Blockchain Scaling: Solutions, Challenges, and Real-World Impact

When you send crypto, you expect it to arrive fast and cheap. But blockchain scaling, the process of making blockchains handle more transactions without slowing down or getting expensive. Also known as network throughput improvement, it’s what keeps DeFi, NFTs, and everyday payments from grinding to a halt. Without it, networks like Ethereum get clogged. Gas fees spike. Transactions take minutes—or hours. That’s not just annoying; it stops people from using crypto at all.

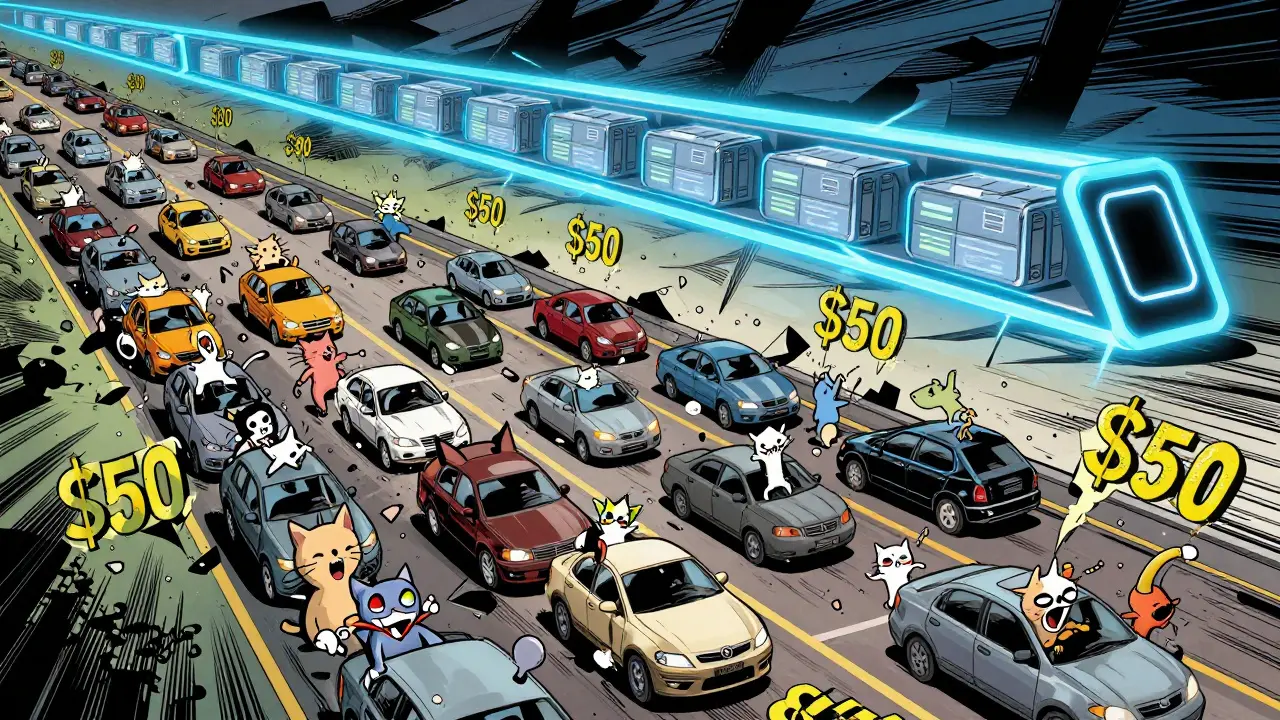

So how do you fix this? Layer 2 solutions, systems built on top of main blockchains to process transactions off-chain and then bundle them back. Think of them like express lanes on a highway. Projects like Arbitrum and Optimism use rollups to handle thousands of trades per second, then snap the results back to Ethereum. Then there’s sharding, splitting the blockchain into smaller pieces so each part handles its own load. Ethereum’s moving toward this with its 2.0 upgrade. And don’t forget state channels—like Lightning Network for Bitcoin—that let users trade directly with each other without touching the main chain until they’re done.

These aren’t just tech specs. They’re what make crypto useful in real life. In Nigeria, people use P2P platforms to trade crypto because their banks are slow. In Argentina, stablecoins help people protect their savings from inflation. But if those platforms can’t handle volume, they fail. That’s why scaling isn’t just for developers—it’s for anyone who wants crypto to work like cash. The posts below show you exactly how this plays out: from DeFi apps that rely on fast settlements, to exchanges that cut fees by using Layer 2, to tokens built on scalable chains that actually get used.

What you’ll find here aren’t theory papers. These are real reviews, breakdowns, and guides from people who’ve tried it. You’ll see how scaling affects fees, speed, and safety—whether you’re trading on Polygon, holding a token on Arbitrum, or wondering why some chains feel faster than others. No fluff. Just what works, what doesn’t, and why it matters for your wallet.