- Home

- Cryptocurrency

- How Exchange Token Burn Mechanisms Drive Value in Crypto

How Exchange Token Burn Mechanisms Drive Value in Crypto

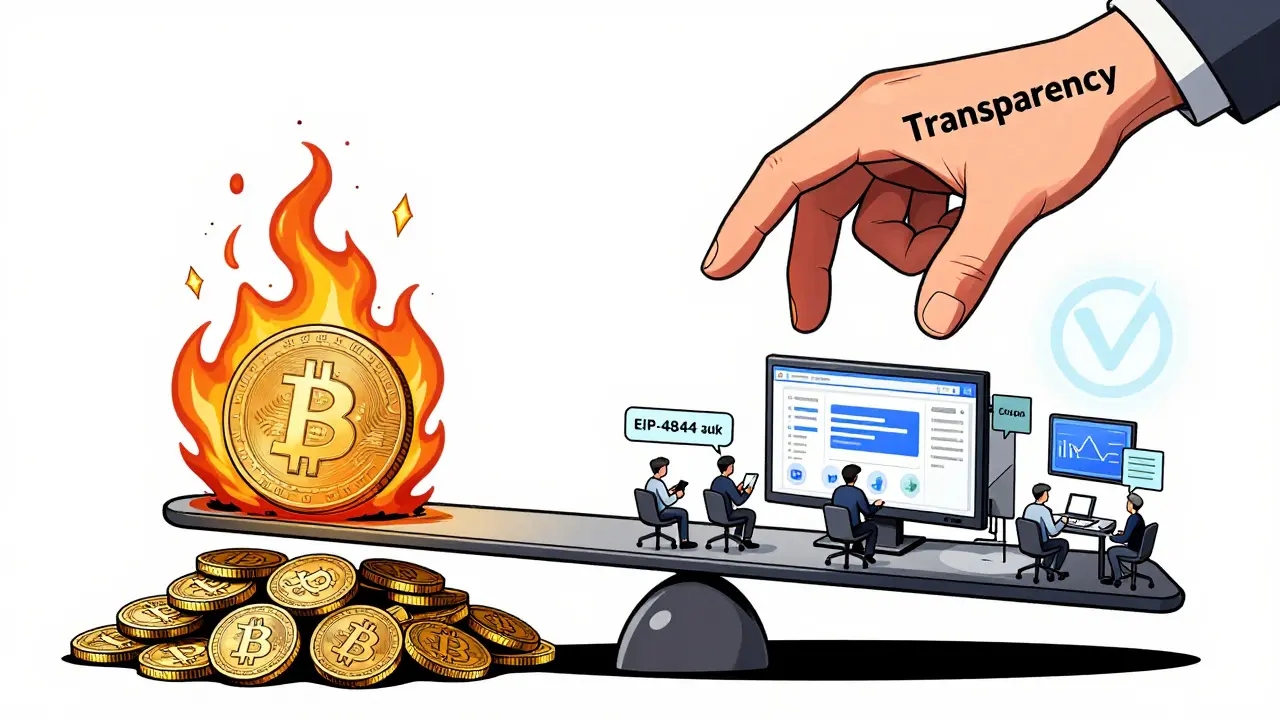

When you hold a token from a crypto exchange like Binance, KuCoin, or OKX, you’re not just holding a digital asset-you’re holding a piece of a business model built on scarcity. The secret sauce? Exchange token burn mechanisms. These aren’t just marketing gimmicks. They’re real, verifiable, and often highly effective tools that remove tokens from circulation to create value for holders. But not all burns are created equal. Some work. Others? They’re just noise.

What Exactly Is a Token Burn?

A token burn is the permanent removal of cryptocurrency tokens from circulation. Once burned, those tokens can never be used, traded, or recovered. They’re sent to a special wallet address-usually the null address (0x000000000000000000000000000000000000dEaD)-that has no private key. No one owns it. No one can access it. It’s a digital black hole. This isn’t magic. It’s economics. When supply drops and demand stays the same-or grows-price pressure rises. That’s basic supply and demand. Exchanges use burns to signal confidence in their platform and to reward long-term holders. The most famous example? Binance’s BNB token. Binance started burning BNB quarterly in 2017, promising to destroy 20% of its trading fees in BNB until half the supply (50 million tokens) was gone. By Q4 2025, they’d burned 44.3 million BNB-44.3% of the original 100 million. The price? Up 18,700% from its $0.10 ICO price to $18.73. That’s not just luck. It’s a direct result of consistent, transparent supply reduction.How Do Exchange Token Burns Actually Work?

