Stablecoins Explained: How They Work, Why They Matter, and What You Need to Know

When you think of crypto, you probably picture wild price swings—Bitcoin jumping 20% in a day, Ethereum crashing overnight. But stablecoins, digital currencies designed to hold a steady value, usually tied to a fiat currency like the US dollar. Also known as pegged tokens, they’re the quiet backbone of most crypto trading and DeFi activity. Unlike Bitcoin or Dogecoin, stablecoins don’t try to be speculative assets. They’re meant to act like digital cash you can send anywhere, fast and cheap, without losing half your money to volatility.

Most stablecoins are fiat-backed, tokens that have real money, like dollars or euros, held in reserve to back each coin. Think of it like a voucher: for every $1 worth of USDC or USDT you hold, there’s $1 in a bank account somewhere. Then there are algorithmic stablecoins, those that use smart contracts and supply changes to maintain price stability without holding cash reserves. These are trickier—when they work, they’re elegant. When they fail, like TerraUSD did in 2022, they can crash hard and fast. That’s why regulators in the UK, US, and EU are pushing for clear rules on who holds the reserves, how often they’re audited, and who’s responsible if things go wrong.

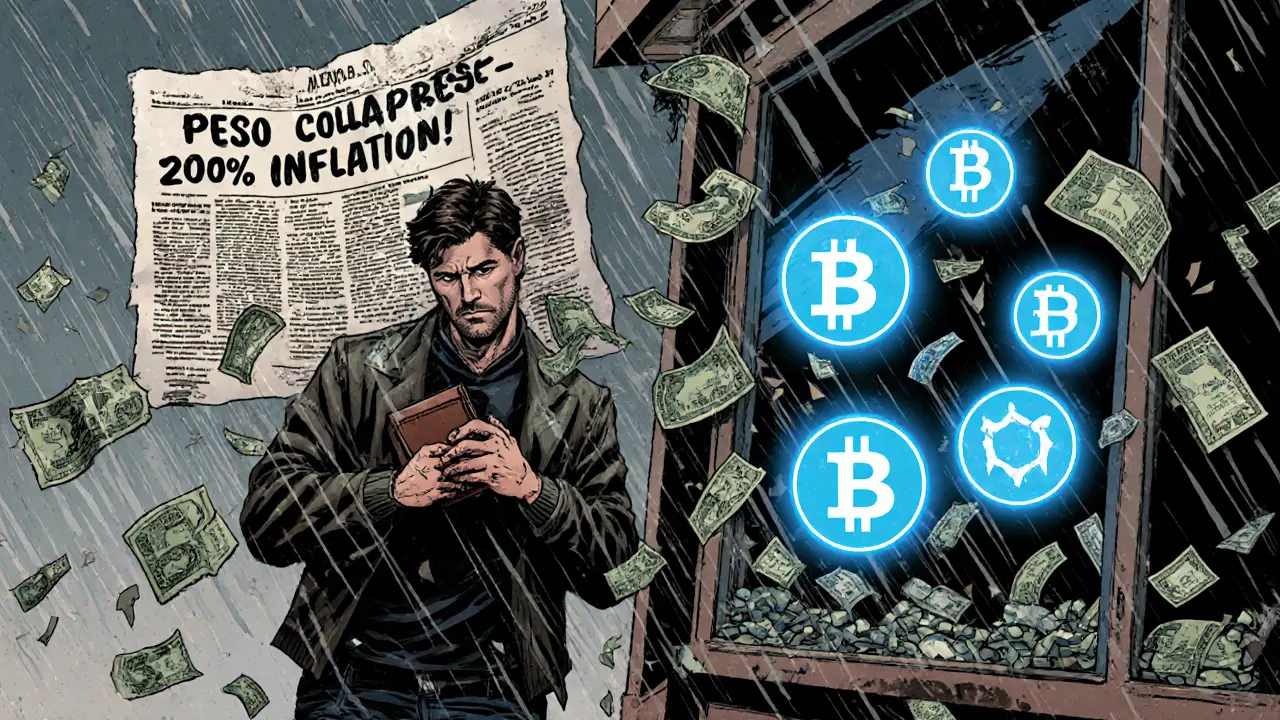

Stablecoins aren’t just for traders. In countries like Nigeria and Argentina, people use them to protect savings from inflation. In Russia, they’re helping bypass sanctions. In DeFi, they’re the default currency for lending, borrowing, and earning yield. You’ll find them in almost every crypto transaction—even when you’re not thinking about them. And as governments explore their own digital currencies, stablecoins are the real-world testbed for how money might work in the future.

What you’ll find here are real guides on how stablecoins fit into crypto markets, what risks to watch for, how they’re being regulated, and which projects actually deliver on their promises. No fluff. Just clear breakdowns of what works, what doesn’t, and why it matters to you.