- Home

- Cryptocurrency

- How CBDCs Benefit Governments: Security, Efficiency & Policy Power

How CBDCs Benefit Governments: Security, Efficiency & Policy Power

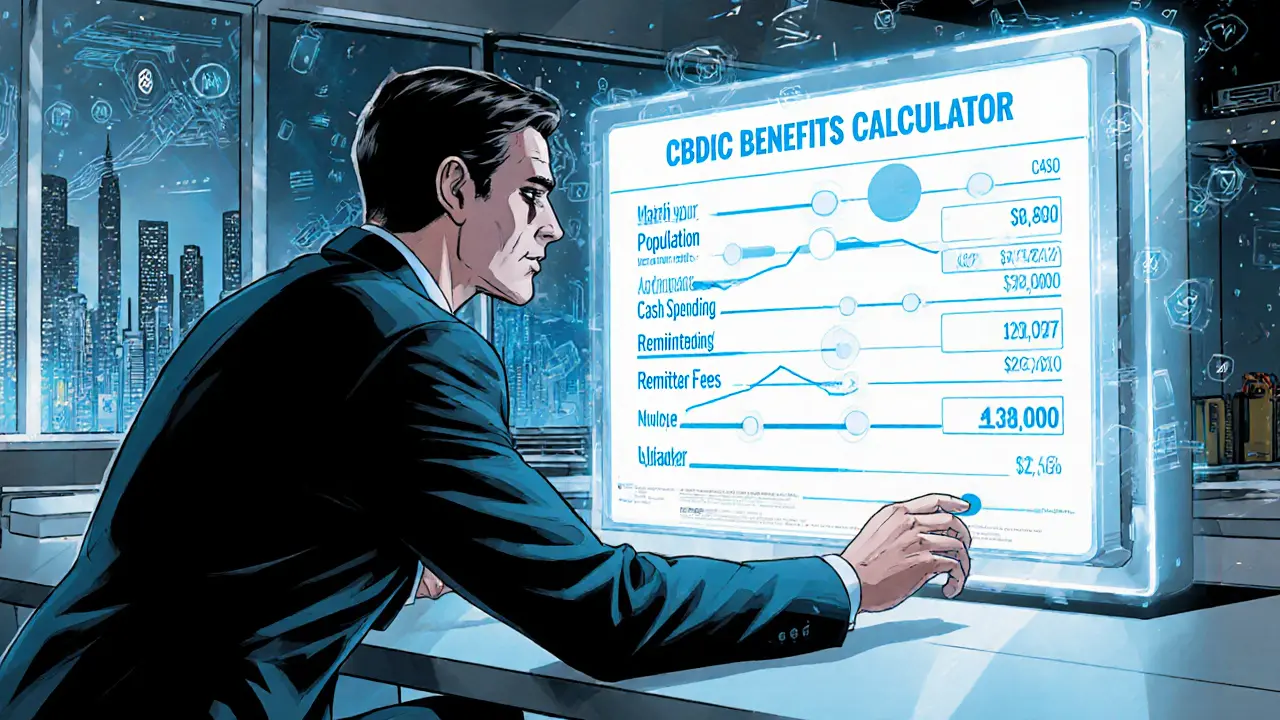

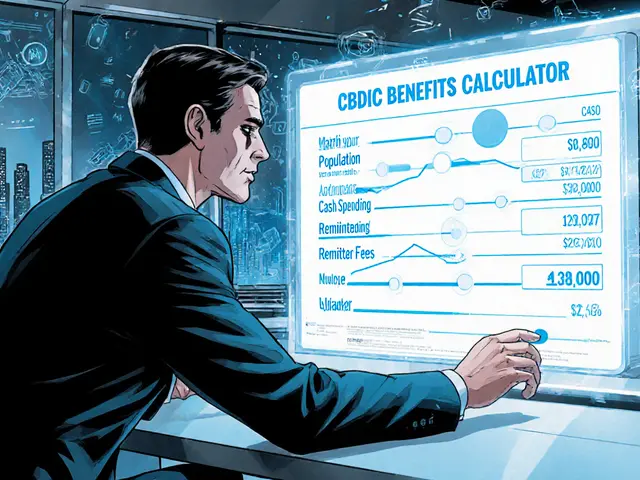

CBDC Benefits Calculator

Estimated CBDC Benefits

Security Savings

Reduced counterfeit risk and elimination of cash-related security costs.

Potential Annual Savings: $0 million

Transaction Efficiency

Instant settlement and reduced cross-border fees.

Potential Annual Fee Reduction: $0 million

Financial Inclusion

Direct government payments to unbanked populations.

Unbanked Population Reached: 0 million

Quick Takeaways

- CBDCs cut fraud and counter‑feiting with advanced encryption.

- Payments settle in seconds, slashing costs for cross‑border transfers.

- Central banks gain real‑time tools for negative rates, stimulus targeting and tax collection.

- Unbanked citizens can receive government aid directly through digital wallets.

- Programmable money lets states enforce spending rules or geographic limits.

