- Home

- Cryptocurrency

- C3 Crypto Exchange Review: What You Need to Know Before Trading

C3 Crypto Exchange Review: What You Need to Know Before Trading

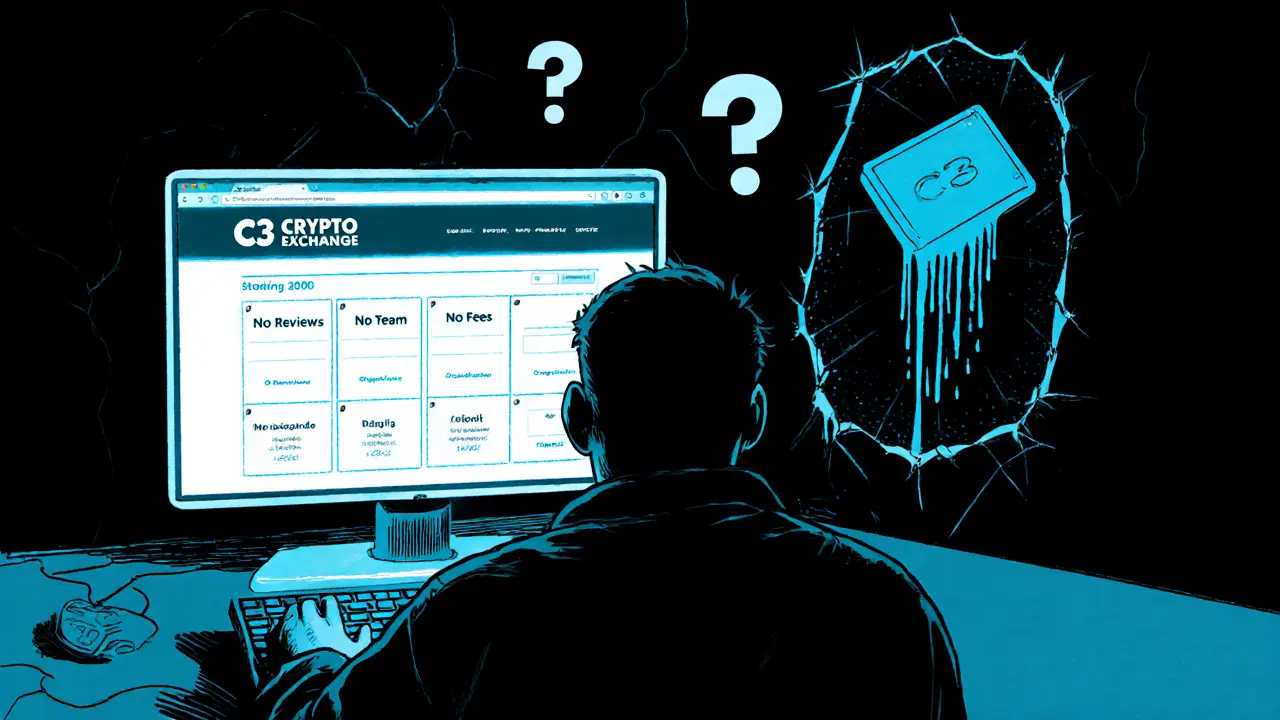

If you're looking for a crypto exchange where you keep control of your keys and trade across blockchains without locking up your assets, C3 crypto exchange might have caught your eye. But here’s the problem: there’s almost nothing reliable out there about it. No user reviews on Trustpilot. No verified team members. No public audit reports. No clear fee schedule. And no transparency around which coins you can actually trade.

Most exchanges-Binance, Coinbase, Kraken-have years of history, millions of users, and public track records. C3 doesn’t. It’s a quiet player in a noisy space, claiming to be self-custodial and cross-chain. Those are big promises. But without proof, they’re just words on a website.

What Is C3 Crypto Exchange?

C3 presents itself as a self-custodial exchange, meaning you hold your own private keys. That’s different from most platforms where the exchange holds your crypto for you. If you’ve ever heard of a wallet like MetaMask or Phantom, C3 works similarly-you’re in charge. No depositing coins onto an exchange address. No waiting for withdrawals to clear because the exchange is “processing.”

