Cross-Chain Trading: How to Move Crypto Between Blockchains Safely

When you want to use cross-chain trading, the process of moving cryptocurrency from one blockchain to another without relying on a centralized exchange. Also known as interoperability, it lets you take your Ethereum-based tokens and use them on Solana, Polygon, or Avalanche—without selling and rebuying. This isn’t just convenience. It’s about access. If you hold $ETH but want to trade on a DEX that only supports $SOL, cross-chain tools let you bridge over instead of paying high gas fees or losing time.

Behind this are bridge protocols, specialized smart contracts that lock tokens on one chain and mint equivalent tokens on another. Think of them like secure tunnels between islands. Popular ones include Polygon’s PoS Bridge, Wormhole, and LayerZero. But not all bridges are equal. Some have been hacked—like the $600M Ronin Bridge breach in 2022—because they rely on centralized validators. That’s why many users prefer atomic swaps, peer-to-peer trades that swap tokens directly between chains without intermediaries. They’re slower and trickier to set up, but they remove trust entirely. No middleman. No custodian. Just code.

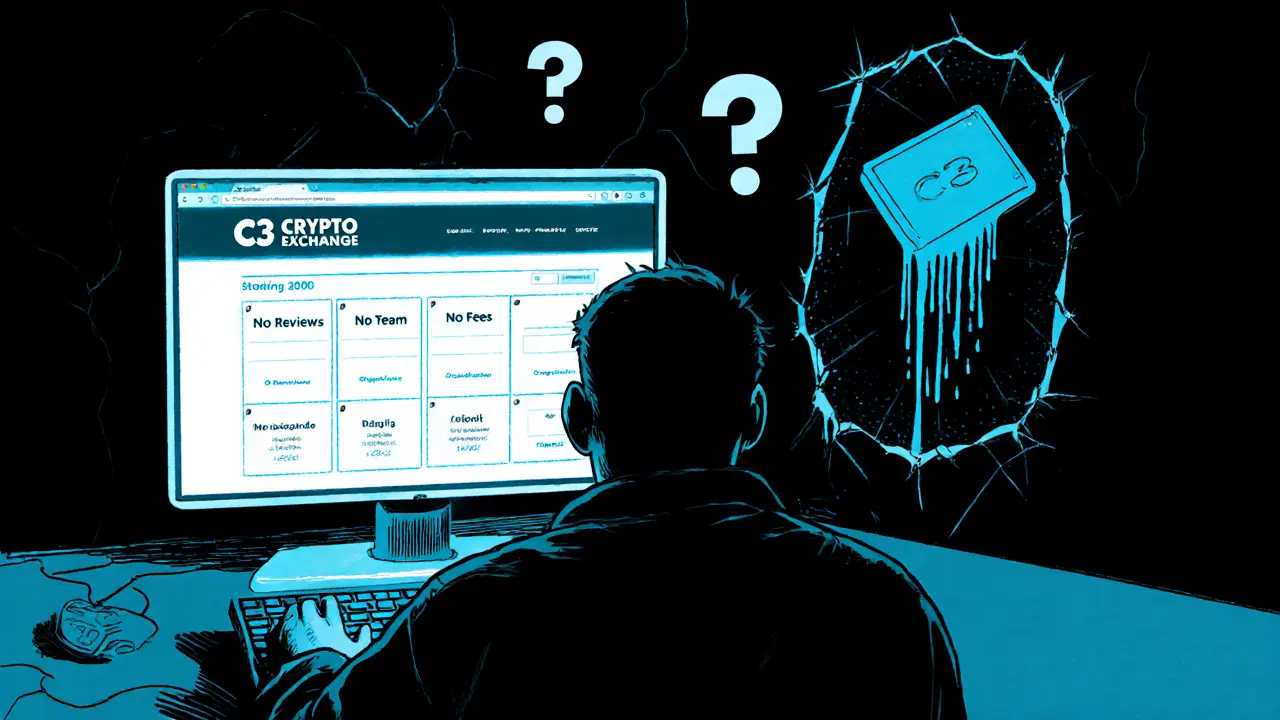

Cross-chain trading is the backbone of modern DeFi, a financial system built on open blockchain networks that doesn’t rely on banks or brokers. It lets you earn yield on one chain, borrow on another, and trade on a third—all in one workflow. But it’s not risk-free. Token prices can shift during the bridge delay. You might send funds to the wrong chain address. Or accidentally use a bridge that’s been flagged as unsafe. That’s why knowing which tools are reliable matters more than ever.

Below, you’ll find real guides and reviews that break down how these systems actually work. From step-by-step bridge tutorials to warnings about sketchy cross-chain projects, everything here is pulled from real user experiences and technical deep dives. No fluff. Just what you need to move your crypto safely between chains.