Concentrated Liquidity: What It Means and Why It Matters

When working with Concentrated Liquidity, a method that lets liquidity providers allocate capital within a narrow price range on automated market makers, boosting capital efficiency. Also known as price‑range liquidity, it helps traders enjoy tighter spreads and lower slippage.

Key Concepts Behind Concentrated Liquidity

To use concentrated liquidity you need a Decentralized Exchange, a platform where users trade directly from their wallets without a central order book. Most modern DEXs run on an Automated Market Maker, a smart‑contract system that prices assets based on the ratio of tokens in a pool. Concentrated liquidity therefore requires an AMM that supports custom price ranges, and it enables providers to concentrate their funds where trades are most likely to happen.

Traditional liquidity pools spread capital across the entire price curve, which often leaves most of the capital idle. By focusing funds into a specific band, concentrated liquidity improves capital efficiency by up to tenfold, according to on‑chain metrics from leading DEXs. This means higher fee earnings for providers and better price depth for traders, especially in volatile markets.

Because the capital sits in a tighter band, providers must monitor price movement and rebalance when the market shifts. This is where Liquidity Pools, the pools of tokens that AMMs use to execute trades become dynamic assets. Tools that track pool performance, price range alerts, and automated rebalancing scripts are now part of a standard DeFi toolbox.

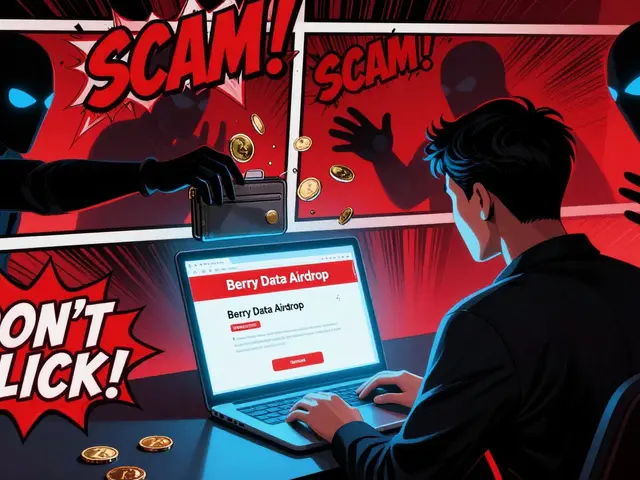

Many users combine concentrated liquidity with Yield Farming, the practice of earning additional token rewards by staking LP tokens. The higher fee returns from a focused range can add up with reward tokens, but the strategy also raises exposure to impermanent loss if the price exits the set range. Below you’ll find guides that walk through risk mitigation, optimal range selection, and real‑world examples of how traders are extracting more value from their capital. Ready to dive deeper? The articles below break down each step, from setting up your first concentrated liquidity position on a DEX to advanced strategies that blend fee capture with yield farming rewards.