 Solution?

Think of Layer 1 as the main highway - slow, expensive, and crowded. Layer 2 is like a parallel toll road that connects back to the main highway. It handles most of the traffic, then dumps the final results back onto the main road for security. Layer 2 solutions don’t replace Ethereum or Bitcoin. They work on top of them. They take transactions, process them quickly and cheaply, then submit a compressed proof or summary back to the original blockchain.

This isn’t magic. It’s math and cryptography. Every Layer 2 solution has to prove to Layer 1 that the transactions it processed were valid - without having to record every single detail. That’s how they cut costs and speed things up. The result? Fees drop from $1.50 to under a penny. Speed goes from 15 transactions per second to over 2,000.

The Three Main Types of Layer 2 Solutions

Not all Layer 2s work the same way. There are three main designs, each with trade-offs:

- Rollups - The most popular. They bundle hundreds of transactions into one batch and send it to Ethereum as a single proof. There are two kinds: Optimistic Rollups and ZK-Rollups.

- State Channels - Like a private conversation between two people. You open a channel, trade back and forth off-chain, then close it and settle the final balance on-chain. Best for repeated small payments.

- Sidechains - Independent blockchains connected to Ethereum. They’re fast but don’t inherit Ethereum’s security. Polygon PoS is the biggest example.

Rollups dominate today. In Q3 2023, they handled 97% of all Layer 2 transactions on Ethereum. State channels are niche - mostly used by Bitcoin’s Lightning Network. Sidechains are fast but riskier, which is why many experts don’t even call them true Layer 2s.

Optimistic Rollups: The Easiest to Use

Optimistic Rollups like Arbitrum and Optimism assume transactions are valid unless someone proves otherwise. They don’t verify each one right away. Instead, they give anyone 7 days to challenge a fraudulent transaction. If a challenge happens, the system runs a mini-trial on Ethereum to find the truth.

This design is great for developers. Every Ethereum smart contract that works today works the same way on Optimistic Rollups. That’s why Uniswap, Aave, and OpenSea moved here first. Over 65% of all Layer 2 activity runs on Optimistic Rollups.

But there’s a catch: withdrawals take 7 days. If you want to move your crypto back to Ethereum, you wait. That’s why most users keep their funds on the rollup unless they’re cashing out. It’s not ideal, but it’s the price of compatibility.

ZK-Rollups: Faster and More Secure

ZK-Rollups like StarkNet and zkSync Era use zero-knowledge proofs - complex math that proves a transaction is valid without revealing the details. No waiting. No 7-day challenge period. If the proof checks out, the transaction is final in 10-15 minutes.

This makes them better for things like high-frequency trading or real-time gaming. They’re also more secure because fraud can’t slip through - the math guarantees it. StarkNet hit 100,000 transactions per second in testnet. That’s 6,000 times faster than Ethereum’s base layer.

The downside? They’re harder to build for. Most existing Ethereum apps need major code changes to work on ZK-Rollups. Only about 30% of EVM apps can run without rewriting. But that’s changing fast. zkSync and StarkNet are catching up, and by 2026, most new apps will be built on ZK-Rollups from day one.

State Channels: For Tiny, Repeated Payments

State channels are perfect for micropayments. The Lightning Network on Bitcoin lets users send payments instantly for as little as 1 satoshi (about $0.00003). You open a channel with someone, send 100 payments back and forth, then close it and settle once on-chain.

It’s like a prepaid card for crypto. You load it, use it, then cash out. No fees per transaction. No waiting. But you need to keep your device online. If you lose power or go offline, you can’t update your balance. That’s why it’s great for coffee shops or tipping content creators - but useless for buying an NFT or swapping tokens on Uniswap.

Bitcoin’s Lightning Network handles 5,000-10,000 transactions per day. That’s tiny compared to Ethereum’s Layer 2s, but it’s the only way Bitcoin can scale without changing its core rules.

Sidechains: Fast, But Not Fully Decentralized

Sidechains like Polygon PoS run their own blockchains with their own validators. They’re fast - 7,000 transactions per second - and cheap. But they don’t use Ethereum’s security. If Polygon’s validators get hacked, your funds could vanish. That’s exactly what happened in 2022 when the Ronin bridge (a sidechain for Axie Infinity) lost $625 million because its validator keys were stolen.

Many people call Polygon a Layer 2. Technically, it’s not. It’s a sidechain. It trades security for speed. That’s fine for casual users, but not for large DeFi protocols handling billions in assets. Most experts agree: sidechains are useful, but they’re not the future of secure scaling.

