ORARE token: What it is, why it matters, and what the data says

When you hear ORARE token, a low-profile cryptocurrency with minimal trading activity and no clear use case. Also known as ORARE, it’s one of hundreds of tokens that pop up on decentralized exchanges but rarely make it to mainstream lists. Unlike Bitcoin or even smaller DeFi coins with active communities, ORARE doesn’t have a whitepaper, a known team, or any real-world application. It’s not listed on major exchanges. It doesn’t power a dApp. And from what the data shows, almost no one is holding it long-term.

What you do see in the posts below are similar tokens—RUGAME (RUG), a token with zero trading volume and no development, BOHR (BR), a zombie token with inconsistent data and no exchange support, and Project 32 (32), a coin with no team, no whitepaper, and conflicting price feeds. These aren’t outliers. They’re the norm for tokens like ORARE. Most of them launch with hype, vanish from charts within months, and leave behind nothing but abandoned wallets and scam alerts.

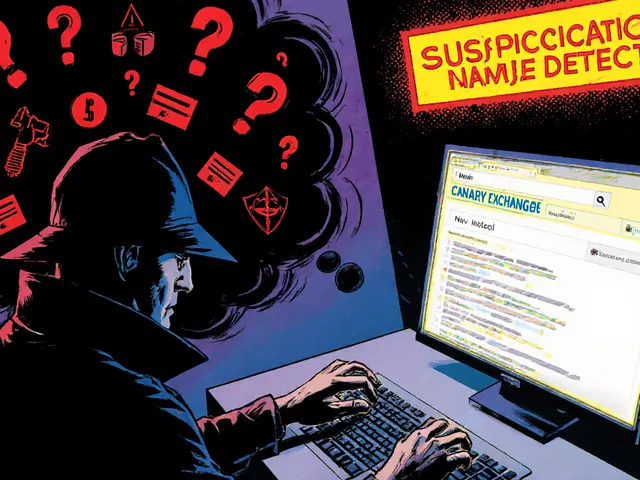

The real question isn’t whether ORARE will go up. It’s whether anyone ever cared enough to make it matter. The posts here don’t just list ORARE—they show you the pattern. You’ll find stories about tokens that promised everything but delivered nothing. You’ll see how airdrops, fake volume, and misleading social media posts trick people into buying coins with no future. You’ll learn how to spot the difference between a real project and a ghost token before you send a single dollar.

If you’re looking for the next big thing, ORARE isn’t it. But if you want to understand why so many crypto tokens fail—before you lose money on the next one—you’ll find what you need below. These aren’t success stories. They’re warning labels.