When the Central Bank Digital Currency is a digital version of a nation’s fiat money issued straight from the central bank, governments unlock a toolkit that goes far beyond what paper cash can do. Unlike private cryptocurrencies, a CBDC lives under the sovereign’s vault, meaning its value stays stable while every transaction leaves a trace that the state can read in real time. That traceability is the engine behind most of the benefits outlined below.

Security and Counterfeit Protection

Digital currencies inherit the cryptographic strength of modern blockchain‑inspired ledgers. Each unit is signed with public‑key encryption, so forging a CBDC token is virtually impossible. For governments, that means the billions spent each year on printing, storing and policing physical cash evaporate. A digital wallet software that holds a citizen’s CBDC balance and signs transactions can verify authenticity instantly, eliminating the need for separate anti‑counterfeit measures.

Instant, Low‑Cost Transactions

Traditional banking routes a payment through multiple intermediaries-correspondent banks, clearing houses, sometimes even legacy legacy systems. Each handoff adds minutes, if not days, and a fee stack that can reach 6% for international remittances. A CBDC runs on a single, government‑controlled ledger, so a transfer from a consumer in Nairobi to a vendor in SãoPaulo can settle in under a second with near‑zero fees. The cost savings ripple through every budget line: less money spent on settlement infrastructure, lower operational overhead for tax agencies, and cheaper cross‑border aid distribution.

Sharper Monetary‑Policy Tools

Because the central bank holds the master ledger, it can apply interest rates directly to every account. Negative rates, once a theoretical footnote, become a practical lever: the bank can debit a fraction of a cent from dormant balances, encouraging spending during a downturn. Monetary policy the set of actions a central bank takes to influence money supply and interest rates thus gains a speed and granularity no longer possible with open‑market operations that rely on commercial‑bank intermediaries.

Financial Inclusion and Direct Government Payments

More than half of the world’s adult population lacks a bank account. A CBDC bypasses that barrier: anyone with a mobile phone can download a government‑approved digital wallet a secure app that stores CBDC and authenticates users via digital ID and start receiving payments. During the 2024 energy‑price shock, several European pilots used CBDCs to push energy‑subsidy checks straight into citizen wallets, cutting processing time from weeks to minutes and eliminating a $200million overhead tied to paper checks and bank transfers.

Real‑Time Financial Surveillance and Policy Enforcement

Every transaction is recorded on a government‑owned ledger, giving regulators an unprecedented view of spending patterns. That visibility helps combat money laundering, tax evasion and illicit financing. It also enables “programmable money”: authorities can set a deadline for stimulus funds to be spent, or tag a payment so it can only be used at certified local vendors, nudging economic activity where it’s needed most. Critics warn about privacy erosion, but from a policy perspective the ability to enforce capital controls or direct aid with surgical precision is a major upside.

Case Studies: Digital Yuan and eNaira

China’s digital yuan the People’s Bank of China’s CBDC, linked to citizens’ social‑credit scores illustrates how a sovereign can merge monetary data with broader governance tools. The system can flag purchases deemed “unhealthy” and restrict spending in real time. Nigeria’s eNaira Nigeria’s CBDC, aimed at boosting financial inclusion shows the other side: rapid rollout of direct cash transfers to unbanked populations during a pandemic, despite early trust hurdles.

Checklist: Why Governments Should Consider a CBDC

| Benefit Area | Key Advantage | Typical Impact |

|---|---|---|

| Security | Cryptographic protection eliminates counterfeiting | Savings of $3‑5bn annually on cash‑related security |

| Transaction Speed | Instant settlement, 24/7 | Cross‑border fees cut from 6% to <1% |

| Policy Flexibility | Direct rate adjustments, programmable spending | More effective stimulus, quicker negative‑rate deployment |

| Financial Inclusion | Digital wallets for the unbanked | Access to government aid for up to 40% of previously excluded citizens |

| Compliance & Transparency | Real‑time transaction monitoring | Reduction in money‑laundering cases by 30% in pilot jurisdictions |

Future Outlook

Beyond the immediate efficiencies, CBDCs promise richer economic data sets. With every purchase logged, central banks can fine‑tune inflation forecasts, tax collections can be automated, and sanctions can be enforced instantly. The combination of digital identity a government‑verified electronic ID linked to a CBDC wallet and programmable money may even enable new social‑credit style programs that tie financial behavior to public‑service eligibility.

Frequently Asked Questions

What makes a CBDC different from Bitcoin?

A CBDC is issued and backed by a nation’s central bank, keeping its value stable, whereas Bitcoin is a decentralized crypto‑asset with volatile market prices.

Can a CBDC reduce the cost of remittances?

Yes. By removing intermediary banks and money‑transfer operators, a CBDC can shave fees from the typical 6% down to under 1% and settle the transfer in seconds.

How does a CBDC help governments fight fraud?

Every transaction is recorded on a tamper‑proof ledger, giving law‑enforcement agencies a complete audit trail that can flag suspicious patterns instantly.

Will a CBDC replace cash?

Most central banks design CBDCs to coexist with cash, offering a digital alternative for those who prefer electronic payments while keeping physical notes for legacy users.

What privacy risks do CBDCs pose?

