- Home

- Cryptocurrency

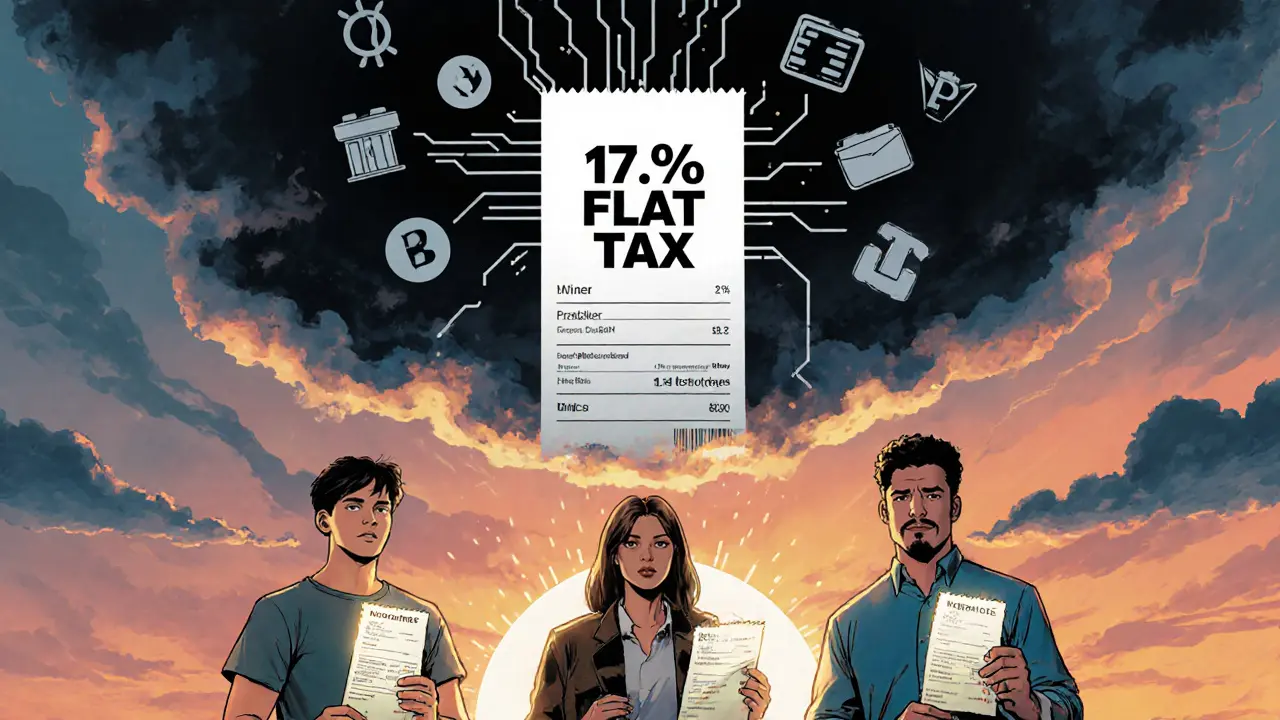

- Brazilian Cryptocurrency Tax Treatment: 17.5% Flat Rate Explained

Brazilian Cryptocurrency Tax Treatment: 17.5% Flat Rate Explained

Brazilian Crypto Tax Calculator

How the Tax Works

Brazil's tax authority (Receita Federal do Brasil) taxes all cryptocurrency gains at a flat 17.5% rate starting June 12, 2025. There are no exemptions for small gains or long-term holdings. Even crypto-to-crypto trades are taxable events. This calculator helps you determine your tax liability based on Brazil's unique FIFO (First-In, First-Out) method for cost basis calculation.

Calculate Your Tax Liability

Tax Calculation Result

Enter transaction details above to see your tax calculation

Why This Matters in Brazil

Step 1: Calculate Capital Gain

Capital Gain = Sale Price - Purchase Price

Step 2: Calculate Tax

Tax = Capital Gain × 17.5%

Step 3: FIFO Method

If you bought the same asset multiple times, the RFB uses First-In, First-Out method to determine your cost basis. This means the first coins you purchased are the first ones sold when calculating your gain.

Before June 2025, Brazil was one of the few countries where you could trade crypto without paying taxes on small gains. Now, that’s over. Starting June 12, 2025, every profit you make from selling, trading, or earning crypto in Brazil is taxed at a flat 17.5% - no exceptions, no exemptions, no loopholes. Whether you bought Bitcoin for $1,000 and sold it for $1,500 last week, or swapped Ethereum for Solana yesterday, the tax man wants his cut. And if you didn’t track those transactions? You’re already behind.

What’s Actually Taxed Now?

