- Home

- Cryptocurrency

- Using Multiple Crypto Exchanges to Avoid Restrictions: Risks and Realities

Using Multiple Crypto Exchanges to Avoid Restrictions: Risks and Realities

Many people think using multiple crypto exchanges is just a smart way to get better prices, access more coins, or dodge local trading limits. But what they don’t realize is that this practice often crosses into legally dangerous territory - especially when the goal is to avoid government rules, sanctions, or anti-money laundering checks. It’s not just about convenience. It’s about hiding where your money came from and where it’s going. And regulators are catching on.

How Multi-Exchange Strategies Work - and Why They’re Tricky

Using more than one exchange isn’t inherently illegal. Traders do it all the time to take advantage of price differences between platforms, access tokens not listed on their main exchange, or spread risk. But when you start switching between platforms to bypass identity checks, bypass deposit limits, or move money out of countries under sanctions, you’re entering a gray zone that’s increasingly monitored - and targeted. One common method is using nested exchanges. These aren’t full-fledged platforms like Binance or Coinbase. They’re middlemen. You send your crypto to them, they use their own accounts on bigger exchanges to trade for you, and then send the result back. Sounds harmless? Not always. Many nested exchanges skip KYC entirely. They don’t ask for ID, don’t verify your address, and don’t track where your funds originated. That’s exactly what criminals look for.The Criminal Playbook: Eight Ways to Evade Sanctions

According to Merkle Science, there are eight main tactics used by bad actors to hide crypto flows using multiple exchanges:- Compromised wallets: Stealing accounts from legitimate users who passed KYC, then using those clean wallets to move illicit funds.

- Non-compliant exchanges: Choosing platforms based in countries that ignore sanctions - like Russia, North Korea, or other sanctioned regions. These act as exit points for laundered money.

- Decentralized exchanges (DEXs): Platforms like Uniswap or PancakeSwap run on code, not companies. No one can force them to block transactions. That makes them ideal for moving funds without oversight.

- Peer-to-peer (P2P) marketplaces: Direct trades with strangers, often via Telegram or WhatsApp, where no identity is verified.

- Coin swap services: Instant crypto-to-crypto or crypto-to-cash services that require no signup. Often run by anonymous operators.

- Chain hopping: Moving funds between blockchains (Bitcoin → Ethereum → Monero → Solana) to break the trail.

- Layered transactions: Sending funds through 5-10 different wallets and exchanges to confuse tracking tools.

- Sanctioned token use: Using digital assets like A7A5, a ruble-backed token created to bypass Western financial controls.

Each of these methods is designed to make it harder for investigators to trace money back to its source. And they’re working - for now.

