Synthetic Assets: What They Are and Why They Matter in Crypto

When you trade a synthetic asset, a digital token that mirrors the value of something else, like a stock, commodity, or currency, without owning the real thing. Also known as synthetic tokens, they let you bet on Apple’s stock price without buying Apple shares, or track gold’s value without storing physical bars. This isn’t magic—it’s DeFi. Platforms like Synthetix and Mirror Protocol build these on blockchains so you can trade anything, anywhere, without banks or brokers.

Synthetic assets rely on tokenized stocks, digital versions of real company shares, pegged to their actual price, like PEPX tied to PepsiCo. They’re not shares themselves—they’re smart contract promises. That’s why you see tokens like PEPX with only eight holders and no exchange support: they’re fragile, illiquid, and often unregulated. But they’re also powerful. If you live in a country where buying U.S. stocks is hard, synthetic assets give you access. They’re also used to simulate crypto prices, oil, or even stock indices—all in one wallet.

Behind every synthetic asset is a system of collateral, oracles, and smart contracts. Someone has to lock up crypto (like ETH or SNX) to back the value of the synthetic token. Oracles feed real-world prices into the blockchain. If the oracle lies, or the collateral crashes, the whole thing can unravel. That’s why most synthetic assets are risky. They’re not for passive investors. They’re for people who understand leverage, volatility, and the gap between digital representation and real-world value.

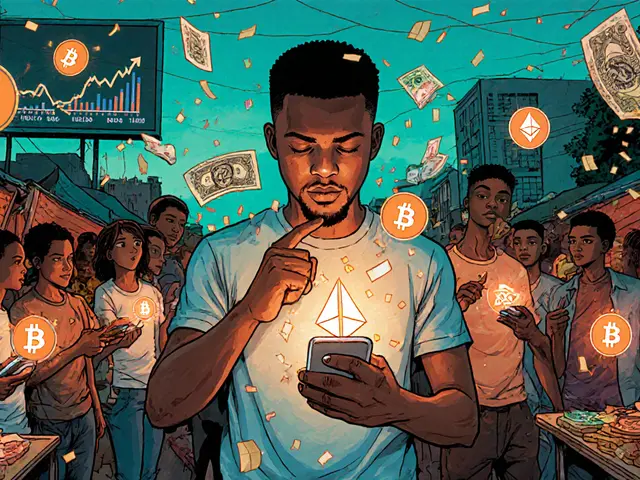

You’ll find synthetic assets popping up in places you wouldn’t expect. In crypto airdrops, fake tokens like 1DOGE or SSF pretend to be tied to real brands. In DeFi, platforms offer synthetic versions of assets that don’t even exist yet. And in markets like Brazil or Nigeria, where traditional finance is restricted, synthetic tokens become the only way to access global assets. But most of the time, these are scams. Real synthetic assets are built on transparent protocols with audited code—not anonymous teams promising 1000% returns.

What makes synthetic assets interesting isn’t just the tech. It’s the idea that anything with a price can become a tradable token. That’s why you’ll see posts here about tokenized PepsiCo stock, dead tokens like BIB, and risky meme coins like WOLF—all trying to mimic real value. Some are legitimate experiments. Most are just noise. The difference? One has real backing, real oracles, and real users. The rest? They’re digital ghosts.