Tax Reporting Staking: Your Guide to Declaring Crypto Rewards

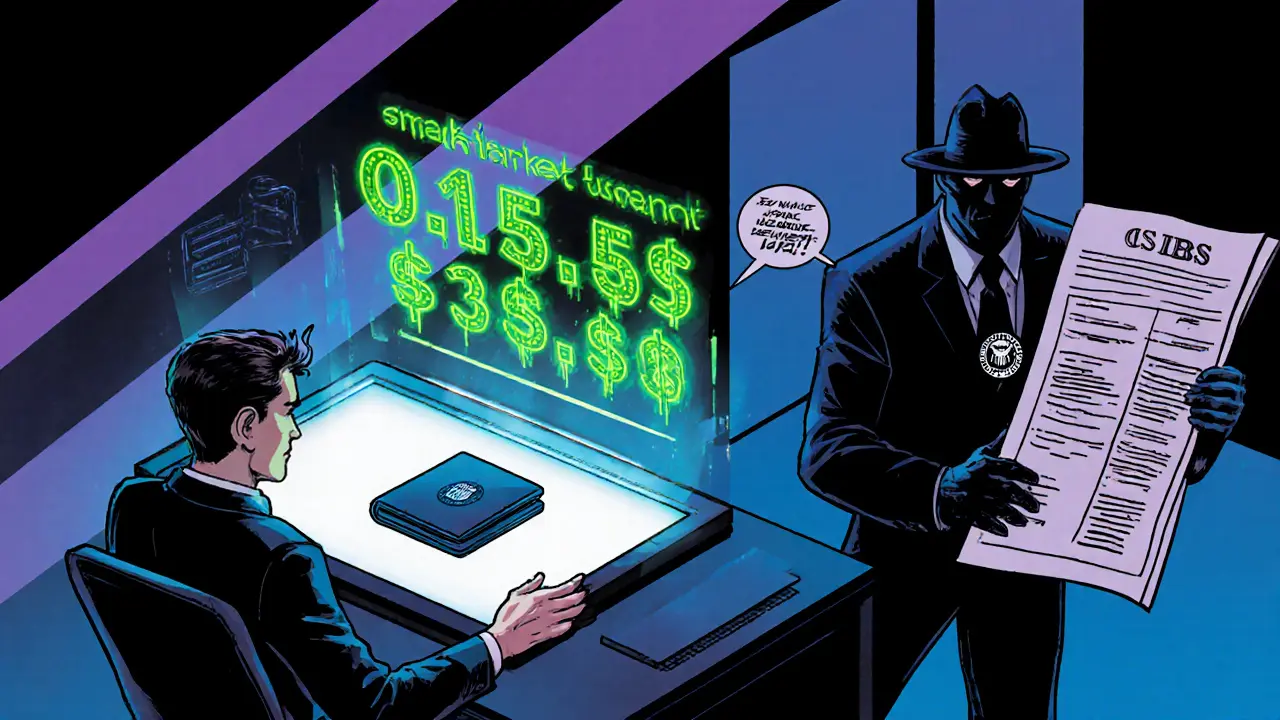

When dealing with tax reporting staking, the process of reporting income earned from crypto staking activities to tax authorities. Also known as staking tax filing, it sits at the intersection of cryptocurrency staking, locking digital assets in a network to earn rewards and the tax obligations, legal duties to report and pay taxes on earned income. tax reporting staking is not optional – most jurisdictions view staking payouts as ordinary income, and failure to report can trigger penalties.

Key Steps for Accurate Staking Tax Reporting

First, understand that staking rewards are treated like any other income. Whether you earn a few dollars from a small validator or large yields from a DeFi pool, the value at the time you receive the reward must be recorded. This creates a clear semantic connection: staking rewards → taxable income. Next, keep a detailed ledger of every staking event – the date, amount, token type, and the USD (or local currency) value at receipt. Accurate record‑keeping requires timestamps from your wallet, exchange statements, and any blockchain explorer data.

Jurisdiction matters. In the United States, the IRS treats staking as ordinary income, while the UK’s HMRC classifies it as miscellaneous income. European regulators are moving toward similar rules. This diversity means the same staking activity can generate different tax treatment depending on where you live. Knowing the local definition of taxable event helps you avoid double‑counting or missing income.

Many people rely on crypto tax software to automate the heavy lifting. Tools like CoinTracker, TokenTax, and Koinly can pull staking data directly from wallets and exchanges, calculate fair market value at the time of receipt, and generate ready‑to‑file tax forms. Using such software bridges the gap between raw blockchain data and the tax filing requirements imposed by authorities.

Common pitfalls include ignoring airdropped tokens that are technically a form of staking reward, misclassifying earned tokens as capital gains instead of income, and failing to account for the change in value when you later sell or re‑stake the rewards. Each mistake can inflate your tax bill or raise red flags during an audit. By treating every incoming token as income, then separately tracking its cost basis for future disposals, you keep the two tax concepts distinct and compliant.

Finally, stay updated on regulatory changes. Tax authorities are rapidly issuing guidance on DeFi, liquidity mining, and staking derivatives. What was a gray area last year may become a clear requirement tomorrow. Subscribing to reliable crypto tax newsletters or checking official tax agency releases ensures you don’t fall behind.

Below you’ll find a curated collection of articles that dive deeper into each of these areas – from detailed security guides for exchanges that affect your staking safety, to country‑specific rules like the UK FCA advertising limits that indirectly influence how you promote staking services. Explore the posts to sharpen your reporting skills, choose the right tools, and keep your staking profits stress‑free.