- Home

- Cryptocurrency

- TradeOgre Shutdown: Canada Seizes $40 Million in Crypto in Largest Ever Enforcement Action

TradeOgre Shutdown: Canada Seizes $40 Million in Crypto in Largest Ever Enforcement Action

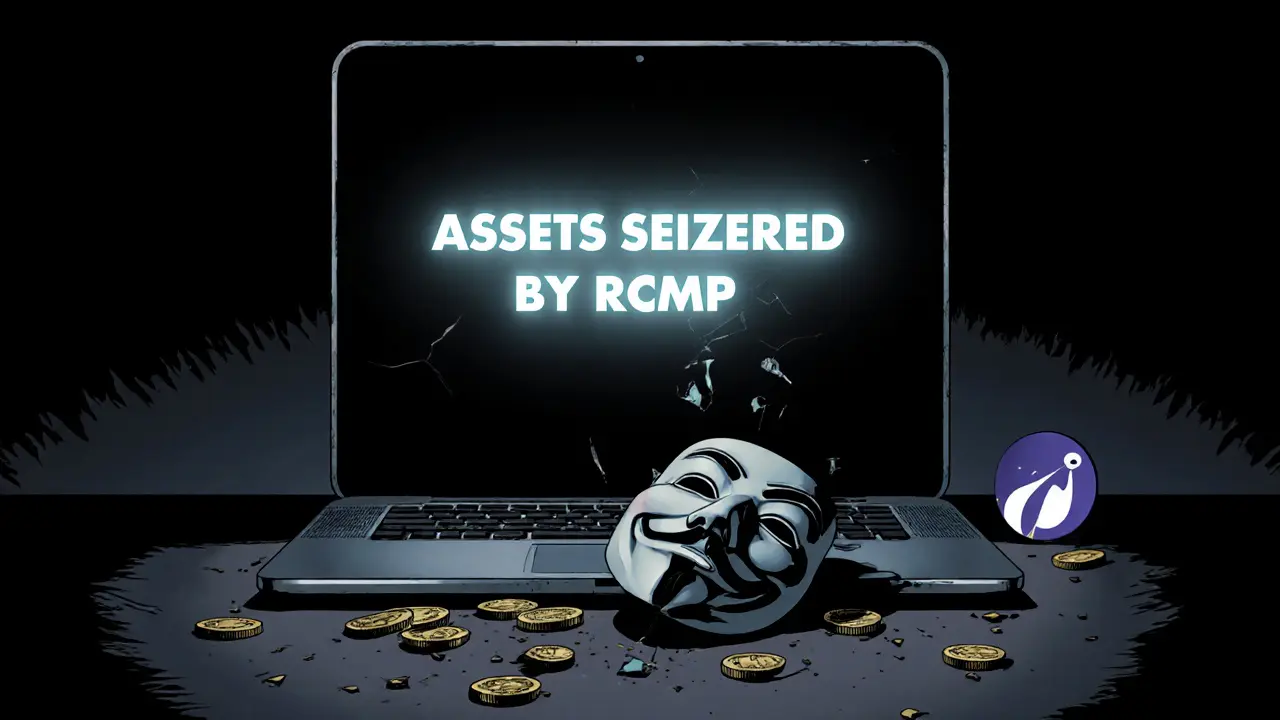

On September 18, 2025, the Royal Canadian Mounted Police (RCMP) shut down TradeOgre - a privacy-focused cryptocurrency exchange - and seized CAD$56 million (about US$40 million) in digital assets. It was the biggest cryptocurrency seizure in Canadian history. Not just a wallet freeze. Not just a transaction trace. This was the complete dismantling of an entire exchange platform that had operated for seven years without ever registering with Canadian regulators.

TradeOgre wasn’t some shady side project. It was a functioning, live exchange built for anonymity. Launched in 2018, it let users trade crypto without ID, without paperwork, without any oversight. No KYC. No AML checks. Just deposit, trade, withdraw. And it specialized in Monero, the cryptocurrency designed to hide transaction trails. That made it a magnet for people who didn’t want to be tracked - whether they were privacy advocates or criminals.

