Self-Custodial Exchange: What It Is and Why It Matters for Your Crypto

When you trade crypto on a self-custodial exchange, a platform where you hold and manage your own private keys without relying on a third party to secure your funds. Also known as non-custodial exchange, it puts you in full control—no one else can freeze, seize, or lose your assets. This isn’t just a technical detail. It’s the difference between renting a safe deposit box and owning the vault itself.

Most popular exchanges like Binance or Coinbase are custodial. That means they hold your keys for you. Convenient? Sure. But if the exchange gets hacked, goes bankrupt, or decides to freeze your account, your crypto is gone—or locked up. With a self-custodial exchange, a platform where you manage your own keys and interact directly with blockchain protocols, your funds live in your wallet, and you sign every transaction yourself. That’s why tools like Uniswap, SushiSwap, or dYdX are called DeFi, decentralized finance applications that run on public blockchains without intermediaries. They don’t touch your money. They just help you trade it.

Think of it like this: a custodial exchange is like handing your car keys to a valet. A self-custodial exchange is like parking it yourself in your garage. You might need to do a little more work—learning how to manage seed phrases, checking gas fees, or avoiding phishing scams—but you never have to wonder if someone else might drive off with your ride. That’s why users in places like Nigeria, Argentina, and Iran, where banks are unreliable or governments restrict access, are shifting fast to self-custodial tools. They’re not just trading crypto. They’re reclaiming financial autonomy.

And it’s not just about security. Self-custodial exchanges often give you access to tokens and features that centralized platforms won’t list—new DeFi protocols, experimental tokens, or niche yield strategies. But with that freedom comes responsibility. If you lose your private key, there’s no customer support to recover it. If you send funds to the wrong address, there’s no undo button. That’s why guides on crypto custody, the practice of securely storing and managing digital assets under your own control are so critical. You need to know how to use hardware wallets, enable multi-signature setups, and verify contract addresses before clicking confirm.

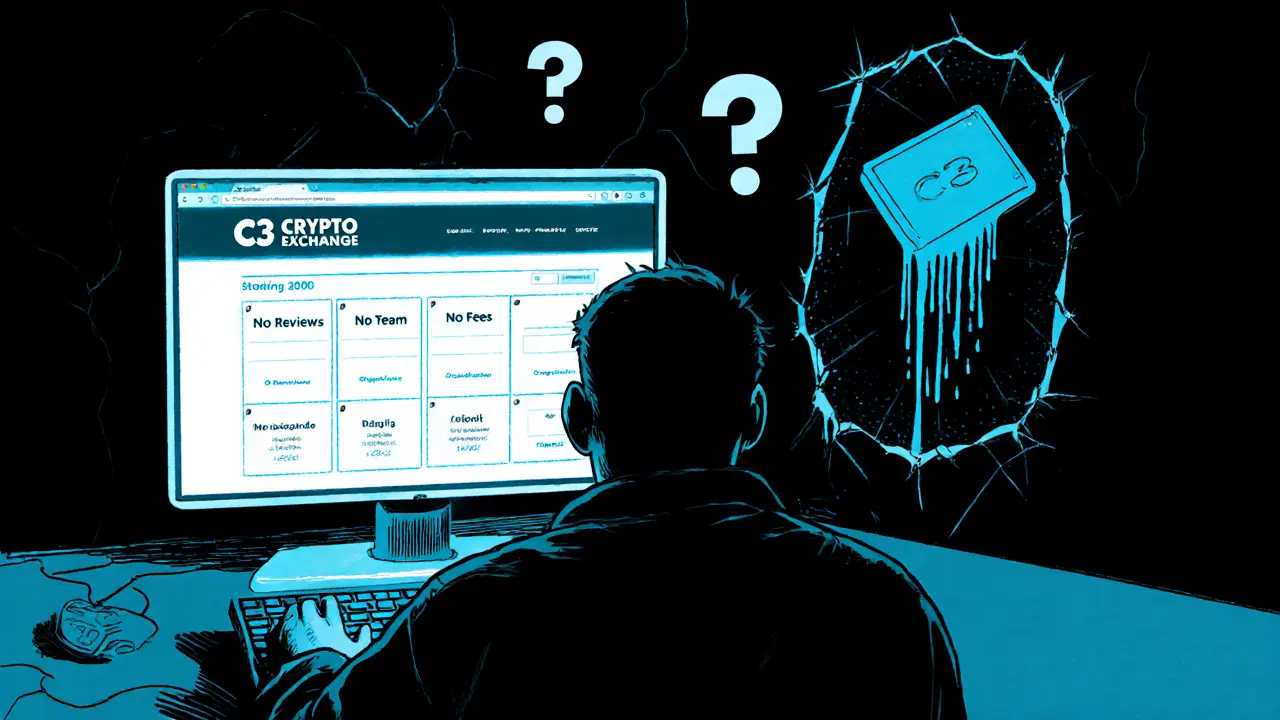

What you’ll find in the posts below isn’t just theory. It’s real-world advice on how to use self-custodial exchanges safely, how to spot fake platforms pretending to be non-custodial, and how to avoid the most common mistakes that cost people their crypto. Whether you’re new to DeFi or you’ve been trading for years, this collection gives you the practical tools to take real control—without falling for scams or making avoidable errors.