- Home

- Cryptocurrency

- Iran's Crypto Strategy for International Trade: How Sanctions Evasion Works in 2025

Iran's Crypto Strategy for International Trade: How Sanctions Evasion Works in 2025

Iran Sanctions Evasion Calculator

Risk Assessment Summary

Enter values and click "Analyze Risk Impact" to see detailed risk analysis.

Key Insights

Based on 2025 data, Iran's crypto strategy involves:

- Over 10,000 licensed mining farms using natural gas

- 11+ million users on state-approved exchanges

- Shady banking networks involving OFAC-designated entities

- Recent hacks and regulatory crackdowns increasing risks

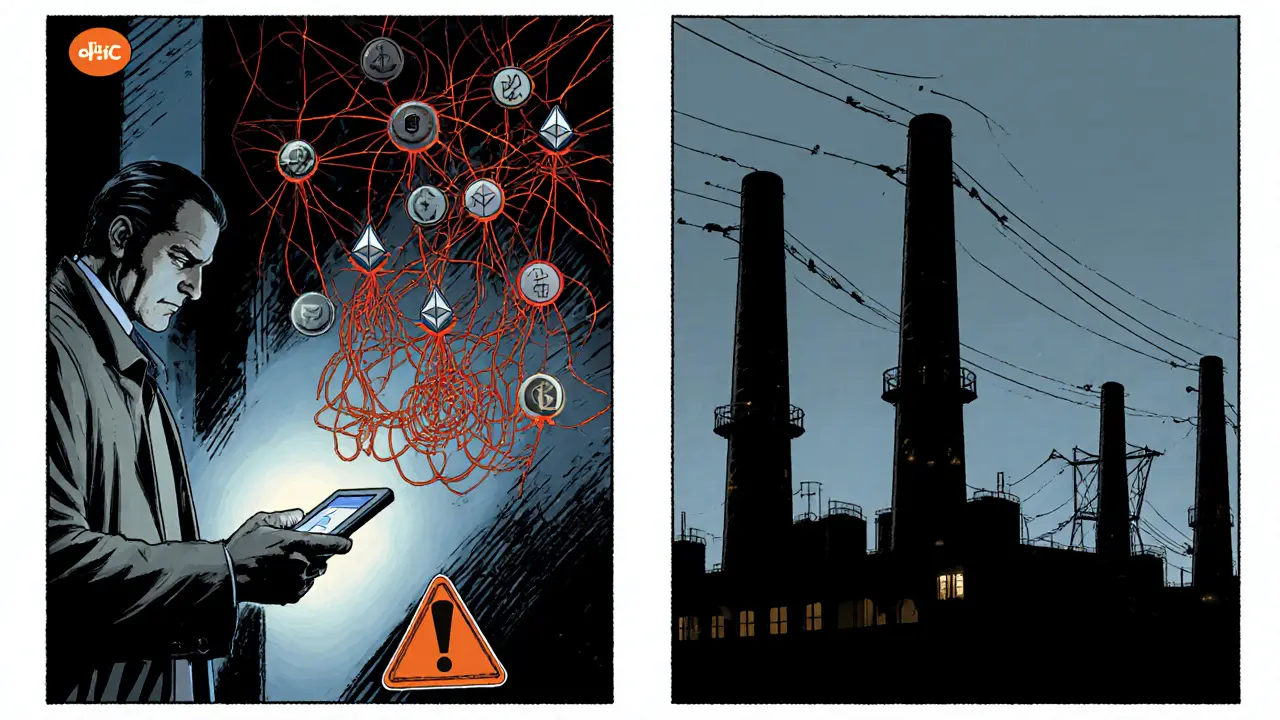

When the global financial system shuts a country out, the government looks for loopholes that let money still move. Iran's cryptocurrency strategy is the latest playbook, using digital coins to keep oil revenues, import payments and shadow banking channels alive despite relentless sanctions. In 2025 the plan had three moving parts - massive Bitcoin mining, a network of state‑approved exchanges, and a web of off‑chain front companies that turned crypto proceeds into hard cash. The result? A risky, energy‑hungry shortcut that kept the economy afloat for a while, but also exposed the regime to massive security breaches and heightened international pressure.

Why Iran Turned to Crypto in the First Place

International sanctions have choked Iran’s traditional banking routes for years. The Central Bank of Iran (CBI) can no longer rely on SWIFT, and the Rial’s value keeps sliding. By 2024, Iranians were moving roughly $4.18billion in crypto assets abroad - a 70% jump from the previous year. The government saw two immediate benefits:

- Crypto could be mined locally using cheap natural‑gas power, creating a home‑grown source of foreign‑exchange.