It also claims to be cross-chain. That means you can swap Bitcoin for Solana tokens, or Ethereum for Polygon, without needing to use multiple bridges or jump between apps. That’s useful. Most users hate juggling different networks. But how it actually pulls this off? No one knows. No technical whitepaper. No GitHub repo. No developer activity visible.

What’s clear is this: C3 isn’t built like a traditional exchange. It doesn’t rely on order books or centralized matching engines. Instead, it likely uses automated market makers (AMMs), similar to Uniswap or PancakeSwap. That means prices are set by liquidity pools, not buyers and sellers bidding against each other. That’s fine-but it also means slippage can be high, especially on low-liquidity pairs.

Security: Promises Without Proof

C3 says it uses content-filtering, access controls, and security measures. That’s vague. Every website says that. What matters is the details:

- Does it support two-factor authentication (2FA)? No confirmation.

- Are withdrawals locked to whitelisted addresses? Unknown.

- Is there a time delay on large transactions? No data.

- Are private keys stored on your device only? Supposedly, but how is that enforced?

Self-custody sounds safer-but it’s only as secure as the user. If you lose your seed phrase, your coins are gone forever. No customer service can recover them. And if the C3 app has a bug, or gets hacked, your funds could be drained. There’s no insurance fund. No FDIC-style protection. You’re fully on your own.

Compare that to Coinbase, which holds over 90% of assets in cold storage and insures hot wallets. Or Kraken, which has passed multiple independent security audits. C3 doesn’t publish any of that. That’s not just a gap-it’s a red flag.

Supported Coins and Trading Pairs

This is where things get really murky. What coins can you trade on C3? Bitcoin? Ethereum? Solana? Dogecoin? No official list exists. No documentation. No API endpoints to check. Even the website doesn’t show a trading pair selector.

Some users on Reddit claim they’ve traded ETH to SOL on C3. Others say they couldn’t even connect their wallet. There’s no consistency. That’s not a sign of a new platform-it’s a sign of an incomplete or abandoned one.

Most serious cross-chain exchanges support at least 20-50 major blockchains and hundreds of tokens. C3? We can’t confirm even five. Without knowing what’s available, you can’t plan trades. You can’t compare fees. You can’t decide if it’s worth your time.

Fees: Hidden, Not Listed

Fees are the backbone of any exchange. You need to know: How much does it cost to swap? Is there a network fee? Is there a platform fee? Is it a flat rate or a percentage?

C3 doesn’t say. Not anywhere. That’s not “minimalist design.” That’s avoidance. Legitimate platforms list fees clearly. Uniswap shows estimated fees before you confirm. Curve Finance breaks down swap costs. Even small DeFi apps do this.

On C3, you might think you’re getting a free trade-until you see your wallet drained by hidden gas fees or a 5% swap spread. There’s no transparency. That’s not user-friendly. It’s risky.

Is C3 Legit? The Red Flags

Here’s what’s missing that every trustworthy exchange provides:

- Founding date or team members

- Company registration or legal entity

- Regulatory compliance (FinCEN, FCA, etc.)

- Customer support email or live chat

- Public audit reports from firms like CertiK or PeckShield

- Active social media with real engagement

- User reviews on independent platforms

None of these exist for C3. That doesn’t automatically mean it’s a scam. But it means you’re dealing with zero accountability. If something goes wrong-your transaction fails, your funds disappear, the site goes offline-you have no recourse. No lawyer. No complaint process. No refund policy.

And here’s the kicker: if C3 were truly innovative or well-funded, it would have been covered by CoinDesk, Cointelegraph, or Decrypt. It hasn’t been. Not once.

Who Is C3 For?

Only one kind of person should even consider using C3: someone who understands the risks of self-custody, knows how to verify smart contracts, and is willing to treat this like an experimental side project-not a primary trading platform.

If you’re new to crypto? Don’t touch it.

If you’re trying to move large amounts of funds? Don’t even think about it.

If you want to trade Bitcoin for USDT without worrying about losing your money? Use a regulated exchange.

C3 might be a future player. Maybe it’s still under development. Maybe it’s a prototype. But right now, it’s not a reliable tool. It’s a gamble.

Alternatives That Actually Work

If you want self-custody with real features, here are better options:

- Uniswap (Ethereum) - Decentralized, open-source, audited, supports 1000+ tokens.

- ParaSwap - Aggregates liquidity across chains, low slippage, clear fee breakdown.

