- Home

- Cryptocurrency

- Understanding 10x, 50x, 100x Leverage in Crypto Trading

Understanding 10x, 50x, 100x Leverage in Crypto Trading

Imagine putting down $100 and controlling a $10,000 trade. That’s what 10x leverage does. It’s not magic. It’s borrowing. And in crypto, where prices swing wildly, that borrowed power can turn a $500 win into a $5,000 win-or wipe your account clean in seconds. Most new traders hear about 100x leverage and think it’s the key to fast riches. But here’s the truth: high leverage doesn’t make you richer. It just makes your mistakes more expensive.

How Leverage Actually Works

Leverage isn’t about increasing your position size. It’s about reducing the cash you need to open one. If you want to buy $10,000 worth of Bitcoin, you don’t need $10,000 in your account. With 10x leverage, you only need $1,000. The exchange lends you the other $9,000. That’s it. The position size stays the same. What changes is your risk.Here’s the math: a 5% move in Bitcoin’s price means a 50% gain or loss on your $1,000 margin. That’s the multiplier effect. At 50x, that same 5% move turns into a 250% swing. At 100x? A 1% price drop wipes you out. No warning. No second chance. Just liquidation.

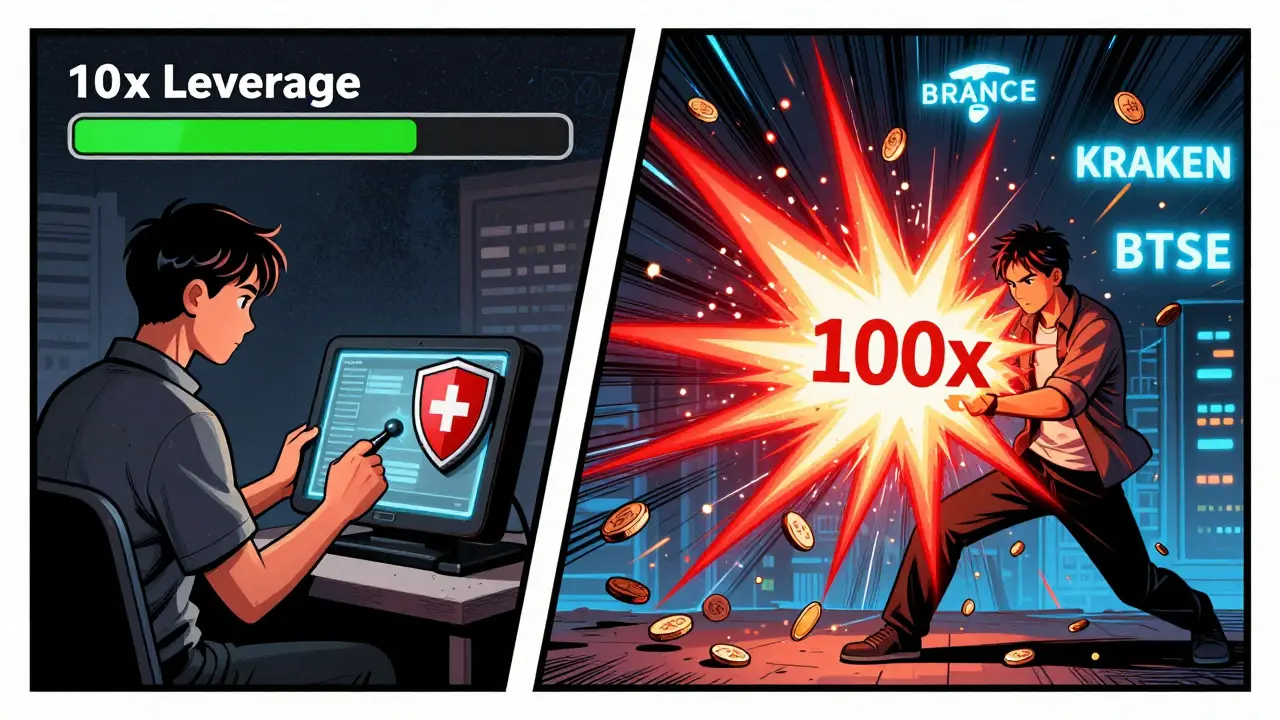

Platforms like Binance, Kraken, and BTSE offer these ratios. BTSE even lets you pick between 1x and 100x. But here’s what no one tells you: higher leverage doesn’t give you more control. It gives you less room to breathe. A 1% spike during a news drop, a flash crash, or even a whale moving coins can trigger liquidation. And you didn’t even lose the trade-you just ran out of cash to hold it.