The mechanics are simple, but the execution matters. Most exchanges use smart contracts-self-executing code on blockchains like Ethereum (ERC-20) or BNB Chain (BEP-20)-to automate the process. Here’s the standard flow:- During a set period (daily, weekly, quarterly), the exchange collects trading fees in BTC, ETH, or other assets.

- It converts a fixed percentage of those fees into its native token (e.g., 20% of BTC fees become BNB).

- The converted tokens are sent to the burn address.

- The transaction is recorded on the blockchain, publicly verifiable.

Not All Burns Are Equal: The Good, the Bad, and the Dubious

Here’s the hard truth: not every exchange burn creates real value. Some are just accounting tricks. The best burns are tied directly to revenue. Binance’s model works because it’s funded by actual trading fees. If the exchange isn’t making money, it can’t burn tokens. That creates a natural feedback loop: more trading → more burns → higher token value. The University of Zurich’s 2024 study confirmed this. Of 14 exchange tokens with burn mechanisms, only those linked to verifiable revenue showed a strong price correlation (r=0.78). The others? No meaningful impact. Then there’s the bad. CoinEgg burned tokens regularly-but its platform had almost no users. The token crashed 99.7%. Why? Because burns without utility are just deleting numbers. No one cares. And then there’s the dangerous. FTX burned 100 million FTT tokens in 2022-right before it collapsed. Regulators later called it market manipulation. The burn looked bullish on the surface. But behind the scenes, it was a distraction. That’s why transparency isn’t optional. It’s survival.

What Makes a Burn Trustworthy?

Trust is everything. If users can’t verify the burn, they won’t believe it. Best practices? Look for these:- Public burn address-published on the exchange’s website and blockchain explorers.

- Real-time burn tracker-like KuCoin’s live counter showing how many tokens have been destroyed.

- Pre-announcement-Binance gives 72 hours’ notice before each burn. That builds anticipation and trust.

- Post-burn proof-transaction hashes shared on Twitter, Telegram, and GitHub within 24 hours.

Why Do Investors Care?

Because token burns are one of the few predictable bullish signals in crypto. A 2025 Fidelity survey found 58% of active crypto traders consider verified token burns a “very important” factor when choosing an exchange. That’s second only to security. And it makes sense. If you’re holding BNB, you know every quarter, millions of tokens vanish. That’s not speculation. That’s a scheduled event. It creates a floor under the price. In bear markets, when everything else is falling, burns become a rare beacon of stability. Nic Carter of Castle Island Ventures put it bluntly: “BNB’s 18-month average 25% premium over non-burn tokens isn’t coincidence. It’s economic design.” But Vitalik Buterin warned exchanges: “Burns must be transparent. Otherwise, they’re confidence tricks.” He’s right. If you can’t prove it, it doesn’t exist.

What’s Next for Token Burns?

The future is getting smarter. Binance just introduced “Proof-of-Burn”-third-party audits by Armanino LLP to verify every burn. That’s a huge step toward institutional trust. Ethereum’s upcoming EIP-4844 upgrade, scheduled for Q3 2026, will bring exchange-style burns directly into the protocol. That means even decentralized platforms will start using burn mechanics. The line between centralized and decentralized tokenomics is blurring. Analysts at Galaxy Digital predict that by 2028, AI will optimize burn schedules in real time-adjusting burn rates based on trading volume, market volatility, and even macroeconomic data. That’s not sci-fi. It’s inevitable. But there’s a warning. A 2025 Cambridge study estimated that if current burn rates continue, 32% of all exchange tokens will be destroyed by 2030. That sounds great for holders-but what if liquidity dries up? What if the token becomes too scarce to trade easily? The answer? Burns must be balanced with utility. Tokens need real use cases: paying fees, staking, voting, accessing premium features. Otherwise, you’re just shrinking the pie without making it tastier.Final Takeaway: Burns Are Powerful-But Only If They’re Real

Exchange token burns are one of the most effective tools in crypto for creating value. But they’re not magic. They’re mechanics. And like any mechanic, they only work if they’re built right. Look for burns that are:- Funded by real revenue

- Transparently verified

- Consistently executed

- Linked to platform growth

Are exchange token burns guaranteed to increase token price?