The Brazilian tax authority, Receita Federal do Brasil (RFB), doesn’t care if you held your crypto for one day or one year. It doesn’t matter if you made $50 or $50,000. Every single capital gain is taxed at 17.5%. That includes:

- Selling crypto for Brazilian reais (BRL)

- Trading one crypto for another (like BTC to ETH)

- Earning staking rewards or mining income

- Receiving crypto as payment for goods or services

- DeFi yield farming, liquidity provision, or airdrops

Even if you never cashed out to BRL, trading crypto-to-crypto counts as a taxable event. That’s a big shift. In many countries, swapping tokens is treated like a barter - not a sale. Not in Brazil. The RFB sees it as a disposal, plain and simple.

When Do You Need to Report?

If your total crypto transactions in a month exceed BRL 5,000 (roughly $950 USD), you must report them. That’s not a threshold for paying tax - it’s a threshold for reporting. Even if you lost money, you still have to file. The deadline is April 30 of the following year. For the 2025 tax year, that’s April 30, 2026.

You file through eCac, the RFB’s online portal. But here’s the catch: eCac wasn’t built for crypto. There’s no “crypto gains” field. You have to manually enter each transaction, calculate profits, and categorize them under “other income.” Many users report the system crashes when uploading large CSVs from exchanges. No official guidance exists on how to handle complex DeFi transactions. You’re on your own.

How the Tax Is Calculated

The math is simple, but the record-keeping isn’t.

Let’s say you bought 0.5 BTC for BRL 25,000 in March 2024. In May 2025, you sell it for BRL 40,000. Your profit? BRL 15,000. Your tax? 17.5% of that = BRL 2,625.

But what if you bought 0.1 BTC on January 15 for BRL 5,000, then another 0.1 BTC on February 10 for BRL 5,500, and sold 0.2 BTC on June 1 for BRL 12,000? The RFB doesn’t let you pick which coins you sold. You must use the first-in, first-out (FIFO) method. That means the first 0.1 BTC you bought (BRL 5,000) and the next 0.1 BTC (BRL 5,500) are your cost basis. Total cost: BRL 10,500. Sale price: BRL 12,000. Profit: BRL 1,500. Tax: BRL 262.50.

Tracking this manually across 10 exchanges, 3 wallets, and 50 trades? It’s a nightmare. That’s why tools like Koinly and CoinTracker are now mandatory for serious traders in Brazil.

What Happens If You Don’t Report?

Penalties are brutal. If you underreport or miss a transaction, the RFB can impose fines up to 150% of the unpaid tax. For repeat offenders, they can freeze bank accounts or block asset transfers. The RFB now cross-references data from major Brazilian exchanges like Foxbit, Bitso, and Mercado Bitcoin. They also get transaction data from international platforms like Kraken and Binance via tax treaties.

One trader in São Paulo got a letter in August 2025. He’d made BRL 8,000 in crypto profits in 2024 but didn’t report. The RFB had his transaction history from his bank’s crypto-linked debit card. He owed BRL 1,400 in tax, plus BRL 2,100 in penalties. He didn’t appeal. He paid.

How Brazil Compares to the Rest of the World

Brazil’s 17.5% rate sits between two extremes:

| Country | Tax Rate | Exemptions | Holding Period Benefit |

|---|---|---|---|

| Brazil | 17.5% flat | None | No |

| Germany | 0% after 1 year | €600 annual tax-free | Yes |

| Portugal | 28% (under 1 year) | 0% if held over 1 year | Yes |

| United Kingdom | 10-20% | £3,000 annual allowance | No |

| United States | 10-37% | $0 (but long-term rates apply) | Yes |

Germany rewards long-term holders. Portugal taxes short-term trades harder. The UK gives you a buffer. Brazil? No mercy. No grace period. No safety net. If you profit, you pay.

Who’s Affected the Most?

Small-time traders feel it the hardest. Someone who buys $100 of Dogecoin every Friday and sells it on Monday for $110? That’s $520 in annual profit. Tax: $91. But now they have to track 52 transactions, export CSVs, reconcile wallets, and file a 20-page report. For many, the time cost outweighs the profit.

Professional traders and institutions don’t mind. The flat rate simplifies things. No more worrying about whether a gain is short-term or long-term. No complex brackets. Just 17.5%. One number. One rule. They’re adapting.

But the real losers? New investors. Brazil had over 30 million crypto users in 2024. Many got in because taxes were low. Now, the barrier to entry has spiked. On Reddit’s r/BrazilCrypto, threads like “Should I even bother trading anymore?” are trending.

What About Crypto Mining and Staking?

