- Home

- Cryptocurrency

- RATO Crypto Coin Explained: What Is Rato The Rat (RATO)?

RATO Crypto Coin Explained: What Is Rato The Rat (RATO)?

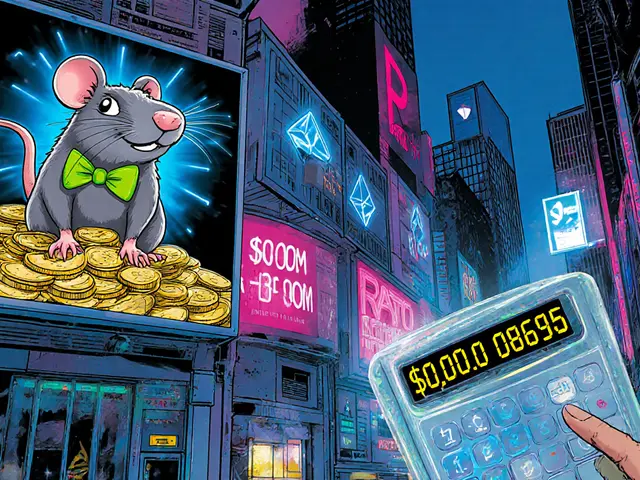

RATO Crypto Calculator

Current RATO Information

Price per Token: $0.00000008695

Market Cap: $368,000

Daily Volume: $279 - $233,240

Volatility: 20%+ Daily

Investment Scenario

Potential Investment Outcome

Ever stumbled on a bizarre meme token named Rato The Rat and wondered if it’s worth a glance? You’re not alone. Below you’ll find a no‑fluff rundown of what the RATO crypto coin actually is, how it works, where you can get it, and why the hype (or lack thereof) matters.

Key Takeaways

- RATO is an ERC‑20 meme token on Ethereum with a total supply of 420.69billion.

- It charges 0% transaction tax and its liquidity is permanently burned.

- Market cap hovers around $368k, with daily volume ranging from a few hundred to a few hundred thousand dollars.

- Price volatility exceeds 20% daily; expect big swings.

- Buying requires an Ethereum‑compatible wallet and access to a supported exchange (Binance, Phantom, etc.).

What Is Rato The Rat (RATO)?

Rato The Rat (RATO) is a meme cryptocurrency launched on the Ethereum blockchain. It is marketed as a peer‑to‑peer, zero‑tax digital token that anyone can send without a middleman. The token’s branding revolves around a cartoon rat, a nod to the "420" meme culture that also appears in its 420.69billion total supply.

Unlike Bitcoin or Ethereum, RATO offers no underlying utility beyond speculative trading. Its main selling points are the ultra‑low price per token (micro‑penny range) and the promise of permanent liquidity burn, which the developers claim adds a thin layer of price stability.

Technical Specs

- Blockchain: Ethereum (ERC‑20 standard)

- Contract address: 0xf816507e690f5aa4e29d164885eb5fa7a5627860

- Total supply: 420,690,000,000 tokens

- Circulating supply: 420.69billion (as of 2025‑10‑01)

- Transaction tax: 0%

- Liquidity: Permanently burned (no unlockable pool)

Because RATO lives on Ethereum, any wallet that supports ERC‑20 tokens-MetaMask, Trust Wallet, or a hardware wallet-can hold it. Gas fees are the same as any other Ethereum transaction, which can be a pain when the network is congested.

Market Data (October2025)

RATO’s price is a moving target. Different data aggregators report slightly different numbers because of low liquidity:

- CoinMarketCap lists $0.00000008695 per token.

- TradingView shows $0.00000098305.

Both values translate to a market cap of roughly $368k-$369k. Daily trading volume is erratic: CoinMarketCap reports $279, Phantom shows $4,500, and 3Commas spikes up to $233,240 on busy days. Volatility indicators range from 16.6% (CoinCodex) to 26.8% (TradingView), meaning price swings of a quarter of the token’s value can happen in a single day.

The all‑time low hit $0.0000000046 on 8May2025, while the recent high (early 2025) barely crossed $0.000001. Forecasts from platforms like LiteFinance and WalletInvestor suggest the token may hover near $0.000001 for the rest of the year, but the consensus is bearish.

