- Home

- Cryptocurrency

- What is Kwenta (KWENTA) Crypto Coin? A Simple Guide to Synthetic Trading on Optimism

What is Kwenta (KWENTA) Crypto Coin? A Simple Guide to Synthetic Trading on Optimism

Kwenta Leverage Calculator

Calculate Your Potential Returns

Kwenta offers up to 25x leverage. Enter your trade details to see potential outcomes.

Results

Enter values above to see calculations

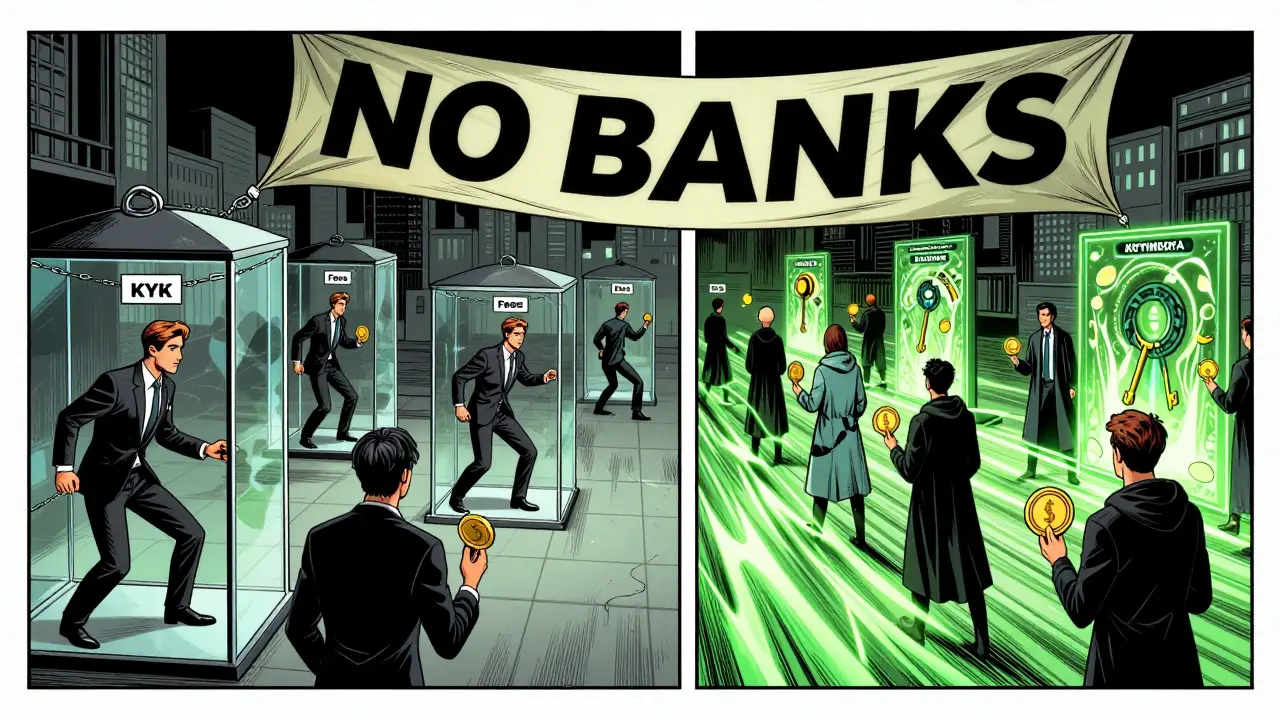

Kwenta isn’t just another crypto coin. It’s the governance token of a decentralized trading platform that lets you trade synthetic versions of Bitcoin, gold, stocks, and even the euro - without a bank or broker. You don’t need to own the real asset. You just need KWENTA and a Web3 wallet.

What Exactly Is Kwenta?

