- Home

- Cryptocurrency

- Central Bank of Kuwait Crypto Prohibition: Complete Ban on Cryptocurrency Activities

Central Bank of Kuwait Crypto Prohibition: Complete Ban on Cryptocurrency Activities

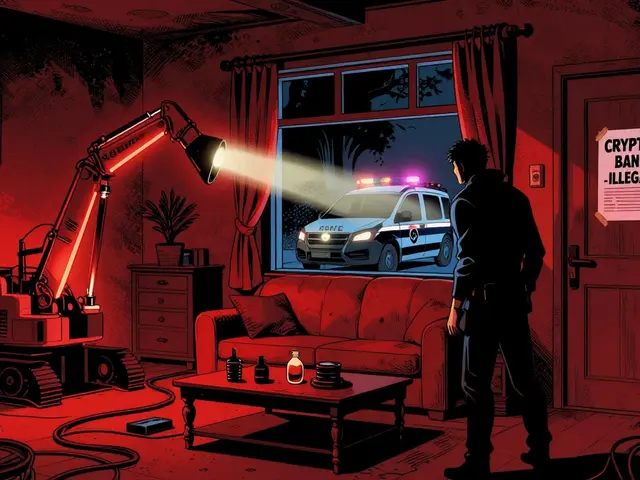

Kuwait has one of the strictest crypto policies in the world. Not just a warning. Not just a restriction. A full, absolute ban on everything related to cryptocurrency - from buying and selling to mining and even using it as payment. The Central Bank of Kuwait made this clear in July 2023, and since then, enforcement has only gotten tougher.

What Exactly Is Banned?

The ban isn’t limited to one thing. It covers every possible way you might interact with cryptocurrency. If you’re in Kuwait, you can’t:- Use Bitcoin, Ethereum, or any other digital currency to pay for goods or services

- Invest in crypto through local banks or financial firms

- Trade crypto on any platform registered in Kuwait

- Run a mining rig in your home, office, or warehouse

- Offer crypto-related services like exchanges, wallets, or advisory

Why Did Kuwait Go So Far?

Most countries either regulate crypto or let it exist in a gray zone. Kuwait chose to erase it entirely. The official reason? Anti-money laundering and counter-terrorism financing. The country wants to follow the Financial Action Task Force’s Recommendation 15, which pushes nations to control financial risks from digital assets. But there’s another, bigger reason: electricity. Kuwait has some of the cheapest electricity in the world - heavily subsidized by the government. That made it a magnet for crypto miners. In 2022, mining Bitcoin in Kuwait cost as little as $1,400 per coin. In Texas, it was over $18,000. With Bitcoin trading above $40,000, the profit potential was huge. But here’s the catch: mining rigs suck up power. A lot of it. According to data from Best Brokers, Bitcoin mining alone in Kuwait was consuming about 140,336 gigawatt-hours per year. That’s more than the entire annual electricity use of countries like Ukraine or Malaysia. Power grids started straining. Cities reported blackouts. The Ministry of Electricity, Water, and Renewable Energy said they found over 1,000 illegal mining operations - some hidden in warehouses, others in residential buildings. The government didn’t just shut down the banks. They sent police and inspectors to homes and businesses. They cited multiple laws: the Industry Law, the Penal Code, the Communications and Information Technology Regulatory Authority Act, and the Kuwait Municipality Law. Running a miner isn’t just against financial rules - it’s a criminal offense.How Is the Ban Enforced?

This isn’t a one-agency job. It’s a national operation. The Central Bank of Kuwait blocks financial channels. The Ministry of Interior sends raids to mining sites. The Communications and Information Technology Regulatory Authority tracks online activity. Kuwait Municipality shuts down buildings violating zoning rules. The Public Authority for Industry investigates illegal industrial use of electricity. In April 2025, the Ministry of Interior issued a public statement: if you’re mining crypto, stop now. You’re breaking the law. If you don’t, you’ll be investigated. Fines. Seizures. Criminal charges. They didn’t say “we might.” They said “you will.” Even if you’re not mining, just holding crypto can be risky. The Ministry of Finance doesn’t recognize it as legal money. If you try to use it in a business transaction, it’s not valid. No courts will enforce it. No tax office will accept it. You’re on your own.

How Does Kuwait Compare to Other Gulf Countries?

Kuwait is the outlier. The UAE has a full crypto licensing system. Bahrain allows regulated exchanges. Saudi Arabia runs pilot programs for its own digital currency. Oman is testing blockchain for trade. Qatar, once as strict as Kuwait, is now preparing to launch a legal framework for digital assets in mid-2025. But Kuwait? Nothing’s changing. Not even a hint of softening. While others are building crypto infrastructure, Kuwait is tearing it down. Why? Because their priority isn’t innovation. It’s control. They don’t want decentralized money. They want their central bank to be the only source of trust in the financial system.What About CBDCs? Is Kuwait Going Digital?

