- Home

- Cryptocurrency

- NovaDAX Crypto Exchange Review: Best for Brazil, Limited Elsewhere

NovaDAX Crypto Exchange Review: Best for Brazil, Limited Elsewhere

If you're in Brazil and looking to buy or trade crypto, NovaDAX is one of the most popular choices. But if you're outside Brazil, you might be better off elsewhere. This isn't just another crypto exchange review. It's a straight talk on what NovaDAX actually delivers - and where it falls short.

What Is NovaDAX?

NovaDAX is a Brazilian cryptocurrency exchange launched in 2018 by NOVADAX BRASIL PAGAMENTOS LTDA, a subsidiary of the Abakus Group. It's not trying to be the next Binance. It's built for Brazil - and it shows. With over 1 million downloads on Google Play and a 4.2-star rating from 21,500 reviews, it's clearly working for its core users. The app lets you open an account in under a minute. No paperwork marathon. No waiting days for verification. That alone makes it stand out in a market where many exchanges still treat new users like suspects.

It supports between 200 and 640 cryptocurrencies, depending on the day. You'll find the usual suspects: Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Litecoin (LTC), Cardano (ADA), Dogecoin (DOGE), and even niche tokens like BitTorrent (BTT) and IOTA (MIOTA). Trading pairs? Over 300, mostly paired with BTC, ETH, or USDT. That’s more than enough for most retail traders.

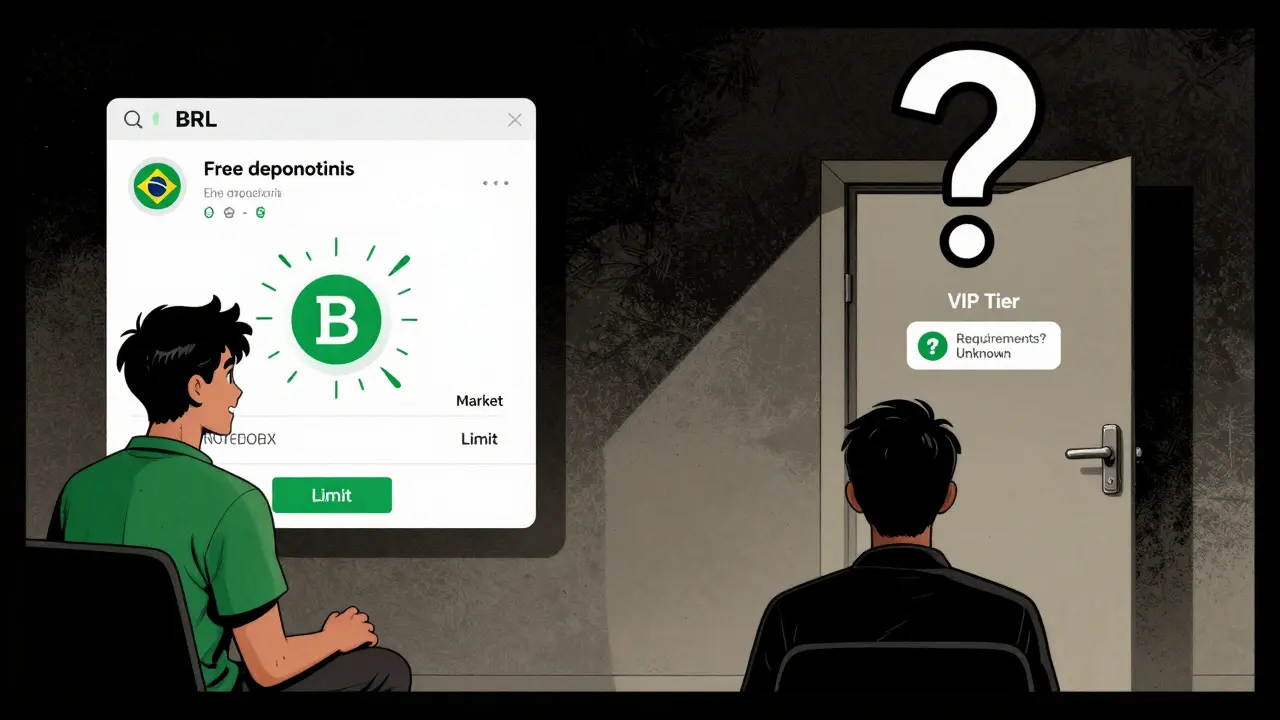

Fees: Low for Some, Confusing for Others

NovaDAX advertises low fees - and it’s partly true. The base trading fee starts at 0.25%. But here’s the catch: it drops all the way to 0.015% for VIP users. Sounds great, right? Except no one knows how to get to VIP. The exchange doesn’t publish the requirements. Ask customer support? Users report getting vague or no answers. That’s not transparency. That’s a black box.

Depositing fiat? Free. Withdrawing fiat? Also free. That’s rare. Most exchanges charge for bank transfers, especially in Latin America. NovaDAX doesn’t. Crypto withdrawals? Variable fees based on the coin. For example, withdrawing Bitcoin costs around 0.0005 BTC - which is average. Not the cheapest, but not the worst.

Compare that to Binance, which charges 0.1% for standard users and lets you cut fees in half by using BNB. NovaDAX doesn’t even offer a token-based discount. You’re stuck with the tier system - and no one knows how to climb it.

