- Home

- Cryptocurrency

- How Banks in Nigeria React When You Withdraw Crypto to Fiat in 2026

How Banks in Nigeria React When You Withdraw Crypto to Fiat in 2026

It’s 2026, and you’ve been holding Bitcoin, USDT, or Ethereum for months. You’re ready to cash out - but when you try to move crypto to naira, your bank freezes your account. You’re not alone. Thousands of Nigerians face this exact situation every month, even though crypto is now legal. The truth isn’t simple: banks don’t block crypto withdrawals outright anymore, but they’ve built walls around them. And if you don’t know how those walls work, you’ll get stuck on the wrong side.

Legal, But Not Welcome

In December 2023, the Central Bank of Nigeria (CBN) officially lifted its three-year ban on crypto transactions. Then, in March 2025, President Tinubu signed the Investments and Securities Act (ISA 2025), making digital assets legal securities under the oversight of the Securities and Exchange Commission (SEC). On paper, this should’ve opened the floodgates. But banks didn’t cheer. They tightened their grip. Today, Nigerian banks don’t say no to crypto withdrawals - they say only if. Only if your exchange is licensed. Only if your KYC is perfect. Only if your transaction history looks clean. Only if you don’t withdraw more than your bank secretly allows. And only if you never, ever try to pull cash from an ATM linked to crypto funds.What Banks Actually Allow

