- Home

- Cryptocurrency

- How Grassroots Crypto Adoption Thrives Despite Government Bans

How Grassroots Crypto Adoption Thrives Despite Government Bans

When your country’s currency loses 75% of its value in less than a decade, when banks freeze accounts without warning, and when sending money to family overseas costs 8% in fees - you don’t wait for permission to find a better way. That’s exactly what millions of Nigerians did. They turned to cryptocurrency - not because it was trendy, but because they had no other choice.

Why People Turn to Crypto When Governments Say No

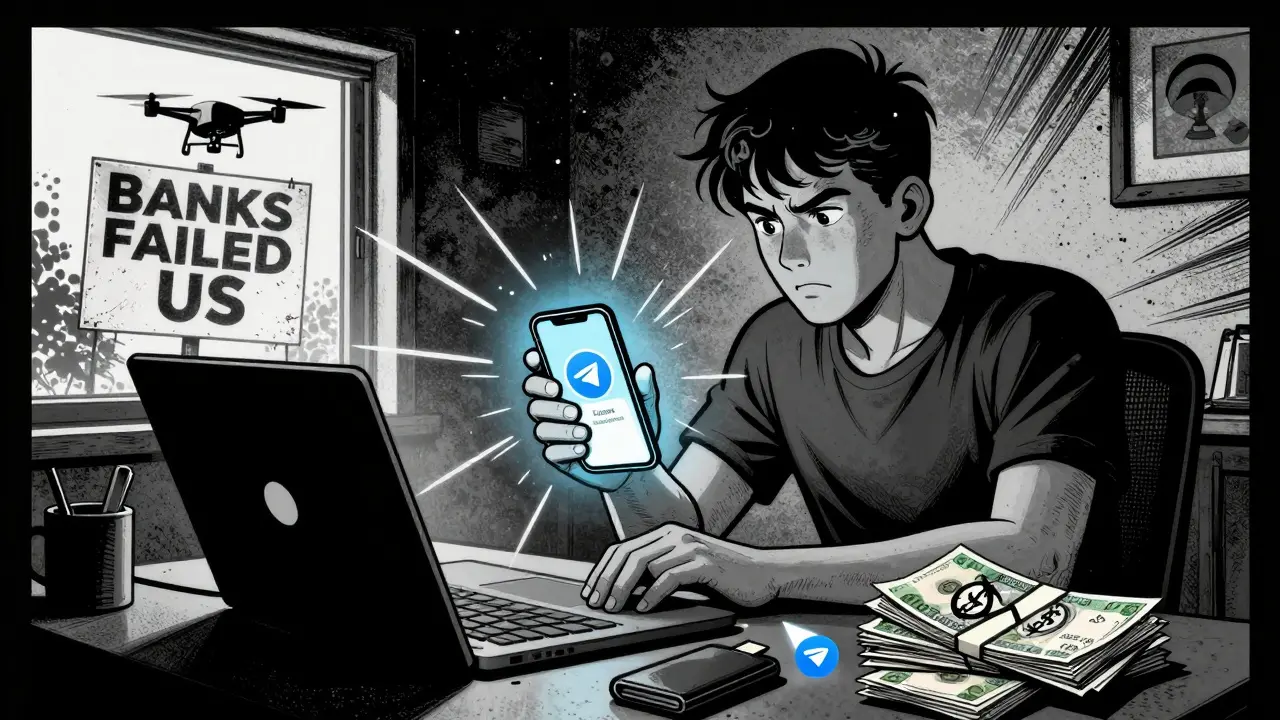

Government bans on cryptocurrency don’t stop adoption. They just push it underground. In places where the economy is unstable and banking systems are broken, crypto isn’t an investment. It’s survival. In Nigeria, inflation hit 24% in 2023. The naira, once worth 150 to the US dollar, now trades near 1,500. People saw their savings vanish overnight. Banks imposed strict limits on dollar withdrawals. Remittances from abroad - lifelines for families - became expensive and slow. Traditional finance failed them. So they turned to Bitcoin, USDT, and other stablecoins. Crypto doesn’t need a bank account. It runs on a phone. A simple app, a QR code, and you can send money across borders in minutes for less than 1%. No middlemen. No delays. No arbitrary freezes. For the 36% of Nigerian adults who are unbanked, this isn’t innovation - it’s access. This pattern isn’t unique to Nigeria. Similar stories are playing out in Argentina, Vietnam, Kenya, and Turkey. Where inflation is high, capital controls are tight, and trust in local banks is low, crypto fills the gap. Governments can ban exchanges. They can shut down local crypto platforms. But they can’t ban peer-to-peer transactions. They can’t stop people from holding digital money on their phones.The Nigerian Model: How It Actually Works