Regulators Are Fighting Back

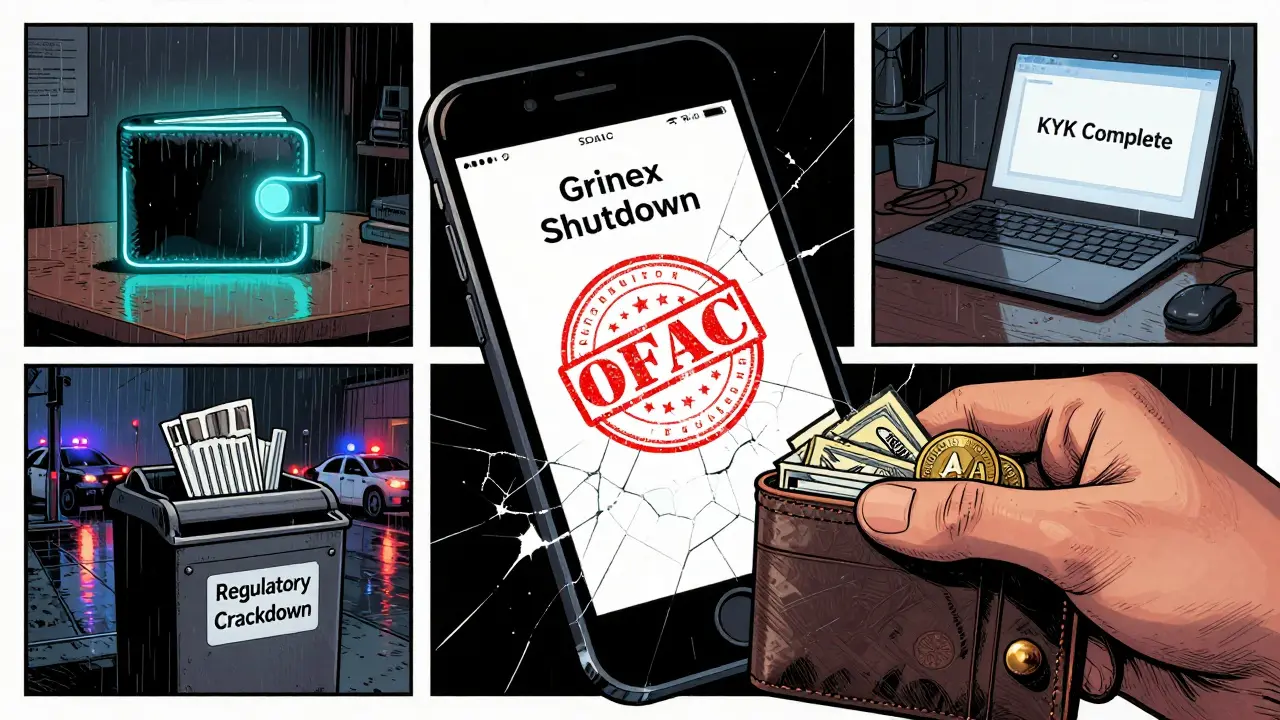

In March 2025, the U.S. Treasury’s Office of Foreign Assets Control (OFAC) took down Grinex, a crypto exchange created specifically to replace Garantex after U.S. sanctions froze Garantex’s assets. Grinex didn’t just continue Garantex’s business - it advertised itself as the new home for sanctioned users. Within weeks, it moved billions in crypto. OFAC didn’t just freeze accounts. They named the company, exposed its founders, and warned every bank and payment processor to cut ties. The SEC is also stepping up. Chair Gary Gensler has repeatedly said most crypto trading platforms are unregistered securities exchanges. That means if you’re running a platform that matches buyers and sellers - even if it’s called a “DEX” - you’re legally required to register. If you don’t, you’re breaking U.S. law. And that includes platforms that serve users from sanctioned countries.

Why Your Money Isn’t Safe on Non-Compliant Exchanges

If you’re using a nested exchange or a no-KYC platform, you’re not just breaking rules - you’re putting your assets at risk. These platforms have no legal obligation to protect you. If they get shut down, your funds vanish. If they’re hacked, you lose everything. If they’re used for laundering, you could be dragged into a criminal investigation. There’s no insurance. No customer support. No chargebacks. No recourse. You’re trusting strangers with your life savings - and those strangers might be criminals themselves.Red Flags That Should Set Off Alarms

Here’s what to watch for if you’re evaluating any exchange:- No KYC or instant account setup: If you can trade $10,000 worth of crypto without uploading ID, walk away.

- Only accepts crypto deposits: Legit exchanges let you deposit fiat via bank transfer or card. If it only takes crypto, it’s likely hiding something.

- Hidden ownership: No clear company name, address, or team on the website. Just a Telegram handle and a logo.

- Offers “unlimited” trading: Legitimate platforms have daily or monthly limits based on compliance. Unlimited? That’s a red flag.

- Uses obscure tokens: If you’re being asked to trade A7A5, GRT, or other tokens not listed on major exchanges, be extremely cautious.

- Encourages chain hopping: If the platform suggests you move funds from Ethereum to Monero to avoid detection, that’s a major warning sign.

If you see any of these, you’re not using a trading tool - you’re using a laundering pipeline.

What Legitimate Multi-Exchange Use Looks Like

There’s a difference between avoiding restrictions and managing risk. Legit traders use multiple exchanges for:- Accessing tokens only available on smaller platforms

- Reducing exposure if one exchange gets hacked

- Arbitrage: buying low on one exchange, selling high on another

- Managing liquidity across markets

The key difference? These traders comply with KYC, report their trades, and don’t try to hide their identity or transaction history. They use exchanges that are regulated, transparent, and accountable.

The Future: More Tracking, Less Anonymity

The days of slipping through the cracks are ending. Blockchain analysis firms like Chainalysis and Elliptic now track fund flows across hundreds of exchanges and wallets. Tools can follow a dollar from a sanctioned wallet on a Russian exchange, through a DEX, into a nested platform, and finally into a U.S.-based wallet - even if it took 17 steps. Regulators are also pushing for global cooperation. Countries that used to turn a blind eye are now under pressure to enforce sanctions. The EU, U.K., Australia, and New Zealand are tightening rules on crypto service providers. If you’re using a platform that’s banned in the U.S., you’re not safe just because you live elsewhere.What You Should Do Instead

If you’re stuck with local trading restrictions - like limited fiat access or banned tokens - here’s what to do:- Use only regulated exchanges that operate legally in your country.