How to Buy & Store RATO

- Set up an Ethereum wallet. Install MetaMask, create a strong password, and back up the seed phrase.

- Buy ETH. You’ll need Ether to pay gas fees. Purchase it on a major exchange (Binance, Coinbase, Kraken) and transfer it to your wallet.

- Find a market that lists RATO. Binance’s “listing” page occasionally shows it, but more often you’ll use smaller platforms like Phantom or decentralized exchanges (Uniswap) that support custom ERC‑20 tokens.

- Swap for RATO. On a DEX, paste the contract address (0xf816507e690f5aa4e29d164885eb5fa7a5627860) and trade a small amount of ETH for RATO. Start with a tiny amount to test slippage.

- Secure your tokens. After the trade, verify the RATO balance in your wallet and consider moving it to a hardware wallet if you plan to hold for any length of time.

Because liquidity is thin, large orders can move the price dramatically. Most traders keep trades under $500 to avoid excessive slippage.

Risks & Red Flags

- Low market cap. At under $400k, even a single whale can swing the price.

- Limited trading volume. Sparse order books mean you may not be able to exit a position without a big price impact.

- No real utility. RATO’s value is purely speculative; there’s no product, service, or ecosystem backing it.

- Potential manipulation. The burned‑liquidity model can be a double‑edged sword-once the pool is gone, price discovery becomes harder.

- Regulatory uncertainty. Meme tokens often fall under “utility token” definitions, but regulators could clamp down if they see consumer risk.

In short, treat RATO like a high‑risk lottery ticket. Only invest money you’re prepared to lose.

Comparison with Other Meme Tokens

| Metric | RATO | Dogecoin (DOGE) | Shiba Inu (SHIB) |

|---|---|---|---|

| Blockchain | Ethereum (ERC‑20) | Dogecoin (Own PoS) | Ethereum (ERC‑20) |

| Total Supply | 420.69B | 132B | 589T |

| Market Cap (Oct2025) | ≈ $368k | ≈ $9.8B | ≈ $5.2B |

| Daily Volume | $279-$233k (highly variable) | $600M+ | $300M+ |

| Transaction Tax | 0% | 0% | 0% (some community fees) |

| Liquidity Model | Permanently burned | Open market | Open market |

| Community Size | Very small, limited social presence | Hundreds of millions | Hundreds of millions |

The table shows why RATO is a niche player. It lacks the massive user base and liquidity that give DOGE and SHIB their staying power. Its 0% tax is nice, but without a strong community or real use‑case, the token remains a speculative gamble.

Future Outlook

Analysts from LiteFinance, TradingBeasts, and WalletInvestor all converge on a modest price ceiling around $0.000001 for the next few years. CoinCodex even predicts a short‑term dip below $0.0000005 by December 2025. In practical terms, unless RATO launches a unique utility, secures a partnership, or goes viral on a platform like TikTok, its upside is limited.

Regulatory trends are also leaning toward greater scrutiny of low‑cap tokens. If major exchanges tighten listing standards, RATO could lose the few remaining markets that currently host it, further squeezing liquidity.

Bottom line: treat RATO as a high‑risk, short‑term speculation. If you enjoy watching price charts and can afford to lose the entire stake, a tiny position might be fun. For anyone seeking long‑term growth or real-world use, look elsewhere.

Frequently Asked Questions

What does the RATO token actually do?

RATO is a meme token with no built‑in utility. Its only function is to be bought, sold, and held like any other ERC‑20 asset.

How can I check the real price of RATO?

Because liquidity is thin, prices differ across sites. The most reliable way is to look at a decentralized exchange (Uniswap) using the contract address, then compare that number to CoinMarketCap or TradingView for a broader view.

Is there any tax when I transfer RATO?

No. The token protocol sets a 0% transaction tax, so you only pay the standard Ethereum gas fee.

Where can I buy RATO?

RATO appears on a few centralized platforms like Binance (region‑dependent) and smaller exchanges such as Phantom. It is also available on decentralized exchanges like Uniswap; you’ll need ETH for the trade.

