- Home

- Cryptocurrency

- Russia Crypto Regulation: Rules, Limits, and What It Means for Investors

Russia Crypto Regulation: Rules, Limits, and What It Means for Investors

Russia Crypto Regulation Checker

Your Profile

Your Eligibility Status

Enter your details and click "Check Eligibility"

Legal Activities

- Holding Crypto Assets Legal

- Crypto Mining Legal

- International Crypto Trade Legal

- Domestic Payments Illegal

- Spot Trading (Under ELR) Conditional

ELR Requirements Summary

Individual Qualifications

- Assets over 100 million rubles OR

- Annual income of at least 50 million rubles

Institutional Qualifications

- Capital base of at least 5 billion rubles

Russia crypto regulation is a moving target that mixes permission, restriction, and experimentation. If you own crypto, want to trade, or run a crypto‑related business in Russia, you need a clear map of what’s legal, what’s banned, and where the loopholes lie.

Legal foundations - the 2020 law and its fallout

Cryptocurrency Regulation in Russia is a legal framework that governs the ownership, trading, and use of digital assets within the Russian Federation. The cornerstone was a July2020 law that officially recognized crypto‑transactions while outlawing their use for domestic payments. Enforcement started on 1January2021, forcing exchanges to shut down or relocate abroad and pushing most retail investors onto foreign platforms.

That dual approach created two clear lines: you may hold and trade crypto, but you cannot use it to buy a coffee, pay rent, or settle a salary in rubles. The law also introduced mandatory reporting for any crypto‑related income, meaning the tax authorities receive transaction data from compliant exchanges.

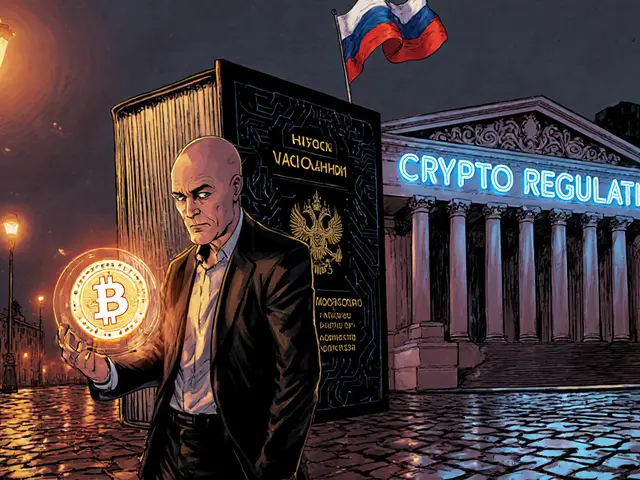

Experimental Legal Regime (ELR) - who can trade legally?

Experimental Legal Regime (ELR) is a temporary three‑year framework launched by the Bank of Russia in March2025. Access is limited to “highly qualified” investors. Private individuals must either hold securities and deposits over 100millionrubles (≈$1.2million) or show an annual income of at least 50millionrubles (≈$600000). Institutional participants need a capital base of at least 5billionrubles.

Within ELR, qualified participants can buy crypto, trade futures, and hold derivatives on regulated exchanges such as the Moscow Exchange. The first month saw $16million in Bitcoin futures bought, mainly by Sberbank’s new crypto desk.

May2025 added crypto‑derivative services for banks, and the regulator hinted that investment funds could join in 2026, widening the pool of qualified players.

What’s allowed - mining, international trade, and the Digital Ruble

Crypto Mining is the only fully recognized legal activity for the broader public. The government runs a registry, taxes mining revenue, and even encourages regions with excess energy to develop mining farms. President Putin’s aide, Boris Titov, notes that mining infrastructure can later support AI workloads, turning a “crypto‑only” asset into a strategic tech base.

Since the 2024 amendment, crypto can be used for International Crypto Trade. Companies settling cross‑border contracts may pay in Bitcoin, Ethereum, or other tokens, bypassing sanctions‑affected SWIFT routes. The first half of 2025 saw roughly 1trillionrubles (≈$12billion) of such transactions.

