Cryptocurrency Mining: Basics, Tools, and Impact

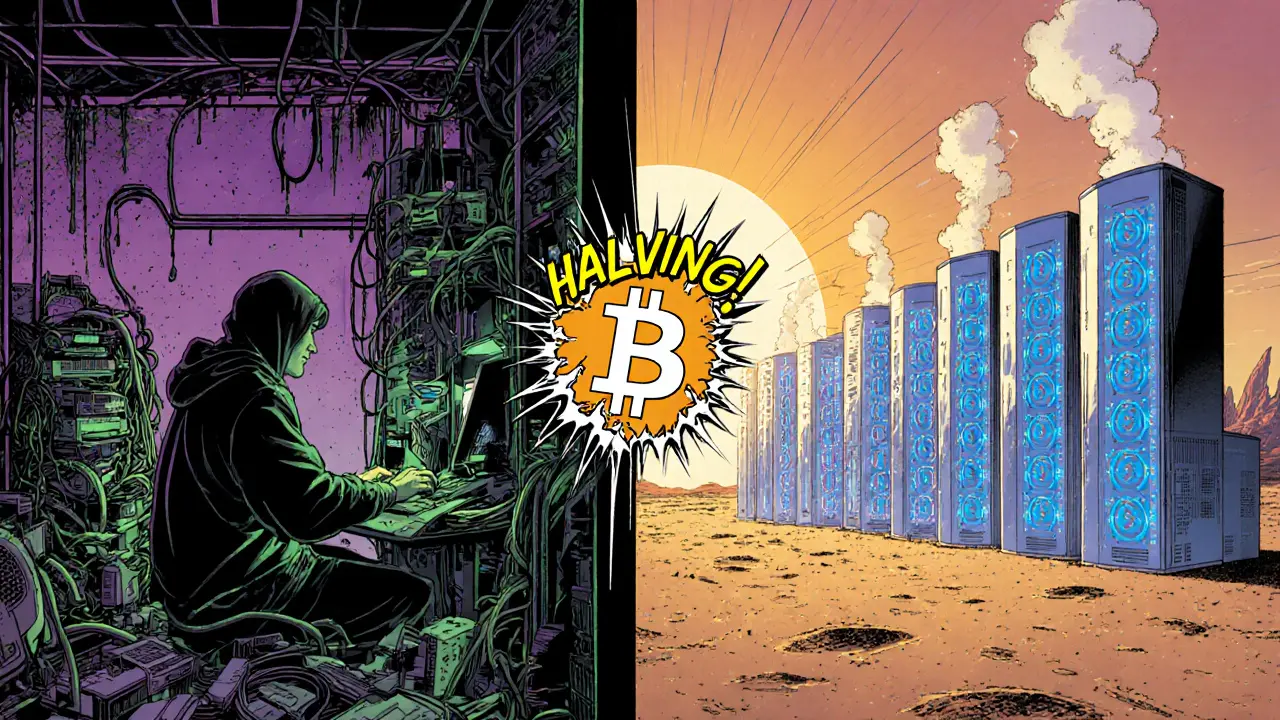

When working with cryptocurrency mining, the practice of using computer power to solve cryptographic puzzles, validate transactions, and create new blocks on a blockchain. Also called crypto mining, it depends on high‑performance hardware and significant electricity. The most common consensus method fueling this work is Proof of Work, a system where miners compete to find a hash below a target, earning rewards for the first to succeed. To run the algorithms, miners rely on mining hardware, specialized ASIC machines or graphics cards that deliver the necessary hash rate, and all of this draws energy consumption, the electricity usage that determines profitability and environmental footprint.

Understanding cryptocurrency mining is essential if you want to navigate the space profitably and avoid common pitfalls.

Key Components of Crypto Mining

The heartbeat of any mining operation is the hardware you plug in. ASICs—Application‑Specific Integrated Circuits—are built to hash a single algorithm at lightning speed, making them the go‑to for Bitcoin and many large‑cap coins. GPUs—Graphics Processing Units—are slower on pure hash power but flexible enough to jump between coins, which is why hobbyists and multi‑coin miners favor them. Choosing the right rig means balancing upfront spend, electricity draw, cooling requirements, and expected revenue over the device’s lifespan. Most miners don’t go solo; they join a mining pool, a collective where participants share their hash power and split rewards proportionally. Pools smooth out the income stream, turning the occasional big payout of solo mining into regular, smaller payments. When you compare ASIC vs GPU, consider the coin’s algorithm, the pool’s fee structure, the hardware’s durability, and the available support for firmware updates.

Energy consumption is the biggest cost driver and the most debated topic in the space. A typical Bitcoin ASIC can guzzle 3,000 watts, which translates to hefty electricity bills unless you secure cheap rates or renewable sources. Some regions offer subsidies for wind or solar power, letting miners offset their carbon footprint while keeping profits healthy. Environmental critics point out that the global hash rate consumes as much electricity as a small country, sparking a push toward greener alternatives. Proof‑of‑Stake blockchains, which replace mining with staking, cut energy use by over 99 percent, but many investors still chase PoW coins for their proven security and liquidity. This tension creates a trade‑off: higher earnings potential often comes with higher carbon impact, prompting miners to look for low‑carbon locales or to invest in waste‑heat recovery systems.

Profitability isn’t static; it swings with coin price, network difficulty, and electricity cost. Before you buy a rig, run a breakeven analysis using online calculators that factor in hash rate, power draw, and your local kWh price. Keep an eye on difficulty adjustments—when many miners join, the network raises the puzzle’s complexity, shaving off your share. Some miners hedge by switching between coins as difficulty spikes, a tactic called algorithm hopping, and they use mining software that supports multiple algorithms to stay flexible. Regulatory changes can also tip the scales; jurisdictions that impose taxes on mining income, restrict high‑energy usage, or require reporting of emissions can erode margins quickly. Staying informed about local policies, market trends, and emerging hardware efficiencies is key to keeping your operation afloat.

Our curated collection below pulls together the most practical guides, deep‑dive analyses, and up‑to‑date news around the world of crypto mining. Whether you’re sizing up a new ASIC, figuring out the best pool, weighing the environmental trade‑offs of Proof of Work, or calculating profitability under different electricity rates, you’ll find actionable insights to help you decide your next move. Dive in to explore detailed hardware reviews, profitability calculators, and the latest policy developments shaping the mining landscape.