Bitcoin block reward: How mining incentives shape the network

When you hear about Bitcoin block reward, the amount of new Bitcoin awarded to miners for validating transactions and adding a block to the blockchain. It's not just a payment—it's the engine that keeps the whole network running. Every ten minutes or so, a new block is added to Bitcoin’s ledger, and whoever solves the cryptographic puzzle first gets rewarded. That reward started at 50 BTC in 2009 and has been cut in half roughly every four years. The last halving dropped it to 3.125 BTC, and the next one in 2028 will bring it down to 1.5625 BTC. This isn’t random—it’s coded into Bitcoin’s DNA to control supply and mimic scarcity, like gold.

The Bitcoin mining, the process of using specialized hardware to validate transactions and secure the network through proof-of-work. It's what makes Bitcoin decentralized and tamper-resistant doesn’t just happen because people want to earn coins. Miners spend real money on electricity, equipment, and maintenance. They do it because the reward still outweighs the cost—for now. But as the block reward shrinks, transaction fees become more important. That’s why you’ll see posts here about blockchain incentives, the economic structures that motivate participants to act in the network’s best interest. They’re not just about mining. They’re about how networks stay alive when the easy money runs out. The halving, the scheduled reduction of the Bitcoin block reward by 50%, occurring approximately every 210,000 blocks. It’s the most predictable event in crypto isn’t just a technical detail. It’s a market event. Every time it happens, people watch prices, speculate on supply shocks, and debate whether scarcity drives value or if demand just follows the hype. Some say the halving is why Bitcoin survived its early years. Others say it’s the reason miners are moving to cheaper energy regions or shutting down entirely when prices dip.

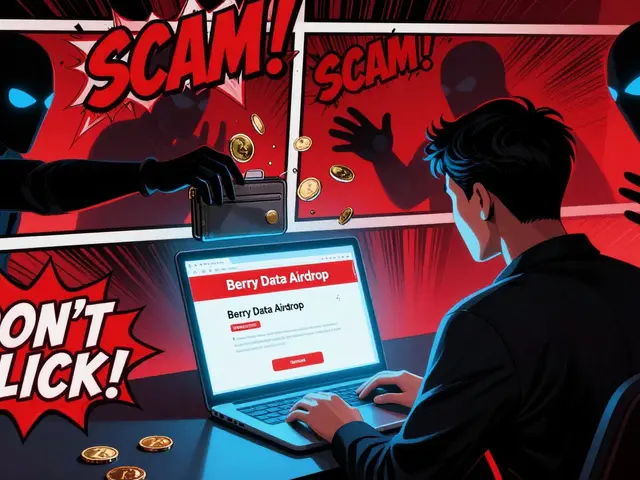

What you’ll find in these posts isn’t just theory. It’s real-world impact. You’ll see how a $40 million crypto seizure by Canada ties into mining compliance. You’ll read about how DeFi growth and liquidity analysis affect miner profitability. You’ll learn why some tokens like RUGAME or BOHR are dead while Bitcoin’s incentive model keeps going. You’ll get the truth about airdrops, exchanges, and zero-knowledge tech—all connected back to how Bitcoin’s block reward shapes the broader crypto economy. This isn’t just about one number. It’s about the system that makes Bitcoin work, and what happens when that system changes. Whether you’re a miner, a trader, or just trying to understand why Bitcoin has value, the block reward is where it all begins.