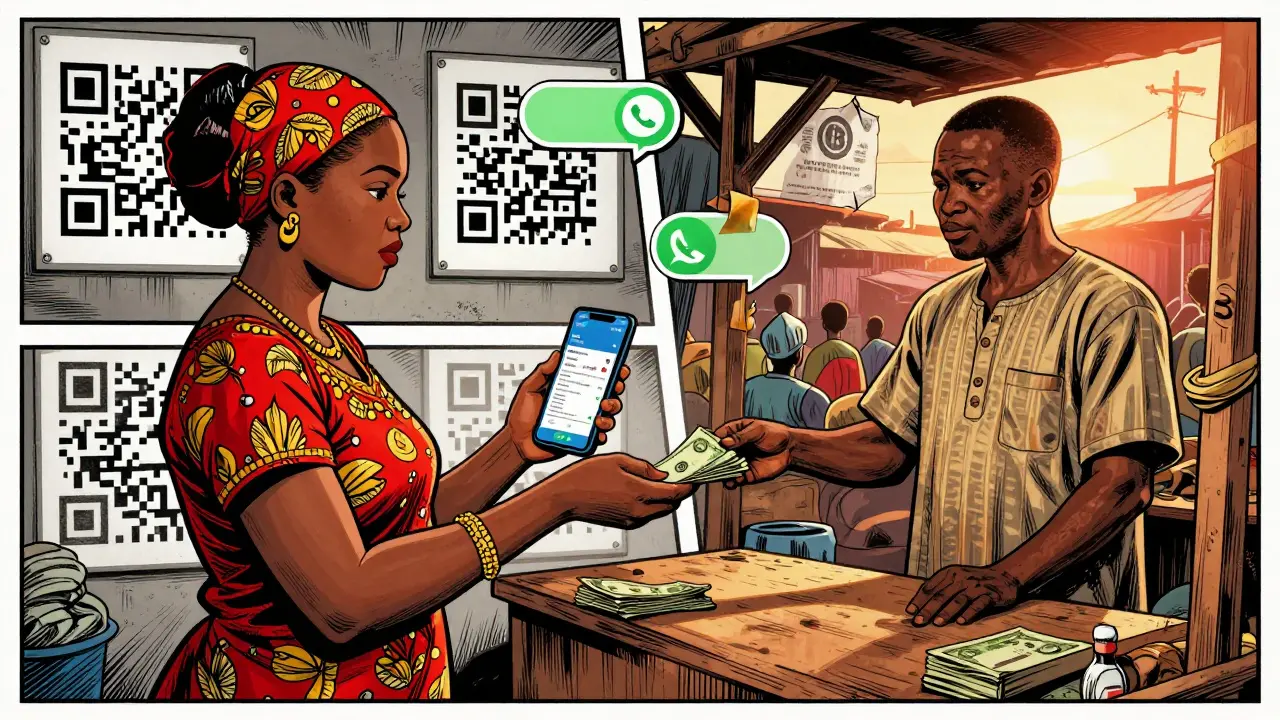

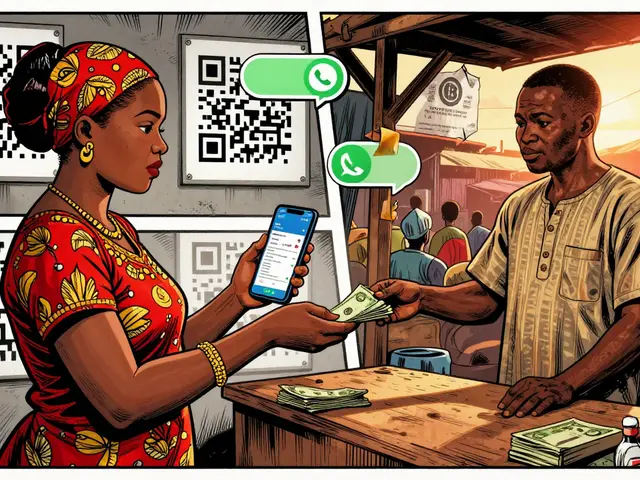

Nigeria is now the second-highest country in the world for cryptocurrency adoption, according to Chainalysis 2024. That’s not because of government support. It’s despite it. In 2021, the Central Bank of Nigeria banned banks from processing crypto transactions. The goal? To stop capital flight. The result? Crypto usage exploded. People switched to decentralized platforms like Paxful, LocalBitcoins, and peer-to-peer apps. They started using WhatsApp groups to connect buyers and sellers. Traders met in markets, exchanged cash, and transferred crypto via Telegram. Stablecoins became the backbone of daily finance. USDT - a digital token pegged to the US dollar - became the unofficial currency for paying freelancers, buying imported goods, and sending money home. A Lagos-based graphic designer earning in dollars from clients in the US no longer waits weeks for wire transfers. They get paid in USDT. Within minutes, they convert it to naira through a local trader. The whole process takes less than an hour. This isn’t speculative trading. It’s utility. People aren’t buying Bitcoin because they think it’ll hit $100,000. They’re buying it because it’s the only reliable way to store value and move money when the system is rigged against them.Why Bans Fail: The Tech Can’t Be Stopped

Governments think they can ban crypto by shutting down exchanges or blocking websites. But blockchain doesn’t live in one place. It’s decentralized. It runs on thousands of computers around the world. You can’t shut down a network that exists on mobile phones, laptops, and even old Android devices with 2GB of RAM. You can’t stop someone from downloading a wallet app from a mirror site. You can’t stop a teenager in Abuja from receiving USDT from their cousin in London via a simple wallet address. Even when Nigeria banned banks from handling crypto, P2P trading volume grew by 220% in the next year. People didn’t stop using crypto. They just got smarter. They used VPNs. They traded