- Home

- Cryptocurrency

- How Kazakhstan Rationed Electricity for Crypto Mining - And Why It Matters

How Kazakhstan Rationed Electricity for Crypto Mining - And Why It Matters

When China shut down crypto mining in 2021, thousands of mining rigs packed up and moved east - straight into Kazakhstan. What started as a quick win for the country’s economy quickly turned into a power crisis. By 2025, crypto miners were using more electricity than entire cities. The government had to act. So they didn’t just raise rates or slap on fines. They built a full state-controlled system to ration electricity like it was wartime fuel. And it’s working - mostly.

The Grid Wasn’t Built for Miners

Kazakhstan’s power grid was designed for factories, homes, and state-run infrastructure. Not for row after row of ASIC miners running 24/7. When Chinese operators arrived with billions of dollars in equipment, they didn’t ask permission. They just plugged in. Within two years, crypto mining consumed over 30% of the country’s total electricity output in some regions. In the winter, when heating demand spiked, schools and hospitals started experiencing blackouts. The government couldn’t ignore it anymore.How the Rationing System Works

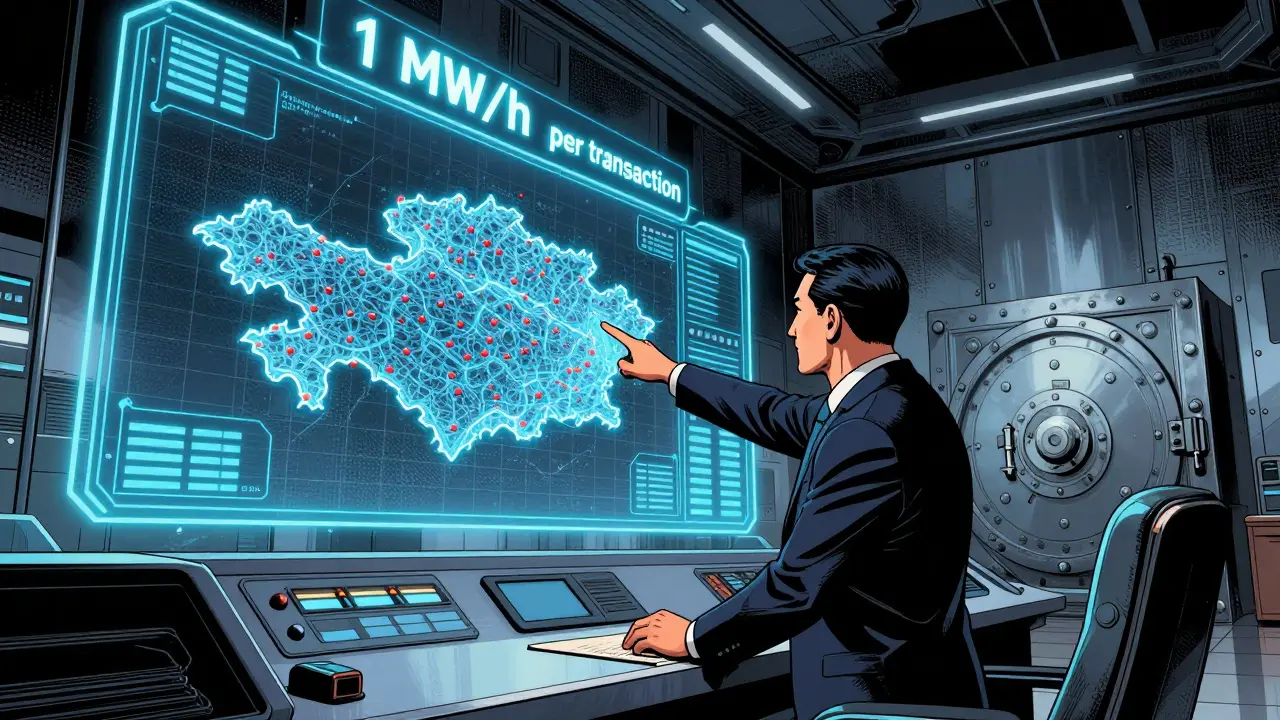

In 2023, Kazakhstan launched its state-run electricity marketplace. No more private deals. No more shady contracts with local utilities. Every legal miner must buy power through the Ministry of Energy’s platform - and they can only buy 1 megawatt-hour per transaction. That’s about what 100 home air conditioners use in an hour. To run a 10-megawatt farm, you need to make 10 separate purchases a day. It’s not just a limit - it’s a bottleneck. To get even that much, you need a license. There are only 84 licenses available. You also have to register every single mining machine in a national database. As of 2023, that’s 415,000 machines tracked down to the serial number. You can’t just buy a few rigs and start mining. You need paperwork, legal counsel, and a relationship with one of the five government-approved mining pools. And here’s the twist: you have to sell 75% of your mined cryptocurrency on the Astana International Financial Centre (AIFC) platform. That’s up from 50% in 2024. The government wants to control the flow of crypto out of the country - not just the electricity going in.

The .5 Million Heist

But not everyone plays by the rules. In October 2025, authorities in East Kazakhstan Oblast uncovered a massive illegal mining ring that had been stealing electricity for two years. Utility workers - people with access to meter readings and grid controls - were diverting power meant for hospitals, schools, and apartment buildings to hidden mining farms. The stolen energy? Over 50 megawatt-hours. That’s enough to power 60,000 people. The cash from selling the mined Bitcoin bought two luxury apartments in Nur-Sultan and four new cars. All of it was seized. This wasn’t an outlier. It was a symptom. The system works for those who follow the rules. But corruption runs deep. And the grid is still vulnerable.Who Wins? Who Loses?