The Digital Ruble pilot, launched in August2023, provides a state‑backed CBDC for domestic payments. While still limited, it demonstrates the government’s willingness to blend central‑bank digital currency with private crypto for future international settlement systems.

What’s prohibited - domestic payments and financial‑institution participation

Using crypto to pay for goods or services inside Russia remains illegal. Banks and payment providers cannot process crypto transactions, and any attempt to route crypto through Russian financial infrastructure triggers heavy fines.

Financial institutions are barred from direct crypto ownership. They may only offer crypto‑related services to ELR‑qualified investors and must keep strict AML/KYC checks. Suspicious‑activity reports are automatically shared with tax authorities, creating a tight monitoring loop.

How investors can participate - thresholds, platforms, and derivatives

- Meet the ELR financial thresholds (≥100millionrubles in assets or ≥50millionrubles yearly income).

- Open a qualified account with a participating bank (Sberbank, VTB, or Moscow Exchange‑linked brokers).

- Trade spot crypto on approved exchanges or purchase futures/options via the ELR derivative platform.

- Stay compliant: provide detailed source‑of‑funds documentation and sign AML contracts.

For institutional investors, the path is similar but the capital floor jumps to 5billionrubles. Once inside, they can allocate a portion of their portfolio to crypto derivatives, hedge exposure, or provide liquidity to the market.

Compliance burden for businesses - AML, KYC, and reporting

Any business offering crypto services must embed a robust AML program. Requirements include:

- Real‑time transaction monitoring for peer‑to‑peer trades.

- Full KYC on all clients, with biometric verification preferred.

- Monthly filing of suspicious‑activity reports to the Federal Financial Monitoring Service.

- Annual disclosures of crypto holdings to the tax authority, using the unified crypto‑reporting form introduced in 2022.

Failure to comply can result in license revocation, fines up to 5% of annual revenue, and criminal prosecution for willful violations.

Future outlook - lowering thresholds and permanent rules

The Experimental Legal Regime is scheduled to expire in 2028. Early 2025 statements from Finance Ministry Director Alexey Yakovlev suggest a push to soften the qualification bar, potentially opening the market to investors with 30millionrubles in assets. The Central Bank, however, remains cautious, emphasizing investor protection and systemic stability.

Expect three possible scenarios:

- Gradual liberalization: Thresholds cut, more banks join, and a broader set of derivatives become available.

- Status‑quo: The central bank keeps the high bar, preserving a two‑tier market.

- Regulatory tightening: New sanctions could prompt harsher limits on crypto‑related activities.

Regardless of the path, crypto mining, international trade usage, and the Digital Ruble are likely to stay central pillars of Russia’s digital‑asset strategy.

Regulated vs. Unregulated crypto activities in Russia

| Activity | Legal Status | Who Can Do It | Key Restrictions |

|---|---|---|---|

| Holding crypto assets | Legal | Anyone | Must report gains for tax |

| Spot trading on approved exchanges | Legal under ELR | Qualified investors only | High financial thresholds, AML/KYC |

| Crypto derivatives (futures, options) | Legal under ELR (2025‑2026) | Qualified investors & banks | Derivatives must be cleared by Moscow Exchange |

| Domestic crypto payments | Illegal | All | Criminal penalties, fines up to 5% of revenue |

| International crypto trade settlement | Legal | Companies with foreign contracts | Must use licensed crypto‑exchange or bank‑approved gateway |

| Crypto mining operations | Legal (registered) | Any legal entity | Must register, pay mining tax (13% of revenue) |

Quick TL;DR

- Crypto ownership is legal; domestic payments are banned.

- The Experimental Legal Regime (ELR) lets only high‑net‑worth investors trade on regulated exchanges.

- Mining and cross‑border crypto settlements are permitted and even encouraged.

- Businesses must implement strict AML/KYC and report all crypto activity.