in cash. They used local agents who acted as human bridges between fiat and digital money. The same thing happened in Russia after sanctions hit in 2022. Banks were cut off from SWIFT. Russians turned to crypto for international payments. In Iran, where Western financial systems are blocked, crypto is used to buy medicine, pay for online courses, and access global services. The lesson is simple: you can’t ban what people need. You can only delay it - and when you delay it, you make it more dangerous. Without regulation, there’s no consumer protection. No dispute resolution. No recourse if you get scammed.

The Global Shift: From Bans to Regulation

Governments that tried to ban crypto are now realizing they can’t win. So they’re changing tactics. In the United States, the regulatory mood shifted dramatically in 2025. The GENIUS Act passed with bipartisan support - 68-30 in the Senate, 308-122 in the House. It created a legal framework for payment stablecoins. Issuers now must back every USDT or USDC with real US dollars or short-term Treasury bonds. No more shady reserves. No more algorithmic collapses. The Trump administration also issued an executive order in early 2025 declaring it “the policy of my Administration to support the responsible growth and use of digital assets.” Even the IRS dropped reporting requirements for small crypto transactions under $200 - a direct response to how everyday people were using crypto for daily payments, not speculation. This isn’t a surrender. It’s adaptation. When grassroots adoption hits critical mass, governments don’t crush it. They try to control it. They create rules. They tax it. They license it. They bring it into the system - on their terms. Nigeria’s government, after years of resistance, quietly began allowing licensed crypto exchanges to operate in 2024. They didn’t say, “We were wrong.” They said, “We’re regulating now.” The result? More transparency. More accountability. More people using legal platforms instead of shady P2P traders.What This Means for the Rest of the World