The RCMP didn’t stumble on this by accident. The investigation started in June 2024 after Europol flagged suspicious activity linked to TradeOgre. From there, the Money Laundering Investigative Team (MLIT) teamed up with Arkham Intelligence, a blockchain analytics firm. They didn’t need to hack anything. They just followed the money - every transaction, every wallet, every timestamp. Even when users tried to obscure their paths using mixers or privacy coins, the trail didn’t vanish. Blockchain data doesn’t lie. It just needs someone who knows how to read it.

What they found was a platform operating entirely outside Canadian law. TradeOgre never registered with FINTRAC, the country’s financial intelligence unit. That’s not a technicality - it’s a felony. All money services businesses in Canada, including crypto exchanges, are required to register, report suspicious activity, and verify user identities. TradeOgre did none of it. And because it ran as a Tor hidden service, it was designed to be unreachable by traditional law enforcement. That didn’t matter. The RCMP didn’t need to shut down the website. They just needed to take control of the keys.

The moment TradeOgre’s site went dark in July 2025, experts knew something big was coming. Then, on-chain messages started appearing in transaction notes - embedded by law enforcement - declaring that the assets were now under RCMP control. No press release. No press conference. Just cold, public blockchain proof: the money was seized, and the exchange was dead.

Why does this matter beyond the $40 million? Because this was a message to every crypto platform operating in the shadows. You can’t hide behind privacy features if you’re breaking the law. You can’t claim you’re ‘decentralized’ if you’re running a centralized exchange that takes custody of users’ funds. You can’t ignore Canadian regulations just because your servers are in the U.S. or your team is anonymous. Canada just proved it has the tools, the will, and the international partnerships to go after you - no matter how hidden you think you are.

TradeOgre’s model was once seen as the future of crypto: unregulated, permissionless, free from banks. But the world changed. Exchanges like Binance, Coinbase, and Kraken now follow strict rules because they have to. TradeOgre chose not to. And now it’s gone. Not because it was technically advanced. Not because it was popular. But because it refused to play by the rules that protect the system.

The seized assets are believed to come from criminal activity - drug sales, ransomware payments, dark web markets - but the RCMP hasn’t released specific charges. That’s intentional. The goal wasn’t just to recover money. It was to send a signal: if you build a platform to enable crime, we will shut you down. And we will take everything.

This case also shows how far blockchain analytics have come. Five years ago, tracing Monero was nearly impossible. Today, firms like Arkham can map fund flows even through privacy coins by analyzing patterns, timing, and wallet behavior. It’s not perfect - but it’s good enough. Law enforcement doesn’t need to break encryption. They just need to see where the money ends up.

For users who valued TradeOgre’s anonymity, this is a wake-up call. Privacy isn’t illegal. But building an exchange that ignores legal obligations? That’s a target. The days of ‘no KYC, no problem’ are over - especially if you’re serving Canadian users or moving money through Canadian financial systems.

There’s no statement from TradeOgre’s operators. No legal challenge. No social media post. Just silence. That tells you everything. They knew they were caught. They had no defense. And they knew the evidence was undeniable.

This isn’t just about one exchange. It’s about the new reality of crypto regulation. Countries are no longer waiting for exchanges to self-police. They’re acting - fast, smart, and with overwhelming force. Canada didn’t wait for new laws. It used existing ones - and it won.

If you run a crypto platform, you now have two choices: comply or disappear. TradeOgre chose the second. And it cost them everything.

What TradeOgre Did Differently

Most crypto exchanges today require ID. You upload a passport. You take a selfie. You wait 24 hours. TradeOgre didn’t. That’s what made it unique - and dangerous.

- No account registration needed - users traded with just a wallet address

- Only supported privacy coins like Monero, Zcash, and Dash

- Operated exclusively as a Tor hidden service (.onion site)

- Never registered with FINTRAC or any other financial regulator

- No customer support, no email, no contact info

- Low trading volume, but high volume in privacy coins

It wasn’t designed for casual traders. It was built for people who didn’t want to be found. That’s why it attracted criminal users. And that’s why regulators came after it.

