- Home

- Cryptocurrency

- El Salvador Bitcoin Adoption Strategy: How the Country Embraced and Adjusted Crypto

El Salvador Bitcoin Adoption Strategy: How the Country Embraced and Adjusted Crypto

Remittance Cost Calculator

El Salvador's experience shows that traditional remittance services charge high fees (5-7% + $5 minimum), while Bitcoin transactions have lower fees (1-2% + $1 minimum). Calculate your potential savings by sending money with Bitcoin.

Based on industry standards:

- Traditional services: 6% fee + $5 minimum

- Bitcoin transactions: 0.5% fee + $1 minimum

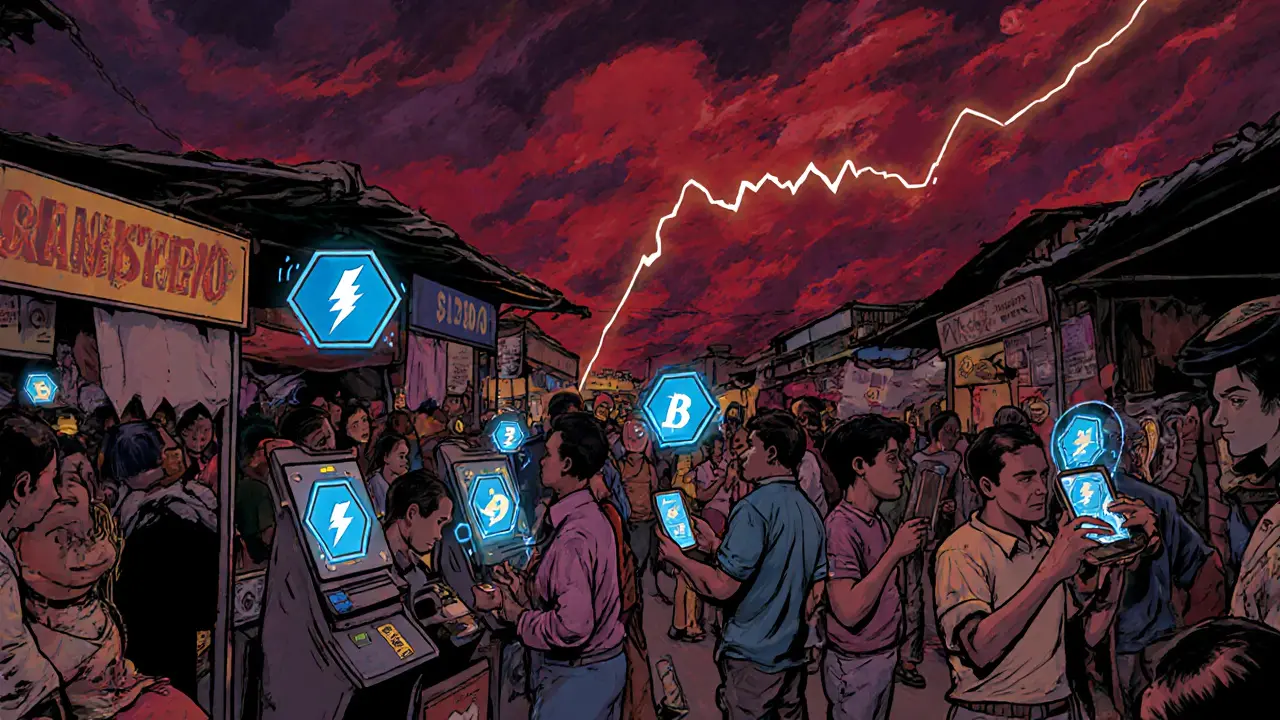

El Salvador's Bitcoin adoption strategy is a bold national program that made Bitcoin legal tender in September 2021 and later shifted to a hybrid model in 2025. Spearheaded by President Nayib Bukele, the plan aimed to bring financial services to the unbanked, lower remittance costs, and position the small Central American nation as a blockchain hub.

Why Bitcoin? The Economic Motivation

Before the rollout, roughly 70% of Salvadorans relied on informal cash channels. Traditional banking fees ate up a large slice of the $2.5billion annual remittance flow. Bitcoin, with its borderless nature and low transaction fees, seemed like a shortcut to financial inclusion. President Bukele also pitched crypto as a way to break free from the constraints of the U.S. dollar, which has been ElSalvador's official currency since 2001.