The future of crypto isn’t in Silicon Valley. It’s in Lagos, Manila, Buenos Aires, and Jakarta. Countries with stable currencies and strong banks might debate whether crypto is a bubble or a revolution. But in places where the currency is falling, banks are unreliable, and remittances cost a fortune - crypto is already the solution. This isn’t about decentralization as a political ideal. It’s about practicality. It’s about a mother in Nairobi sending $50 to her daughter in Kampala without waiting three days or paying $4 in fees. It’s about a freelance coder in Ukraine getting paid in crypto because their bank froze their account after the war started. The global financial system was built for the 20th century. It assumes you have a bank account, a credit history, and a government-issued ID. But billions don’t. Crypto doesn’t care. It works with a phone number and an internet connection. The real question isn’t whether crypto will survive government bans. It’s whether governments will keep trying to ban something that’s already working for millions.

The Risks Are Real - But So Are the Rewards

Let’s be clear: crypto isn’t magic. It’s risky. Scams are everywhere. Wallets get hacked. People lose money. Without regulation, there’s no safety net. In Nigeria, some P2P traders run fake platforms. Others disappear with cash after a crypto transfer. There’s no FDIC insurance. No recourse. That’s why the push for legal, licensed exchanges matters. It’s not about control. It’s about protection. The goal shouldn’t be to stop crypto. It should be to make it safer. To bring it into the light. To teach people how to use it without losing everything. The most successful countries aren’t the ones that banned crypto. They’re the ones that recognized its role in their economy and started building rules around it - like the US did with the GENIUS Act. They’re the ones that partnered with local fintechs to create compliant, accessible platforms.What Comes Next?

Grassroots crypto adoption isn’t going away. It’s growing. And it’s not driven by tech enthusiasts. It’s driven by necessity. As inflation rises in more countries, as banks tighten access to foreign currency, and as remittance costs stay high, more people will turn to crypto. Governments will have to choose: fight a losing battle, or step in and help people do it safely. The next five years will show whether regulators prioritize control - or whether they prioritize people. For now, the message is clear: if you want to stop crypto, you have to fix the system that made people turn to it in the first place.Grassroots crypto adoption isn’t a rebellion. It’s a response. And as long as the old system fails, the new one will grow.

Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

Popular Articles

18 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

Let me tell you something - I’ve seen this play out in real time. My cousin in Lagos uses USDT to pay her freelance clients in the US. No more waiting 5 days for a wire. No more $40 in fees. She converts it to naira via a WhatsApp trader, gets cash in 20 minutes. This isn’t crypto bros gambling. This is survival. And honestly? It’s beautiful to see people build their own financial system from scratch. The banks didn’t fail them because they were lazy - they failed because they were broken.

And guess what? The government didn’t stop it. They just tried to ban it. That’s like trying to stop water from flowing downhill. You don’t stop a tide - you learn to surf.

People in Nigeria aren’t trying to overthrow the system. They’re just trying to eat. And crypto? It’s the only fork they’ve got.

Wait, wait, wait - so you’re saying… crypto is GOOD? Because people are poor? That’s like saying fire is good because people get cold. You’re romanticizing chaos! What about the scams? The rug pulls? The people who lose everything because they didn’t know what a private key was?! You’re ignoring the human cost! And don’t even get me started on the energy usage!!

im just here for the vibe lol

like… my aunt in naija sent me $50 via usdt last week. i got it in 12 mins. no bank. no forms. no ‘we need your 3rd cousin’s birth certificate’. it just… worked.

and i cried. not because it’s tech. because it was human.

also… who even is the cbn anyway? why do they get to decide if my family gets to feed themselves?