The rationing system has reshaped the mining industry in Kazakhstan. Big players with capital - like Bitfarms or Core Scientific - can afford the legal fees, the compliance teams, and the time it takes to navigate the bureaucracy. They’ve even improved their efficiency by 40% over the past year, dropping their power use to 22.5 watts per terahash. That’s world-class. Small operators? They’re getting squeezed out. One miner in Almaty told investigators he had to shut down his 100-rig farm because he couldn’t afford the compliance costs. The 15% tax on profits, plus the 10-15% of operating expenses spent just on paperwork, made it unprofitable. He’s now working as a technician for a licensed farm. The government says this is intentional. They want high-value, compliant mining - not a wild west of underground rigs draining the grid. But critics argue it’s just creating a cartel: a few big companies with licenses, and everyone else either leaves or goes dark.

The Bigger Picture

Kazakhstan’s approach is unique, but it’s not isolated. Russia is now tracking every mining rig with a national registry. France is testing how to use idle nuclear plants for Bitcoin mining. Even Texas, the old mining capital, is debating whether to cap energy use for miners during peak demand. Kazakhstan’s 70/30 energy proposal - where foreign investors fund new power plants, and 70% of the output goes to the public grid while 30% is reserved for miners - could be the next step. It’s not about stopping mining. It’s about making it sustainable. The world is watching. If Kazakhstan can balance economic growth with energy security, it could become the model for other countries trying to tame the crypto mining beast. But if the corruption keeps leaking, and the grid keeps failing, then this rationing system won’t last. It’ll just be another failed experiment in controlling the uncontainable.What’s Next for Crypto Mining in Kazakhstan?

Legislators are now talking about decriminalizing crypto trading for people using licensed platforms. That’s a big shift. It means the government might start treating crypto not as a threat, but as a financial asset - if it’s regulated. The East Kazakhstan case is still under investigation. More arrests are expected. More utility employees will be fired. And the Ministry of Energy is rolling out new AI-powered monitoring tools to detect abnormal power usage in real time. For miners who still want to operate legally, the path is clear: get licensed, register every rig, buy power through the state platform, sell 75% on AIFC, pay the tax, and keep meticulous records. It’s expensive. It’s slow. But it’s the only way left. For everyone else? The lights might go out before you get the chance to plug in.Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

23 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

This is insane!!! The grid was never meant for this!!! They’re literally turning a country into a giant ASIC farm!!! And now they’re charging 75% of the crypto??!! Who even thought this up???

So let me get this straight - the government turned electricity into a lottery ticket and called it 'regulation'? Brilliant. Now only the rich can mine, and the rest get to watch their lights flicker. Classic.