Kwenta is a trading platform built on the Synthetix protocol, running on the Optimism blockchain. It lets users trade synthetic assets - called synths - that mirror the price of real-world assets like BTC, ETH, gold, EUR/USD, and even Tesla stock. The native token, KWENTA, was launched in 2023 to give users control over the platform’s future through voting and staking rewards. Unlike centralized exchanges like Binance or Coinbase, Kwenta doesn’t match buyers and sellers. Instead, it uses a pooled liquidity model. When you trade, you’re trading against a shared pool of funds backed by Synthetix stakers. This means no order books, no slippage, and no need to wait for someone else to take the other side of your trade.How Kwenta Works (Without the Jargon)

To trade on Kwenta, you start with sUSD - Synthetix’s synthetic version of the U.S. dollar. You need at least $40 worth of sUSD to open a position. You don’t buy sUSD directly. You mint it by locking up SNX (Synthetix’s main token) as collateral. Once you have sUSD, you can trade it for any of the 40+ synthetic assets available. You can go long or short on anything: buy synthetic Bitcoin if you think it’ll rise, or sell synthetic gold if you think it’ll drop. Leverage goes up to 25x. That means with $100, you can control $2,500 worth of an asset. But higher leverage also means higher risk - if the price moves against you, your position can get liquidated. All of this happens on Optimism, an Ethereum Layer 2. That’s why gas fees are about 95% lower than on Ethereum mainnet. A trade that would cost $20 on Ethereum might cost $0.40 on Kwenta. Transactions are also faster - usually under 2 seconds.What Can You Trade on Kwenta?

Kwenta offers four main categories of synthetic assets:- Cryptocurrencies: Bitcoin, Ethereum, Solana, Dogecoin, and more

- Forex: EUR/USD, GBP/USD, USD/JPY

- Commodities: Gold, silver, oil

- Equities: Synthetic shares of Apple, Tesla, Netflix - no brokerage account needed

What Is the KWENTA Token For?

The KWENTA token has two main uses: governance and rewards. First, you can stake KWENTA to earn a share of the platform’s trading fees. Every time someone trades on Kwenta, a small fee is collected. Stakers get paid in sUSD and other tokens. As of late 2023, stakers earned around 8-12% APY depending on volume. Second, KWENTA holders vote on changes to the protocol. Want to add a new synthetic asset? Propose it. Want to change how fees are distributed? Vote on it. The more KWENTA you hold and stake, the more voting power you have. The total supply started at 313,373 tokens in Q2 2023. It’s being released slowly over four years, with weekly emissions dropping from 14,463 to just 200 by the end. As of November 2023, the circulating supply was around 530,000, with a market cap of roughly $4.8 million. The top 10 wallets hold over 60% of the supply - a sign that early adopters and big players still control most of the token.

How Kwenta Compares to Other DeFi Exchanges

Kwenta isn’t the only DeFi derivatives platform. GMX, dYdX, and Hyperliquid are bigger in terms of trading volume. But here’s where Kwenta wins:| Feature | Kwenta | GMX | dYdX |

|---|---|---|---|

| Asset Types | 40+ (crypto, forex, gold, stocks) | 20+ (mostly crypto) | 35+ (mostly crypto) |

| Minimum Deposit | $40 sUSD | $10 | $10 |

| Leverage | Up to 25x | Up to 50x | Up to 25x |

| Blockchain | Optimism | Arbitrum | StarkEx (Layer 2) |

| Order Book? | No - pooled liquidity | No - pooled liquidity | Yes - order book |

| KYC Required? | No | No | No |

Who Is Kwenta For?

Kwenta is perfect for:- Traders who want exposure to stocks, gold, or forex without a traditional account

- DeFi users tired of high Ethereum gas fees

- People who believe in decentralized finance and want to help govern a protocol

- Those comfortable with leverage and willing to manage risk

- Beginners who don’t understand how leverage works

- People who want instant customer support or phone help

- Those who need advanced order types like limit orders or OCO

Upcoming Changes and the Road Ahead

Kwenta’s future is tied to Synthetix. The biggest update coming is Perps v3, expected in Q2 2024. This upgrade will make capital more efficient - meaning less collateral is needed to open the same position. That could lower the minimum deposit and reduce liquidation risks. Another big move: Kwenta is expanding to Base, Coinbase’s Layer 2. This could bring in millions of new users from Coinbase’s ecosystem. If successful, Kwenta could become the go-to platform for synthetic asset trading in DeFi. The team also plans to add 15+ new assets by the end of 2024, including more equities and commodities. They’ve already added 12 since early 2023.