While I appreciate the sentiment behind this piece, I must emphasize that the adoption of cryptocurrency in developing economies should be accompanied by financial literacy initiatives. Without proper education, even well-intentioned tools can lead to unintended consequences. The Nigerian experience, though inspiring, must be viewed through the lens of systemic vulnerability - not as a model to be replicated without safeguards.

Regulation is not suppression; it is stewardship.

How quaint. You treat a desperate people’s last resort as some kind of revolutionary triumph. The fact that Nigerians are forced to use crypto because their own government is incompetent doesn’t make crypto noble - it makes the government a failure. And you? You’re celebrating the symptom while ignoring the disease.

Meanwhile, in India, we have UPI - instant, free, regulated, and used by 400 million people. No blockchain required. No volatility. No scams. Just… functionality.

Maybe stop romanticizing chaos and fix your own systems first?

There’s a deeper philosophical layer here that’s often missed. Crypto isn’t just money - it’s autonomy. When you live under a system that can erase your wealth overnight, the ability to hold value outside of institutional control becomes a moral imperative.

This isn’t about technology. It’s about dignity.

People in Lagos aren’t using Bitcoin because they think it’ll hit $100k. They’re using it because they refuse to be powerless. And that’s a human story older than any ledger.

When governments ban what people need, they’re not protecting stability - they’re denying agency. And history always punishes those who confuse control with order.

LOL you guys act like crypto is the answer but did you know 80% of p2p trades in nigeria are scams? and usdt isn’t even fully backed? and the cbn banned it because they saw the inflation spiral and tried to stop capital flight? you’re not saving your family - you’re gambling with your savings. and calling it ‘access’ doesn’t make it smart.

also - ‘no middlemen’? lol who do you think runs the whatsapp traders? they’re middlemen with no accountability. and you’re proud of this?

How dare you glorify financial anarchy? This is precisely why we need regulation - to prevent the masses from being exploited by unlicensed actors operating in the shadows. Your ‘grassroots adoption’ is just predatory capitalism with a blockchain veneer.

People don’t need crypto. They need competent governance. But you’d rather blame the system than demand better leaders.

Pathetic.

Actually, this is exactly why India’s UPI works better. Instant, zero cost, regulated, and integrated with Aadhaar. No volatility. No wallet security risks. No need to trust strangers on WhatsApp.

Crypto works in Nigeria because the system collapsed. That’s not a win - it’s a warning.

Fix the system before you build alternatives.

OH MY GOD. YOU JUST MADE CRYPTO SOUND LIKE A SUPERHERO. DID YOU JUST CALL A NIGERIAN WOMAN USING USDT A REVOLUTIONARY? SHE’S JUST TRYING TO EAT. YOU’RE TURNING SURVIVAL INTO A TED TALK.

AND DON’T EVEN GET ME STARTED ON THE ‘GENIUS ACT’ - THAT’S JUST WALL STREET IN A NEW SUIT. THEY’RE NOT HELPING PEOPLE. THEY’RE TAXING THEM.

THIS ISN’T LIBERATION. IT’S A NEW KIND OF PRISON - WITH MORE SCAMS AND LESS LAWYERS.

Let’s be real - the entire narrative here is dangerously oversimplified. Yes, crypto provides liquidity where banking fails. But the lack of consumer protection is catastrophic. In Nigeria, over 60% of P2P traders operate without KYC. That means money laundering, fraud, and ransomware payments are flowing freely.

And you think this is ‘access’? No - it’s exposure. People aren’t empowered - they’re exposed to risks they can’t even comprehend. A mother sending $50 to her daughter doesn’t know what a smart contract is. She just sees ‘send crypto’ and clicks ‘confirm’.

