- Home

- Cryptocurrency

- How Fiat Money and Digital Currencies Can Coexist: Models, Benefits, and Risks

How Fiat Money and Digital Currencies Can Coexist: Models, Benefits, and Risks

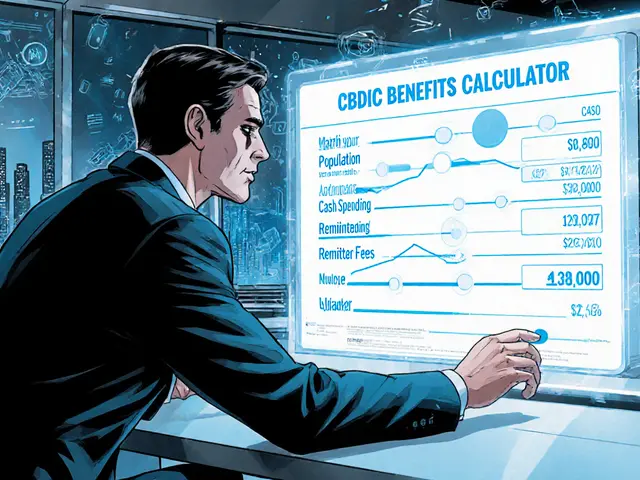

CBDC vs Stablecoin Comparison Tool

Transaction Comparison

Comparison Results

Cost Comparison

Settlement Speed

CBDC is recommended for domestic transactions due to lower costs and near-instant settlement.

Governments, banks, and fintech firms keep asking the same question: can traditional money live side‑by‑side with the new wave of digital currency without breaking the system? The answer is yes, but only if we understand the technical, economic, and regulatory bridges that connect them. This guide walks through the key patterns, real‑world pilots, and the road ahead so you can see how the two worlds are starting to work together.

Key Takeaways

- CBDCs and stablecoins already operate in dozens of countries, handling billions of transactions.

- Domestic payments favor CBDCs for reliability; cross‑border flows lean on stablecoins for speed and cost.

- Regulation, interoperability, and user experience are the biggest hurdles to full coexistence.

- Projects like mBridge and the BIS "unified ledger" prototype show a path toward a three‑layer system by 2030.

- Stakeholders can prepare by investing in hybrid DLT architectures and clear reserve‑backing rules.

What’s the Difference? Fiat, CBDC, and Stablecoin Defined

Fiat currency is a government‑issued legal tender that has value because a central authority says so, not because of a physical commodity. It lives in bank accounts, cash, and legacy payment rails like SWIFT.

Central Bank Digital Currency (CBDC) is a government‑issued digital version of a fiat currency that runs on a permissioned distributed ledger. By design, a CBDC mirrors the sovereign’s monetary policy while adding programmable features and near‑instant settlement.

Stablecoin is a cryptocurrency pegged 1:1 to a fiat reserve, usually held in segregated accounts. Stablecoins live on public blockchains (Ethereum, Solana) and rely on private custodians to keep the reserve fully funded.

Integration Patterns: How the Two Worlds Talk to Each Other

CBDCs typically use permissioned DLT with a two‑tier model: the central bank runs the core ledger, while commercial banks or fintechs provide user‑facing wallets. The Bahamas’ Sand Dollar uses exactly this design, letting merchants accept offline NFC payments even when the internet is down.

Stablecoins, by contrast, sit on open blockchains. USDC, for example, settles a transaction in under 30 seconds at about $0.05, far cheaper than a SWIFT transfer that can cost 3‑5% and take days. This speed makes stablecoins the go‑to tool for cross‑border remittances and corporate treasury operations.

Bridging the gap requires interoperable gateways. The mBridge project links China’s digital yuan, the UAE’s digital dirham, Thailand’s digital baht, and Hong Kong’s e‑Hong Kong dollars. Since its 2023 launch, it has moved $22 billion in cross‑border payments, showing that a hybrid of permissioned and public ledgers can work.

Economic Implications: Gains and Growing Pains

From an efficiency standpoint, CBDCs boost domestic retail payment success rates-Jamaica’s JAM‑DEX hit 98.7% versus 89.2% for mobile money. Stablecoins shine internationally: McKinsey’s 2025 analysis notes they process transactions 100‑1,000 times faster than traditional cross‑border methods at roughly 90 % lower cost.

Financial inclusion also improves. The IMF estimates that CBDCs could lift inclusion rates by 15‑20 percentage points in emerging markets. Nigeria’s e‑Naira, for instance, reached 11.3 million active users (17 % of adults) by early 2025.

However, risks loom. Unregulated stablecoins could dilute central banks’ ability to steer monetary policy, warned BIS chief Agustín Carstens. Conversely, programmable CBDCs could enable negative rates that squeeze savers, a concern voiced by Nobel laureate Joseph Stiglitz.