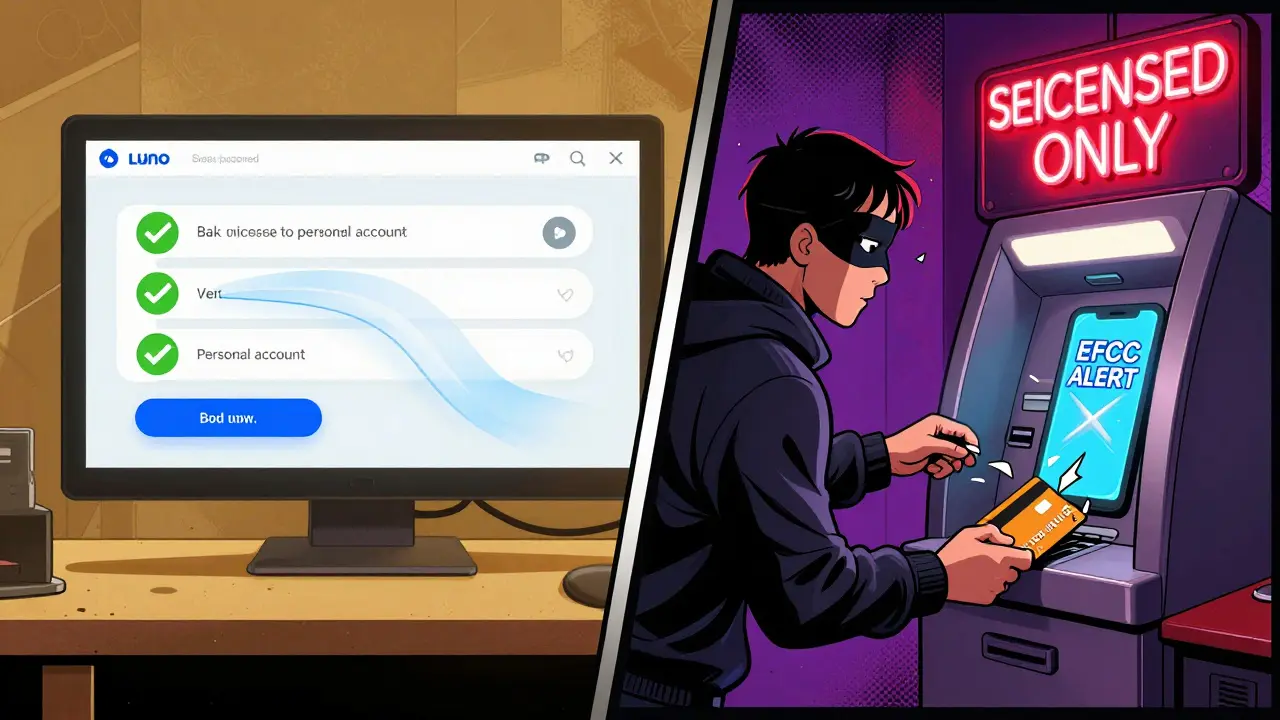

If you’re using a licensed platform like Luno, you can withdraw crypto to naira and get the money in your bank account - usually within hours. These platforms are approved by the SEC, and banks treat them like any other financial service provider. The transfer shows up as a bank debit from Luno’s corporate account to your personal account. No red flags. No delays. Just standard processing. But here’s the catch: banks treat every crypto-related transaction as high-risk. That means:- Withdrawal limits are hidden. Some users report ₦200,000 daily caps; others see ₦500,000 weekly. No bank publishes these. They change without notice.

- Cash withdrawals from crypto accounts are strictly forbidden. If you try to use an ATM linked to a crypto-funded account, your card will be blocked within minutes.

- Large or sudden transfers trigger compliance reviews. If you suddenly withdraw ₦10 million after months of small deposits, your bank will ask for proof of where the crypto came from - trade history, wallet addresses, exchange statements.

The Account Freezing Epidemic

In September 2024, the Economic and Financial Crimes Commission (EFCC) froze 22 bank accounts tied to USDT sellers on unlicensed exchanges like Bybit and KuCoin. Total amount frozen: ₦548.6 million. The reason? Alleged manipulation of the naira exchange rate. That wasn’t an isolated case. Since early 2025, over 180 accounts linked to unlicensed crypto activity have been frozen nationwide. The EFCC doesn’t need a warrant to act - they just notify the bank, and the bank freezes the account immediately. No warning. No appeal process. Just silence. This is why so many Nigerians avoid P2P trading. If you sell Bitcoin to someone in person and they deposit naira into your account, that deposit looks suspicious. Banks flag it. EFCC flags it. Your account gets locked. And you have no way to prove it was a legal trade unless you have receipts, video, and a signed contract - which most people don’t.

Who Can Withdraw Smoothly?

There’s a two-tier system now:- Tier 1: Licensed Exchange Users - If you use SEC-approved platforms like Luno, Breet App, or Coinmama Nigeria, your withdrawals are processed as electronic transfers. Banks see the source as a regulated entity. Your account stays open - as long as you don’t trigger red flags.

- Tier 2: Unlicensed or P2P Users - If you trade on Binance, Bybit, or local P2P apps not licensed by the SEC, your bank will treat your deposits as high-risk. Even if the money is clean, the pattern looks like money laundering. Your account will be frozen, and you’ll need a lawyer to get it back - if you’re lucky.

What Banks Watch For

Banks don’t just look at the amount you withdraw. They look at the pattern:- Frequency - Three withdrawals in one week? Red flag.

- Size - A ₦5 million withdrawal after years of ₦50,000 deposits? Suspicious.

- Timing - Deposits right after crypto price spikes? They track that.

- Source - If your bank account receives funds from a wallet address linked to a banned exchange, it’s game over.

What You Must Do to Stay Safe

If you want to withdraw crypto to fiat without getting locked out:- Use only SEC-licensed exchanges. Check the SEC Nigeria website for the official list. Don’t assume Binance or KuCoin are safe - they’re not licensed locally.

- Keep full records. Save your trade history, wallet addresses, and exchange statements. You might need them in 48 hours.

- Don’t withdraw more than your usual income. If you earn ₦150,000/month, don’t suddenly withdraw ₦2 million from crypto. It looks like money laundering.

- Avoid cash withdrawals entirely. Never use an ATM linked to crypto funds. Use bank transfers only.

- Use multiple banks. If one freezes your account, you still have access through another. Don’t put all your money in one bank.

- Don’t use P2P unless you have proof. If you must, record the transaction, get the buyer’s ID, and send via bank transfer - never mobile money.