- Digital wallets bypass the need for sanctioned banks, letting firms pay for imported goods with Bitcoin or Ethereum.

That logic persuaded Tehran to legalise crypto mining (while still banning everyday crypto payments) and to grant licences to thousands of mining farms and dozens of exchanges.

Key Pieces of the Ecosystem

The strategy hinged on three pillars that fed each other like a closed loop.

| Component | Purpose | Primary Actors |

|---|---|---|

| Bitcoin Mining Farms | Generate new coins using domestic gas‑power | State‑run and privately licensed farms (≈10,000 licences) |

| State‑Sanctioned Exchanges | Convert mined crypto into fiat for imports | Nobitex (11million users), plus ~90 smaller platforms |

| Shadow Banking Network | Layer crypto proceeds through front companies to hide IRGC involvement | IRGC‑aligned firms, offshore shell corporations, OFAC‑designated wallets |

Each piece reinforced the others: mining fed the exchanges, the exchanges fed the shadow banks, and the banks helped finance oil sales and essential imports.

The Role of Nobitex - Iran’s Crypto Hub

Nobitex emerged as the nation’s digital exchange backbone. With over 11million registered users, it handled the bulk of Bitcoin, Ethereum and Tron trades. Blockchain‑intelligence firms like Elliptic linked Nobitex wallets to the Islamic Revolutionary Guard Corps (IRGC) through recurring transaction patterns and shared IP addresses. That made the platform a high‑value target for both hackers and sanction‑enforcement agencies.

On 18June2025, a sophisticated exploit drained more than $90million from Nobitex’s hot wallets. The breach didn’t just hurt the exchange’s balance sheet; it shattered the trust that the whole crypto‑evasion chain relied on. Traders scrambled to move funds to overseas mixers, while regulators scrambled to prevent a total collapse of the state‑controlled crypto flow.

OFAC’s Crackdown on the Shadow Banking Layer

The U.S. Office of Foreign Assets Control (OFAC) announced in September2025 a $600million sanction‑evasion network tied to Iranian oil sales. The network used a blend of traditional front companies and crypto wallets - notably Ethereum and Tron addresses owned by Arash Estaki Alivand - to funnel over $100million from oil revenues into the global financial system.

Key tactics included:

- Purchasing crypto on Nobitex with Rial‑linked accounts.

- Transferring the assets to offshore mixers that obscured the source.

- Converting the cleaned crypto into dollars via peer‑to‑peer platforms outside regulated jurisdictions.

OFAC’s designations forced several offshore banks to freeze accounts, nudging Tehran to reconsider the reliance on such opaque chains.

Energy Strain and Legal Tightening

Mining Bitcoin is power‑intensive - roughly 150kWh per BTC. Iran’s mining boom tapped cheap natural‑gas, but by early 2025 the grid faced chronic outages. The CBI responded by ordering the shut‑down of rial‑payment gateways for crypto exchanges, arguing that unchecked mining was draining the nation’s electricity budget.

At the same time, the government tightened licensing: every mining farm now needed a real‑time energy‑consumption report, and any exchange handling more than $10million in daily volume had to submit audit logs to the central bank. While these moves aimed to curb “illegal” mining, they also made it harder for the sanctioned regime to keep the crypto pipeline flowing.

What This Means for International Traders

If you’re a business considering trade with Iran, the crypto route adds a layer of complexity you can’t ignore:

- Compliance risk: Any transaction that touches a sanctioned wallet - even indirectly - can trigger secondary sanctions on your firm.

- Operational friction: You’ll need an on‑ramps/off‑ramps partner that complies with both U.S. OFAC rules and Iran’s volatile licensing regime.

- Security concerns: The June2025 Nobitex exploit showed that even state‑run platforms can be breached, risking loss of funds mid‑deal.

Most reputable banks now refuse to process crypto‑linked invoices for Iranian parties, pushing legitimate traders toward high‑risk P2P channels that lack legal protection.

Future Outlook - Will Crypto Keep Iran Afloat?

Two trends will decide the next chapter:

- International enforcement: As blockchain‑forensics improve, agencies can trace more of Iran’s crypto flow. Expect tighter designations and more asset freezes.

- Domestic sustainability: If power shortages force mining farms offline, the supply of newly minted Bitcoin will shrink, cutting off a cheap source of foreign exchange.

Until one of those forces overwhelms the other, Iran will likely keep tweaking its crypto playbook - adding new exchanges, diversifying into privacy‑focused coins, or even exploring sovereign digital currencies. For now, the strategy works as a stop‑gap, but the growing technical, regulatory, and security headwinds suggest it’s far from a long‑term solution.

Frequently Asked Questions

How does Iran use Bitcoin mining to bypass sanctions?