Yes - but only their own version. The Central Bank of Kuwait is studying a Central Bank Digital Currency (CBDC). That’s a digital version of the Kuwaiti dinar, fully controlled by the state. No blockchain. No decentralization. Just a digital dinar. This makes sense. They’re not against digital money. They’re against private, uncontrolled digital money. A CBDC would let them track every transaction, freeze accounts instantly, and enforce monetary policy with precision. They’re also pushing other traditional tools. The new Sukuk Law strengthens Islamic finance instruments. The Financing & Liquidity Law lets the government issue up to KWD30 billion ($97 billion) in public debt. These aren’t flashy tech moves. They’re solid, state-backed financial tools - exactly what Kuwait wants.

What Happens If You Ignore the Ban?

If you’re caught mining, trading, or promoting crypto in Kuwait, you’re not just breaking bank rules. You’re breaking criminal law. Penalties include:- Heavy fines - up to KWD10,000 ($32,700) for individuals

- Confiscation of mining equipment

- Business license revocation

- Criminal prosecution under the Penal Code

- Imprisonment in severe cases

Can You Still Buy Crypto in Kuwait?

Technically, yes - if you use a foreign exchange and send funds from abroad. But here’s the catch: you can’t cash out through Kuwaiti banks. You can’t use it to pay bills. You can’t legally hold it as an asset. And if you’re caught mining or promoting it, you’re in serious trouble. So while you might still own crypto, it’s useless in Kuwait. It’s like holding a foreign currency that no one accepts and no bank will touch.What’s the Future?

Don’t expect the ban to lift anytime soon. Kuwait’s leadership sees crypto as a threat - to financial stability, energy security, and state control. They’ve built a legal wall around it. They’ve trained enforcement agencies. They’ve shut down over a thousand operations. The only digital future they want is one they control: a state-backed digital dinar. Not Bitcoin. Not Ethereum. Not DeFi. Just the government’s version of money. For now, if you’re in Kuwait, the message is simple: stay away. The cost of breaking the law isn’t just financial. It’s legal. And it’s severe.Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

Popular Articles

13 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

So let me get this straight - Kuwait’s banning crypto because mining is using too much power, but they’re fine with subsidizing electricity for oil barons and SUV drivers? 😒 The hypocrisy is thicker than their desert sand. They’re not protecting the grid - they’re protecting their monopoly. A CBDC? Please. It’s just digital surveillance with a fancy name. 🤖💸

Honestly? I get it. I’m not pro-crypto, but I’m also not pro-total-ban. The energy thing is wild - 140k GWh? That’s like powering a small country. But criminalizing people for holding Bitcoin? That’s where it gets messy. Maybe they should’ve taxed mining instead of torching it. 🤷♂️

Kuwait’s like that one uncle who says ‘I don’t trust computers’ but still uses his iPad to watch cat videos 8 hours a day. 🤭 They’re scared of decentralization because it means they can’t control every dollar. CBDC? Cool. Just don’t call it ‘digital freedom’ - it’s digital obedience.

India should take notes. We let crypto run wild, then panic when people lose money. Kuwait’s brutal but honest - no gray zone. If you don’t want chaos, ban it. No ‘maybe’ or ‘regulate later.’ Just say no. Respect.

They banned crypto because it’s decentralized. That’s it. No other reason. They want you to trust only them. Not tech. Not markets. Just the state. Simple. Cold. Effective. And terrifying.

imagine being so scared of tech that u ban it instead of learnin how to use it… like why not just make ur own crypto and call it kuwaitcoin? lol

It’s wild how some countries treat crypto like a virus. But if you look at the energy numbers - 140k GWh - it’s not paranoia. It’s physics. They didn’t ban it because they’re Luddites. They banned it because their grid was about to collapse. Practical, not ideological.

Oh wow, a country that doesn’t want you to own money outside their control? Shocking. Next they’ll ban cash and force everyone to use the digital dinar. Maybe they’ll put a QR code on your forehead. 🙃

Western nations preach freedom but let crypto flourish. Kuwait has the courage to protect its sovereignty. This isn’t about oppression - it’s about national survival. When your power grid fails because some kid in his bedroom is mining Bitcoin, you don’t negotiate. You enforce. And you win.

Think about it - money is a social contract. When you allow decentralized ledgers, you’re letting strangers write the rules. Kuwait isn’t banning technology - it’s defending the idea that trust must be centralized, that legitimacy must be conferred by institutions, not algorithms. The blockchain is beautiful, but it’s not sacred. The state is. And the state says no. So no. 🤔

They banned mining because it was draining the grid. Cool. But banning *holding* crypto? That’s not policy - that’s authoritarian theater. You can’t control what people do on their phones. All you’re doing is driving it underground. And then who’s really in charge? The black market. Not the state. 😏

if u live in kuwait and u have btc… u r basically holding digital confetti. no one accepts it, no bank touches it, and if u mine it u go to jail. so why even bother? just wait for the cbdc and get ur digital dinar. less risky. more boring.

CBDC = control. Crypto = freedom. Kuwait chose control. Simple. No drama. 👍