- Home

- Cryptocurrency

- Rfinex Crypto Exchange Review 2025: Fees, Liquidity & Security

Rfinex Crypto Exchange Review 2025: Fees, Liquidity & Security

Rfinex Trading Fee Calculator

Fee Analysis Overview

Rfinex offers a flat 0.10% trading fee for both makers and takers, which is significantly below the industry average of 0.25%. However, withdrawal fees are higher than typical exchanges.

Trading Fee: 0.10% per trade (flat rate)

Bitcoin Withdrawal Fee: 0.002 BTC (higher than industry average of ~0.0005 BTC)

Current BTC Value: $60,000 (based on $60,000/BTC)

Trade Cost Calculator

Total Trading Fee:

Equivalent USD:

Withdrawal Cost Calculator

Withdrawal Fee:

Equivalent USD:

Fee Percentage:

Comparison Summary

How Rfinex Compares to Other Exchanges

- Rfinex: 0.10% flat fee, 0.002 BTC withdrawal

- Binance: 0.10% maker / 0.10% taker, 0.0005 BTC withdrawal

- Coinbase: 0.50% flat fee, 0.0004 BTC withdrawal

- Kraken: 0.16% maker / 0.26% taker, 0.0005 BTC withdrawal

Quick Take

- 0.10% flat trading fee - well below the industry average.

- Only 6‑9 ETH‑paired altcoins; no fiat on‑ramps.

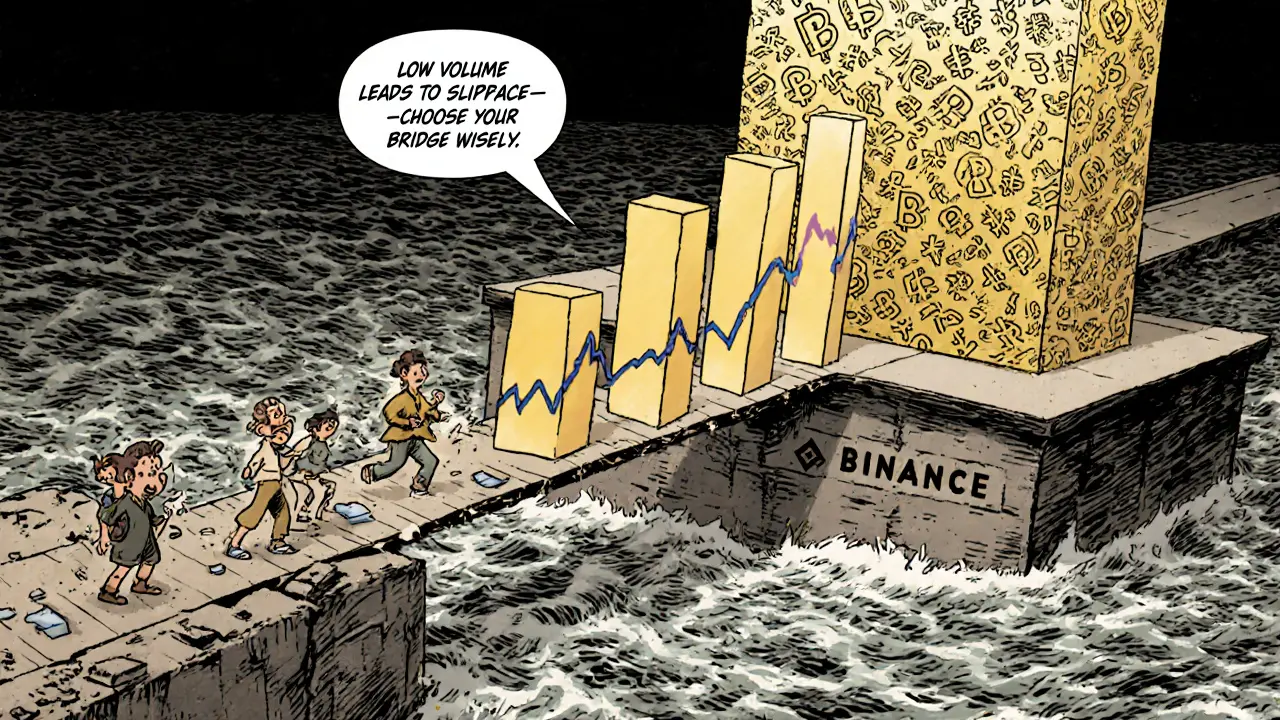

- Liquidity is low (≈197ETH daily volume), so large orders can slip.

- Mandatory 2FA and Let\'s Encrypt SSL keep the platform secure.

