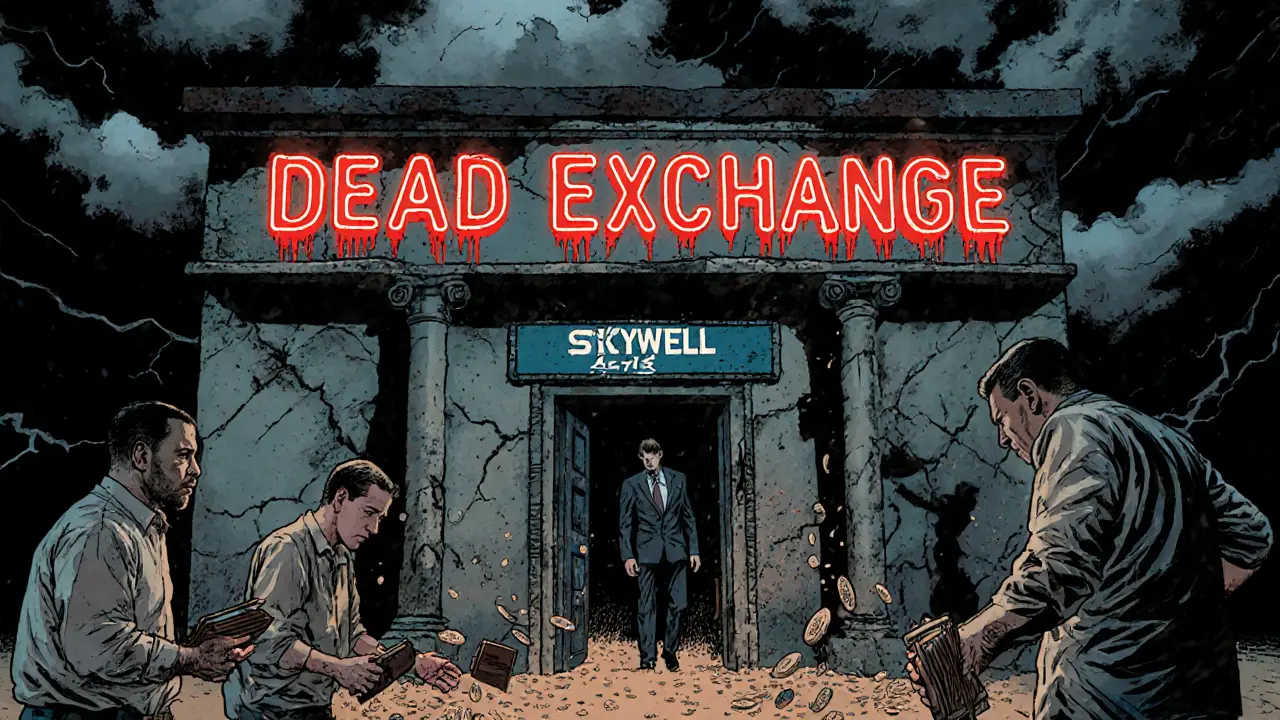

BitWell Review: What You Need to Know Before Trading

When you hear BitWell, a crypto exchange that blends centralized and decentralized trading features. Also known as BitWell Exchange, it positions itself as a hybrid platform for users who want both simple buying and advanced derivatives trading. But is it just another flashy name, or does it actually deliver on its promises? Many traders are asking this question after seeing ads promising high yields, low fees, and easy access to DeFi tools—all in one place.

BitWell isn’t just another exchange. It’s part of a growing group of platforms trying to blur the line between centralized exchanges, traditional crypto trading platforms where you hand over control of your funds and decentralized exchanges, platforms where you keep control of your wallet and trades happen on-chain. That sounds great in theory—until you dig into user reports. Some traders say withdrawals take days. Others report confusing fee structures or sudden changes in interest rates on their staking rewards. And while BitWell offers futures trading, options, and even crypto-backed loans, none of that matters if you can’t get your money out when you need it.

What makes BitWell different from platforms like Binance or KuCoin? For one, it leans hard into yield farming and staking, pushing users to lock up their tokens for high APYs. But high returns often come with high risk—especially when the underlying protocols aren’t audited or transparent. The platform also supports a wide range of coins, including obscure tokens you won’t find on major exchanges. That might sound exciting, but as seen in our coverage of Mistery On Cro, Project 32, and BOHR, more tokens don’t mean more safety. In fact, the opposite is often true.

And then there’s the regulatory gray zone. BitWell isn’t registered with major financial authorities like the SEC or FCA. That means if something goes wrong, you have no legal recourse. Compare that to Cryptomate, a UK-based exchange with clear compliance steps and limited features, which may be boring but at least gives you a paper trail. BitWell doesn’t offer that. It’s built for users who want maximum flexibility—and are willing to accept maximum risk.

So what’s the real story? BitWell works for experienced traders who understand the risks of leveraged trading and are comfortable with self-custody. But for beginners, or anyone who values security over hype, it’s a dangerous bet. Below, you’ll find real user experiences, hidden fees, withdrawal delays, and comparisons to other platforms—all pulled from actual reports and verified incidents. No fluff. No marketing spin. Just what you need to decide if BitWell is worth your crypto.