- Home

- Cryptocurrency

- What is Glue (GLUE) crypto coin? A simple breakdown of the unified DeFi ecosystem

What is Glue (GLUE) crypto coin? A simple breakdown of the unified DeFi ecosystem

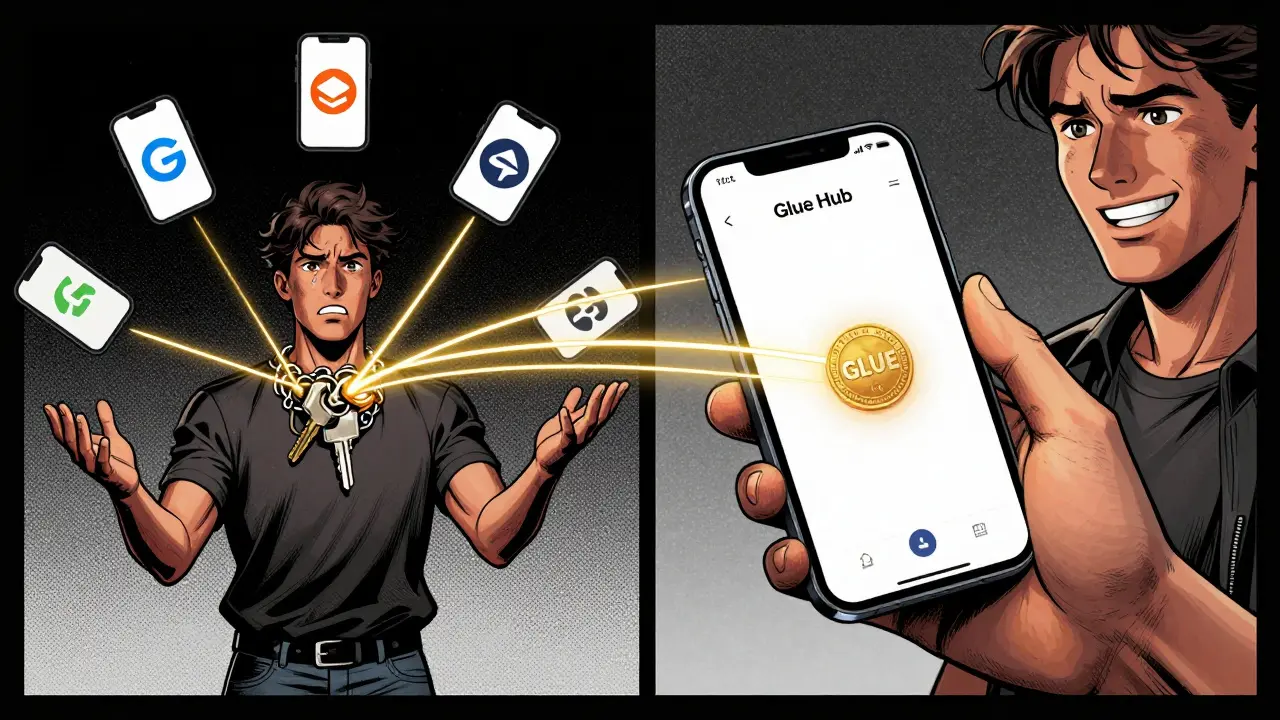

Most people think of crypto as a mess of different blockchains, wallets, and apps you have to juggle just to send a dollar’s worth of ETH or swap tokens. Glue (GLUE) is trying to fix that - not by making another blockchain, but by stitching them all together into one simple system. If you’ve ever struggled with gas fees across networks, lost track of your assets on different chains, or just wanted to use DeFi without reading a 50-page manual, Glue is built for you.

What exactly is Glue (GLUE)?

Glue is a blockchain ecosystem designed to unify decentralized finance (DeFi) tools into one seamless experience. Unlike projects that focus on one thing - like trading (Uniswap) or lending (Aave) - Glue aims to be the all-in-one platform for everyday users.

It’s not just another Layer 1 chain. Glue combines its own Layer 1 blockchain with three specialized Layer 2 networks built for finance, gaming, and payments. These aren’t separate systems you switch between - they’re all connected under one roof. The Glue Hub, its main interface, acts like a decentralized app store and wallet rolled into one. You log in once, and you can send, swap, stake, or play games without ever leaving the app.

How does Glue solve real crypto problems?

Right now, using crypto feels like driving five different cars with five different keys. You need MetaMask for Ethereum, Phantom for Solana, and a separate wallet for Binance Chain. Glue removes that friction.

- Fragmentation? Glue connects Ethereum, Solana, and other chains through LayerZero, so your assets move freely. No more bridging manually.

- Complex interfaces? Every app in the Glue Hub looks and feels the same. No more learning a new UI for every dApp. Think Apple’s iPhone design - consistent, clean, intuitive.

- Too many steps? Gas fees? Paid in GLUE token across all layers. Taxes? Insurance? Accounting? Third-party services can plug into Glue’s system and take a tiny cut from transactions - automatically.

This last part is unique. On most blockchains, if you want tax help, you go to a separate website, connect your wallet, and pay extra fees. On Glue, a tax service can be built directly into the transaction flow. You send a swap, and the system quietly adds a 0.1% fee to cover the service. No extra clicks. No separate payments.

The GLUE token: What it does

The GLUE token is the single utility token powering the entire ecosystem. Total supply is 1 billion, but only about 988 million will ever be in circulation.

- 73.43% goes to the On-Chain Treasury - controlled by token holders through voting. This funds development, rewards users, and pays for ecosystem growth.

- 15% is reserved for founders and early team members.

- 10% is held by the Glue Foundation to support long-term development.

- 1.57% was allocated to early contributors and operational costs.

