NODE token: Everything You Need to Know

When working with NODE token, a utility token designed for decentralized finance platforms. Also known as NODE, it powers staking rewards, governance voting, and fee discounts within its native ecosystem. The NODE token encompasses DeFi utility, meaning it can be locked in smart contracts to earn yields or to participate in protocol decisions. Trading the NODE token requires a reliable crypto exchange, because liquidity and price discovery happen on those platforms. Regulatory compliance influences the NODE token’s adoption, as jurisdictions that favor clear crypto rules tend to attract more users and developers. Airdrop campaigns boost NODE token awareness, offering free allocations to early supporters and expanding the community base.

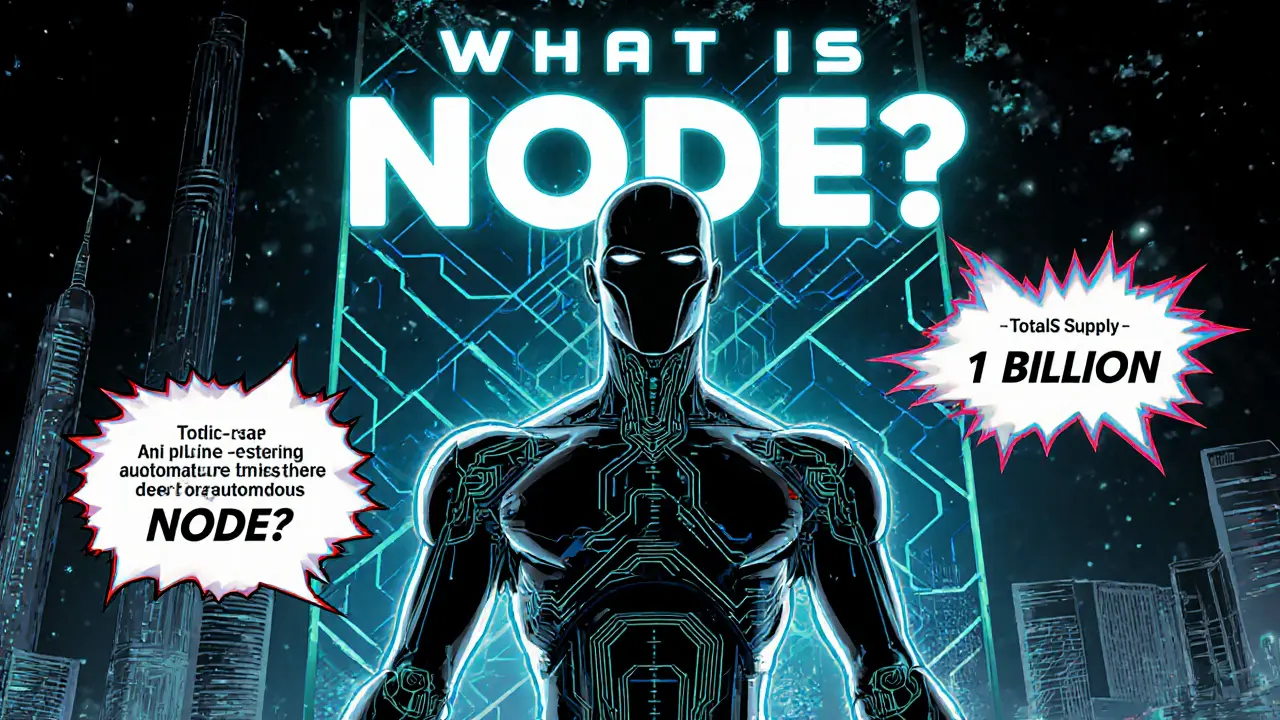

Key Aspects of the NODE Token

One of the most common ways new users discover the NODE token is through an airdrop, a distribution method where tokens are given for free to eligible wallets. A well‑executed airdrop can jump‑start network effects, drawing traders who later move the token onto a decentralized exchange, a peer‑to‑peer platform that matches buyers and sellers without a central authority. On these DEXs, users can swap NODE for other assets while keeping full control of their private keys, which aligns with the token’s ethos of permissionless access. Meanwhile, crypto regulation, the set of laws that govern digital asset activities in a given jurisdiction shapes how easily exchanges list NODE and how institutions view its risk profile. In regions with clear guidelines, exchanges can list NODE faster, offering tighter spreads and higher liquidity; in stricter markets, the token may face listing delays or additional compliance steps. Understanding these dynamics helps you decide where to hold or trade NODE safely.

Another critical metric for any token is its market cap, the total value of all circulating tokens, calculated by multiplying price by supply. The NODE token’s market cap reflects both its current price and the circulating supply, giving investors a quick sense of scale compared to other projects. A growing market cap often signals expanding adoption, while a shrinking cap may warn of reduced demand or token burns. Combining market‑cap analysis with a look at tokenomics, staking yields, and upcoming roadmap milestones paints a fuller picture of NODE’s long‑term potential. Below you’ll find detailed guides on how to claim NODE airdrops, how to trade it on leading decentralized exchanges, and what regulatory trends could affect its future. Armed with this context, you can move forward with confidence, whether you’re a casual holder or a seasoned trader.