Trading Tools: Simple for Beginners, Barebones for Pros

The interface is clean. The mobile app works smoothly on both iOS and Android. The basic trading view shows price charts, order book, and a simple buy/sell button. Perfect for someone who just bought their first Bitcoin and doesn’t want to be overwhelmed.

But if you’re used to advanced tools - like limit orders with time-in-force, stop-loss triggers, or trailing stops - you’ll be disappointed. NovaDAX offers market and limit orders. That’s it. No conditional orders. No OCO (one-cancels-the-other). No grid trading. No copy trading. No futures. No margin. Nothing.

This isn’t a minor gap. It’s a dealbreaker for anyone serious about trading. In 2026, if you’re not offering futures or margin, you’re not competing with the big players. You’re playing in a different league. And NovaDAX knows it. That’s why it doesn’t try.

Security: Solid Backing, No Public Proof

NovaDAX doesn’t brag about cold storage or insurance. But it doesn’t need to. It’s owned by Abakus Group, a well-known financial technology company in Brazil with a track record. That’s more reassuring than any marketing slogan. Most exchanges claiming to be "100% secure" are startups with no real backing. NovaDAX has a parent company with real assets and regulatory presence.

There’s no public audit of reserves. No proof of solvency. No transparency report. That’s a red flag for global users. But for Brazilians? It’s not the biggest concern. Local trust matters more than blockchain transparency. And Abakus has built that trust over years.

Customer Support: The Weak Link

This is where NovaDAX stumbles hard. Users across Reddit, Trustpilot, and Google Play complain about slow, robotic, or no responses. Some say they waited over a week for a reply to a simple withdrawal question. Others got automated replies that didn’t address their issue at all.

It’s not that the platform is broken. It’s that the support team is understaffed or untrained. In a market where trust is everything - especially with crypto - bad support can kill a platform faster than any hack.

Who Is NovaDAX For?

Let’s cut through the noise.

- If you live in Brazil: NovaDAX is one of the easiest, fastest, and cheapest ways to trade crypto. The app works. The fees are low for average users. The selection is wide. And since it supports BRL deposits and withdrawals, you’re not dealing with currency conversion headaches.

- If you live in Europe: NovaDAX now supports EUR deposits. That’s a smart move. But the support is still slow, the trading tools are basic, and you’re better off with Kraken or Bitpanda - which offer more features, better support, and global reputation.

- If you’re outside Brazil or Europe: Skip it. You’ll find better options. Binance, Coinbase, Kraken - they all offer more coins, more tools, better support, and lower fees with clear paths to discounts.

How It Compares to the Giants

| Feature | NovaDAX | Binance | Coinbase |

|---|---|---|---|

| Trading pairs | 300+ | 1,000+ | 300+ |

| Base trading fee | 0.25% | 0.1% | 0.5% |

| VIP fee discount | Yes (no public criteria) | Yes (clear tiers) | No |

| Futures trading | No | Yes | Yes |

| Margin trading | No | Yes | Yes |

| Fiat deposit (BRL/EUR) | Free | Not available | Not available |

| Mobile app rating | 4.2/5 (21,500+ reviews) | 4.5/5 (5M+ downloads) | 4.6/5 (10M+ downloads) |

| Customer support | Slow, inconsistent | 24/7, multilingual | Good, but slow on complex issues |

The table says it all. NovaDAX wins on local convenience and low fiat fees. But it loses on almost every advanced feature. It’s not trying to compete globally. It’s trying to dominate Brazil. And so far, it’s doing that.

Final Verdict

NovaDAX isn’t perfect. But it doesn’t need to be - if you’re in Brazil. For local users, it’s fast, reliable, and affordable. The app works. The coins are there. The fees are fair. And the backing from Abakus Group gives it real credibility.

But if you’re outside Brazil, or if you want to trade derivatives, use advanced orders, or need responsive support - look elsewhere. NovaDAX isn’t a global player. It’s a regional champion. And that’s okay.

The real question isn’t whether NovaDAX is good. It’s whether you need it. If you’re Brazilian? Yes. If you’re not? Probably not.

Is NovaDAX safe to use?

Yes, for users in Brazil. NovaDAX is backed by Abakus Group, a known financial tech company with regulatory presence in Brazil. While it doesn’t publish reserve audits or insurance details, its ownership gives it more credibility than most crypto-only exchanges. Still, never keep large amounts on any exchange - use a personal wallet for long-term storage.

Can I trade futures on NovaDAX?

No. NovaDAX does not offer futures, margin trading, or any derivatives. It’s strictly a spot exchange. If you want to trade leveraged positions or short crypto, you’ll need to use Binance, Bybit, or Kraken.

How do I become a VIP user on NovaDAX?

NovaDAX does not publicly disclose the requirements for VIP status. Users report that higher trading volume may trigger tier upgrades, but there’s no official threshold. Support teams have been unresponsive when asked for details. This lack of transparency is a major drawback for serious traders.

Does NovaDAX support USD or other fiat currencies?

NovaDAX primarily supports BRL (Brazilian Real) and EUR (Euro). It does not support USD, CAD, AUD, or other major currencies. If you’re outside Brazil or Europe, you’ll need to use a third-party service to convert your currency before depositing.

Is NovaDAX available outside Brazil?

Yes, but with limits. The app is downloadable in many countries, and EUR deposits are accepted. However, customer support is optimized for Brazilian users, and the platform doesn’t offer localized features like tax reporting or local payment methods outside Brazil and Europe. Most international users find better alternatives.

Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

Popular Articles

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.