Iran mines Bitcoin with cheap natural‑gas power, creates new coins domestically, and then sells those coins on state‑approved exchanges. The proceeds are converted into foreign currency without needing a sanctioned banking channel.

What was the impact of the June 2025 Nobitex exploit?

The hack wiped out over $90million from Nobitex’s hot wallets, eroding confidence in Iran’s primary crypto exchange. Traders rushed to move funds to foreign mixers, and the incident gave regulators a concrete reason to tighten exchange licensing.

Can foreign companies legally trade with Iran using crypto?

Generally no. Most jurisdictions, including the U.S., consider any transaction that involves a sanctioned Iranian wallet as a violation. Companies risk secondary sanctions and asset freezes.

What role did OFAC play in 2025?

OFAC identified and sanctioned a $600million shadow‑banking network that moved crypto proceeds from Iranian oil sales. The designation targeted specific wallets, front companies, and individuals, freezing their assets and cutting off a major conduit for sanctions evasion.

Is Iran planning a sovereign digital currency?

There are rumors of a state‑backed digital rial, but as of late 2025 the focus remains on Bitcoin and major altcoins. A sovereign digital currency would require broader international acceptance, which sanctions already block.

Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

Popular Articles

21 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

Wow, Iran really thinks turning gas‑guzzling mining farms into a holy grail for sanctions evasion is a bright idea, huh? It's almost adorable how they repurpose cheap natural gas to mint Bitcoin while the rest of the world watches the power grid flicker. Sure, the extra crypto might keep a few import trucks rolling, but the risk of a hack or a sudden power cut is pretty much a built‑in timer. And let's not forget the offshore mixers – they're like the cheap knock‑off of a money‑laundering spa. All in all, a fascinating case study in how desperation breeds creativity, even if that creativity comes with a side of electric bill shock.

Looking at the bigger picture, Iran's pivot to crypto is more than just a financial hack; it's a philosophical response to isolation. When traditional channels are blocked, the state redefines value, turning computational power into a sovereign asset. This aligns with the ancient idea that scarcity drives ingenuity. Yet, the sustainability of such a model is questionable, especially when the mining rigs drain the very resources the country needs for its citizens. It's a delicate balance between short‑term relief and long‑term resilience, and the current trajectory feels like walking a tightrope without a safety net.

Hey folks, just wanted to throw some optimism into the mix – the sheer scale of those mining farms shows there’s massive technical talent in Iran. If they can channel that expertise into more sustainable energy projects, the crypto push could become a springboard for a greener tech sector. For now, though, the risk‑reward equation is shaky, and anyone dealing with these channels should keep a close eye on regulatory updates.

From an observer’s standpoint, the real story here is the feedback loop: mining fuels the exchanges, the exchanges fund the shadow banks, and the banks keep the mining rigs running. Break any link and the whole chain wobbles. That’s why the June 2025 Nobitex hack felt like an earthquake – it wasn’t just about lost dollars, it shook the entire evasion architecture.

It's kind of wild how the Iranian government can turn a power‑hungry crypto craze into a lifeline for oil revenue. The colorful dance between mining, exchanges, and offshore mixers feels like a high‑stakes circus act, and each performer is juggling flaming torches. If one torch drops, the whole show could go up in smoke – but until then, the audience keeps buying tickets.

Powerful but risky.

The technical underpinnings of Iran's crypto framework are surprisingly sophisticated. State‑approved exchanges like Nobitex have built API layers that interface directly with mining pool outputs, creating an almost seamless flow of newly minted coins into fiat conversion pipelines. Meanwhile, the shadow banking network employs layered entities across multiple jurisdictions, leveraging correspondent banking relationships that remain largely opaque to mainstream oversight. From a compliance perspective, the use of mixers adds another obfuscation tier, making transaction tracing a daunting task even for seasoned forensic analysts. However, the reliance on a single dominant exchange also introduces a single point of failure, as evidenced by the June 2025 breach that siphoned $90 million. Future resilience will likely depend on diversifying exchange infrastructure and tightening audit trails without compromising the speed that sanctions evaders crave.

Listen up, because the truth about Iran's crypto game is way messier than the official press releases let on. First off, the whole “natural‑gas‑powered mining farms” narrative is a smokescreen – many of those so‑called farms are actually retrofitted industrial plants that were built for oil processing, now just repurposed to churn out Bitcoin while the grid teeters on the brink of collapse. Second, the offshore mixers aren’t just random services; they’re tightly knit networks run by individuals with direct ties to the IRGC, meaning every coin that passes through them carries a hidden fingerprint of state sponsorship. Third, the alleged “state‑approved exchanges” like Nobitex are less regulated than a neighborhood barter club; they operate with minimal KYC, allowing anyone with a phone number to trade, which creates a fertile breeding ground for money‑laundering schemes that even the most sophisticated blockchain analysts struggle to untangle.