No. Token burns can create upward price pressure, but they don’t guarantee it. If the underlying exchange isn’t growing, or if trading volume drops, burns alone won’t save the token. BNB rose because Binance grew massively-burns amplified that growth. CoinEgg burned tokens regularly but collapsed because its platform had no users. Burns need utility to work.

Can I verify an exchange’s token burn myself?

Yes, if the exchange is transparent. Look for the burn address on their official site, then check the blockchain explorer (like BscScan or Etherscan). Search for transactions sent to 0x0000...dEaD. If you see regular, verifiable transfers matching their announced burn amounts, it’s real. If the address isn’t published or transactions are missing, be skeptical.

Which exchanges have the most effective burn mechanisms?

Binance (BNB) leads in scale and transparency, burning over 2 million BNB in Q4 2025 alone. KuCoin (KCS) stands out for frequency-daily burns since 2020. OKX combines monthly burns with buybacks during downturns. All three publish live trackers and transaction proofs. Gate.io’s dynamic model is innovative but harder to predict. Avoid exchanges without public burn addresses or real-time tracking.

Do token burns affect the exchange’s revenue?

No-they’re funded by revenue, not the other way around. Exchanges take a portion of trading fees (in BTC, ETH, etc.) and convert them into their native token to burn. This doesn’t reduce their income; it’s just a way to redistribute value to token holders. In fact, strong burns can attract more traders, increasing revenue over time.

Are token burns regulated?

Yes, increasingly so. The U.S. SEC’s 2024 Framework for Token Burns warned that if a burn is tied to profit-sharing promises or implied returns, it could be classified as an unregistered security. That’s why Coinbase and others now avoid language like “token value will rise” in burn announcements. Transparency is legal, too.

Can token burns be stopped or changed?

Yes-exchanges can change burn rules at any time. Binance, for example, originally planned to burn until 50% of BNB was gone, but after hitting that target in 2021, they extended the program indefinitely. Always check the latest official documentation. A burn schedule that’s “forever” is rarely forever. Trust, but verify.

Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

Popular Articles

6 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

This is the most bs i've read all week. Burns don't create value they just delete numbers. BNB went up because Binance is a monopoly not because of some magic burn fairy. 🤡

I get what you're saying about burns being economic not magic but honestly the whole thing feels like a shell game to me. You're telling me that if a company just deletes tokens it makes them more valuable but what if no one actually uses the token for anything other than speculation? Like I get the math but real value comes from utility not deletion. I've seen coins get burned 10 times and still crash because no one cared about the platform behind it. The burn is just the icing not the cake and if the cake is stale no amount of sprinkles helps.

Man I love how this post breaks it down so clearly 🙌 Like seriously Binance didn't get rich by magic they built a platform people actually use and then used burns to reward the people who stuck around. It's not about deleting tokens it's about aligning incentives. When you see KuCoin burning daily and OKX buying back during dips you know they're playing the long game. Not all burns are equal but when they're tied to real revenue? That's when you see the magic. Don't chase the burn chase the business behind it 💪

Burns are a distraction. Value comes from adoption not deletion.

The assertion that token burns create value through supply-demand mechanics is fundamentally flawed. Value is not derived from scarcity alone but from network effects, utility, and trust. A burn without a functional ecosystem is merely a cryptographic null operation.

LMAO look at all these crypto bros acting like burning tokens is some genius economic theory. Binance burns 2 million BNB and suddenly it's 'economic design'? Bro they're just taking your trading fees and throwing them in a digital dumpster. The real scam is how people think this isn't just a marketing stunt. And don't even get me started on those 'live trackers' - anyone with a brain knows those can be faked. You think the SEC didn't notice this? They're just waiting for the right moment to shut it all down. You're all just feeding the machine.