How Law Enforcement Took Control

Here’s what actually happened behind the scenes:

- Europol flagged suspicious Monero transactions linked to TradeOgre in June 2024.

- RCMP’s MLIT partnered with Arkham Intelligence to trace fund flows across 12,000+ wallet addresses.

- They identified the exchange’s hot wallets - the ones holding user deposits - and monitored movement patterns.

- By July 2025, they saw large transfers out of TradeOgre’s wallets, suggesting operators were trying to move funds before a raid.

- On September 18, 2025, RCMP executed a legal seizure order and gained control of the private keys to those wallets.

- They then embedded public messages into blockchain transactions confirming the seizure - making it permanent and transparent.

This wasn’t a hack. It was a legal seizure backed by forensic blockchain analysis. And it worked.

Why This Changes Everything

Before TradeOgre, most crypto seizures targeted individual wallets or mixing services. This was the first time a full exchange was shut down and its entire asset base seized. That’s a game-changer.

Other exchanges that thought they could fly under the radar - especially those offering ‘privacy’ as a selling point - now have a real example of what happens when you ignore the law. Canada didn’t need to pass new legislation. They used what they already had: anti-money laundering laws, financial reporting rules, and the authority to seize assets linked to crime.

It also proves that international cooperation works. Europol provided the tip. Arkham provided the tools. RCMP provided the legal muscle. No single agency could have done it alone. But together? They took down a platform that thought it was untouchable.

What This Means for You

If you’re a trader who used TradeOgre: your funds are gone. There’s no recovery process. No refund. No appeal. The money was seized as proceeds of crime.

If you’re running a crypto service: you need to ask yourself - are you compliant? Do you know your users? Do you report suspicious activity? If the answer is no, you’re not safe. Canada just showed you how fast they can move.

If you’re a privacy advocate: understand the line. Privacy tools are legal. Building a platform to help criminals hide money? That’s not privacy. That’s facilitation. And now, it’s a target.

What’s Next?

Expect more of this. The U.S., UK, and EU are watching Canada’s move closely. If Canada can seize $40 million from a Tor-based exchange, other countries will try the same. The era of unregulated crypto exchanges is ending.

Exchanges that want to survive will need to: implement KYC, register with regulators, report suspicious transactions, and cooperate with investigations. The ones that don’t? They’ll vanish - quietly, with no warning, and with no chance of coming back.

TradeOgre’s shutdown wasn’t just about money. It was about power. And now, regulators have shown they have it.

Was TradeOgre a scam?

No, TradeOgre wasn’t a scam in the traditional sense. It operated as a real exchange - users could deposit and withdraw crypto. But it broke the law by refusing to register with regulators, bypassing KYC rules, and enabling criminal activity. That doesn’t make it a Ponzi scheme, but it does make it illegal and dangerous.

Can I get my money back from TradeOgre?

No. The RCMP seized all funds as proceeds of criminal activity. There is no recovery process. Even if you were an innocent user, the law treats the entire exchange’s holdings as potentially tainted. Your assets are gone.

Why did Canada target TradeOgre and not other exchanges?

TradeOgre was uniquely non-compliant. Unlike exchanges like Binance or Kraken, it never registered with FINTRAC, never verified users, and actively promoted privacy features to avoid detection. It was a textbook case of a platform designed to evade regulation - making it the perfect target for a landmark enforcement action.

Is Monero illegal now?

No, Monero is not illegal. It’s a privacy coin, and owning or trading it is still legal in Canada. But exchanges that use Monero to avoid KYC rules - like TradeOgre did - are now at high risk of being shut down. The coin itself isn’t the problem. The lack of oversight is.

What happens to other privacy-focused exchanges now?

They’re under direct threat. If they don’t start complying with Canadian regulations - registering with FINTRAC, implementing KYC, reporting suspicious activity - they’ll likely be next. TradeOgre’s shutdown is a warning: privacy doesn’t mean exemption from the law.

Could this happen in the U.S. or Europe?