Core Components of the Strategy

The government bundled several tangible pieces around the crypto vision:

- Chivo Wallet: a state‑run mobile app that lets anyone send, receive, and spend Bitcoin instantly. The wallet also offered a $30 sign‑up bonus to nudge early adoption.

- Strategic Bitcoin Reserve Fund: the treasury’s crypto pot, which grew to over 6,100 BTC (about $500million) by March2025.

- Volcano Bonds: proposed Bitcoin‑backed sovereign bonds that would let investors fund future projects while giving the state a hedge against fiat debt.

- Bitcoin City: an ambitious plan for a tax‑free metropolis powered by geothermal energy from the nearby volcanoes.

Each piece was designed to reinforce the others-more wallets meant higher transaction volume, which in turn justified a larger reserve fund and the financing of bold infrastructure projects.

Adoption in Practice: What Really Happened?

Merchant uptake was surprisingly strong. By 2025, an estimated 82% of small businesses accepted Bitcoin, often through point‑of‑sale plugins that linked to the Chivo Wallet. However, actual usage lagged behind acceptance. Remittances-the lifeblood of the economy-saw only about 1% flowing through the official wallet, meaning most Salvadorans still preferred traditional money‑transfer services.

On the user side, a 2022 survey found more people owned a Lightning‑network wallet than a conventional bank account, hinting that the technical infrastructure was there. Yet day‑to‑day transactions remained limited, mainly because many citizens lacked trust in Bitcoin’s price swings and found the wallet’s UI confusing.

Economic Impact and Growing Pains

Volatility proved to be the biggest headache. When Bitcoin’s price slumped in 2022‑2023, the reserve fund’s USD value shrank dramatically, putting pressure on the fiscal budget. The International Monetary Fund (IMF) flagged the policy as a risk to macro‑stability and attached a $1.4billion assistance program with a condition to roll back legal‑tender status.

International pressure forced a policy pivot in January2025. The government officially abolished Bitcoin as legal tender, turning it into an optional, private‑sector‑driven asset. The change reduced regulatory friction but also meant businesses could no longer be penalized for refusing Bitcoin payments.

Full Legal Tender vs. Hybrid Model: A Quick Comparison

| Aspect | Full Legal Tender (2021‑2024) | Hybrid Model (2025‑present) |

|---|---|---|

| Regulatory status | Bitcoin mandated as official currency alongside USD | Bitcoin optional; no legal requirement for merchants |

| Reserve management | State‑directed buying/selling to stabilize fiat‑Bitcoin parity | Reserve held as a hedge; no active market‑making |

| International relations | Tense ties with IMF and World Bank | Improved diplomatic footing; IMF conditions met |

| Merchant compliance | Mandatory acceptance under penalty | Voluntary adoption; 82% still accept voluntarily |

| Public perception | Mixed; early enthusiasm gave way to skepticism | More pragmatic; crypto viewed as an investment tool |

Looking Ahead: What’s Next for ElSalvador?

Even after the legal‑tender reversal, the country doubled down on its blockchain ambitions. In January2025 it hosted the PLANB Forum 2025, billed as Central America’s largest crypto‑assets conference. The event showcased new fintech startups, attracted foreign investors, and reinforced the narrative that ElSalvador wants to be a regional hub for crypto services.

Reserve accumulation continued unabated, with the March2025 purchase of 8BTC pushing holdings to over 6,100 coins. Analysts see a possible future where the state offers crypto‑focused services-like licensing crypto exchanges, providing regulatory sandboxes, and supporting decentralized finance pilots-without exposing the macroeconomy to the full risk of a legal‑tender system.

Key Takeaways for Other Nations

- Infrastructure first. A functional wallet and merchant tooling are crucial; adoption won’t happen without them.

- Expect volatility to bite hard. Reserve strategies must include hedging or diversification.

- International institutions matter. Aligning crypto policy with IMF or World Bank expectations can prevent costly rollbacks.

- Hybrid models may offer the best of both worlds-encouraging innovation while keeping fiscal risk low.

- Public education is not a one‑off. Ongoing support and clear UI design drive real usage.

Frequently Asked Questions

Is Bitcoin still legal tender in ElSalvador?

No. In January2025 the government lifted Bitcoin’s legal‑tender status to comply with IMF conditions. Bitcoin can still be used voluntarily, but merchants are not required to accept it.