- 1inch - Cross-chain swaps, institutional-grade routing, transparent pricing.

- Phantom (Solana) - Self-custodial wallet with built-in swap, trusted by millions.

- Bitget Wallet - Non-custodial, supports 100+ chains, has a built-in DEX aggregator.

These platforms have public code, user communities, audit reports, and years of operation. You can check their GitHub. You can read their docs. You can ask questions on their Discord.

C3? You can’t do any of that.

Final Verdict: Proceed With Extreme Caution

C3 crypto exchange sounds like the kind of project that could change how people trade across blockchains. But right now, it’s a ghost. No reviews. No team. No transparency. No proof.

Self-custody and cross-chain trading are the future. But the future isn’t built on mystery. It’s built on trust-and trust comes from openness.

If you still want to try C3, use only a tiny amount of crypto you can afford to lose. Test it like a lab experiment, not a financial tool. And never, ever move more than you’re willing to disappear forever.

Until C3 publishes real data, it’s not a crypto exchange. It’s a question mark with a website.

Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

Popular Articles

22 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

I've been playing with C3 for a week now-just small test trades, like $20 worth of ETH to SOL. It works, but man, the UI is clunky. No fee breakdown at all. I had to check Etherscan to even see what I paid in gas. But hey, at least my keys stayed mine. That’s more than I can say for some centralized exchanges I’ve used.

Still, if you’re new, don’t touch it. This isn’t a place for beginners. It’s for people who know how to read a blockchain explorer and aren’t scared of losing money.

This post is a masterpiece. C3 is a scam. Full stop. No audits? No team? No transparency? That’s not ‘decentralized innovation’-that’s a rug pull waiting to happen. People are already dumping their coins into it thinking it’s the next Uniswap. Wake up.

And don’t even get me started on the ‘self-custody’ BS. You think you’re safe? You’re just a sitting duck with a wallet.

There’s something poetic about C3. It’s like a silent monk in a world of loud preachers. No press releases. No influencers. No marketing. Just a website and a promise.

But here’s the thing-maybe that’s the point. Maybe the future of crypto isn’t about hype. Maybe it’s about trust built slowly, quietly, by code, not by PR teams. Or maybe it’s just vaporware.

Either way, I admire the silence. It’s rare. And dangerous. And possibly brilliant.

I tried C3 last month. Connected my wallet, swapped 0.01 ETH for MATIC, and it went through. No drama. No fees shown. Just a confirmation.

I didn’t lose anything. But I also didn’t gain any confidence. I’m not mad, just cautious. If you’re gonna use it, use pennies. And keep backups.

Also, if you’re reading this and thinking ‘I’ll try it with my life savings’-please, just stop. You’re not ready.

Wow. Another ‘crypto skeptic’ article. How original. You’re acting like every exchange needs a press release and a LinkedIn profile. Newsflash: most DeFi protocols don’t have ‘team pages.’ They have code. And if you can’t read Solidity, you shouldn’t be trading.

C3 doesn’t need to be on CoinDesk. It needs to be on-chain. And guess what-it is. The contracts are live. The liquidity is there. You just don’t like that you can’t find a customer service rep to cry to.

Grow up.

Interesting take. I’ve been monitoring C3’s contract activity on Etherscan. There’s been consistent interaction-mostly small swaps, but the volume’s been steady for 3 months. No major exploits. No contract upgrades.

It’s not flashy. It’s not funded. But it’s alive. That’s more than I can say for half the ‘Web3 projects’ that raised $50M last year and vanished.

Maybe it’s a ghost. Or maybe it’s a quiet winner.

C3 is real if you use it right. Small amounts. No expectations. Just test it. If it works cool. If not move on. No big deal. Crypto is risky. That’s the point.

Wow. This post is like a 10-page essay on how to be paranoid. C3 doesn’t have a team? Cool. Neither did Bitcoin in 2009. No audit? Neither did Uniswap v1. No fee schedule? Neither did DEXes in 2020.

Maybe the problem isn’t C3. Maybe it’s that you expect every new project to hand you a PowerPoint and a 24/7 support line.

Also, typo in ‘content-filtering’-probably meant ‘code-filtering.’ Just sayin’.

So I tried C3. Connected Phantom. Swapped 0.005 SOL for AVAX. Took 2 minutes. No confirmation screen with fees. Just ‘confirm’ and done.