- Complete full KYC. It takes time, but it protects you.

- Use decentralized wallets (like MetaMask) to hold your own keys - not exchanges for long-term storage.

- If you need access to a token not available locally, wait for it to be listed on a compliant platform.

- Report your crypto activity to tax authorities. Compliance isn’t optional anymore.

There’s no shortcut that’s both safe and legal. Trying to outsmart regulators with layered trades and hidden wallets doesn’t make you clever - it makes you a target.

Final Thought: The Cost of Convenience

Crypto was built to give people control over their money. But control doesn’t mean ignoring the law. Using multiple exchanges to avoid restrictions might feel like a workaround today - but tomorrow, it could mean frozen assets, legal trouble, or even criminal charges. The technology is powerful. But the rules are catching up. Play by them - or risk losing everything you’re trying to protect.Is it illegal to use multiple crypto exchanges?

It’s not illegal to use multiple exchanges for legitimate reasons like arbitrage or diversification. But if you’re doing it to bypass KYC, hide the source of funds, or evade sanctions, then yes - it’s illegal. Regulators treat intentional evasion as money laundering, which carries serious criminal penalties.

Can I get in trouble even if I didn’t know the exchange was sanctioned?

Ignorance doesn’t always protect you. If you used a platform later designated as sanctioned by OFAC or another regulator, you could still face asset freezes or investigations. That’s why due diligence matters - check if an exchange is on OFAC’s SDN list before depositing funds. Never trust a platform that hides its ownership or refuses to show compliance details.

Why do some exchanges not require KYC?

Some exchanges operate in jurisdictions with weak or no crypto regulations. Others are intentionally non-compliant to attract users who want to avoid identity checks - often criminals. These platforms have no legal obligation to report suspicious activity. That’s why they’re popular for money laundering, ransomware payments, and sanctions evasion.

Are decentralized exchanges (DEXs) safe for avoiding restrictions?

DEXs don’t require KYC, so they’re often used to evade restrictions. But that doesn’t make them safe. Transactions on DEXs are public and permanent. Law enforcement can trace them. If you’re moving funds linked to sanctions or crime, you’re still at risk - even if the DEX itself can’t be shut down. Plus, smart contract bugs and scams are common on lesser-known DEXs.

What happens if I use a nested exchange and it gets shut down?

Your funds disappear. Nested exchanges don’t hold your assets in your name - they hold them in their own accounts on other exchanges. If the nested platform is seized or goes offline, you have no legal claim to recover your money. There’s no customer service, no insurance, and no recourse. It’s like giving cash to a stranger and hoping they don’t run off.

Can I still trade crypto if my country bans it?

If your country bans crypto trading, using foreign exchanges to bypass the ban still violates local law. Even if you’re using a platform outside your country, authorities can track your IP, bank transfers, or wallet addresses. Penalties vary - from fines to criminal charges. The safest path is to follow your country’s laws, even if they’re restrictive.

How do regulators track crypto across multiple exchanges?

Regulators use blockchain analytics tools that trace every transaction across all public ledgers. Even if you move funds through 10 wallets and 5 exchanges, these tools can link them back to a single origin. Companies like Chainalysis, Elliptic, and TRM Labs work with governments to map these flows. Anonymity is a myth on public blockchains.

What’s the difference between a nested exchange and a regular one?

A regular exchange holds your funds and executes your trades directly. A nested exchange doesn’t. Instead, it uses its own accounts on other exchanges to trade on your behalf. You never directly interact with the underlying platform. This creates opacity - and risk. You’re trusting a middleman with your assets, and that middleman may not be regulated or secure.

Is it safe to use a crypto exchange based in Russia or North Korea?

No. Exchanges based in sanctioned countries are flagged by OFAC and other global regulators. Using them violates international sanctions. Even if you’re not from those countries, you can still be penalized. Your funds may be frozen, your bank accounts investigated, or your access to global financial systems cut off. These platforms exist to facilitate crime - not commerce.

What should I do if I’ve already used a non-compliant exchange?

Stop using it immediately. Move any remaining funds to a regulated exchange where you’ve completed KYC. Document everything - dates, amounts, wallet addresses. If you’re unsure whether you broke the law, consult a legal professional who specializes in crypto regulation. Don’t wait for a notice from authorities. Proactive steps can reduce your exposure.

Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

Popular Articles

2 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

lol so now you're telling me using 5 exchanges is money laundering? I just wanted to buy SHIB cheaper.

I don't care what the government says. If I can make money by moving crypto between platforms, I'm doing it. They don't own my assets. They don't get to tell me how to store my wealth. This is freedom, not crime.