Order Book Explained: How Crypto Exchanges Match Buys and Sells

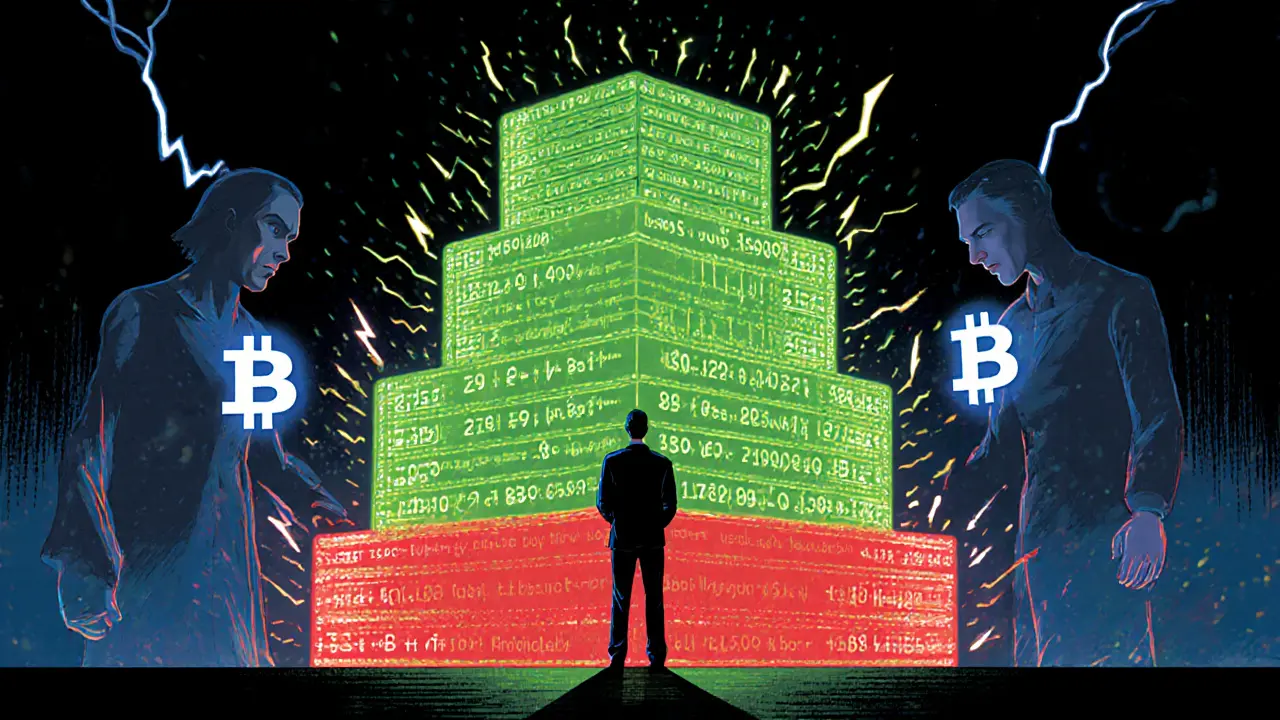

When you trade crypto on a decentralized or centralized exchange, you're not just clicking a button—you're interacting with something called an order book, a live list of all pending buy and sell orders for a specific asset, sorted by price. Also known as a depth chart, it shows exactly what other traders are willing to pay and accept at any given moment. This isn’t just data—it’s the heartbeat of price discovery in crypto markets.

Every trade starts with two sides: the bid, the highest price someone is willing to pay to buy, and the ask, the lowest price someone is willing to accept to sell. The gap between them is the spread. A tight spread means high liquidity—lots of buyers and sellers actively trading. A wide spread? That’s a red flag. It often shows low volume or manipulation, which you’ll see in exchanges like UBIEX or BitWell where withdrawals fail and prices jump for no reason. The order book reveals whether a price move is real or just noise.

Large traders—called whales—don’t just buy at market price. They place big orders just below the current price to suck in retail buyers, then pull back. That’s why you’ll sometimes see a huge buy wall on the order book that vanishes the second you try to trade. This tactic works because most people don’t look past the top few rows. But if you dig into the full market depth, the full range of all open orders, not just the top bids and asks, you can spot fake volume, hidden sell pressure, or real accumulation. That’s how you avoid getting trapped in a pump-and-dump like the ones around RUGAME or MERY.

Order books also explain why some exchanges are safer than others. On a real DEX like Balancer v2, your trade executes against actual liquidity pools, and the order book reflects real demand. On shady platforms like HyperPay Futures or Cryptomate, the order book might be faked—no real buyers, just bots. That’s why you’ll never see a real order book on a platform that shuts down overnight. The order book doesn’t lie. If there’s no depth, there’s no market.

Understanding the order book helps you trade smarter—not harder. You’ll know when to wait for a better price, when to avoid a coin with thin liquidity, and when a price spike is about to crash. The posts below show real examples: how TradeOgre’s lack of compliance made its order book unreliable, how airdrops like CYT and MTLX created sudden order book spikes, and why zero-knowledge tech doesn’t fix bad order books. You’ll see how order books behave during halvings, scams, and market crashes. This isn’t theory. It’s what you need to see before you click buy.