BitWell Exchange: What It Is, How It Works, and What Users Really Say

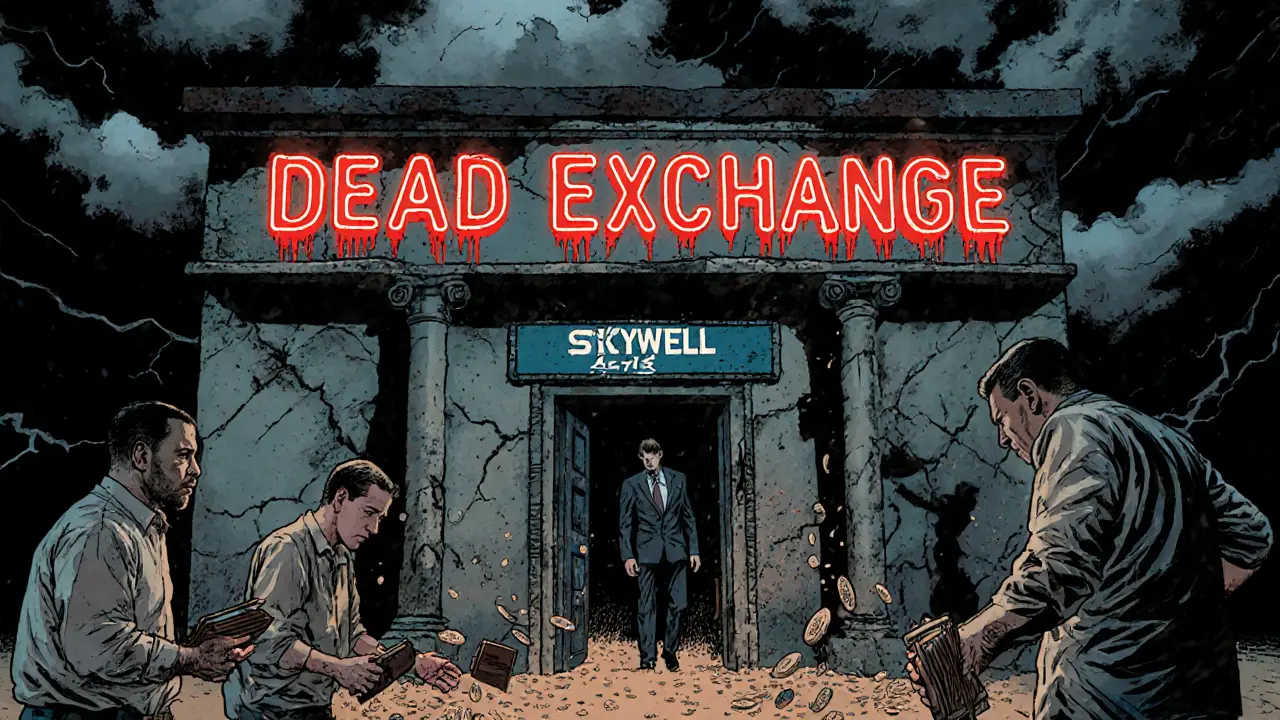

When you hear BitWell exchange, a crypto trading platform offering spot, futures, and staking with a focus on high-yield opportunities. Also known as BitWell.io, it claims to blend centralized convenience with DeFi-style rewards. But behind the flashy yield numbers, there’s a lot of noise. Is it a legit exchange or just another platform chasing quick users with unsustainable incentives?

BitWell exchange sits in a tricky spot. It’s not fully decentralized like Uniswap, but it’s not a traditional exchange like Binance either. It offers futures trading, derivatives contracts that let you bet on price moves without owning the underlying asset, which attracts traders looking to leverage positions. At the same time, it pushes staking rewards, earnings from locking up crypto to support network operations that often look too good to be true—sometimes over 100% APY. That’s not a bug; it’s a red flag. High yields usually mean either high risk, unstable tokenomics, or a rug pull waiting to happen. Users on forums report withdrawal delays and sudden changes in reward structures, especially around low-liquidity tokens.

What’s missing from BitWell’s marketing? Transparency. Unlike exchanges that publish regular audits or have clear team identities, BitWell hides behind vague corporate structures. There’s no public info on where user funds are held, no proof of reserves, and little detail on how they manage risk in their futures market. Compare that to exchanges like Kraken or Coinbase, where security and compliance are front and center. BitWell’s appeal is simple: if you’re chasing quick gains and don’t mind playing Russian roulette with your crypto, it’s tempting. But if you want to hold your assets safely while earning steady returns, you’re better off elsewhere.

The posts below dive into exactly that. You’ll find real user experiences with BitWell, comparisons with other platforms like Cryptomate and C3, and breakdowns of the risky tokens that often get pushed through its interface. Some articles warn about fake airdrops tied to BitWell-promoted coins. Others show how low-cap tokens listed there vanish overnight. This isn’t a list of promotional fluff—it’s a collection of hard truths from people who lost money trying to chase the hype. If you’re thinking about using BitWell exchange, read these first. What you learn might save your portfolio.