Because the state can see every transaction, there is a risk of surveillance over personal spending habits. Some designs propose layered anonymity features, but full privacy comparable to cash is unlikely.

Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

Popular Articles

19 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

Ever wonder why every government suddenly jumps on the digital cash bandwagon? It feels like a coordinated effort to insert an invisible fingerprint into every transaction you make, turning your wallet into a surveillance drone.

It is a moral outrage that states would trade our financial privacy for the illusion of efficiency; citizens deserve transparency, not an all‑seeing ledger that could be weaponized against dissent.

Nice, another tech fad that promises to save us billions while handing the Fed a backdoor.

What you’re missing is that the whole premise assumes people will trust a system designed by the very institutions that have historically mismanaged billions; you can’t just hand over sovereignty without demanding airtight oversight.

While the concerns are valid, it is also worth acknowledging that, if implemented with robust safeguards, digital currencies could streamline aid distribution and reduce corruption in regions that struggle with cash logistics.

Imagine a world where every cent is tracked-oh, the horror!-yet also imagine the bureaucracy disappearing, taxes being collected with the swipe of a finger, and governments finally being able to fund public services without endless paperwork!!!

The concept of a state‑issued digital token is, at first glance, a brilliantly efficient solution to the age‑old problem of cash handling, yet beneath that gleaming veneer lies a thicket of ethical quandaries that demand relentless scrutiny. When a central bank can peer into each transaction, it effectively erodes the veil of anonymity that has long been a cornerstone of personal liberty, turning every purchase into a data point for the ever‑watchful eye of the apparatus. Proponents argue that this transparency will slash money‑laundering and tax evasion, but the same tools could be repurposed to silence dissent, target political opponents, or even dictate how citizens allocate their own earnings. Moreover, the technological infrastructure required to support a nationwide digital ledger is riddled with vulnerabilities; a single breach could expose the financial lifeblood of an entire nation to malicious actors. The promise of instantaneous, low‑cost cross‑border remittances is intoxicating, especially for diaspora communities sending money home, yet the centralization of that capability raises the specter of geopolitical coercion-imagine a scenario where a rival state forces a country to freeze digital assets as leverage. On the inclusion front, while a CBDC could indeed bring banking services to the unbanked via a simple smartphone app, the prerequisite of digital identity verification may paradoxically exclude those whose very lack of documentation keeps them on the margins. As governments draft programmable money scripts to enforce spending restrictions, we must ask who writes these scripts and whose interests they serve; the line between beneficial policy tools and paternalistic control becomes dangerously blurred. Historical precedents, such as the introduction of the Social Credit system, remind us that good intentions can easily morph into mechanisms of control. In practice, the rollout of a digital currency requires massive public education campaigns, and any misstep could sow distrust that lingers for years. Critics also point out that central banks could wield negative interest rates in real time, sapping savings and forcing consumption in ways that feel manipulative. The environmental impact of maintaining a robust, secure ledger is another often‑overlooked concern, especially if the system relies on energy‑intensive consensus mechanisms. Additionally, the legal framework governing data ownership and cross‑border flows remains murky, leaving citizens vulnerable to exploiting loopholes. If a government decides to token‑gate public services, access could become contingent on compliance with political criteria, effectively weaponizing welfare. The potential for financial innovation is undeniable, but it coexists with a risk of creating a digital panopticon that reshapes the social contract. Ultimately, policymakers must balance the seductive promise of efficiency against the profound implications for privacy, autonomy, and societal power structures that could redefine the very nature of money.

From a philosophical standpoint, the emergence of a centrally‑issued token challenges our conception of value as a socially constructed narrative, prompting us to ask whether money is a tool of liberation or a modern chain; the answer, of course, hinges on the governance framework we choose to embed within it. 😊

The trade‑off between speed and privacy is not binary; nuanced policy can craft a middle path that preserves essential civil liberties while harnessing technological gains.

Sounds like a win‑win if we get the safeguards right.

Wow, another utopian pipe dream dressed up as fiscal reform; the reality will be a bureaucratic nightmare where every cent is tagged, tracked, and possibly confiscated without due process.

Let’s keep the conversation constructive-if we demand clear limits, transparent audits, and strict oversight, the technology could serve the public good rather than become a surveillance tool. 👍

In practice, many countries are piloting limited‑scope CBDC projects; studying those trials can provide valuable data on adoption rates, technical resilience, and the actual cost‑benefit balance.

Empirical evidence from existing pilots suggests that projected savings are often overstated; a rigorous cost‑effectiveness analysis must account for implementation overhead, cybersecurity expenditures, and the potential for systemic risk amplification.

Sure, let’s hand over the keys to our wallets while promising we’ll get free pizza; only time will tell if the promised efficiencies outweigh the erosion of personal agency.

Even with the challenges, collaborative international standards could pave the way for secure, inclusive digital currencies that respect user rights.

From a technocratic perspective, the integration of distributed ledger tech into sovereign monetary policy introduces layers of middleware complexity that could bottleneck transaction throughput and inflate latency metrics.

Interesting take.

Thanks everyone for sharing such diverse viewpoints; it’s clear that careful design and public dialogue will be essential as we explore this frontier.