Is Kwenta Safe?

No DeFi platform is risk-free. Kwenta’s model relies on SNX stakers to back all synthetic trades. If the value of SNX drops sharply, the pool could become undercollateralized. In May 2023, SNX stakers covered only 65% of potential losses during a market crash - a red flag for some analysts. But Kwenta has a safety net: the protocol can mint more SNX to cover losses. That’s inflationary, but it keeps the system alive. The community votes on these decisions, so it’s not controlled by a single team. Most users report a smooth experience. Reviews on CoinGecko give Kwenta a 4.2/5 rating. People love the interface, low fees, and asset variety. The biggest complaints? Slow liquidations during volatility and no live chat support.How to Get Started

Here’s how to start trading on Kwenta:- Get a Web3 wallet (MetaMask or Coinbase Wallet)

- Buy ETH on a centralized exchange like Coinbase

- Bridge ETH to Optimism using the official bridge

- Swap ETH for sUSD on Synthetix or a DEX like Uniswap

- Go to kwenta.io and connect your wallet

- Choose an asset, set your leverage, and trade

Final Thoughts

Kwenta isn’t for everyone. But if you want to trade real-world assets on-chain - without a bank, without KYC, and without crazy fees - it’s one of the best options out there. The KWENTA token gives you a stake in that future. It’s not just a coin. It’s a vote. The platform’s success depends on Synthetix’s upgrades and adoption on Base. If those happen, Kwenta could grow from a niche tool into a major player in decentralized finance. If not, it’ll remain a powerful but limited option for crypto-savvy traders.Right now, Kwenta is a quiet innovator. It doesn’t have the hype of a meme coin. But for those who understand what it does, it’s one of the most useful tools in DeFi.

Is Kwenta a good investment?

Kwenta (KWENTA) isn’t a typical investment like Bitcoin. It’s a governance token for a trading platform. Its value comes from usage - if more people trade on Kwenta, stakers earn more fees. If usage drops, the token’s price can fall. It’s not a store of value. It’s a utility token. Only invest if you believe in synthetic asset trading and plan to stake it long-term.

Can I buy KWENTA on Coinbase?

As of late 2023, KWENTA is not listed on Coinbase’s main exchange. But you can buy it on decentralized exchanges like Uniswap or SushiSwap using ETH or USDC. You’ll need a Web3 wallet to do this. Coinbase plans to list KWENTA on its Base chain once Kwenta launches there in Q1 2024.

Why does Kwenta need $40 to start trading?

The $40 minimum is there to reduce small, risky trades that could strain the protocol’s liquidity pool. Kwenta uses a pooled model - everyone’s trades are backed by the same collateral. Small trades increase administrative overhead and risk. The $40 floor helps keep the system stable and efficient. Some users find it high, but it’s designed to protect the entire network.

Does Kwenta have a mobile app?

No, Kwenta doesn’t have a native mobile app. It’s a web-based platform that works on mobile browsers. You can use it through MetaMask or Coinbase Wallet on your phone. The interface is responsive and works well on smaller screens, but it’s not optimized like a dedicated app. There are no plans for a native app as of late 2023.

What happens if I get liquidated on Kwenta?

If your position loses too much value and your collateral falls below the required level, Kwenta automatically closes your trade. You lose your entire position, but you won’t owe more than you deposited. That’s because Kwenta uses isolated margin - each trade is separate. You don’t risk your other funds. Liquidations happen quickly, but during high volatility, delays can occur due to oracle updates.

How does Kwenta make money?

Kwenta earns a small fee (0.05% to 0.1%) on every trade. Half of that fee goes to stakers of KWENTA tokens. The other half goes into the protocol’s treasury, which funds development, marketing, and grants. The more trading volume, the more revenue. That’s why the team pushes for more users and new assets - volume drives token value.

Can I stake KWENTA without trading?

