Depth of Market: What It Is and Why It Matters in Crypto Trading

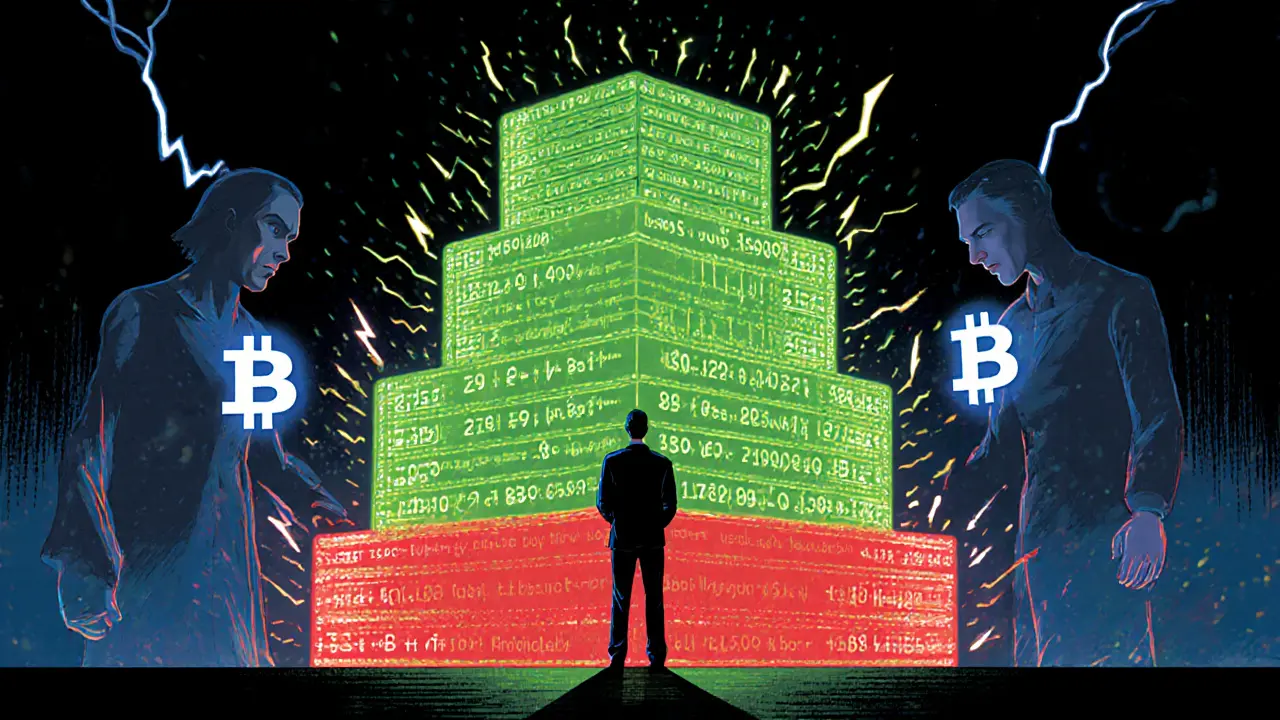

When you look at a crypto price chart, you’re only seeing half the story. The depth of market, the real-time display of buy and sell orders at different price levels. Also known as order book depth, it shows you who’s actually willing to trade—and at what price—before a single trade happens. Most traders chase price moves. Smart ones check the depth first. Because price can be fake. Liquidity isn’t.

The order book, the live list of all pending buy and sell orders for a crypto asset. is the backbone of any exchange. Big buy orders stacked at $30,000 for Bitcoin? That’s support. Huge sell walls at $32,000? That’s resistance you can’t see on a candlestick. This isn’t theory—it’s what separates traders who get stopped out from those who ride trends. And it’s why exchanges like TradeOgre and UBIEX can look active on the surface but have thin depth underneath—making them easy to manipulate.

Liquidity, how easily an asset can be bought or sold without moving the price. isn’t just about volume. It’s about concentration. A coin with $100 million daily volume but orders scattered across 50 price levels? That’s fake liquidity. A coin with $10 million volume but 80% of orders clustered in a $500 range? That’s real depth. This is why tokens like RUGAME or BOHR can spike 200% in minutes and crash just as fast—there’s no depth to hold the price. Real markets have walls. Scams have holes.

And then there’s trading volume, the total amount of an asset traded over a set period.. Volume tells you interest. Depth tells you intent. You can have high volume with zero depth—like a party with lots of people but no one willing to buy drinks. That’s what you see in airdrop coins like CYT or MTLX right after launch. Everyone rushes in. No one’s ready to hold. The depth vanishes. Price collapses.

Depth of market isn’t just for pros. If you’re buying any crypto, you need to know if the price you’re seeing is real. Look at the order book. Are there big buy orders below the current price? That’s where the floor is. Are there massive sell orders just above? That’s the ceiling. If the depth is thin on both sides, you’re trading in a minefield. That’s why exchanges like Balancer v2 and C3—despite being DeFi-focused—still make depth visible. They know you can’t trust a market that hides its bones.

You’ll find posts here that show you exactly how depth plays out in real cases—from the $40 million crypto seizure at TradeOgre (where hidden orders masked real liquidity) to the quiet collapse of dead tokens like BitWell and HyperPay Futures. You’ll see how airdrops like OneRare and Dragonary created fake depth that evaporated the moment people cashed out. And you’ll learn how to spot the difference between a market with real buyers and one that’s just a puppet show.

Price tells you where an asset is. Depth tells you where it’s going. And if you’re trading crypto without checking it, you’re not trading—you’re guessing. Below, you’ll find real examples, real data, and real lessons from markets that got it right—and those that didn’t.