Inflation – What It Means for Crypto, Stablecoins and Your Wallet

When talking about Inflation, the steady increase in overall price levels that reduces the buying power of money over time. Also known as price inflation, it shows up in everything from grocery bills to mortgage rates. Understanding inflation is the first step before looking at how it nudges people toward digital assets.

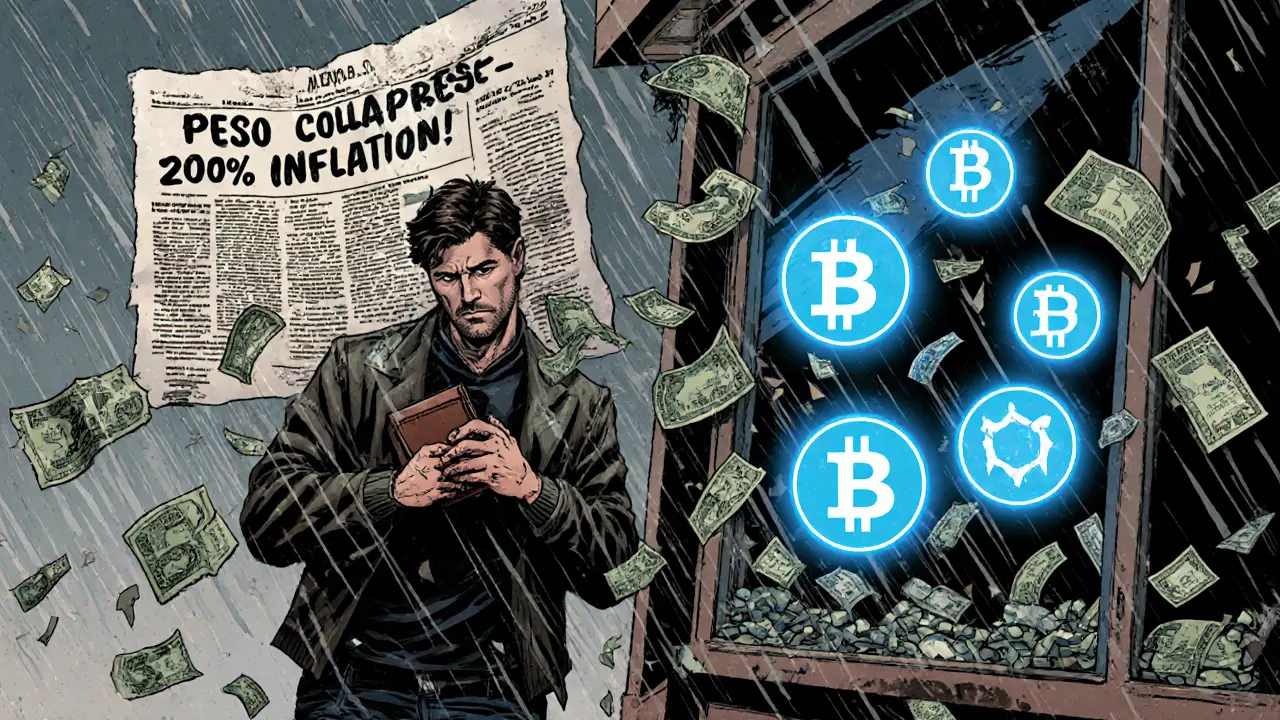

Why Inflation Drives Interest in Cryptocurrency, a decentralized form of digital money that operates on blockchain networks

When prices keep climbing, many investors start asking: "Where can I store value without losing it to rising costs?" That question fuels demand for cryptocurrency because it’s seen as an alternative store of wealth. inflation pushes people toward assets that are not directly tied to any single government, so crypto often gets a boost after major price‑rise reports. At the same time, crypto markets react quickly to inflation data, creating price swings that savvy traders try to capture.

One way the market tries to tame inflation risk is through Stablecoin, a digital token designed to maintain a stable value by pegging to a fiat currency or a basket of assets. Stablecoins aim to combine the speed of crypto transactions with the price stability of traditional money. Because they’re engineered to counteract inflation, they become popular for everyday payments, remittances, and as a safe haven during volatile market phases. Projects that succeed at keeping their peg often see higher usage when inflation spikes, illustrating the direct link between inflation pressure and stablecoin adoption.

Behind the scenes, Fiat Money, government‑issued currency like the US dollar or Euro that isn’t backed by a physical commodity is the most exposed to inflation. Central banks control the supply of fiat money, and their policies determine how quickly prices rise. When a central bank raises interest rates to slow inflation, borrowing costs go up, and consumers may shift some of their cash into crypto or stablecoins for better returns. This dynamic creates a feedback loop: inflation influences central‑bank decisions, which in turn affect fiat money supply, and that shifts user behavior toward digital alternatives.

Speaking of Central Bank, the national authority that manages monetary policy, currency issuance, and financial stability, its role is crucial. By adjusting policy rates, printing money, or implementing quantitative easing, a central bank directly battles inflation. Those policy moves ripple through the entire financial system, shaping the attractiveness of both traditional assets and crypto‑based solutions. For instance, when a central bank signals aggressive easing, crypto prices often climb as investors search for non‑inflation‑linked stores of value.

All these pieces—inflation, cryptocurrency, stablecoins, fiat money, and central‑bank actions—interact in a constantly shifting landscape. The articles below unpack each angle, from how a sudden price rise can trigger a Bitcoin rally to why stablecoin regulations matter for everyday users. Whether you’re looking to hedge against rising costs, understand market swings, or explore new investment ideas, this collection gives you the context you need to make informed decisions.