Yes, they’re taxed too. If you mine Bitcoin and sell it, you pay 17.5% on the sale price minus your electricity and hardware costs (if you can prove them). Staking rewards? Taxed as income when you receive them, not when you sell. So if you earn 0.05 ETH as staking reward in January and sell it in June, you pay tax twice: once on the value of the ETH when you received it, and again on the gain from that value to the sale price.

DeFi is even messier. Providing liquidity on Uniswap? Taxed on the value of tokens received. Receiving a governance token airdrop? Taxed as income. Even failed transactions that cost gas fees? Those fees aren’t deductible. The RFB doesn’t recognize them as expenses.

What’s Next?

Brazil isn’t done. The Central Bank is testing Drex, its own digital currency. The goal? To replace cash and control the flow of money. Crypto taxation is part of that control. More regulation is coming. Expect mandatory KYC for all wallets. Possibly, a blockchain monitoring system linked to banks.

Other Latin American countries are watching. Argentina and Colombia have hinted at similar rules. If Brazil’s revenue targets hit - estimated at BRL 12 billion in 2025 - expect a regional domino effect.

What Should You Do Now?

If you trade crypto in Brazil:

- Export all transaction history from every exchange and wallet since January 1, 2024.

- Use a crypto tax tool like Koinly or CoinTracker - set it to FIFO and Brazil tax rules.

- Calculate your gains and losses for 2024 and 2025 separately.

- Start filing now, even if you’re not sure. The RFB doesn’t care if you’re confused - they care if you’re late.

- Keep receipts for hardware, electricity, and software costs. Even if they’re not deductible now, they might be later.

There’s no amnesty. No grace period. The clock started on June 12, 2025. If you haven’t filed for 2024, you’re already in violation.

Final Thought

Brazil didn’t just tax crypto. It ended the illusion that digital assets were outside the system. This isn’t about fairness. It’s about control. The government now sees every transaction - every swap, every trade, every reward - as part of its revenue stream. Whether you like it or not, crypto in Brazil is no longer a gray area. It’s a ledger. And the ledger is always watching.

Is crypto trading tax-free in Brazil anymore?

No. As of June 12, 2025, all crypto gains - whether from selling, trading, staking, or mining - are taxed at a flat 17.5%. There are no exemptions, even for small amounts or long-term holdings.

Do I have to report crypto losses?

Yes. If your monthly crypto transactions exceed BRL 5,000, you must report all activity, including losses. You can’t offset losses against other income, but reporting them helps avoid suspicion from the tax authority.

What happens if I didn’t track my transactions before 2025?

You’re at risk. The RFB can access data from exchanges and banks dating back to 2023. If you made gains before June 2025 and didn’t report, you may owe back taxes plus penalties. Start reconstructing your history using wallet exports and exchange statements.

Can I use foreign exchanges like Binance or Kraken?

Yes, but you still must report all gains. Foreign exchanges share data with Brazil under international tax agreements. Not reporting foreign activity is considered tax evasion and carries heavier penalties.

Are crypto-to-crypto trades taxed?

Yes. Swapping Bitcoin for Ethereum is treated as selling Bitcoin and buying Ethereum. You must calculate the capital gain on the Bitcoin at the time of the swap and pay 17.5% on that profit.

Is there a tax-free allowance in Brazil like in the UK or US?

No. Brazil has no annual tax-free allowance for crypto. Every cent of profit is taxed, regardless of size. Even a $10 gain is subject to 17.5% tax.

Can I deduct mining or gas fees as expenses?

Not officially. The RFB does not currently allow deductions for electricity, hardware, or gas fees. Some tax advisors suggest keeping records in case rules change, but you cannot reduce your taxable gain by these costs right now.

Do I need to report crypto held in wallets, not exchanges?

Yes. The RFB requires you to report all crypto holdings, regardless of where they’re stored. If you hold BTC in a hardware wallet and sell it, you must report the gain. You’re responsible for tracking transactions from any wallet you control.

Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

Popular Articles

19 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

Bro, this is wild 😱 I just sold my last 0.1 ETH and got hit with $18 in tax on a $100 profit. Who even designed this? It’s like the government wants you to stop trading entirely. I’m just here for memes, not spreadsheets 🤡

This is not taxation. This is surveillance capitalism dressed in fiscal clothing. The Brazilian government, in collusion with international financial institutions, has engineered a system to track every digital transaction - not to collect revenue, but to establish total monetary control. The Drex digital currency is the endgame. They’re preparing to phase out cash entirely. You are being monitored. Always.