10x vs. 50x vs. 100x: Real Risk Differences

Let’s break down what each level actually means in practice:

| Leverage | Margin Required | Price Move to Liquidate | 5% Price Move = ? Profit/Loss on Margin |

|---|---|---|---|

| 10x | 10% | 10% | 50% |

| 50x | 2% | 2% | 250% |

| 100x | 1% | 1% | 500% |

At 10x, you still have breathing room. A 10% move against you kills your position. That’s a lot-but in crypto, markets often swing 5-15% in a day. You can ride it out. At 50x, you need a 2% move to blow up. That happens in minutes. At 100x? One bad tweet, one exchange outage, one big sell order-and you’re gone.

Some traders brag about turning $500 into $50,000 with 100x. They don’t mention the 97 other traders who lost everything trying the same thing. The ones who win? They’re not gambling. They’re using 10x or 20x, with tight stop-losses, and they’ve spent months learning how price reacts to news, volume, and order flow.

Why Beginners Should Avoid High Leverage

Reddit threads are full of stories: "I used 100x on BTC and made $8,000 in a week!" Then the next post: "My account is gone. I didn’t know liquidation was so fast." That’s not a mistake. That’s a design flaw in the system.

Exchanges don’t care if you win or lose. They make money from fees and funding rates. High leverage traders pay more. And they lose more. That’s why platforms push 50x and 100x. It’s not to help you. It’s to get you to trade more-and lose faster.

Industry experts agree: if you’re new to crypto, stick to spot trading first. Learn how charts work. Learn how to read volume. Learn how to set stop-losses. Then, if you’re consistently profitable over 6 months, try 5x leverage on a small position. Not 50x. Not 100x. Five times. That’s enough to feel the power without becoming a statistic.

Autowhale and Margex both warn: leverage doesn’t make you a better trader. It makes your existing skills more dangerous. If you don’t know when to exit, 100x will exit for you-and it won’t be pretty.

How to Trade Leverage Safely

If you’re serious about using leverage, here’s how to do it without blowing up:

- Start with 5x or less. Even 5x is enough to feel the momentum without risking your entire account on a single trade.

- Use stop-losses religiously. BTSE calls them "crucial." They’re not optional. Set them before you open the trade. Don’t wait. Don’t hope.

- Never risk more than 2% of your account on one trade. That’s the golden rule. Even with 10x, if you lose 2%, you’re down $200 on a $10,000 account. Manage position size, not leverage.

- Understand liquidation price. Every platform shows it. Know it. Write it down. If the price hits that number, you’re gone. Don’t wait for the alert.

- Use isolated margin. Don’t let your whole account be collateral. Isolated mode limits your risk to just the funds you put into that trade.

- Practice first. Use paper trading on Binance or Kraken. Trade with fake money for 30 days. See how your emotions react. Then, if you’re still calm and consistent, go live-with small amounts.

Most people skip steps 1 through 5. They jump straight to 100x and wonder why they lost everything. It’s not the market’s fault. It’s theirs.

Regulations and Market Trends

Europe has already capped retail crypto leverage at 2x. The U.S. doesn’t have a federal cap, but some states restrict it. Meanwhile, places like Malta and the Bahamas still allow 100x. That’s why many traders use offshore exchanges.

But the writing’s on the wall. Regulators are watching. High leverage is seen as gambling, not investing. And the trend is clear: more oversight, fewer high-leverage options. Institutional players are moving in, and they don’t use 100x. They use 5x with complex hedging strategies.

Platforms are also adding new tools: partial liquidation, dynamic leverage adjustments, volatility buffers. These aren’t gifts. They’re damage control. Because exchanges know how many accounts get wiped out.

The Bottom Line

10x leverage can be a tool. 50x is a gamble. 100x is a casino. And the house always wins in the long run.

There’s no shortcut to making money in crypto. No magic ratio. No secret formula. Just discipline, education, and patience. If you’re chasing 100x returns, you’re not trading-you’re playing Russian roulette with your savings.

Use leverage to amplify your edge, not to cover your ignorance. Start low. Learn fast. Protect your capital. The market will give you plenty of chances to make money. Don’t blow them all on one reckless trade.

Can you really make money with 100x leverage?

Yes-but only if you’re already a skilled trader with a proven strategy. Most people who try 100x leverage lose everything within weeks. The few who win usually have years of experience, strict risk controls, and trade only during low-volatility windows. For 99% of people, it’s a fast way to lose money.

Is 10x leverage safe for beginners?

It’s less dangerous than 50x or 100x, but still risky for someone new. Beginners should start with spot trading and only try 10x after months of practice and consistent profits on small positions. Even then, never risk more than 2% of your account on a single trade.

What’s the difference between cross and isolated margin?