Meanwhile, the real winners? The guys running the WhatsApp liquidity pools. They’re not heroes. They’re unregulated financial predators with phone numbers and no accountability.

And don’t get me started on the environmental cost. One Bitcoin transaction uses more electricity than a Ghanaian household uses in six months. You’re solving one crisis by creating three others.

Don’t mistake desperation for innovation. It’s just capitalism with a blockchain tattoo.

I’ve talked to dozens of people in Lagos, Nairobi, and Manila who use crypto daily. Not for speculation. Not for ‘getting rich’. Just to survive. One guy I met in Abuja - he’s a mechanic. He gets paid in naira by local clients. But his wife’s family in the UK sends him money in pounds. He used to wait 10 days. Lost 20% in fees. Now? He gets USDT. Converts to naira in 15 minutes. Pays for his kid’s school fees. Buys engine parts. Keeps his lights on.

This isn’t tech. This is love.

They’re not hacking the system. They’re healing it. With their phones. With their trust. With their grit.

And yeah - there are scams. Of course there are. But you don’t stop people from using fire because someone got burned. You teach them safety. You build better stoves.

The real tragedy? The world watches this miracle happen - and calls it a problem to be banned. Not a solution to be supported.

Maybe the question isn’t ‘can we stop crypto?’

Maybe it’s - ‘why are we still letting people starve so we can protect our banks?’

Let’s not pretend this is some noble grassroots movement. It’s financial anarchy dressed up in tech jargon. The fact that people are turning to crypto because their governments are corrupt doesn’t make crypto virtuous - it makes those governments failures. And you? You’re just happy to profit from their misery.

And don’t get me started on the ‘GENIUS Act’ - that’s not regulation. That’s corporate capture. They’re not helping people. They’re making crypto compliant so they can tax it and control it.

Same game. New cards.

YESSSSSSSSSSSSSSSSS!!! 💪🔥

THIS IS WHY I LOVE HUMANITY!!!

People in Lagos didn’t wait for permission. They didn’t complain. They just… DID IT. With phones. With WhatsApp. With trust. With grit.

NO BANKS. NO BUREAUCRACY. JUST PEOPLE HELPING PEOPLE.

WE NEED MORE OF THIS. NOT LESS.

TO THE GOVERNMENTS: STOP FIGHTING THE FUTURE. JOIN IT.

❤️🌍 #CryptoIsFreedom

people are dumb and crypto is a scam

if you need it you’re already broke

why are you even reading this

I just want to say - thank you for writing this. I’ve been thinking about this for months. My friend in Kenya uses crypto to send money to her sister in Uganda. No delays. No fees. Just… done.

It’s not perfect. But it’s better than what they had.

And honestly? I think we’re seeing the future. Not the flashy kind. The quiet kind. The kind where a mother chooses dignity over dependence.

Let’s not fight it. Let’s make it safer.

There’s something poetic about this. Crypto isn’t being adopted because it’s cool. It’s being adopted because it’s kind.

It doesn’t ask for your ID. Doesn’t judge your credit score. Doesn’t care if you’re unbanked. It just… works.

It’s like a digital handshake between strangers across borders.

And maybe that’s the real revolution - not the price chart. Not the blockchain. But the quiet, stubborn act of trusting each other when the system says you shouldn’t.

Shubham, you’re right - UPI is brilliant. But here’s the thing: UPI needs a bank account. It needs an ID. It needs infrastructure. In Nigeria, 36% of adults don’t have bank accounts. No ID. No address. No credit history. UPI can’t reach them. Crypto can.

It’s not about choosing one over the other. It’s about recognizing that different people need different tools.

And sometimes - the most powerful innovation isn’t the one invented in a lab. It’s the one invented by a mother in a Lagos market, trading cash for USDT so her kid can eat tomorrow.