GLUE isn’t just for trading. You use it to pay for gas on the Layer 1 blockchain, on any of the three Layer 2 networks, and even for services inside the Glue Hub. Want to buy insurance for your crypto holdings? Pay in GLUE. Need a tax report? Pay in GLUE. It’s the fuel for everything.

As of early 2026, the token price was around $0.08927 on Crypto.com, with a public sale market cap of roughly $105 million. But remember - the mainnet hasn’t launched yet.

Who’s behind Glue?

The team behind Glue stays anonymous, but they have a major endorsement: Bryan Pellegrino, CEO of LayerZero Labs. LayerZero is one of the most trusted cross-chain protocols in crypto. When Pellegrino says, “Glue is tackling one of the biggest challenges in crypto adoption,” it carries weight.

The project started in July 2021. The seed round closed in February 2022. Since then, they’ve rolled out testnets, launched the Glue Hub interface in June 2024, and activated AlphaNet in September 2024. The big moment is coming: Mainnet launches January 1, 2025.

How Glue compares to the competition

| Feature | Glue | Ethereum + L2s | Polkadot/Cosmos | Uniswap/Aave |

|---|---|---|---|---|

| Unified Interface | Yes - Glue Hub | No - separate wallets and UIs | No - chains operate independently | No - single-purpose apps |

| Layer 1 + Layer 2 Integration | Native - built together | Disconnected - Optimism, Arbitrum, etc., are separate | Interoperable - but not unified | N/A - single app |

| Service Layer (tax, insurance, etc.) | Yes - built into transactions | No | No | No |

| Cross-chain Tech | LayerZero (native) | Third-party bridges | IBC protocol | Only on Ethereum |

| Current Status | Mainnet launching Jan 2025 | Live since 2015 | Live since 2020 | Live since 2018 |

Glue doesn’t compete with Ethereum - it competes with the mess that Ethereum has become. While Ethereum has over $50 billion locked in DeFi, users still juggle ten different wallets. Glue wants to be the clean, simple alternative.

Why it matters - and why it might fail

The global DeFi market is expected to hit $231 billion by 2025. But most people still don’t use it. Why? Too complicated.

Glue’s big idea: Make crypto feel like using a smartphone. You don’t need to know how 5G works to send a text. You shouldn’t need to know how zk-SNARKs work to swap tokens.

But here’s the catch: It hasn’t launched yet. All the promises are on paper. No one has used the real system. Competitors like Uniswap and Aave process trillions in volume. Glue has zero live users.

Success depends on three things:

- Can they get developers to build on it? (EVM compatibility helps - you can port Ethereum apps easily.)

- Can they convince users to trust a new system? (The Glue Hub interface will be the first real test.)

- Will regulators allow a platform that automates services like tax collection? (Unclear - this could be a hurdle.)

If Glue delivers on its vision, it could become the first blockchain that feels like it was built for regular people - not just techies. If it doesn’t, it’ll join the long list of ambitious crypto projects that never got off the ground.

What’s next?

The next few months are critical. After Mainnet launches on January 1, 2025, watch for:

- Real user feedback on the Glue Hub

- First third-party services going live (tax, insurance, accounting)

- Volume of cross-chain transfers

- How fast developers build new apps

Until then, Glue remains a bold promise - not a proven product. But if you’re tired of crypto being a chore, it’s one of the few projects trying to fix that.

Is GLUE a good investment?

There’s no way to say for sure. GLUE hasn’t launched its mainnet yet, so there’s no real usage data. The token price is based on pre-launch speculation. If the ecosystem works as promised, early holders could benefit. But if the team fails to deliver, the token could lose value. Treat it like a high-risk bet on a future product, not a safe investment.

Can I buy GLUE now?

Yes - GLUE is available on some exchanges like Crypto.com and Gate.io. But since the mainnet isn’t live, the token has no real utility yet. You’re buying into a future version of the platform, not an active product. Be cautious - many pre-mainnet tokens lose value after launch.

How is GLUE different from Ethereum?

Ethereum is a single blockchain with many separate Layer 2 solutions (like Arbitrum and Optimism) that don’t talk to each other smoothly. Glue is one ecosystem with its own Layer 1 and three integrated Layer 2 networks - all under one interface. You don’t need to switch wallets or bridges. Glue also adds a service layer that lets third-party tools earn from transactions automatically - something Ethereum doesn’t do.

What is the Glue Hub?

The Glue Hub is the central app that lets you access all of Glue’s services - swapping tokens, staking, gaming, paying with crypto, and using third-party tools like tax calculators - all from one wallet and one interface. It’s designed to feel like using an iPhone: simple, consistent, and unified.

Why does Glue use LayerZero?

LayerZero is one of the most secure and widely trusted cross-chain protocols. By integrating it natively, Glue can move assets between Ethereum, Solana, and other chains without relying on risky third-party bridges. This makes asset transfers faster, cheaper, and safer - a key part of Glue’s promise to simplify crypto for everyday users.

Is Glue a scam?

There’s no evidence Glue is a scam. It has a clear roadmap, public development milestones, and a credible endorsement from LayerZero’s CEO. But like all crypto projects, it carries risk. The team is anonymous, the mainnet isn’t live, and the market is crowded. Do your own research. Don’t invest more than you can afford to lose.

Final thoughts

Glue (GLUE) isn’t trying to beat Ethereum. It’s trying to fix the broken experience that Ethereum and other chains have created. If it works, it could be the first blockchain that actually feels easy. If it fails, it’ll be another ambitious project that ran into reality. Either way, it’s one of the most interesting ideas in crypto right now - because it’s not about technology. It’s about people.

Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

1 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

glue? more like duct tape for crypto lol. why do we need another thing that says 'it'll fix everything' when we already have 50 of them? just let me send eth without 12 tabs open.