I feel you. I used to trade for fun, now it’s like doing my taxes on a Friday night while my cat stares at me like I’ve betrayed her. I started using Koinly just to survive. Still cry sometimes when I see the ‘FIFO’ dropdown. It’s not just tax - it’s emotional labor now. 😔

OMG I just realized I didn’t report my BNB airdrop from last year!! 😱 I’m so done. I’m moving to Portugal. At least there they give you a break if you hold for a year. Why did I even start this? I just wanted to buy Dogecoin and meme.

This isn’t a tax policy - it’s a psychological operation. The state doesn’t want you to profit. It wants you to fear profit. Every time you click ‘sell,’ you’re not just transacting - you’re submitting to a system that reduces your autonomy to a decimal point on a ledger. And yet… we keep coming back. Why? Because we still believe in decentralization. Even when the state is watching. Even when it’s taxing every whisper of gain.

Ohhh so NOW they care about crypto taxes? Funny how they didn’t care when you were losing money. But as soon as the price went up? Boom. ‘We need revenue!’ Meanwhile, your neighbor’s Airbnb? Tax-free. Your uncle’s side hustle? ‘Oh, that’s just hobby income.’ But your 0.002 BTC swap? ‘FIFO, ma’am. Pay up.’ Classic. The system doesn’t want you to win. It wants you to be broke and obedient.

I’m done. I cried for three hours. I lost $5000 last year and didn’t report. Now I owe $2100 in penalties. My mom found out. She said, ‘Why did you gamble with your money?’ I didn’t gamble. I believed. Now I’m bankrupt in spirit.

Let’s get real - this is a liquidity capture mechanism. The RFB is leveraging DeFi’s composability to extract rent from retail participants who lack institutional-grade accounting. FIFO + no expense deductions = structural disincentive to micro-trading. The real winners? Exchanges that sell tax reporting tools. Koinly’s valuation just spiked 300%. This isn’t fiscal policy. It’s a rent-seeking infrastructure play.

I’ve lived in three countries, and Brazil’s approach is the most honest - if brutal. No exemptions mean no favoritism. No loopholes mean no privilege. It’s not fair, but it’s clear. Maybe we need more systems like this - transparent, simple, and unforgiving - instead of the messy, loophole-ridden tax codes we have elsewhere. I don’t like it, but I respect its clarity.

Oh honey, you think this is bad? Wait till they start taxing your NFT profile pictures. ‘You posted a Bored Ape? That’s $22.50 in capital gains.’ I’m moving to Antarctica. At least the penguins don’t file 1099s.

You people are acting like this is the first time a government taxed something. Welcome to capitalism. The fact that you thought crypto was some magical tax-free zone proves you never understood money. Now you’re mad because the system worked? Get over it. The rest of us paid taxes on stocks for decades. You just got caught up in the fantasy.

Okay, real talk - this is a nightmare for beginners, but here’s the silver lining: you’re forced to get organized. I used to lose track of everything. Now I have a folder for every exchange, every wallet, every CSV. I even color-coded my spreadsheets. 🎨 I still hate it… but I’m better at finance now. Sometimes the pain makes you grow. And yes, Koinly saved my life. Thank you, Koinly.

You’re all whining like children. If you can’t handle basic accounting, you shouldn’t be trading. You’re not a ‘small trader’ - you’re a liability to the system. The RFB is doing the right thing. If you’re too lazy to track your trades, you deserve to be fined. Stop playing victim. Get a tool. Do your homework. Or get out.

I used to think crypto was freedom. Now I see it as just another system we have to play by. But hey - at least we have tools now. Koinly, CoinTracker, even Excel if you’re old-school 🤓 I just set up auto-sync for my wallets. Took 2 hours. Worth it. You’re not alone. We’re all in this mess together. 💪

i just realized i traded like 50 times last year and never thought to save anything. now im just staring at my phone wondering if i should just delete my accounts and start over. no one else seems to get how messed up this is

Wait so you’re telling me I can’t just buy Bitcoin and hold it forever? I thought that was the whole point? This is why I quit crypto. It’s not about money anymore. It’s about paperwork. I’m going back to cash under my mattress.

I just used CoinTracker and it auto-filled my 2024 trades. I cried. Not from sadness. From relief. Like, ‘Oh wow, I didn’t have to do this manually?’ I’m still mad about the tax… but I’m not drowning anymore.

The system is designed to break the little guy. Brazil didn’t tax crypto because it’s fair. They taxed it because they can. The moment you think blockchain is free from control, they build a bigger cage. We’re not traders. We’re data points. And the ledger doesn’t care if you’re broke.

While Brazil’s approach is stringent, it reflects a broader global trend toward transparency in digital asset transactions. The absence of exemptions, while harsh, ensures equity in enforcement. Other nations may follow suit as cross-border tax compliance becomes increasingly automated. This is not punitive - it is procedural. The responsibility now lies with individuals to adapt, not to resist.