- Withdrawal fee for Bitcoin is high (0.002BTC) compared to peers.

Rfinex is a cryptocurrency exchange launched in 2017 that concentrates on exotic altcoins traded against Ethereum (ETH). It positions itself as a niche player rather than a mainstream hub like Binance or Coinbase.

What Rfinex Actually Offers

Rfinex limits every market to an ETH base pair. The current roster includes EOS, MHT, ATM, CXTC, EGT, FUT, TRX, ICX and BPT - nine tokens at most, depending on the snapshot you look at. Because there is no fiat gateway, you must already own crypto to deposit, typically sending ETH from another wallet.

The exchange’s UI resembles a stripped‑down trading console. Charts are powered by a professional library, and order types are limited to market and limit. There is no margin, futures, or staking section. In short, if you want a simple ETH‑centric market for obscure coins, Rfinex delivers - otherwise you’ll feel the lack of depth fast.

Fee Structure - Where Rfinex Shines

Most exchanges charge a tiered maker‑taker model ranging from 0.10% to 0.25% for high‑volume traders. Rfinex flattens the curve: both makers and takers pay a flat 0.10% per trade. That rate is roughly 60% cheaper than the global average of 0.25%.

Withdrawal fees tell a different story. For Bitcoin, Rfinex levies 0.002BTC per withdrawal - about 150% higher than the industry norm of 0.0008BTC. As of early 2025, 0.002BTC translates to roughly $30USD, which can erode profits for frequent traders.

Liquidity and Trading Volume

The platform reports a daily trading volume of about 197ETH. Compare that with Binance’s multi‑billion‑ETH daily flow, and Rfinex’s market feels thin. Low liquidity means slippage can spike, especially on larger orders or during volatile periods. Traders who need swift, large executions should consider more liquid venues.

Security Measures

Security basics are covered:

- Mandatory two‑factor authentication (2FA) for every login.

- HTTPS secured by Let\'s Encrypt certificates.

- Cold‑storage handling of user funds (details not publicly disclosed).

User Experience & Support

Rfinex’s onboarding process includes phone verification and a forced 2FA setup. The KYC workflow is lightweight - just a name, address, and ID picture. Once approved, you can start trading instantly.

Support is advertised as "responsive" and reachable via email and live chat. Since public reviews are virtually non‑existent, it’s hard to verify the claim. The help center hosts standard articles about deposits, withdrawals, and API usage, but the depth is shallow.

How Rfinex Stacks Up Against the Big Guys

| Exchange | Trading Pairs (ETH‑base) | Flat Fee | BTC Withdrawal Fee | Fiat Support | Daily Volume (ETH) | Security |

|---|---|---|---|---|---|---|

| Rfinex | 6‑9 | 0.10% (both sides) | 0.002BTC | No | ≈197ETH | 2FA, SSL (Let\'s Encrypt) |

| Binance | Thousands (incl. fiat) | 0.10% maker / 0.10% taker (discounts for BNB) | 0.0005BTC | Yes | >5METH | 2FA, DDoS protection, hardware‑wallet whitelist |

| Coinbase | Hundreds (incl. fiat) | 0.50% (no maker‑taker split) | 0.0004BTC | Yes | ≈1METH | 2FA, insurance fund, cold storage |

| Kraken | ~200 (incl. fiat) | 0.16% maker / 0.26% taker | 0.0005BTC | Yes | ≈300kETH | 2FA, GlobalSign SSL, cold storage |

Pros & Cons - The Bottom Line

Pros

- Ultra‑low flat trading fee (0.10%).

- Focus on exotic ETH‑paired altcoins not found on bigger exchanges.

- Mandatory 2FA and SSL encryption keep basics secure.

- Simple UI - easy for users who only need spot trading.

Cons

- No fiat on‑ramps - you must own crypto beforehand.

- Thin liquidity leads to slippage on larger trades.

- High Bitcoin withdrawal fee discourages frequent BTC moves.

- Lack of advanced features (margin, futures, staking).

- Sparse community feedback makes risk assessment harder.

Is Rfinex Worth Your Time?

If you are a hobbyist looking to dabble in low‑volume, ETH‑based exotic tokens and you value a cheap flat fee, Rfinex can fit the niche. For anyone seeking deep liquidity, fiat gateways, or advanced trading tools, the platform falls short. Its modest security setup is fine for modest balances, but the high BTC withdrawal cost can eat into profits.

Given the limited public roadmap and the platform’s "under development" vibe, keep an eye on announcements. A future upgrade could broaden pair listings or lower withdrawal fees, which would tilt the balance.

