ASIC Mining: What It Is, Why It Matters, and Current Trends

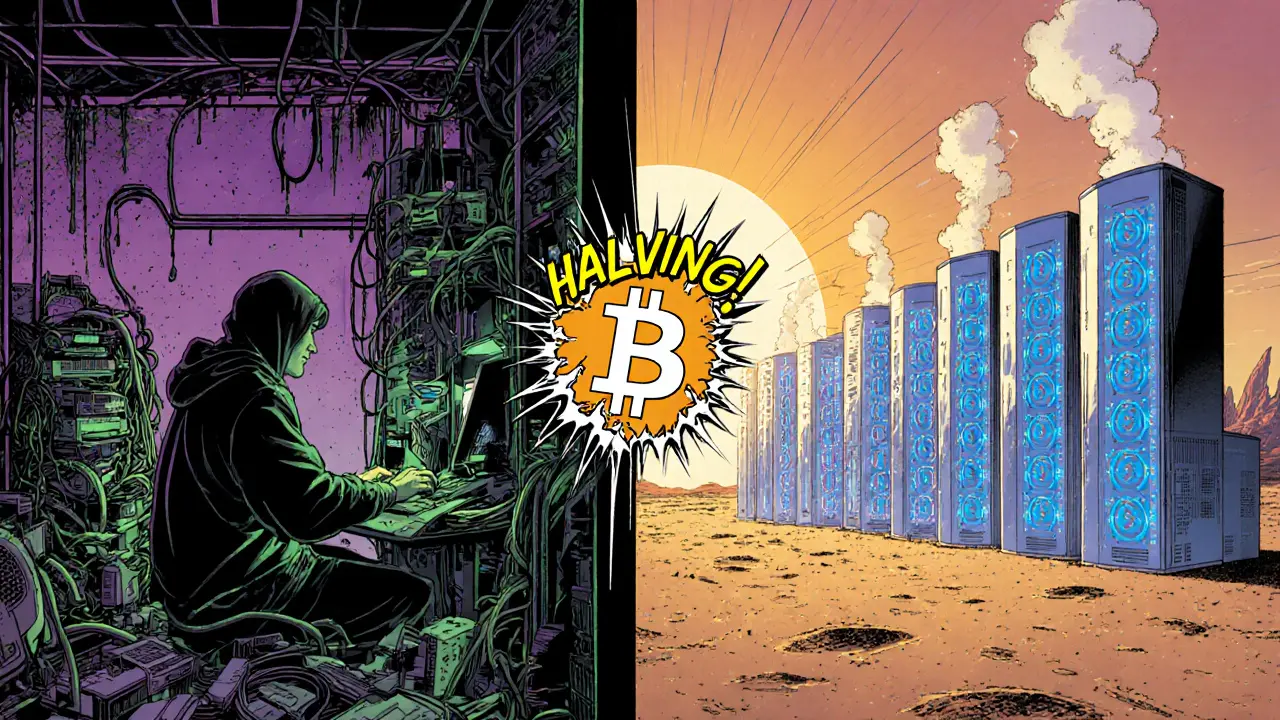

When working with ASIC mining, the use of application‑specific integrated circuits to solve cryptographic hash puzzles and earn block rewards. Also known as hardware mining, it powers many of today’s major proof‑of‑work blockchains. Understanding ASIC mining helps you see how specialized chips, electricity costs, and market dynamics intertwine.

One core driver behind ASIC mining is Proof of Work, a consensus mechanism that requires miners to perform computational work to validate transactions. Proof of Work dictates the need for ever‑more efficient hardware, which in turn fuels the ASIC arms race. Another crucial factor is the environmental impact, the electricity consumption and carbon footprint associated with large‑scale mining operations. As miners chase lower energy costs, they often relocate to regions with cheap power, influencing local economies and regulatory discussions. This energy angle also ties into the rise of Bitcoin futures, financial contracts that let traders speculate on Bitcoin’s price without owning the underlying asset. Futures markets give investors a way to hedge against the volatility that heavy mining activity can cause, and they reflect how mining profitability ripples through broader crypto finance.

Key Concepts Linked to ASIC Mining

Beyond the hardware itself, miners must navigate a maze of cost structures. Early‑generation ASICs consumed megawatts for each terahash, while newer models squeeze more hashes per joule, shrinking the break‑even point. This efficiency battle shapes supply chains: manufacturers release batch updates, and miners constantly evaluate ROI based on current coin prices and network difficulty. Regulatory trends also play a role. Some jurisdictions impose taxes or outright bans on high‑energy mining, prompting operators to diversify across jurisdictions like the UAE free zones or offshore data centers. Meanwhile, sustainability initiatives—such as using renewable energy or waste‑heat recovery—are gaining traction as investors demand greener crypto practices.

The collection of articles below dives deeper into each of these angles. You’ll find a detailed look at proof‑of‑work energy concerns, a guide to Bitcoin futures trading, and practical insights on how ASIC mining fits into the larger crypto ecosystem. Whether you’re a hobbyist curious about setting up a single rig or a professional tracking market trends, the posts ahead give you actionable knowledge to make informed decisions.