Now, let’s talk enforcement. OFAC’s recent crackdown wasn’t a surprise – they’ve been tracking transaction clusters for years, using AI‑driven heuristics to flag patterns that match known IRGC‑linked wallets. The $600 million shadow‑banking network they froze is just the tip of the iceberg; dozens of smaller “front” companies are still moving crypto under the radar, shielding themselves behind vague corporate structures in places like the Seychelles and Panama.

Energy consumption is another Achilles’ heel. The mining boom has pushed Iran’s electricity demand up by an estimated 20 %, prompting the government to impose rolling blackouts in several provinces. This not only harms civilian life but also threatens the stability of the mining operation itself – a single grid failure can wipe out weeks of mining output, sending shockwaves through the entire sanctions‑evasion chain.

Finally, the human element: the people running these operations are increasingly aware of the legal and cyber‑security risks. After the June 2025 Nobitex exploit, we saw a wave of internal dissent, with several senior engineers quitting and warning about the “fragility” of the system. Their concerns are valid – a single vulnerability can be weaponized by hostile actors, potentially turning Iran’s own crypto infrastructure into a backdoor for foreign interference.

Bottom line: Iran’s crypto strategy is a high‑risk, high‑reward gamble that buys temporary liquidity at the cost of massive exposure to cyber‑attacks, energy scarcity, and international legal pressure. It’s not a sustainable long‑term solution, and the more you pull at the threads, the more likely the whole tapestry will unravel.

Whoa, that was a marathon of intel! It’s crazy how every layer you peel back reveals even more chaos. I mean, the whole thing sounds like a dystopian thriller where the villains are also the heroes. Props for breaking it down so thoroughly.

In my humble opinion, the entire enterprise is a textbook example of moral bankruptcy. The sheer audacity of exploiting a nation's desperate need for hard currency, while simultaneously endangering the global financial system, is beyond reprehensible. Moreover, the lack of accountability on the part of the regime demonstrates a flagrant disregard for international law.

yeah, but you cant deny the data tells a story of unchecked greed.

Totally feel the intensity! 😱 The hack on Nobitex showed just how brittle this crypto lifeline is. If they lose another $100 million, it could shatter trust completely. Traders need to keep their eyes peeled and maybe diversify away from those shady mixers. 😓

One must contemplate the existential implications of state‑driven cryptoeconomics. When a sovereign power co‑opts decentralized technology, it paradoxically undermines the very premise of decentralization, creating a hybrid that is neither fully free nor wholly regulated. This dialectic raises profound questions about the nature of sovereignty in the digital age. Is the state merely a new custodian of the blockchain, or does it become an adversarial force that weaponizes the technology against its own populace? The answer may lie in the evolving legal frameworks that strive to reconcile traditional jurisdictional authority with borderless digital assets. In any case, the Iranian model serves as a cautionary tale of how power can be both amplified and constrained by the tools it adopts.

Enough philosophy – the reality is that these so‑called experts are just lining their pockets. The aggressive push for privacy coins is a blatant attempt to mask illicit profit, and anyone who supports it is complicit. Stop romanticizing the tech and call out the corruption.

From a practical standpoint, anyone looking to do business in that environment should first check the latest OFAC lists. The risk of secondary sanctions isn’t a vague threat; it’s an immediate legal liability that can cripple a company overnight.

While I appreciate the caution, it would be remiss not to acknowledge that the regulatory landscape is in flux. Companies must therefore adopt a dynamic compliance strategy, regularly updating internal policies to reflect new designations and emerging enforcement trends.

Honestly, the whole crypto workaround feels like a high‑stakes gamble. The energy costs, the hack risks, the legal gray zones – it’s a perfect storm that could collapse any minute.

What you call a "high‑stakes gamble" is nothing compared to the systemic damage these illicit networks inflict on global finance. The ripple effects are felt far beyond Iran's borders, destabilizing markets and eroding trust.

In formal terms, the intersection of sanctions law and blockchain technology presents a novel compliance challenge. Firms must integrate sophisticated blockchain analytics into their anti‑money‑laundering (AML) frameworks to detect illicit flows before they trigger regulatory penalties.

And let’s not forget the human cost – every kilowatt‑hour diverted to mining is a kilowatt‑hour denied to hospitals and schools. The socioeconomic impact is profound and deserves more attention.

Interesting points all around – I’m particularly curious about how emerging AI tools might improve transaction tracing in such opaque networks.