Frequently Asked Questions

Can I deposit fiat currency on Rfinex?

No. Rfinex only accepts cryptocurrency deposits, primarily Ethereum (ETH). You need to buy crypto on another exchange first.

What security measures does Rfinex provide?

The platform enforces mandatory two‑factor authentication (2FA) for every login, uses HTTPS secured by Let\'s Encrypt certificates, and stores the majority of funds in cold storage.

How many trading pairs are available?

Rfinex lists between six and nine ETH‑based pairs, including EOS, MHT, ATM, CXTC, EGT, FUT, TRX, ICX and BPT.

Is the 0.10% trading fee applied to both makers and takers?

Yes. Rfinex uses a flat 0.10% fee for every trade, regardless of whether you add liquidity (maker) or take liquidity (taker).

Why is the Bitcoin withdrawal fee so high?

Rfinex charges a fixed 0.002BTC per withdrawal, which is above the market average. The fee likely covers higher network costs for smaller exchanges and contributes to operating expenses.

Overall, the Rfinex review points to a specialized, low‑cost platform that serves a narrow audience. It isn’t a replacement for the big exchanges, but it can be a useful side‑door for traders hunting specific ETH‑paired altcoins.

Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

Popular Articles

13 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

Rfinex’s flat 0.10% fee is a real breath of fresh air for anyone who’s tired of the usual 0.25% drag on every trade. If you’re a small‑time trader, that difference adds up fast, and you’ll actually see more of your profits staying in your pocket.

The fee structure looks good on paper, but Nigerian traders need to watch the BTC withdrawal charge. At 0.002 BTC you’re paying a premium that can erode margins, especially when the market swings heavily.

Low fees are nice but that withdrawal cost is a bit steep compared to Binance or Kraken. If you move a lot of BTC it might bite you.

While the trading fee is commendably low, the withdrawal penalty is unacceptably high; discerning investors will undoubtedly reconsider their platform allegiance.

Indeed, the trading fee is attractive, yet the withdrawal surcharge cannot be ignored. For frequent BTC movers, the net cost may rival that of higher‑fee exchanges.

Rfinex promises low fees but hides it behind an absurd withdrawal charge that feels like a cash‑grab. It’s a classic bait‑and‑switch.

Every exchange balances convenience against cost; Rfinex leans heavily on cheap trades but demands a premium when you actually try to pull your funds out. It forces users to think twice about liquidity.

Rfinex’s fee model really shines for newcomers and hobbyist traders who are just getting their feet wet in the crypto waters. A flat 0.10% means there’s no surprise tiered structure that can suddenly sap your earnings as you scale up. The predictability is a huge psychological comfort, especially when you’re juggling multiple assets and trying to keep your budget in check. On the flip side, the withdrawal fee of 0.002 BTC can feel like a hidden tax for those who trade aggressively or need to move large sums quickly. If you’re moving only a few satoshis, that fee seems reasonable, but for high‑volume players it becomes a serious cost factor. In practice, many traders might find themselves weighing the low‑fee advantage against the potential exit penalty, perhaps even keeping the bulk of their holdings on the exchange to avoid the fee. That’s a risky strategy, as keeping large balances on any platform heightens exposure to security vulnerabilities. Speaking of security, the review didn’t touch on Rfinex’s custody solutions, so prospective users should do a deep dive into their insurance policies and audit history. Liquidity appears decent compared to the big names, but you’ll want to check order‑book depth during volatile periods. Overall, the platform’s pricing is competitive for spot trades, but the withdrawal structure demands careful planning. In short, if you’re a small trader looking for cheap execution and can tolerate occasional withdrawal costs, Rfinex could fit the bill. However, if you plan to move sizeable BTC amounts frequently, you might want to keep an eye on other exchanges with lower exit fees. The decision ultimately hinges on your trading style, risk tolerance, and how you prioritize fee transparency versus withdrawal flexibility.

Great rundown! If you’re okay with a higher withdrawal cost, the cheap trading fee can really boost your bottom line. Keep an eye on your withdrawal strategy.

The withdrawal fee scares me.

Balancing low trading fees with higher withdrawal costs is a trade‑off many platforms make. Users should align the exchange’s fee profile with their own trading frequency and cash‑out habits.

Absolutely, the key is matching the fee model to your activity. If you trade often but cash out rarely, Rfinex’s 0.10% can be a win. 🙂 Just watch the BTC withdrawal when you finally need it.

From a liquidity engineering perspective, Rfinex offers a respectable order‑book depth, yet the withdrawal surcharge introduces a friction layer that can suppress market‑making incentives, especially for bots that rely on rapid fund turnover.