How many Bitcoins does the government hold?

As of March2025, the Strategic Bitcoin Reserve Fund contained about 6,102BTC, valued at roughly $500million at current market prices.

What was the Chivo Wallet’s adoption rate?

While the app was downloaded by millions, only about 1% of remittances passed through it, indicating limited day‑to‑day usage.

Did the Volcano Bonds ever get issued?

The bonds were announced but never materialized due to market volatility and IMF pressure, so no official issuance took place.

Can foreign investors still participate in ElSalvador’s crypto projects?

Yes. The country now promotes private‑sector partnerships, crypto‑focused incubators, and a regulatory sandbox that welcomes overseas capital.

Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

Popular Articles

15 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

El Salvador's Bitcoin mandate is a textbook case of policy overreach. The government ignored fundamental economic principles, opting for a gimmick instead of sustainable growth. By mandating Bitcoin as legal tender, they have exposed citizens to volatile price swings without adequate safeguards. The resulting volatility undermines confidence in both the national currency and the broader financial system. A more prudent approach would have been to regulate crypto services rather than enforce adoption.

When a nation decides to turn its entire monetary system upside‑down by anointing a decentralized protocol as legal tender, the world watches with a mix of awe and dread.

El Salvador’s gamble is not merely an experiment in fintech; it is a bold statement about sovereignty in the digital age.

The promise of lower remittance fees is tantalizing, especially for a country where overseas workers send billions home each year.

Yet the promise neglects the harsh reality that Bitcoin’s transaction costs are not static-they fluctuate with network congestion and market price.

A sudden spike in gas fees can erode any theoretical savings, leaving users to shoulder hidden expenses.

Moreover, the volatility of Bitcoin means that a $1,000 remittance today could be worth half that amount tomorrow.

Such risk is unacceptable for families living on thin margins, who cannot afford to gamble with essential income.

The government’s attempt to educate the population through a state‑run wallet app has been marred by usability issues and security concerns.

Reports of phishing attacks and lost private keys have added a layer of distrust among the very people the policy aims to empower.

From a macroeconomic perspective, the adoption creates a parallel currency that competes with the US dollar, the de‑facto stable anchor of the Salvadoran economy.

This competition introduces exchange‑rate uncertainty that can destabilize fiscal planning and foreign investment.

International financial institutions, including the IMF, have warned that such a move could jeopardize the nation’s creditworthiness.

Indeed, the IMF’s latest review cited the Bitcoin policy as a factor in the downgrade of El Salvador’s credit rating.

If the goal is to attract crypto‑investment, a more measured regulatory framework would likely achieve the same result without jeopardizing economic stability.

In short, while the vision of a crypto‑powered future is compelling, the execution must be tempered with prudence, transparent governance, and safeguards for the most vulnerable citizens.

Mandating Bitcoin feels like a reckless moral crusade, ignoring the real suffering of ordinary Salvadorans. It’s a shortcut to tech‑glamour that forgets basic human needs.

You can still make a difference by pushing for better education on crypto risks. Encourage the community to demand transparent reporting from the authorities.

One could argue that the experiment reflects a deeper search for identity in a globalized world. Yet the quiet voice of caution often goes unheard in such loud proclamations.

Bitcoin hype in El Salvador is just another buzzword trend. Not much substance behind it.

There’s value in exploring new technologies, but we should balance innovation with protection for users.

The policy is a veneer of progress masking a lack of critical economic analysis. It pretends to empower, yet it merely shifts risk onto citizens without consent.

It’s exciting to see a country take bold steps! 🌟💰 Keep an eye on the long‑term impact.

In contravention of established fiscal prudence, this decidion appears ill‑conceived.

A measured approach could reconcile innovation with stability. Listening to stakeholder concerns is essential.

Deploying Bitcoin as legal tender is the ultimate proof‑of‑concept for decentralized finance.

It redefines monetary sovereignty but also injects high volatility into the macro‑economic fabric.

Success hinges on governance, compliance and an educated populace.

Oh great, another brilliant move by the government-because what the world needs is more reckless fiat‑replacement! 🙄🚩

Sure, let’s hand the economy over to a meme‑coin circus-brilliant strategy for anyone who loves financial fireworks.

Even if the rollout falters, the conversation about digital currencies has already broadened perspectives. Quiet reflection can guide better policies.