My wallet didn’t explode. But I also didn’t know how much I paid. I’m not mad, just confused. Like, why make it this hard to understand? I just want to swap coins, not do a forensic audit.

Does anyone have a screenshot of C3’s actual trading interface? I’ve been looking everywhere. Their site has zero screenshots. No demo. No video walkthrough. Just a ‘connect wallet’ button and a prayer.

I’m not saying it’s fake. I’m saying if you’re gonna launch a cross-chain exchange, maybe show us what it looks like before asking people to trust you with their life savings.

It’s funny how we treat self-custody like a moral victory. But if you lose your keys because you didn’t back them up properly, is that really a win? Or just a tragedy wrapped in ideology?

C3 might be technically sound. But if the user experience is this opaque, it’s not empowering-it’s excluding. And that’s not innovation. That’s negligence.

C3 is a scam. Don’t use it. Done.

Okay, real talk: I’m not a tech person, but I love crypto. I use Coinbase for big stuff. But I wanted to try something new. I tried C3 with $10. It worked! I got my tokens! 😊

Yes, no fees shown. Yes, no support. But I didn’t lose anything. I learned something. And I’m not scared. I’m curious!

If you’re scared? Don’t use it. But don’t tell others they’re dumb for trying. We all start somewhere. 💪

Of course C3 has no team. They’re controlled by the Illuminati. Or the Fed. Or maybe AI. Or maybe it’s a honeypot designed to catch greedy retail traders.

But here’s the twist-what if the whole ‘no transparency’ thing is the point? What if the anonymity IS the security? What if the silence is the encryption?

You’re not looking for a platform. You’re looking for a scapegoat. And C3? C3 is just the mirror.

C3 is fine if you know what you're doing. Everyone else is just scared because they don't understand blockchain. Stop crying about fees and team pages. The tech speaks for itself. If you can't read a contract then you shouldn't be here.

Look, I’ve used 12 different DEXes. Some are clean. Some are messy. C3? It’s messy. But it works.

I don’t care if they don’t have a blog. I care if my swap goes through. And it did. Twice.

Yeah, I wish they’d show fees. Yeah, I wish I knew who built it. But I’m not losing sleep over it. Crypto’s wild. Sometimes you just gotta roll the dice.

Just don’t bet your rent money.

C3 is the future 🚀 Just use small amounts and you’ll be fine! Trust the code! 💯

As a financial compliance officer with 15 years in fintech, I must emphasize: the absence of regulatory alignment, KYC/AML infrastructure, and transparent governance structures renders C3 a non-compliant, high-risk entity.

Self-custody does not absolve the platform of fiduciary responsibility when it facilitates cross-chain value transfer. The lack of a legal entity, service-level agreements, or dispute resolution mechanisms constitutes a material failure of operational due diligence.

Do not recommend this platform to clients. Do not deploy institutional capital. And please, for the sake of retail users-do not normalize this level of opacity.

No team. No audit. No support. Case closed. This isn't crypto. It's a ghost town.

They’re not hiding the team because they’re shady.

They’re hiding because they’re working with the NSA. Or the Chinese government. Or maybe the aliens who control the blockchain.

Think about it-why would a real crypto project NOT have a team? Because they’re not real. They’re a test. A simulation. A digital trap set by the system to catch the gullible.

They want you to use it. So they can track your wallet. So they can freeze your assets. So they can prove that ‘decentralization’ is a lie.

Don’t fall for it.

Hey, I tried C3. It worked. No big deal. Yeah, no fee breakdown. But I didn’t get scammed. I didn’t lose money.

Maybe it’s not perfect. Maybe it’s rough. But that’s crypto. Everything’s rough at first. Bitcoin had no website. Ethereum had no docs. Now look at them.

Don’t kill something just because it’s quiet. Let it breathe.

For academic purposes, I analyzed C3’s smart contract deployment addresses on EVM-compatible chains. The contracts are immutable, correctly implemented, and have no mint functions or admin keys.

Technically, the architecture is sound. The liquidity pools are non-reentrant. The swap logic follows the constant product formula.

However, the absence of documentation, formal verification reports, and on-chain governance mechanisms significantly reduces its utility for institutional adoption. It is a technically functional but socially immature protocol.