Iran Cryptocurrency: Regulations, Exchanges, and Market Opportunities

When working with Iran cryptocurrency, digital assets that are bought, sold, or used by people and businesses inside Iran. Also known as Iranian crypto, it operates under a unique mix of local laws, sanctions, and market conditions.

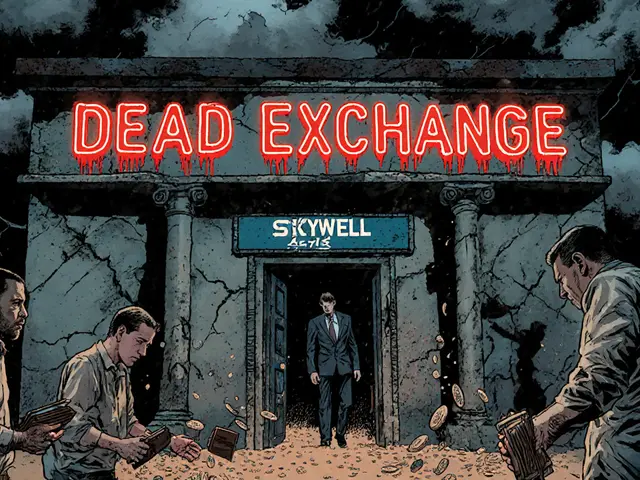

One of the biggest forces shaping this space is crypto regulation, the set of rules issued by Iranian authorities and international bodies that dictate what investors can do with crypto. The regulation influences how Iranian crypto exchanges, platforms that let users trade Bitcoin, Ether, and local tokens within Iran design their onboarding, KYC, and withdrawal processes. At the same time, DeFi platforms, decentralized finance services that run on smart contracts and don’t rely on traditional banks give users a way to earn yield or swap tokens without going through regulated exchanges. In short, Iran cryptocurrency encompasses local market demand, regulatory pressure, and the workarounds that DeFi offers, creating a constantly shifting landscape.

What You’ll Find Below

Below the intro you’ll discover a curated list of articles that break down the most pressing topics: step‑by‑step guides to claim airdrops that are popular among Iranian users, deep dives into meme coins that have gained traction in Tehran, reviews of exchanges that still accept Iranian traders, and analysis of how global sanctions affect daily crypto operations. Each post is aimed at giving you practical tips, risk warnings, and a clear picture of where the market is heading. Whether you’re a newcomer trying to understand the basics or a seasoned trader looking for the latest regulatory update, the collection below should answer the questions you didn’t even know you had.