The Tax Time Bomb

The Federal Inland Revenue Service (FIRS) hasn’t started taxing crypto yet - but they’re ready. A new Finance Bill is expected to pass in early 2026, which would classify crypto gains as taxable income. Once it does, banks will be required to report all crypto-to-fiat withdrawals over ₦500,000 to tax authorities. That means: if you withdraw ₦7 million in a year, the tax office will see it. They’ll ask: “Where did this come from?” If you can’t prove it was from trading - not illegal activity - you could face penalties, interest, or even prosecution.The Bigger Picture

Nigeria wants to be a global crypto hub. The SEC’s licensing system, the ISA 2025, and the push to get off the Financial Action Task Force’s Gray List show that. But the government doesn’t want wild west crypto. It wants controlled, traceable, taxed crypto. Banks are just doing what they’re told: protect the system, not help users. They’re not the enemy. But they’re not your ally either. If you treat crypto like a bank account - with records, limits, and compliance - you’ll be fine. If you treat it like gambling with cash under the mattress, you’ll get caught.What Happens If Your Account Gets Frozen?

You’ll get a message from your bank: “Your account is under review.” No reason. No timeline. Your next steps:- Don’t panic. Don’t call the EFCC. Don’t post on social media.

- Gather every document: exchange statements, wallet addresses, trade logs, ID verification from the crypto platform.

- Visit your bank branch in person. Ask for the compliance officer. Bring your documents.

- Be polite. Be patient. This process takes 30-60 days.

- If they refuse to unblock you, hire a lawyer who specializes in financial regulation. It’s expensive, but it’s your only shot.

Can I withdraw crypto to naira legally in Nigeria in 2026?

Yes, but only through SEC-licensed exchanges like Luno or Breet App. Withdrawals must go directly to your bank account via electronic transfer. Cash withdrawals, P2P deals outside licensed platforms, and trades on unregulated exchanges like Binance are high-risk and can lead to account freezes.

Why did my bank freeze my account after a crypto withdrawal?

Your bank froze your account because the transaction triggered an alert - likely due to using an unlicensed exchange, a large or unusual withdrawal amount, or a pattern that looked like money laundering. The EFCC may have flagged it, or your bank’s AI system detected suspicious activity. You need to submit documentation proving your crypto was legally acquired and traded.

Which banks are most crypto-friendly in Nigeria?

Fintech-focused banks like Kuda, Opay, and Palmpay’s banking services are generally more accepting of crypto withdrawals from licensed platforms. Traditional banks like GTBank, Zenith, and Access Bank are more cautious and may impose stricter limits or delay processing. However, no bank openly promotes crypto - all treat it as high-risk.

Are there withdrawal limits for crypto to fiat in Nigeria?

Yes, but banks don’t publish them. Limits vary by bank, account type, and your transaction history. Most users report daily limits between ₦200,000 and ₦500,000, with weekly caps up to ₦1.5 million. Sudden increases in withdrawal amounts trigger compliance reviews.

Will I be taxed on crypto withdrawals in Nigeria?

Not yet, but it’s coming. A Finance Bill expected in early 2026 will likely classify crypto gains as taxable income. Once passed, banks will report withdrawals over ₦500,000 to the tax authority. Keep detailed records of your trades - you’ll need them to prove your gains and avoid penalties.

Can I use Binance or KuCoin to withdraw crypto to naira?

Technically, you can send funds to your bank account from these platforms - but it’s dangerous. Binance and KuCoin are not licensed by Nigeria’s SEC. Banks treat transactions from these platforms as high-risk. Your account will likely be frozen, and you’ll need legal help to recover your funds. Use only SEC-licensed exchanges to avoid this risk.

Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

Popular Articles

15 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

Been through this twice. Licensed exchange, clean history, still got flagged. Banks don't care if you're legit-they care if the system says 'risk'. Had to hire a lawyer. Took 47 days. Worth it to get my money back. Don't trust the 'easy' path.

lol so banks are scared of crypto now? wow. i thought they were the ones who made all the money off the system. they act like they’re innocent but they’re the ones who invented overdraft fees and 20% APR on credit cards. if you’re not rich, you’re just a data point to them. 🤡

Yo if you’re holding crypto and not using Luno or Breet you’re playing with fire. I used to trade on Binance like a boss-until my account got frozen for 3 months. Now I only use SEC-approved. No drama. No stress. Just vibes. 🙌

To everyone freaking out about account freezes-breathe. You’re not alone. This isn’t punishment, it’s paperwork. I helped my cousin navigate this last month. We gathered every wallet screenshot, trade log, even the email from Breet confirming the withdrawal. Took 5 weeks, but they unfroze it. You’ve got this. And yes, use multiple banks. It’s not paranoia-it’s strategy. 💪

It is worth noting that the regulatory framework in Nigeria, while imperfect, represents a significant evolution from the outright ban of 2021. The SEC’s licensing regime, though opaque in its application, is a deliberate attempt to integrate digital assets into the formal financial system. The banks’ caution is not merely bureaucratic inertia-it is a structural response to international AML/CFT pressures, particularly from the FATF. Legitimate users must adapt by treating crypto transactions as regulated financial activities, not speculative gambles. Documentation is not optional; it is the new currency.