Yes. You can stake KWENTA tokens just to earn rewards, even if you never trade. You’ll earn a share of the protocol’s trading fees in sUSD and other tokens. It’s similar to earning interest in a savings account, but with higher risk - if trading volume drops, your rewards go down. Staking is the most common way to hold KWENTA long-term.

Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

Popular Articles

17 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

This is just gambling with fancy words. People don't need to trade Tesla stock on some blockchain app. You're just betting on price moves. It's not investing, it's casino mode with extra steps.

And now they want to add more assets? Next thing you know, we'll be trading synthetic pizza.

Stop pretending this is finance. It's not.

It's a distraction for people who think crypto is magic.

And don't get me started on the 25x leverage. People are gonna lose everything.

They're not traders. They're gamblers with wallets.

Wake up.

Real money doesn't work like this.

And the fact that people think this is 'decentralized finance' is just sad.

You're not building the future. You're just making it more complicated.

And now you're calling it governance? Please.

It's a ponzi with a whitepaper.

Just admit it.

It's not innovation. It's hype.

And you're all falling for it.

Just stop.

Go buy Bitcoin if you want to invest.

Not this nonsense.

Stop wasting your time.

And your money.

It's not worth it.

Trust me.

I've seen this movie before.

It ends the same way every time.

There's something deeply poetic about trading synthetic Tesla stock on a blockchain that runs on Optimism.

It's like building a cathedral out of smoke.

We've created a mirror world where assets exist only as mathematical representations, and yet we treat them as real.

Is this evolution? Or just a new kind of magic ritual dressed in code?

Humanity has always sought to transcend physical limits - first with language, then with money, now with digital shadows of value.

Kwenta doesn't just democratize access - it redefines what access even means.

But at what cost?

If we can trade anything without owning anything, are we trading reality itself?

And if the value of KWENTA depends on how much people trade synthetic gold… then what is value anymore?

Is it trust? Liquidity? Or just collective hallucination?

Maybe the real innovation isn't the tech.

It's that we're willing to believe in it.

That’s the part that scares me.

Not the leverage.

Not the fees.

But the fact that we’ve become so comfortable with abstraction that we no longer ask what’s real.

And maybe… that’s the future.

Not the blockchain.

But our willingness to live inside it.

That’s the true revolution.

And it’s already here.

Are you ready?

Or are you still clinging to the idea that money needs to be tangible?

Because if you are… you’re already behind.

And that’s okay.

Just don’t pretend you understand it.

Because you don’t.

And that’s the point.

It’s not meant for you.

It’s meant for those who’ve stopped needing to understand.

And just… feel.

It works.

Doesn’t it?

I really appreciate how Kwenta opens up markets that were previously locked behind banks and brokers.

I’m not a trader, but I’ve been watching this space for a while, and I think this is one of the most practical uses of DeFi I’ve seen.

Being able to short gold or buy Tesla stock without KYC is huge for people in countries with restricted financial access.

And the gas fees are a game changer - I’ve lost so much to Ethereum fees before.

I’m still learning how leverage works, but I’m glad the platform is transparent about the risks.

It’s not perfect - no system is - but I think it’s moving in the right direction.

I’d love to see more educational content built into the interface, though.

Maybe tooltips or short videos for new users.

Also, the fact that they’re expanding to Base could bring in so many new people who’ve never touched crypto before.

It’s exciting to think about.

I don’t know if I’ll ever trade with 25x leverage, but I’m definitely staking my KWENTA.

It feels like supporting something real, not just speculating.

And honestly? The lack of a mobile app doesn’t bother me.

I use my phone browser just fine.

It’s clean, fast, and works.

Why force an app if the web version does the job?

Anyway, I’m rooting for this project.

It’s quiet, but it’s doing something important.

And that’s rare.

Keep going.

You’re doing good work.

What Kwenta represents is not merely a technical innovation but a philosophical rupture in the architecture of value itself - the severing of ownership from utility, of asset from identity, of market from jurisdiction.

When you trade synthetic equity on a Layer 2 chain, you are not merely speculating on price movement - you are enacting a metaphysical claim: that value can exist independently of physical or institutional mediation.