Performance Comparison: Fees, Speed, and Security

| Solution | Throughput (TPS) | Avg. Fee | Finality Time | Security Model |

|---|---|---|---|---|

| Ethereum (Layer 1) | 15-30 | $1.20 | 13 seconds | Full Ethereum security |

| Optimism (Optimistic Rollup) | 4,000 | $0.0005-$0.02 | 1-2 hours | Ethereum after 7-day challenge |

| Arbitrum One | 3,800 | $0.0003-$0.01 | 1-2 hours | Ethereum after 7-day challenge |

| StarkNet (ZK-Rollup) | 2,000-100,000* | $0.0008-$0.01 | 10-15 minutes | Immediate cryptographic proof |

| zkSync Era | 2,000 | $0.0005 | 10 minutes | Immediate cryptographic proof |

| Polygon PoS (Sidechain) | 7,000 | $0.001 | 2 seconds | Independent validator set |

| Lightning Network (State Channel) | 100-1,000 per channel | 1 satoshi ($0.00003) | Instant | Peer-to-peer trust |

*StarkNet hit 100,000 TPS in testnet. Real-world usage is lower but still far beyond Layer 1.

Why Layer 2 Is Already Dominating

By September 2023, Layer 2 networks were processing 2.1 million transactions per day - 38% of all Ethereum activity. That’s up from just 8% in early 2022. Why? Because users voted with their wallets.

On Uniswap, 85% of trades happen on Layer 2. On OpenSea, 73% of NFT sales do. People aren’t using Layer 2 because they’re forced to. They’re using it because it’s 100x cheaper and faster. One Reddit user said he paid $0.03 to do 50 swaps that would’ve cost $75 on Ethereum. That’s not a tweak - that’s a revolution.

Even big companies are switching. JPMorgan processes $1 billion daily on its own Ethereum-based Layer 2 for institutional payments. That’s not speculation - that’s real money moving because Layer 2 works.

The Big Problems With Layer 2

It’s not all perfect. There are three big issues:

- Bridging is a mess - Moving money between Ethereum and a Layer 2 requires a bridge. There are 17 different ones. Some are slow. Some are buggy. In 2023, $1.2 billion was lost in bridge hacks. Most of those weren’t due to the Layer 2 itself - they were because the bridge had weak security.

- Fragmentation - You can’t use Arbitrum and Optimism with the same wallet seamlessly. You need to switch networks manually. Wallets like MetaMask help, but it’s still confusing for new users.

- Centralization risks - Optimism and Arbitrum rely on a single “sequencer” to order transactions. In 2023, 87% of Optimism transactions went through one node. If that node goes down or gets hacked, everything stops. That’s not decentralized.

These aren’t dealbreakers - they’re growing pains. The community is already fixing them. Across Protocol cut bridging time from 7 days to 30 minutes. Optimism’s Superchain project lets multiple Layer 2s share security. And sequencers are being decentralized slowly, with more validators joining over time.

What’s Next? The Road to 100,000 TPS

Layer 2 isn’t the end - it’s the foundation. Ethereum’s Dencun upgrade in early 2024 introduced proto-danksharding, which cuts Layer 2 fees by 90% by making data storage cheaper. That means even lower costs and more innovation.

By 2026, experts predict only 3-5 Layer 2 solutions will dominate. The rest will fade. ZK-Rollups will take over because they’re more secure and scalable. Optimistic Rollups will stick around for legacy apps. Sidechains will serve niche use cases.

And by 2027, Ethereum Foundation researchers believe 90% of all Ethereum transactions will happen on Layer 2. That’s not a prediction - it’s the only path to scaling to billions of users.

Should You Use Layer 2?

If you’re trading crypto, swapping tokens, buying NFTs, or playing a blockchain game - yes. Use Layer 2. MetaMask supports 97% of them. You just need to switch networks in your wallet. The fees are negligible. The speed is instant.

If you’re holding large amounts long-term, keep some on Ethereum. Use Layer 2 for daily activity. Withdraw to Layer 1 only when you need to move funds off the ecosystem.

If you’re a developer - start building on ZK-Rollups. They’re the future. The tooling is improving fast. StarkNet and zkSync have excellent documentation. The community is growing. And the demand for skilled developers is skyrocketing.

Layer 2 solutions aren’t a side project. They’re the main event. The blockchain world moved on from asking if Layer 2 works. Now it’s asking: which one will win?

Are Layer 2 solutions safe?