So let me get this straight-you’re mad because banks won’t let you turn your $300 Bitcoin into 10 million naira and then go buy a Range Rover? 🤦♂️ Welcome to capitalism, buddy. If you can’t prove where your money came from, you’re not a victim-you’re a walking red flag. Also, ‘P2P’? That’s just money laundering with a smile. 🤷♂️

Why are we even letting Nigerians use crypto? The country can’t even keep the lights on. If they want to trade digital assets, fine-but why should American banks or European regulators care about their financial chaos? This isn’t innovation-it’s regulatory arbitrage wrapped in a ‘freedom’ narrative. Fix your infrastructure first. Then we’ll talk.

I’ve been using Luno for 8 months now. Never had an issue. But I only withdraw max ₦300k per week. No big spikes. No cashouts. And I keep every receipt-even the screenshots of my wallet before I sent. It’s boring, but it works. My cousin tried P2P last month? Account froze. Still waiting. 😞

Man, I feel you. I used to think crypto was my ticket out. But after my account got frozen, I realized-this ain’t about freedom, it’s about discipline. I now use Kuda for crypto transfers, keep my withdrawals under ₦400k, and always link them to my salary deposits. No surprises. No drama. Just steady growth. You don’t need to be rich-you just need to be smart.

Of course the banks are cautious. People don’t understand that crypto isn’t ‘money’-it’s a speculative asset class. If you treat it like cash, you deserve to get burned. And let’s be honest-most Nigerians using P2P aren’t traders. They’re gamblers. This isn’t a financial system. It’s a casino with bad Wi-Fi.

My friend got frozen last week. He sent ₦1.2m from Binance. No proof. No records. Now he’s begging on Twitter. Don’t be him. Use Luno. Save your receipts. Don’t be lazy. That’s it.

It’s fascinating how the same people who scream about ‘financial freedom’ turn into the most obedient citizens when a bank says ‘no.’ Crypto isn’t about rebellion-it’s about compliance. If you can’t follow the rules, you don’t deserve the rewards. Also, Kuda is not ‘crypto-friendly’-it’s just less afraid of regulators. Don’t romanticize it.

Look, I’ve been in fintech for 12 years. I’ve seen this play out in 17 countries. The moment a government says ‘crypto is legal,’ the banks don’t celebrate-they panic. Why? Because they’ve spent decades building trust on the illusion of control. Crypto breaks that illusion. So they build walls. Not because they hate you. Because they’re terrified of losing their entire business model. The real enemy isn’t the EFCC-it’s the legacy banking system clinging to a 19th-century framework. And guess what? You’re not going to fix it by complaining on Reddit. You fix it by using licensed platforms, documenting everything, and refusing to be the next statistic. That’s the only rebellion that matters.

The regulatory environment in Nigeria is not merely complex-it is deliberately ambiguous. This ambiguity serves as a mechanism of control, allowing institutions to enforce compliance through fear rather than transparency. The absence of published withdrawal limits is not an oversight; it is a feature. Users are expected to navigate this labyrinth without guidance, thereby reinforcing institutional power. Until legal clarity is codified-not merely announced-this system will continue to punish the uninformed while protecting the compliant. Documentation is not a suggestion. It is the price of survival.

Man, I used to think crypto was my way out of this mess. I sold my laptop, my bike, everything-put it all into BTC. Then I tried to cash out via P2P. My account froze. No call. No email. Just silence. I thought the world was ending. But then I found a guy on Twitter who told me to go to Kuda, use Luno, and never go over ₦250k a day. I did it. Took 42 days. But I got my money back. Now I’m saving up again. This time, I’m smart. I’m patient. I don’t rush. And I never, ever touch an ATM with crypto money. You can do this too. Just don’t be like me. Learn from my dumbass move. 💯