Bitcoin Mining: How It Works, Costs, and Trends

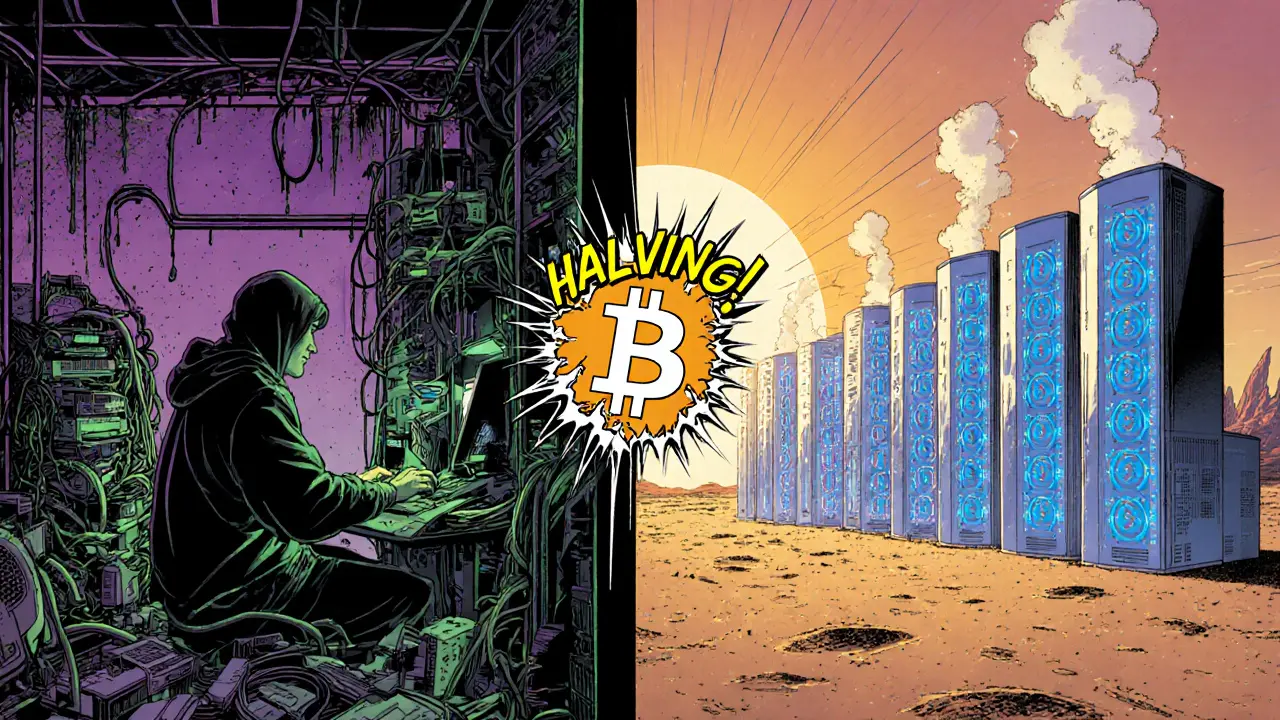

When you hear about Bitcoin mining, the method of creating new bitcoins by solving cryptographic puzzles on a decentralized network. Also called BTC mining, it secures the blockchain and issues fresh coins. Proof of Work, the consensus algorithm that requires miners to find a hash below a target value is the core mechanic that Bitcoin mining relies on. To compete, miners deploy specialized mining hardware, ASIC devices designed to deliver massive hash rates while consuming electricity. Because a single rig rarely finds a block alone, participants often join mining pools, collective groups that share hash power and split rewards proportionally. All of this generates substantial energy consumption, the power draw of mining equipment, which makes sustainability a hot topic in the industry. In short, Bitcoin mining encompasses Proof of Work, requires mining hardware, is amplified by mining pools, and is heavily influenced by energy consumption.

Key Concepts You’ll Encounter

Understanding Bitcoin mining means looking at a few concrete attributes. The consensus mechanism is Proof of Work, which sets the difficulty level based on the network’s total hash power. As of 2025 the average difficulty sits around 60 trillion, meaning a miner must perform roughly 60 trillion hash attempts to find a block. The block reward is 6.25 BTC, plus any transaction fees, so a miner’s daily revenue depends on both hash rate and the current BTC price. Typical ASIC rigs deliver 100 TH/s while drawing 3 kW of electricity, translating to about 30 J/TH – a metric many use to compare efficiency. Energy consumption directly impacts profitability; a farm in a low‑cost region can break even at $0.04/kWh, whereas the same setup in a high‑price market may run at a loss. Mining pools affect reward distribution by smoothing out variance: a solo miner might wait months for a single block, while a pool pays out daily fractions. These relationships form a clear chain: higher hash power reduces variance, but raises electricity bills, which in turn pressures operators to seek cheaper power or more efficient hardware.

Looking ahead, the landscape is shifting. Regulations in several countries now target high‑energy crypto operations, prompting miners to relocate to renewable‑rich zones or to adopt greener hardware. Innovations like immersion cooling and on‑site solar farms cut the energy‑per‑hash ratio, nudging the industry toward sustainability. Meanwhile, discussions around a possible transition to alternative consensus models keep the debate alive, even though Bitcoin’s community remains firm on Proof of Work. All of these forces—regulatory pressure, tech upgrades, and market dynamics—shape the future profitability and environmental footprint of Bitcoin mining. Below you’ll find a curated mix of guides, analysis, and real‑world examples that dive deeper into each of these topics, giving you actionable insight whether you’re just starting out or looking to optimize an existing operation.