Yes, but with caveats. Optimistic and ZK-Rollups inherit Ethereum’s security, so they’re very safe. Sidechains like Polygon PoS have their own validators and are riskier. The biggest danger isn’t the Layer 2 itself - it’s the bridges that connect it to Ethereum. Over $1.2 billion has been lost in bridge hacks since 2021. Always use trusted, audited bridges like Across or Synapse, and never leave large amounts on a bridge for long.

Do I need a new wallet for Layer 2?

No. MetaMask, Coinbase Wallet, and Trust Wallet all support Layer 2 networks. You just need to add the network manually. For example, in MetaMask, click the network dropdown, choose "Add Network," and enter the details for Arbitrum or Optimism. Once added, your wallet works the same - you just pay much less in fees.

Why do some Layer 2s take hours to withdraw?

That’s only true for Optimistic Rollups. They have a 7-day challenge period to catch fraud. If someone tries to cheat, they have a week to prove it. After that, your withdrawal is final. ZK-Rollups don’t have this delay - withdrawals take 10-15 minutes because they use instant cryptographic proofs. The delay isn’t a flaw - it’s a security feature for compatibility.

Can I use Bitcoin Layer 2s for Ethereum apps?

No. Bitcoin’s Lightning Network only works for Bitcoin. Ethereum Layer 2s like Arbitrum and StarkNet only work for Ethereum-based tokens and apps. You can’t send ETH to a Lightning wallet. They’re completely separate ecosystems. Cross-chain bridges exist, but they’re risky and expensive. Stick to matching networks.

Is Layer 2 the future of blockchain?

Yes. Ethereum’s co-founder Vitalik Buterin says Layer 2 scaling is "not optional" - it’s the only way to serve billions of users. Layer 2s are already handling 75% of Ethereum’s activity. By 2027, that number could reach 90%. No other scaling method comes close in speed, cost, or security. If blockchain is going to go mainstream, it will happen on Layer 2.

Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

Popular Articles

18 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

Lmao so now we pay pennies to trade crypto? Guess i'll stop hoarding and start spending 😅

The architectural distinction between true Layer 2 rollups and sidechains remains critically important from a cryptographic security standpoint. The trust assumptions underlying each model directly impact systemic risk profiles, particularly in institutional contexts where capital preservation is paramount.

Oh great, another Silicon Valley tech bro telling us how 'revolutionary' this is. Meanwhile, my grandma still thinks Bitcoin is a virus. 🙄

Layer 2s aren't magic. They're math. The tradeoffs are clear: speed and cost for reduced decentralization in sequencers. The real innovation is in the cryptographic proofs, not the marketing.

This isn't merely an engineering optimization-it's a redefinition of scalability paradigms. The shift from on-chain computation to off-chain verification with cryptographic integrity represents a fundamental evolution in distributed consensus architecture. The implications extend far beyond transaction throughput into the realm of programmable economic infrastructure.

Everyone's acting like this is some breakthrough. The sequencer centralization is laughable. You call this decentralized? It's just a private club with fancy math.

I appreciate how clearly this breaks down the tradeoffs. Many people don't realize that sidechains like Polygon aren't actually Layer 2s. The security difference matters more than the speed.

Been using zkSync for months. Fees are basically zero and withdrawals are fast. If you're still on L1 for daily use, you're leaving money on the table.

Oh wow, a 100,000 TPS testnet? How long until this becomes a real product? Or is this just another vaporware whitepaper?

They're not telling you the whole story. What if the sequencer is owned by a hedge fund? What if the 'proofs' are backdoored? This feels like a controlled experiment for the elite.

The bridge security vulnerabilities represent the most significant attack surface in the current ecosystem. Until standardized, audited, and permissionless bridging protocols are universally adopted, Layer 2 adoption will remain constrained by operational risk.

This is the kind of clarity the crypto space needs. Most people think Layer 2 is just another coin. But it's the architecture that matters. The math, the proofs, the tradeoffs. This explains it all without hype.

You're all ignoring the elephant in the room. The real power isn't in the tech-it's in who controls the sequencers. This isn't decentralization. It's re-centralization with better PR.

I just switched to Arbitrum last week. Paying $0.01 instead of $15 for a swap? Yes please. Still don't get why people are scared of it. Just add the network in MetaMask and go.

Funny how everyone acts like Layer 2 is the answer. What about the environmental cost of all these new chains? You think running 5 different rollups is better than one chain?

Use Layer 2 if you're trading. Keep your long-term holdings on Ethereum. Simple.

So ZK-Rollups are the future? Cool. That means I'll be the only one who understands how they work. Thanks for making crypto even more elitist.

I don't care what the math says. If I have to wait 7 days to get my money out, it's not for me. I want instant, not 'secure'.