What are the biggest risks of holding RATO?

Low market cap, thin volume, no real use‑case, and the possibility of price manipulation are the core risks. Extreme volatility means you could lose most of your investment quickly.

Does RATO have a roadmap or upcoming developments?

As of October2025, the project has not published a public roadmap, partnership announcements, or major development updates. This lack of activity adds to the uncertainty.

Should I consider RATO for a long‑term portfolio?

Generally no. Long‑term crypto holdings should focus on assets with proven utility, network security, and community support. RATO’s speculative nature makes it unsuitable for a stable, long‑term strategy.

Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

Popular Articles

17 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

I just bought $20 worth... and now I'm just watching it dance. 😅 It's not investing, it's like betting on a squirrel running a race.

In India, we call this 'chalta hai' crypto-no utility, no roadmap, no team, but the chart looks pretty at 3 AM. The 0% tax is nice, but without community, it's just digital confetti. 🇮🇳

I read the whole thing. Honestly? It feels like reading a flyer for a garage sale that’s been out in the rain for a week. Still, I’m not mad. Sometimes the chaos is the point.

I’ve seen this before in Lagos-low cap, no team, zero transparency. But hey, if you’re playing with money you can afford to lose, go for it. Just don’t confuse it with finance. Stay safe out there.

This token is a linguistic and economic oxymoron. The very notion of a 'permanently burned liquidity pool' is a semantic fallacy-liquidity cannot be 'burned' in any meaningful financial sense. It is merely removed from circulation. The marketing is sophomoric.

The contract address is publicly listed. The whitepaper is nonexistent. The team is anonymous. The market cap is less than the average monthly rent in Austin. This is not a cryptocurrency. It is a social experiment in collective delusion.

I’ve held a few meme coins over the years. Most die quietly. Some explode. This one? It’s got the vibe of a campfire story someone told you at 2 a.m. You don’t believe it... but you still stare into the fire.

Ah yes, the classic '0% tax' gimmick. That’s like saying your lemonade stand has no sugar tax. Congrats, you’ve removed the only thing that makes the drink worth anything. Meanwhile, DOGE has a dog. SHIB has a whole ecosystem. RATO has... a cartoon rodent and a prayer.

I’m genuinely concerned about people treating this like an investment. You’re not building wealth-you’re funding someone’s weekend getaway. If you’re reading this and thinking 'I’ll just put in $500,' please, for the love of all that’s holy, go buy a book instead.

This is a Fed tool. The burn is fake. The liquidity was never real. They’re using this to drain retail wallets before the next crypto crash. You think you’re buying a meme? You’re buying a trapdoor.

I’ve traded this for two weeks. The slippage on $100 trades is wild. But honestly? It’s the only thing keeping me engaged in crypto right now. It’s not about returns-it’s about the ride. And the ride is bizarre.

I love how meme coins bring people together-even if it’s just to laugh at how ridiculous they are. 🐀💖 I bought a tiny bit just to feel part of the chaos. No regrets. (But I’m not selling my Bitcoin for this.)

The ERC-20 standard ensures compatibility, but the lack of a dev team or roadmap is a red flag that’s blinking like a broken neon sign. In emerging markets, this is called 'pump-and-dump 101.' Still, I admire the simplicity of the branding. The rat is oddly charming.

You think you’re smart for finding this? You’re just the next person who will cry when it hits zero. Real wealth is built with discipline, not memes. This isn’t finance. It’s a carnival game where the house always wins.

The contract address was deployed by a wallet that has since vanished. The 'burned liquidity' was likely never funded. This is a honeypot. The 420.69 billion supply? A distraction. They’re not selling RATO-they’re selling FUD to the gullible.

I appreciate the transparency in the risks outlined here. However, I must emphasize that speculative assets like this should never be included in any financial plan, regardless of how 'fun' they seem. The emotional toll of volatility is often underestimated.

I’ve seen this exact pattern before-low cap, no team, burned liquidity that’s actually just a rug pull in disguise. The only difference? This time they added a cartoon rat. Cute. But it doesn’t change the math.