Liquidity shocks are another worry. The Bank of England’s 2025 Financial Stability Report models a rapid shift to stablecoins and predicts deposit outflows of 15‑25 % in a severe crisis.

Real‑World Pilots: What We’re Seeing Today

Four countries have fully launched retail CBDCs: Jamaica’s JAM‑DEX (2022), the Bahamas’ Sand Dollar (2020), Zimbabwe’s ZiG (2024), and Nigeria’s e‑Naira (2021). China’s digital yuan is in an advanced pilot across 26 regions, serving 261 million users and processing $26.4 billion in Q2 2025.

On the private side, stablecoins dominate the crypto market. As of June 2025, $250 billion in stablecoins circulate, with USDC (45 %) and USDT (42 %) leading. MoneyGram began using USDC for remittances in 2022, cutting transfer times from three days to under ten minutes and dropping fees from 6.3 % to 1.8 %.

Enterprise demand is rising fast. OpenPayd added stablecoin support in Q1 2025 after 78 % of its cross‑border clients asked for it. Meanwhile, the European Central Bank has earmarked €1.2 billion for its digital euro project through 2027, whereas the U.S. Federal Reserve has allocated $47 million for Project Hamilton.

Implementation Hurdles: From Tech to Policy

Technical hurdles include interoperability-only 37 % of CBDC pilots incorporate cross‑border features. Documentation quality varies; the Eurosystem scores 4.2/5 for its digital euro docs, while Nigeria’s e‑Naira sits at 2.8/5 according to GitHub developer surveys.

Regulatory fragmentation is equally stark. The EU’s MiCA framework demands daily attestations of 1:1 reserves for stablecoins, yet the U.S. still lacks a unified federal rule. Meanwhile, 64 countries have introduced stablecoin‑specific regulations, but only 28 have comprehensive CBDC legislation.

Adoption costs matter too. Jamaican merchants face an average $280 per POS terminal to accept JAM‑DEX, which explains why only 42 % of merchants have onboarded despite 63 % of consumers registering.

Human factors are often overlooked. Central bank staff need about 172 hours of specialized training to manage CBDC infrastructure, compared with 89 hours for traditional systems. That learning curve can delay rollouts.

Future Trajectory: Toward a Three‑Layer Monetary System

The BIS Innovation Hub’s 2025 "unified ledger" concept envisions three layers by 2027:

- CBDCs for sovereign policy and domestic payments.

- Regulated stablecoins for cross‑border commerce and corporate treasury.

- Legacy fiat for legacy contracts and cash‑based transactions.

Project Agorá, a prototype testing environment with 12 major central banks, is already experimenting with tokenized reserves that can flow between layers. Nigeria’s e‑Naira 3.2 upgrade added offline functionality and loyalty rewards, boosting active users by 37 % in Q2 2025.

By 2030, the IMF predicts the coexistence model will be the norm, with most economies running hybrid payment ecosystems that let users pick the most suitable instrument for each use case.

Getting Ready: Practical Steps for Stakeholders

- Governments: Draft clear reserve‑backing rules for stablecoins and set interoperability standards for CBDC gateways.

- Financial Institutions: Invest in hybrid DLT platforms that can talk to both permissioned and public ledgers.

- Enterprises: Pilot stablecoin settlements for cross‑border invoices to test cost savings.

- Developers: Contribute to open‑source CBDC tooling and improve documentation quality.

What is the main advantage of CBDCs over traditional fiat?

CBDCs keep the same legal status as cash but add instant settlement, programmable features, and reduced transaction costs, especially for low‑value retail payments.

Why are stablecoins faster for cross‑border payments?

They run on public blockchains that settle in seconds, bypassing legacy correspondent banking networks that can take days and charge high fees.

Can a CBDC replace cash completely?

Most central banks see CBDCs as a complement to cash, not a full replacement, because cash still serves populations without digital access and provides anonymity.

What regulatory steps are needed for stablecoins?

Regulators require full reserve backing, regular audits, and high‑quality liquid assets to ensure stability and protect consumers.

How can businesses start using stablecoins?

Partner with a payment provider that offers stablecoin integration, set up a custodial wallet, and begin piloting invoices in USDC or USDT to compare fees and speed.

Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

Popular Articles

20 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

Ever notice how every new "innovation" is framed as a solution, yet the same old powers stay in control? The narrative around digital currencies feels like a carefully scripted play, designed to distract us from the real shift in monetary sovereignty. By pulling the strings behind CBDCs and stablecoins, central authorities can monitor every transaction while promising speed and cheapness. It's as if the future is being sold to us in a glossy brochure while the underlying mechanisms tighten the leash.

When you peel back the glossy veneer, you see the same old institutions repackaging old problems as new technology. The promise of instant settlement often masks a deeper agenda of data collection and policy control. It's a subtle coercion, wrapped in the language of progress, that many accept without question.