- Future reforms may lower ELR thresholds, but the central bank is likely to keep tight controls.

Frequently Asked Questions

Can I buy Bitcoin on a Russian exchange?

Only if you qualify for the ELR. Otherwise you must use foreign platforms, which are not regulated in Russia.

Is crypto mining legal?

Yes, provided the mining business registers with the authorities and pays the applicable mining tax.

Can a Russian company pay suppliers in crypto?

Yes, for international contracts. The 2024 law allows crypto settlements abroad, but domestic payments remain illegal.

What are the financial thresholds for the ELR?

Individuals need assets over 100millionrubles or annual income of 50millionrubles. Institutions need a capital base of at least 5billionrubles.

Will the ELR become permanent?

The ELR runs until 2028. A permanent regime will be drafted based on its outcomes, but the exact rules are still being debated.

Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

16 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

The recent Russian crypto regulatory framework imposes a duality that merits careful scholarly consideration.

On one hand, the legislation affirms the legality of holding digital assets, thereby preserving property rights for private individuals.

On the other hand, it erects substantial barriers to domestic transactional use, reflecting a precautionary stance toward monetary stability.

Investors who meet the Experimental Legal Regime thresholds should view this as a structured gateway rather than an arbitrary hurdle.

Eligibility criteria-assets exceeding one hundred million rubles or annual income beyond fifty million rubles-serve to delineate qualified participants with sufficient financial sophistication.

This demarcation aligns with international best practices that aim to mitigate systemic risk.

Moreover, the mandatory reporting obligations reinforce transparency, a cornerstone of sound fiscal governance.

Compliance, while seemingly onerous, cultivates investor confidence and may attract institutional capital seeking a regulated environment.

Future policy directions, such as potential threshold reductions, could broaden market participation without compromising protective measures.

Nevertheless, the prohibition on domestic crypto payments remains unequivocal and must be respected to avoid punitive sanctions.

Cryptocurrency mining, by contrast, enjoys explicit legal recognition, offering a viable entry point for those seeking exposure without breaching payment restrictions.

International crypto trade settlement is legally sanctioned, providing a pragmatic avenue for cross‑border commerce amid geopolitical constraints.

The emergence of the state‑backed Digital Ruble further illustrates the government's nuanced approach to digital finance.

Stakeholders would do well to integrate robust AML/KYC frameworks now, anticipating stricter oversight as the regime evolves.

In sum, the current Russian crypto environment rewards diligent adherence to regulatory provisions while presenting opportunities for disciplined investors.

Continued vigilance and strategic planning will be indispensable for navigating this complex yet promising landscape.

Ah, the Russian crypto saga-nothing says “welcome to the future” quite like a regulatory labyrinth that feels like it was designed by a committee of bored bureaucrats with a penchant for theatrical drama.

First, they bless us with the ability to hold crypto, as if saying, “Sure, keep your digital treasures, just don’t *ever* try to spend them on a latte in Moscow.”

Then, they sprinkle in the Experimental Legal Regime, a three‑year experiment that sounds like a lab test for the elite, demanding assets that would make a small island nation blush.

Only the financially anointed-those with more rubles than you could count on a pocket calculator-may step onto the regulated exchange stage, while the rest are nudged toward shadowy foreign platforms, because why make things simple?

The law even paints mining as the “heroic” industry, hinting at future AI glory, as if the humming of ASIC rigs will one day power a nation’s neural network.

And let’s not forget the Digital Ruble, the state‑crafted cryptocurrency sidekick, promising efficiency while whispering, “We’re watching you.”

All of this is wrapped in a veneer of “transparency” through mandatory reporting, which essentially translates to a tax authority’s version of a nosy neighbor peeking over the fence.

If you’re daring enough to qualify for ELR, congratulations-you’ve won a ticket to a tightly regulated playground where every trade is logged, every smile is recorded, and every mistake is fined.