Cross margin uses your entire account balance as collateral for all open positions. If one trade goes bad, it can drain your whole account. Isolated margin limits risk to just the funds you assign to that specific trade. Isolated is safer for beginners and anyone trading multiple positions.

Why do exchanges offer 100x leverage if it’s so risky?

Because it makes them money. Higher leverage means more trading volume, more fees, and more funding rate payments. Exchanges don’t profit when you win-they profit when you trade. High leverage keeps traders active, even if they’re losing. It’s a business model built on volume, not customer success.

Do I need a crypto leverage calculator?

Yes. A leverage calculator tells you your liquidation price, profit potential, and margin requirements before you open a trade. Most exchanges have one built in. Use it. Don’t guess. A 1% miscalculation at 100x means you’re flat broke. Calculators remove guesswork.

Is leverage trading legal?

In most countries, yes-but regulations vary. The EU caps retail leverage at 2x. The U.S. has no federal cap, but some states restrict it. Countries like Malta and the Bahamas allow up to 100x. Always check your local laws. Using offshore platforms doesn’t make you immune to tax or legal consequences.

What to Do Next

If you’re thinking about using leverage, pause. Ask yourself: Have I traded spot for at least six months? Do I know how to read a 4-hour chart? Do I have a written trading plan? Do I understand funding rates and liquidation triggers?

If the answer to any of those is no, don’t touch leverage. Not even 2x. Focus on learning. Practice on paper. Study how price reacts to news. Watch how big players move the market.

When you’re ready, start with 5x. Trade small. Use stop-losses. Protect your capital. The goal isn’t to get rich overnight. It’s to survive long enough to get rich slowly.

Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

Popular Articles

16 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

bro i used 100x on solana last month and got liquidated in 3 minutes. thought i was a genius. turns out i just had bad timing and zero discipline. learned the hard way. now i stick to 5x and sleep at night. 🤡

love this breakdown. so many new traders think leverage is a cheat code, but it’s really just a turbocharged version of your worst habits. if you don’t know when to get out, 100x doesn’t make you rich-it makes your regret louder. start small, stay humble, and let the market come to you. 💪

It’s appalling that North American exchanges still permit 100x leverage. In Canada, we’ve seen too many young people ruin their futures because of this casino-style gambling masquerading as finance. This isn’t trading-it’s financial negligence.

Oh please. You think 10x is ‘safe’? That’s what the retail sheep say after they’ve been herded into the slaughterhouse. Real traders use 50x and trade the order flow. If you can’t handle 2% volatility, maybe you shouldn’t be on a screen at all. Just sayin’.

sooo… you’re saying people who lose money are just dumb? what about the fact that exchanges design these products to maximize liquidations? maybe the problem isn’t the trader… it’s the system. just sayin’ 😊

Good article. In India, many young traders are drawn to high leverage because they want quick money. But discipline is more important than leverage. Start with 2x, learn price action, and never risk more than 1% of capital. Slow and steady wins the race.

100x is basically a slot machine with charts. i used to think i was smart using it… until i lost my rent money. now i paper trade for 3 months before touching real cash. best decision ever. 🙏

Anyone using 100x is just begging for a financial divorce. These platforms are rigged. They make money off your losses. You think you’re trading crypto? Nah. You’re feeding the machine. Get real.

yo i made 40k in 2 days with 100x on eth then lost it all in 12 hrs… but hey at least i tried right?? 😅 now i use 5x and i’m actually making consistent gains. the key is patience, not power.

funny how people brag about their 100x wins but never mention the 17 other accounts that blew up trying the same thing. the market doesn’t care about your courage. it only cares if you have a plan. no plan = no survival.

leverage isn’t the problem. it’s the delusion that you’re smarter than the algorithm. if you can’t predict a 1% move, why are you betting your life savings on it? this isn’t trading-it’s self-sabotage with a chart.

in my culture, we say ‘a slow river cuts deep.’ leverage is like a flash flood-impressive, but it destroys everything in its path. take your time. build real skill. the money will follow.

One thing no one talks about: funding rates. At 100x, you’re paying hundreds of dollars in funding fees every day just to hold a position. Most people don’t even realize they’re losing money before the price even moves. Check your funding rate before you trade.

Start with spot. Learn candlesticks. Understand volume. Then try 5x. Then 10x. Not because it’s ‘safe’-but because you’ll actually know why you’re entering and exiting. Most people skip the foundation and wonder why they crash.

bro, i started with 100x and lost $2k in a week. then i switched to 5x and made $1.5k in 3 weeks. same strategy, same market. the only thing that changed? my patience. leverage doesn’t make you rich. discipline does.

you think this is about trading? nah. this is about the fed printing money and pushing people into crypto so they can bleed them dry. 100x leverage? it’s a distraction. the real game is inflation, not BTC.