It is incumbent upon scholars and policymakers to delineate the operational boundaries between sovereign digital tokens and privately issued stablecoins. A rigorous assessment must encompass not only transactional efficiency but also the attendant macro‑economic externalities, such as liquidity risk and regulatory arbitrage. Moreover, the interoperability frameworks proposed by initiatives like mBridge warrant thorough scrutiny to ensure they do not become avenues for systemic contagion.

CBDCs give governments a digital ledger. Stablecoins offer speed across borders. Both need clear rules. Users deserve transparency.

Sounds like a pipe dream.

Ah, the perennial optimism that a novel ledger will magically resolve centuries of monetary dysfunction-how delightfully naïve. One might argue that sprucing up the terminology with buzzwords constitutes progress, albeit of the superficial variety.

Wow, Isabelle, you're really crushing the dream! 😱 But hey, maybe next week they'll invent a "transparent" blockchain that also prints money on demand! 😏

If you're looking to experiment with stablecoins for cross‑border invoicing, start by setting up a custodial wallet on a reputable exchange. Make sure the provider adheres to the local AML/KYC regs-otherwise you could end up with frozen assets. Also, keep an eye on the 1:1 reserve attestations; they change more often than you think.

From a theoretical standpoint, the coexistence of CBDCs and stablecoins could be modeled as a multi‑layered network where each layer possesses distinct settlement finality guarantees. 🚀 Such a framework permits granular policy interventions while preserving market‑driven liquidity provisions. 🌐

Exactly, Johnny! This layered view captures the essence of flexibility we need, and it also signals to innovators that there’s room to build on top of sovereign backbones without overstepping regulatory bounds.

Reading through the plethora of pilot projects, one cannot help but be struck by the sheer diversity of implementation choices across jurisdictions. Some nations have opted for a strictly permissioned ledger, while others experiment with hybrid models that straddle both permissioned and permissionless domains. This heterogeneity, while reflective of local regulatory preferences, also introduces a formidable challenge in terms of achieving seamless cross‑border interoperability. The technical specifications of the underlying consensus mechanisms often dictate the latency and finality characteristics, which in turn affect user experience. Moreover, the governance structures surrounding who can write to the ledger and under what conditions remain a contested topic. In many cases, central banks retain ultimate authority, yet they delegate day‑to‑day operations to commercial banks or fintech firms, creating a layered responsibility matrix. From an economic perspective, the introduction of programmable money could enable novel policy tools, such as targeted stimulus distribution, but it also raises concerns about privacy and the potential for negative interest rates to be enforced automatically. Stablecoins, on the other hand, bring the allure of speed and cost efficiency to cross‑border payments, but their reliance on private custodians introduces counterparty risk that regulators are still grappling to mitigate. The interplay between these two paradigms may ultimately yield a symbiotic ecosystem, where each fills the gaps left by the other. However, achieving that balance will require robust legal frameworks, clear reserve‑backing standards, and a concerted effort to harmonize technical standards across borders. The BIS “unified ledger” concept is a promising step, yet the road to widespread adoption is still fraught with uncertainty. Stakeholders must therefore approach integration with both optimism and caution, investing in modular architectures that can adapt to evolving regulatory landscapes. Ultimately, the success of this coexistence will be measured not only by transaction volumes but also by the degree to which financial inclusion is genuinely advanced. As we look ahead to 2030, the convergence of these technologies could redefine the very nature of money, blurring the lines between sovereign authority and private innovation. Only time will tell whether this vision materializes or collapses under the weight of its own complexity.

That was a great read. I actually tried setting up a sandbox for a CBDC test last month and spent way more time fixing node sync issues than I expected. My partner kept asking why I was up at 3 am, and I just told her it was “research”. Honestly, I think most people don’t realize how much personal time these experiments eat up. It makes you wonder if the payoff is worth the sacrifice.

The hype surrounding digital money often eclipses the simple truth: cash still reigns for many.

True, Paul, yet consider the poetic irony of a world where physical bills, etched with ink, coexist with invisible tokens dancing on a blockchain. The contrast paints a vivid tableau of transition, reminding us that progress is rarely linear.

Oh, because nothing says “forward thinking” like reinventing the wheel and calling it “innovation”.

haha yeah Jireh, it feels like we keep rehashing the same ideas 🙃 but at least the tech keeps getting faster, even if the marketing sounds the same.

Honestly!!! The whole CBDC‑stablecoin conversation is riddled!!! with buzzwords!!! and vague promises!!! that make it hard to separate fact from fiction!!!

Our country must prioritize sovereign digital solutions over foreign stablecoins to safeguard economic sovereignty and protect our citizens from external monetary influences.

While preserving sovereignty is crucial, collaborating with reputable stablecoin projects can also bring valuable expertise and accelerate financial inclusion for underserved communities.

It is a moral imperative that we scrutinize any technology that could erode personal freedom. When governments gain the ability to monitor every transaction in real time, we edge closer to a surveillance state.