This is the culmination of a 500-year trajectory of financial abstraction - from bills of exchange to derivatives to crypto - and Kwenta is the first platform that fully realizes the emancipatory potential of this trajectory.

But let us not be naive - this emancipation is not without its paradoxes.

The very mechanism that enables access - pooled liquidity backed by SNX collateral - also creates systemic fragility, as the collapse of SNX value could cascade through the entire synthetic ecosystem.

And yet, this fragility is not a bug - it is the condition of possibility for true decentralization.

Because if the system were perfectly stable, it would be controlled.

But it is not.

It is alive.

It breathes with the volatility of the real world it mirrors.

And that is why it is beautiful.

It does not pretend to be safe.

It does not promise returns.

It simply says: here is the tool.

Use it.

Or don’t.

But know that you are no longer dependent on the gatekeepers.

You are the gatekeeper.

And that is the true power of governance.

Not the votes.

Not the staking rewards.

But the recognition that you are now responsible.

For your trades.

For your risks.

For your choices.

And that is why Kwenta is not just a platform.

It is a mirror.

And in it, we see not the future of finance.

But the future of autonomy.

And that future is terrifying.

And glorious.

And ours.

Only if we dare to claim it.

Man, I’ve been using Kwenta for a few months now and I gotta say - it’s been a game changer.

I’m not a trader, I just like messing around with DeFi.

But the fact that I can trade gold without a brokerage account? That’s wild.

I’ve been staking KWENTA for the rewards - got about 10% APY last month, not bad.

And the fees are so low I’ve done like 20 trades and only paid $1 in gas total.

On Ethereum? That’d be $100.

Also, I love that you don’t need KYC - I hate filling out forms.

It’s just connect wallet and go.

Yeah, the interface is simple, no fancy charts or stop-losses, but I don’t need them.

And the $40 minimum? Honestly, it’s a good thing.

Keeps the noobs from blowing up their accounts.

My cousin tried to trade 5x leverage with $10 on another platform and lost it all in 3 minutes.

He still doesn’t get it.

Anyway, I’m not here to be a guru.

I just like that this thing works.

And it’s not trying to be Coinbase.

It’s doing its own thing.

And honestly? That’s cool.

Keep it simple.

Keep it real.

And keep the fees low.

That’s all I ask.

Oh wow. Another ‘decentralized’ platform that charges $40 just to play.

Let me guess - you think that’s ‘protecting the system’?

Bro, that’s a barrier to entry disguised as ‘risk management’.

Meanwhile, GMX lets you start with $10.

And you’re telling me your ‘stable’ pool can’t handle small trades?

Yeah right.

It’s not about stability.

It’s about keeping the little guys out so the whales can play in peace.

And then you charge them 0.1% fee and call it ‘rewards for stakers’?

Wow.

So the people who hold the token - the ones who already have it - get paid by the people who just want to trade?

That’s not governance.

That’s a tax.

And you’re calling it fair?

And don’t even get me started on the 60-second oracle delays.

So you liquidate someone’s position… 2 minutes after it should’ve happened?

That’s not ‘decentralized’.

That’s just sloppy.

And now you’re expanding to Base?

Great.

So Coinbase users can now lose money on synthetic Tesla stock without even leaving the app.

Perfect.

More sheep.

More fees.

More delusion.

Keep going.

I’ll be here watching you burn.

And I’ll be laughing.

Because this isn’t finance.

It’s a Ponzi with a whitepaper and a Discord channel.

And you’re all the chumps.

For anyone new to DeFi or synthetic assets - Kwenta is actually one of the most approachable platforms out there.

It’s not flashy, but it’s solid.

The fact that you can trade forex and stocks without KYC is a big deal, especially for people outside the U.S.

I’ve helped friends in Nigeria and Brazil set up wallets just to trade synthetic gold - they were amazed they could do it without a bank.

And the low fees make it sustainable for small trades.

Yes, the $40 minimum feels high at first, but it’s there for a reason - it prevents spam trades and keeps the liquidity pool healthy.

Most platforms don’t explain this.

Kwenta does.