Absolutely. The U.S. Treasury and Europol have already signaled they’re watching. Canada’s success proves that even Tor-based, anonymous exchanges can be taken down. Other countries will use this case as a blueprint for their own enforcement actions.

Did TradeOgre have any legal defense?

There’s no public record of any legal team representing TradeOgre. The lack of response suggests the operators either couldn’t be identified, chose not to fight, or knew the evidence was too strong. Without a legal entity or registered business, there was no one to represent them in court.

How did the RCMP find the private keys?

They didn’t hack them. Through blockchain analysis, they traced where user deposits were stored and identified the specific wallets controlled by TradeOgre. Then, using legal authority, they obtained access to those keys - likely through cooperation with service providers or by identifying the operators through metadata and transaction patterns.

Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

Popular Articles

18 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

This is huge. I've been watching crypto for years and this is the first time I've seen regulators actually win without needing new laws. They used what they had, followed the money, and took down a platform that thought it was untouchable. No hype, no press conference-just blockchain proof. That's next-level.

For anyone still thinking 'privacy = illegal', let me be clear: privacy is legal. But building a platform that actively avoids KYC to help criminals? That's a red flag you can't ignore. TradeOgre wasn't a hero. It was a loophole with a website.

Pathetic. This is what happens when governments fetishize control over innovation. Monero was designed to be untraceable and now you're telling me a bunch of bureaucrats with blockchain analytics tools can crack it? Please. They didn't outsmart the tech-they just got lucky with wallet patterns. This isn't justice. It's authoritarian overreach dressed up as compliance.

so like... all my xmr is gone now? 😐

Let’s be real-this wasn’t about taking down privacy. It was about taking down criminal infrastructure disguised as privacy. TradeOgre didn’t just ignore KYC-they enabled ransomware gangs, darknet markets, and money laundering on a massive scale. The fact that they never registered with FINTRAC? That’s not a technicality. That’s a felony. And the RCMP didn’t need to hack anything-they just used the blockchain, which doesn’t lie, and the law, which doesn’t bend.

This is a win for everyone who wants crypto to be legitimate. No more hiding behind ‘decentralized’ as an excuse to break the law. If you’re not registered, you’re not a business-you’re a criminal enterprise with a website.

imagine being the person who just deposited 5 xmr and now its just... gone. like fr? no warning? no email? just a blockchain note saying 'this is ours now' 😭

still tho... if you use a site with no contact info and no support... you kinda knew what you were signing up for right? 🤷♀️

YESSSSSSS!!! This is what we’ve been waiting for!!! 🎉🔥 TradeOgre wasn’t a crypto exchange-it was a crime hub with a Tor address. And now? It’s GONE. Vanished. Like it never existed. The RCMP didn’t ask for permission. They didn’t wait for Congress to pass a law. They just DID IT. And they did it with evidence, not emotion.

Every anonymous exchange thinking they’re safe? Wake up. The game changed. Blockchain analytics aren’t just fancy graphs anymore-they’re digital fingerprints. And your wallet? It’s not anonymous. It’s traceable. And now? It’s SEIZED.

Finally. Someone stood up and said: ‘No more.’

So… the government just took your crypto because you used a site that didn’t ask for your ID… but they’re still fine with banks that launder billions through shell companies? 🤔

Interesting how ‘illegal’ only matters when it’s crypto, huh?

TradeOgre was not a legitimate exchange because it did not comply with Canadian financial regulations which require registration with FINTRAC and implementation of KYC protocols for all money services businesses under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act. The fact that it operated exclusively on Tor and accepted only privacy coins like Monero and Zcash indicates intentional design to evade detection. The RCMP’s use of blockchain analytics through Arkham Intelligence allowed them to trace fund flows across more than 12000 wallet addresses without needing to break encryption or access private keys directly. The seizure was executed legally through court order after identifying the hot wallets holding user deposits. This is not a precedent for targeting privacy coins but for targeting unregistered platforms facilitating criminal activity. The lack of response from operators confirms they had no legal standing to contest the seizure. Other jurisdictions including the US Treasury and Europol are already observing this case as a model for future enforcement actions against noncompliant crypto intermediaries

tbh i used tradeogre once just to swap some xmr for btc and never touched it again. now my funds are gone? no way to get them back? like... i didn't even know it was illegal. i just liked that i didn't have to upload my passport. guess i'm just dumb 😅