In the grand theater of Russian finance, the script is clear: you can hold, you can mine, you can trade if you’re rich enough, but you may never, ever use crypto to buy a bagel on the street, no matter how tempting that digital doughnut looks.

So, dear investor, strap on your compliance helmet and enjoy the ride-just don’t expect any popcorn.

One must contemplate, with a discerning eye, the epistemological ramifications of Russia’s bifurcated stance on digital assets, a phenomenon wherein the state extols possession whilst repudiating quotidian utilisation.

Such a dichotomy, dear interlocutor, invites a Sartrean analysis of freedom constrained by legislative determinism.

In the realm of the Experimental Legal Regime, the thresholds delineated are not mere fiscal metrics but symbolic rites of passage for the financial aristocracy.

Compliance, therefore, becomes an aesthetic pursuit, a choreography of AML/KYC rituals performed with meticulous precision.

Consider this, and you shall navigate the regulatory tapestry with the grace of a virtuoso-if you dare, of course. :)

Whoa, looks like Russia's finally letting the big players dip their toes in the crypto pool-finally some good news for the daring!

Just make sure you meet those asset numbers, or you’ll be stuck watching from the sidelines.

Who's ready to ride this wave?

Hey there, crypto enthusiasts! 😊 The new ELR framework might seem intimidating, but think of it as a VIP lounge for qualified investors. 🌟 By meeting the thresholds, you gain access to regulated exchanges and even futures markets, which can boost your portfolio’s resilience. Remember, every regulatory step is also a step toward greater market legitimacy and protection. 🚀

For anyone grappling with the Russian crypto rules, the key takeaway is clarity on what’s permitted versus prohibited. Holding crypto assets remains legal, but using them for domestic payments is expressly forbidden. To trade on regulated platforms, you must qualify for the Experimental Legal Regime, which requires either assets over 100 million rubles or annual income above 50 million rubles. Institutional players need a capital base of at least 5 billion rubles, after which they can engage in derivatives and liquidity provision. Ensure your AML/KYC procedures are robust to avoid fines and maintain compliance.

I hear the confusion-it’s a lot to take in, especially with the thresholds shifting. Take it step by step, and you’ll find a path that fits your comfort level.

The regulatory architecture is a classic case of over‑engineered compliance scaffolding, diluting market efficiency with redundant AML/KYC layers. Such bureaucratic bloat inflates operational CAPEX and skews risk‑adjusted returns for any rational crypto fund. Bottom line: this regime introduces non‑value‑adding friction that erodes net alpha.

Just remember, you can always hold crypto; the rest is just red tape.

Friends, the landscape may look rugged, but every mountain has a trail for those prepared. By meeting the ELR criteria, you’re not just complying-you’re unlocking a gateway to regulated crypto markets. Let’s support each other, share knowledge, and make the journey less daunting. Together, we can turn these challenges into opportunities.

i think this reegim is just a way to keep the small investors out, sooo yeah.

I appreciate the detailed overview and would add that diversifying across compliant exchanges can mitigate concentration risk. Let’s keep the conversation going and share best practices.

The current thresholds are a vanity metric designed to appease the political elite rather than protect investors. By inflating the entry bar, regulators are effectively coddling the wealthy while marginalizing the average trader. This approach will only stifle organic market growth.

It is commendable that you are seeking to understand the intricacies of Russia’s crypto legislation. By adhering to the stipulated AML and KYC requirements, you will safeguard both your assets and reputation. Proceed with diligence, and the regulatory framework will serve as a guide rather than an obstacle.

Yo, the whole ELR thing feels like a hype train that’s already left the station. Most of us are just grinding on offshore DEXs while the big banks play regulator’s pet. Guess we’ll see who actually profits.

Behold! The sovereign's edict, a veritable tapestry of moral rectitude, draped across the digital frontier, demanding devotion, obedience, and the sacrifice of liberty-an affront to the very spirit of innovation!

We, the custodians of conscience, must rise, condemn, and, with relentless fervor, expose the tyranny that masquerades as regulation!