BIB Meta: What It Is and Why It Matters in Crypto and Tokenized Assets

When you hear BIB Meta, a term used to describe low-effort, high-hype crypto projects built on borrowed credibility. Also known as shadow tokens, it usually shows up as a token with no team, no utility, and a name that sounds like it was pulled from a trending project—like PepsiCo Tokenized Stock (PEPX) or Landwolf WOLF. These aren’t innovations. They’re lookalikes. And they’re everywhere. You’ll find them in airdrop scams like Artify X CoinMarketCap, where fake promises of free ART tokens lured people into wallets that never paid out. Or in tokens like RUGAME (RUG), which had zero trading volume and no code updates—yet still had a website, a Twitter, and a Discord full of bots. BIB Meta isn’t a coin. It’s a blueprint for failure dressed up as opportunity.

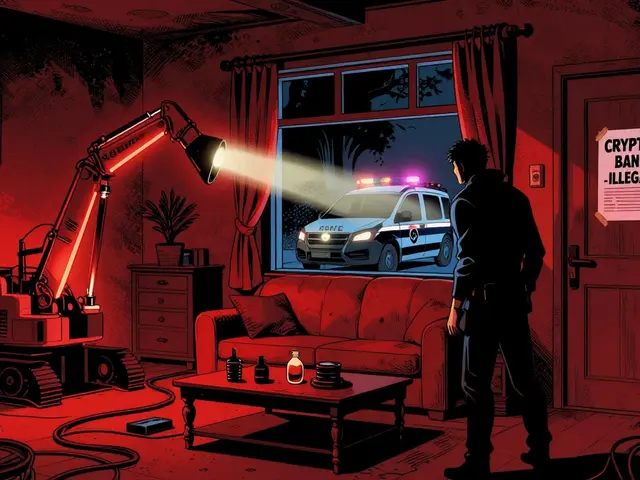

It thrives where trust is easy to fake. That’s why it shows up on decentralized exchanges, platforms like PulseX or UBIEX that offer low fees but no oversight. These platforms let anyone list a token with no verification, and that’s exactly where BIB Meta tokens go to live. They also show up in crypto airdrops, fake giveaways tied to CoinMarketCap or other trusted names. The KALATA and Starchi Launch airdrops weren’t just unverified—they were outright fabrications. No official announcement. No contract. Just a website asking you to send crypto to claim free tokens. That’s the BIB Meta playbook: use a real brand’s name, add a dash of urgency, and vanish before anyone checks the ledger. Even blockchain gaming, a space meant for real play-to-earn value, gets hijacked. DOGAMÍ (DOGA) and Dragonary had real backing, but many copycats popped up with the same theme—digital dogs, races, NFTs—only to disappear after a month. The real projects fight for users. The BIB Meta ones just take their money. You’ll see it in the data: tokens with 8 holders, zero liquidity, and no exchange listings. Tokens like BOHR (BR) and MERY that have no roadmap, no team, and no reason to exist beyond a ticker symbol. These aren’t investments. They’re traps.

What you’re looking at in this collection isn’t a list of coins. It’s a catalog of red flags. Each post here pulls back the curtain on a different BIB Meta variation—whether it’s a tokenized stock with no legal backing, a meme coin on Base chain with no utility, or a shutdown exchange like BitWell that vanished with users’ funds. You won’t find hype here. You’ll find facts: who’s behind it, what the numbers say, and whether it’s worth your time. If you’ve ever wondered why some crypto projects die before they launch, or why airdrops never pay out, this is your guide. The pattern is clear. Now you know how to spot it.