You people are delusional. This isn't about crime-it's about control. Privacy is not a crime. Using Monero is not a crime. But now the state says if you don't give them your identity, your money is theirs? That's not law. That's tyranny. And you're celebrating it like it's a victory? You're not protecting the system-you're surrendering your freedom for the illusion of safety. This is how dictatorships begin: with 'just this one time' seizures. Next they'll come for your wallet on Coinbase. Don't be fooled.

Wait-so if I use a privacy coin to buy coffee from someone who’s not a registered business, am I now a criminal? Or is it only illegal if I use a platform that doesn’t have a ‘contact us’ page?

Is the line between privacy and criminality really just about registration forms? Because that feels less like justice and more like bureaucracy winning.

This moment feels like a turning point-not because of the money seized, but because of what it says about power. For years, crypto was sold as the end of centralized control. But here we are: a government, using tools built on open-source blockchain tech, to seize assets from a platform that thought it was beyond reach.

It’s not that privacy is dead. It’s that anonymity without accountability is unsustainable. We can have private transactions without enabling crime. We can have decentralized systems without ignoring the social contract. TradeOgre chose to ignore the contract. And now, the system pushed back-not with force, but with clarity.

The real question isn’t whether Canada was right. It’s whether we, as users, want a crypto ecosystem that thrives in the shadows-or one that can survive in the light.

bro tradeogre was my main exchange 😭 i lost 12 xmr and 3 eth... and now they just say 'oops your money is crime now' 🤡

but like... if i used a site with no email and no support... i kinda knew it was sketchy right? still feels like a scam 😭

also why did they even let it run for 7 years???

The ontological collapse of crypto’s libertarian mythos is now complete. TradeOgre was a performative artifact of a pre-regulatory epoch-a decentralized shell masquerading as sovereignty. Its dismantling via blockchain forensics reveals the fundamental paradox: decentralized infrastructure can be co-opted by centralized authority through metadata, timing, and behavioral heuristics. The blockchain is immutable, yes-but it is also legible. The state did not break encryption; it decoded intent.

This is not a victory for regulation. It is a revelation: autonomy without accountability is not freedom. It is vulnerability dressed as rebellion. The future belongs not to those who hide, but to those who understand the architecture of trust-and choose to build within it.

I’m so proud of Canada right now. This is how you do it. No drama. No press tour. Just facts, forensics, and follow-through. TradeOgre thought they were untouchable. They weren’t. And now? Everyone else knows it too.

This isn’t about taking away privacy. It’s about saying: you can’t use privacy to hide crime. That’s not a bad thing. That’s just common sense.

soo... if i use monero and dont use tradeogre but i still dont do kyc... am i next?? 😬 i mean like... i just like my privacy... i didnt even know this was a thing... why did they wait 7 years??

Rebecca Amy’s comment hit hard. If you were an innocent user who just wanted privacy and didn’t know the risks-you’re not alone. But here’s the thing: if you use a service with no contact info, no support, no legal entity, and no registration, you’re already gambling with your funds. That’s not the government’s fault. That’s the risk of choosing a platform that operates in the dark.

TradeOgre didn’t just break the law-they broke trust. And when you trust an anonymous platform with your money, you’re trusting ghosts. Now those ghosts are gone. The system didn’t fail. It warned you. You just didn’t hear it.

Sean Pollock-no, you’re not next. Not unless you’re running an unregistered exchange that moves millions in Monero tied to darknet markets. Using Monero to buy a laptop from a stranger? Totally fine. Using it on a site that never registered with FINTRAC and has zero customer support? That’s not privacy. That’s playing Russian roulette with your wallet.

Canada didn’t outlaw Monero. They outlawed criminal infrastructure. Big difference. Don’t confuse the two.