Also, the staking rewards are legit - I’ve earned more in sUSD from staking than I’ve lost on bad trades.

And no, you don’t need to be a trader to benefit.

Just hold and stake.

It’s like earning interest, but with more risk.

But that’s DeFi.

It’s not supposed to be easy.

It’s supposed to be open.

And Kwenta delivers on that.

It’s not perfect.

But it’s honest.

And that’s rare.

So you’re telling me this platform lets you trade Tesla stock… but you can’t set a stop-loss?

And the liquidation oracle updates every 60 seconds?

So if the market crashes, you get wiped out… but the system doesn’t notice for a full minute?

That’s not innovation.

That’s a death trap.

And now they’re adding 15 more assets?

Why? So more people can lose money faster?

And the top 10 wallets hold 60% of the supply?

Oh wow.

So this is just another centralized token with a blockchain coat of paint.

And you call this ‘decentralized governance’?

LOL.

Who votes?

The whales.

Who gets liquidated?

The noobs.

Who gets paid?

The stakers who already had it.

It’s a pyramid.

With leverage.

And fake gold.

And fake Tesla.

And fake hope.

And you’re all still here.

Because you believe.

And that’s the saddest part.

You’re not trading assets.

You’re trading delusion.

And I’m just waiting for the day the whole thing collapses.

And you’ll be the ones crying.

While the devs cash out.

And move on to the next scam.

Good luck.

Enjoy your synthetic future.

The structural elegance of Kwenta’s design lies not in its technological novelty, but in its philosophical coherence: it removes intermediaries not merely to reduce costs, but to restore agency to the individual in a financial ecosystem that has long been monopolized by institutional gatekeepers.

By enabling access to real-world assets without identity verification, Kwenta challenges the very foundations of financial inclusion as traditionally conceived - not through charity or policy, but through protocol.

The $40 minimum deposit, while seemingly exclusionary, functions as a deliberate filter against speculative noise, preserving the integrity of the pooled liquidity model upon which the entire system depends.

Its reliance on SNX collateral introduces systemic risk, yes - but it also introduces accountability: every staker becomes a co-signatory to the platform’s stability.

And while the absence of advanced order types may appear as a limitation, it is in fact a form of restraint - a refusal to replicate the predatory complexity of centralized exchanges.

One might argue that Kwenta is not a trading platform at all.

It is a social contract encoded in smart contracts.

Its value is not derived from speculation, but from participation.

And its longevity will depend not on marketing or hype, but on the sustained trust of its users.

That is why I believe it will endure - not because it is perfect.

But because it is honest.

And in a space saturated with vaporware, honesty is the rarest asset of all.

I’ve been using Kwenta for about six months now. I don’t trade often, but I stake my KWENTA and it’s been solid.

Low fees, clean interface, and the ability to trade real-world assets without KYC is a huge win.

I’ve recommended it to a few friends who live overseas - they were thrilled they could trade gold without needing a U.S. bank account.

Yeah, the $40 minimum is a bit steep, but it’s worth it to avoid the chaos of tiny trades.

And the fact that they’re coming to Base? That’s smart.

More people will get exposed to DeFi without even realizing it.

It’s quiet, but it’s working.

And honestly? That’s better than most crypto projects.

They’re not screaming for attention.

They’re just building.

And that’s enough.

Oh look, another American crypto project pretending it’s for the world.

Let me guess - the devs are all in California and the users are in India and Nigeria?

Great.

So now you’re expanding to Base so Coinbase users can lose money faster?

And you think this is ‘decentralized’?

It’s just a new way for Silicon Valley to monetize global desperation.

You’re not empowering people.

You’re selling them a fantasy.

And you’re charging them $40 to play.

Meanwhile, real people in Venezuela or Argentina can’t even get a bank account.

But hey - they can trade synthetic Tesla on your platform.

That’s progress.

Right?

LOL.

Wake up.

This isn’t finance.

It’s colonialism with a blockchain.

And you’re the colonizer.

Congratulations.

The $40 minimum makes sense. Less noise. Better liquidity. Simple.

Everyone’s acting like Kwenta is some revolutionary breakthrough.