I can’t believe this is real 😭 I mean, imagine your grandma’s heater going out because some dude in a warehouse is chasing 0.0001 BTC with 2000 rigs... I’m not mad, I’m just disappointed. And also kinda turned on? Idk anymore.

It is, without a doubt, a profoundly regressive and structurally unsound economic policy to institutionalize energy rationing through centralized bureaucratic control mechanisms, especially when those mechanisms are predicated upon the commodification of cryptographic assets that possess no intrinsic value. The fact that this is being hailed as a 'solution' speaks volumes about the intellectual bankruptcy of modern governance.

This is actually one of the smarter moves a developing country has made. Regulating energy use for crypto prevents collapse. The real win is forcing miners to contribute to the economy through the AIFC. Small miners? They should’ve planned better.

The systemic imbalance here is deeply troubling. While the state’s intent to safeguard public infrastructure is commendable, the exclusionary nature of the licensing regime risks entrenching oligarchic control over a nascent technological sector. This is not regulation - it is enclosure.

Dude. They’re stealing power from hospitals?? That’s not even crypto anymore. That’s just evil. I’m not even mad, I’m just like... wow. How do you sleep at night??

This is all a CIA plot. They want to control the world’s crypto through Kazakhstan so they can track your Bitcoin. The 75% sale rule? That’s the tracking chip. The grid failures? False flags. They’re coming for your wallet next.

So you’re telling me I can’t just buy a few rigs and make bank anymore?? Like?? That’s so unfair. I thought crypto was supposed to be free?? Now I gotta do paperwork?? Ugh.

The real question isn’t whether the system works - it’s whether we should be building systems at all that depend on energy-intensive digital speculation. Maybe the answer isn’t rationing. Maybe it’s rethinking the value we assign to mining itself.

Oh wow. So the government is basically saying 'you can mine, but only if you’re rich enough to afford lawyers and have a LinkedIn profile.' How innovative. I’m crying with laughter. And also, 75%? Who even is this AIFC? Some crypto Disney World?

I mean, I get it. The small guys are getting crushed. But let’s be real - if you didn’t have the capital to comply, you were always going to lose. This isn’t cruelty. It’s capitalism. And honestly? It’s cleaner than the chaos before.

They’re not stopping mining. They’re just making it boring. Like, who even wants to mine if you need a spreadsheet for every watt? This isn’t regulation. It’s a corporate HR seminar with power outlets.

Kazakhstan is demonstrating that state oversight can coexist with innovation. The key is transparency. Tracking every rig, requiring licensing - these are not burdens. They are foundations.

This is actually kind of inspiring? Like, imagine if every country had the guts to say 'no more chaos' and actually build a system instead of just letting the wild west burn? We need more of this. Go Kazakhstan!

The AI-powered monitoring infrastructure is a necessary evolution of energy governance. Real-time anomaly detection on the grid, coupled with blockchain-verified metering, creates a non-repudiable audit trail that mitigates systemic risk. This is infrastructural maturation.

I suppose one could argue that this is a pragmatic solution. But the aesthetic of it - the bureaucratic tedium, the soul-crushing compliance - is so profoundly uncool. Mining was supposed to be anarchic. Now it’s a corporate retreat with a server rack.

i love how theyre trying to fix it!! like yeah its messy but theyre actually doing something!! not just ignoring it like everyone else!! 💪✨ even if its slow and weird, its better than nothing!!

This is the kind of leadership we need. Not just reacting to crises, but designing systems that protect people first. The miners who left? They’ll find another country. The kids who keep their lights on? That’s the win.

It’s fascinating how a resource constraint becomes a filter for value. The market didn’t collapse. It just got more selective. Maybe that’s not a flaw - maybe it’s an upgrade.

Kazakhstan’s model offers a blueprint for emerging economies navigating the intersection of technological disruption and public infrastructure. The emphasis on regulatory clarity, energy equity, and financial integration is commendable and worthy of international study.

So you’re telling me the only reason this works is because the government is playing god with electricity? That’s not a system. That’s a dictatorship with Wi-Fi.

yesss finally someone is doing something real!!! no more chaos!!! go kazakhstan!!! 🚀🔥 the grid is saved and the future is bright!!!