Capital Controls: How Governments Shape Crypto and Global Money Flows

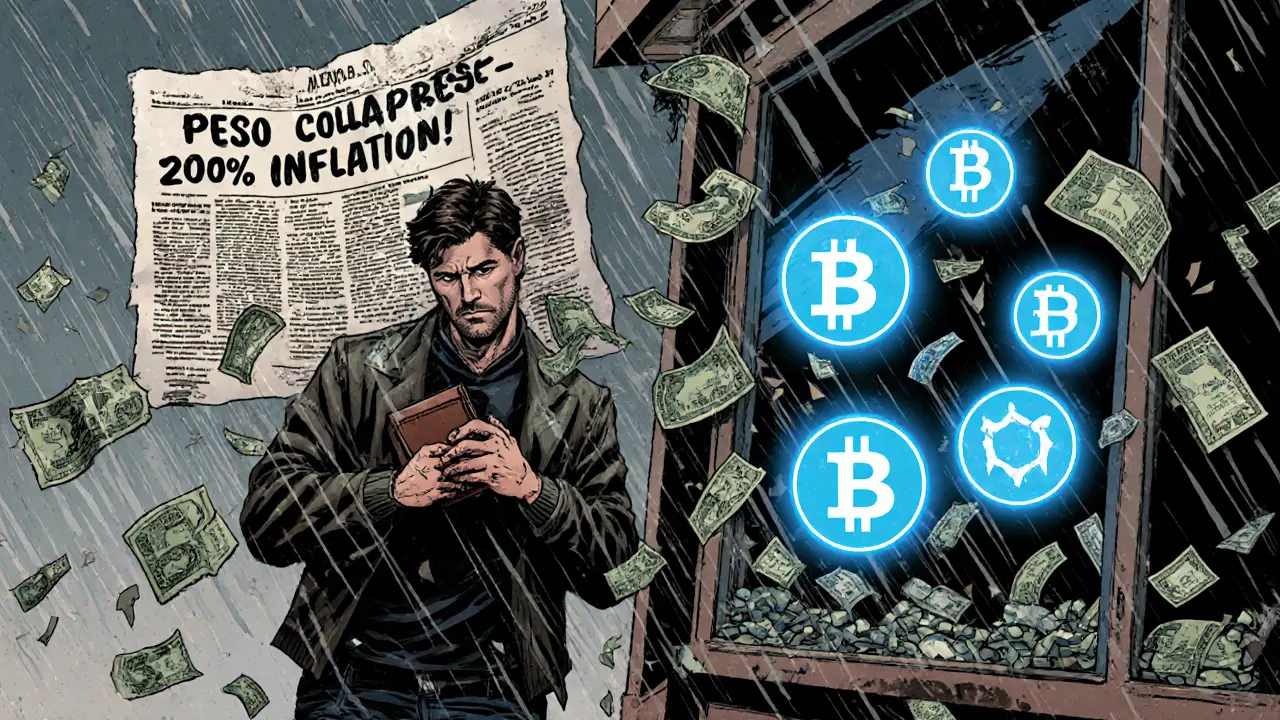

When dealing with capital controls, government measures that limit the movement of money across borders, restrict foreign exchange, or cap investment flows. Also known as foreign exchange controls, they influence everything from everyday remittances to large‑scale crypto transactions. Capital controls encompass limits on currency conversion, taxation on outbound transfers, and licensing requirements for crypto exchanges. They require compliance tools like blockchain AML solutions and affect how firms design cross‑border payment pipelines.

One major offshoot is crypto regulation, the set of rules that governments apply to digital assets, exchanges, and token issuers. Crypto regulation often mirrors capital controls by demanding licensing, reporting, and anti‑money‑laundering (AML) checks. For example, the UK’s FCA framework ties crypto licensing to capital control objectives, ensuring that firms can’t bypass currency restrictions through decentralized platforms. This relationship means that any change in capital control policy instantly reshapes the compliance landscape for crypto businesses.

Another linked concept is sanctions evasion, the practice of using alternative financial routes to avoid international trade or financial restrictions. When capital controls tighten, nations like Russia and Iran turn to crypto as a loophole, creating stablecoin corridors or mining operations that sidestep traditional banking sanctions. Sanctions evasion strategies therefore depend on the rigidity of capital controls and the openness of crypto markets, creating a cat‑and‑mouse game between regulators and innovators.

Stablecoins enter the picture as a practical response to both capital controls and sanctions evasion. These digital tokens, often pegged to a fiat currency, let users move value quickly without converting through the traditional banking system. In countries with strict foreign‑exchange limits, stablecoins become a de‑facto bridge, allowing citizens to preserve purchasing power and conduct cross‑border trade. Yet, stablecoins also attract regulator attention because they can undermine the effectiveness of capital controls if not properly supervised.

The UK’s push to become a crypto hub illustrates how policy can blend capital controls with proactive regulation. The FCA’s two‑phase approach requires crypto firms to obtain a license, implement robust AML checks, and adhere to advertising standards that prevent unchecked capital outflows. By aligning crypto regulation with capital control goals, the UK hopes to attract innovation while keeping a firm grip on money‑movement risks.

Meanwhile, Russia’s decision to legalize crypto mining was a direct attempt to skirt Western sanctions. By turning mining into a state‑supported activity, Moscow creates a domestic source of crypto that can be exported without triggering traditional capital controls. Iran follows a similar playbook, using platforms like Nobitex to funnel crypto trade around international restrictions. Both cases show how capital controls can spark creative, sometimes risky, crypto strategies.

From a compliance perspective, blockchain AML technology has become essential. Tools that analyze transaction graphs, flag suspicious patterns, and enforce know‑your‑customer (KYC) rules help firms stay within capital control limits while still offering crypto services. AI‑driven analytics and decentralized identity solutions are now standard components of a compliant crypto operation, especially in jurisdictions where capital controls are aggressively enforced.

What You’ll Find Below

Below this overview you’ll discover a curated set of articles that dive deeper into each of these themes. We cover the UK crypto hub ambitions, FCA advertising rules, Russia’s mining legalization, Iran’s sanctions‑evasion tactics, stablecoin regulation, and practical guides on exchange security and AML compliance. Whether you’re a trader worrying about capital controls, a startup navigating crypto regulation, or an investor curious about how stablecoins can bypass traditional limits, the posts ahead give you clear, actionable insights.

Start scrolling to see how each piece unpacks the impact of capital controls on the crypto world, and pick up the tools and strategies you need to stay ahead of policy shifts.