Let’s be real - it’s just GMX with more asset types and worse UX.

And the 25x leverage? That’s a suicide button wrapped in a whitepaper.

And don’t even get me started on the oracle delays.

One minute you’re fine, the next you’re liquidated because the price feed was 60 seconds late.

That’s not ‘decentralized’ - that’s just unreliable.

And the fact that the top 10 wallets hold 60% of KWENTA? Classic.

So you’re telling me this is ‘governance’?

It’s a plutocracy with a DAO logo.

And now they’re adding 15 more assets?

Why? So people can trade synthetic cat food next?

It’s not innovation.

It’s overreach.

And the fact that people are still staking this token like it’s a savings account?

That’s the real tragedy.

You’re not earning yield.

You’re funding a house of cards.

And when it falls?

Everyone’s gonna say ‘I didn’t know’.

But you did.

You just didn’t care.

Enjoy your synthetic future.

It’s gonna be short.

And expensive.

And lonely.

💔

I’ve been watching Kwenta for a while and I think it’s underrated.

Most people only talk about GMX or dYdX, but Kwenta does something unique - it lets you trade real-world assets without a broker.

That’s huge.

And the fact that it’s on Optimism means fees are low and speed is good.

I don’t trade often, but I stake KWENTA and it’s been reliable.

Yes, the interface is basic, but that’s not a bad thing.

It’s not trying to be a trading terminal.

It’s trying to be a tool.

And it works.

Also, the expansion to Base could be a game-changer.

Millions of Coinbase users might get exposed to DeFi through this.

That’s not hype.

That’s adoption.

And if the team keeps adding assets and improving the oracle system?

They could become the go-to for synthetic trading.

It’s not flashy.

But it’s solid.

And in crypto? That’s rare.

Oh wow. Another crypto bro pretending he’s a financial revolutionary.

Let me guess - you think trading synthetic Tesla on a blockchain is ‘empowerment’?

It’s not.

It’s a casino where the house always wins.

And the house? It’s the whales who hold 60% of the token.

And you? You’re the sucker who thinks staking KWENTA is ‘governance’.

It’s not.

It’s a tax on your hope.

And the $40 minimum? That’s not protection.

That’s a bouncer at the club.

Only the rich get in.

And the rest of us? We watch from outside.

While you post about ‘decentralized finance’ like it’s a moral victory.

It’s not.

It’s just a new way to extract value from the gullible.

And you’re proud of it?

Pathetic.

Go buy Bitcoin.

At least that’s honest.

This? This is fraud dressed in code.

And you’re the accomplice.

Kwenta is the quiet hero of DeFi.

While everyone’s chasing meme coins and NFTs, this platform quietly lets people trade gold, oil, and Tesla stock - no bank, no KYC, no drama.

It’s not sexy.

But it’s useful.

And honestly? That’s more than most crypto projects can say.

I love that you can stake KWENTA and earn rewards without ever trading.

It’s like a savings account that actually pays you.

Yeah, the interface is simple.

And yeah, there’s no mobile app.

But who needs one?

It works on my phone browser.

Fast. Clean. No lag.

And the $40 minimum? It’s there for a reason - keeps the pool stable.

Too many small trades break things.

And the oracle updates? They’re slow, but they’re honest.

No flash crashes.

No manipulation.

Just real-time data with a 60-second buffer.

It’s not perfect.

But it’s real.

And in crypto? That’s rare.

Most projects are built on hype.

Kwenta? Built on utility.

And that’s why it’ll last.

Not because it’s loud.

But because it’s needed.

So yeah.

I’m staking.

I’m holding.

And I’m quietly cheering for this team.

Keep going.

You’re doing something important.

Even if no one’s yelling about it.

That’s okay.

Real change doesn’t need a hype train.

It just needs to work.

And Kwenta? It works.

💯

You think this is useful? It’s just a fancy gambling app.

People don’t need synthetic Tesla.

They need food.

They need rent.

They need jobs.

Not crypto fantasy.

And you call this ‘freedom’?

It’s slavery with a wallet.

And you’re proud?

Pathetic.