- Home

- Blockchain

- What Are Layer 2 Solutions for Blockchain? A Clear Guide to Scaling Ethereum and Beyond

What Are Layer 2 Solutions for Blockchain? A Clear Guide to Scaling Ethereum and Beyond

Layer 2 Solution Selector

Select what matters most for your use case to get personalized recommendations

Your Best Choices

Key Considerations for Your Priority

| Layer 2 | TPS | Avg Fee | Finality | EVM Compatible |

|---|---|---|---|---|

| Ethereum (Layer 1) | 15–30 | $1.20 | 13 seconds | Yes |

| Arbitrum One | 4,000 | $0.002 | 1–2 hours | Yes |

| Optimism | 3,500 | $0.001 | 1–2 hours | Yes |

| StarkNet | 2,000 | $0.0008 | 10–15 minutes | Partial |

| zkSync Era | 1,800 | $0.0005 | 10 minutes | Partial |

| Polygon PoS | 7,000 | $0.0003 | 2 seconds | Yes |

| Lightning Network | 100–1,000 | $0.00001 | Instant | No |

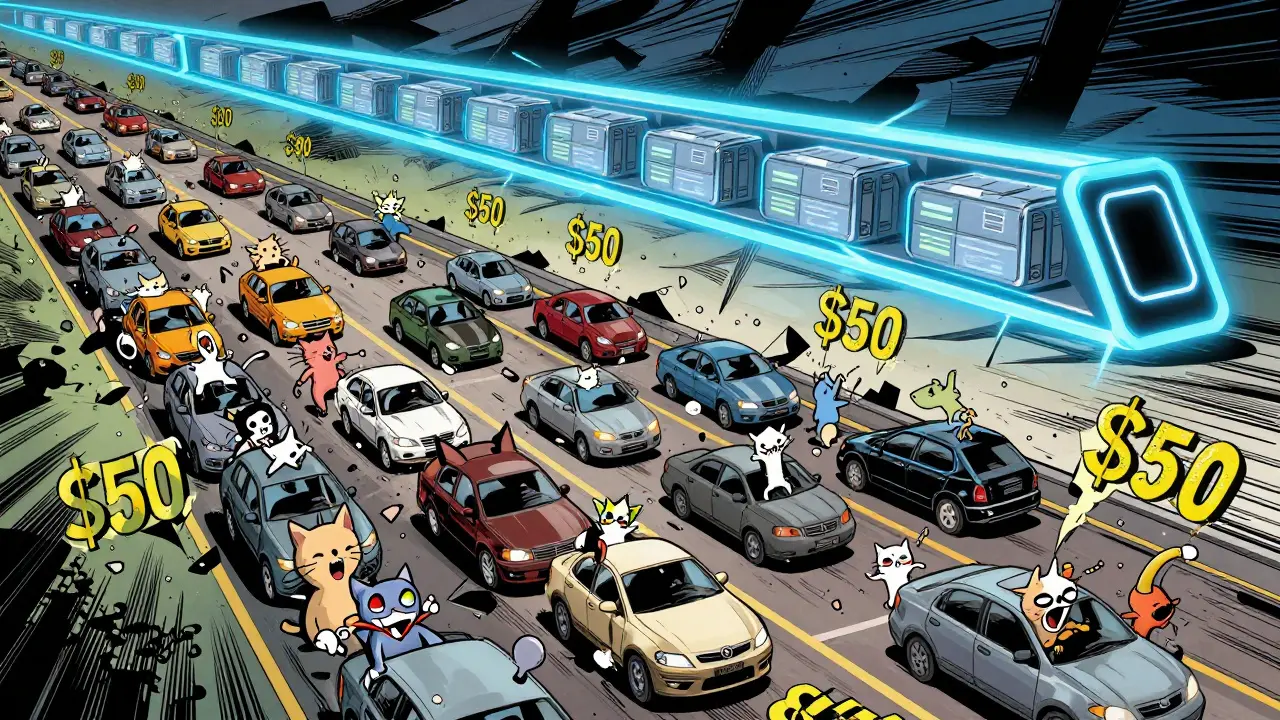

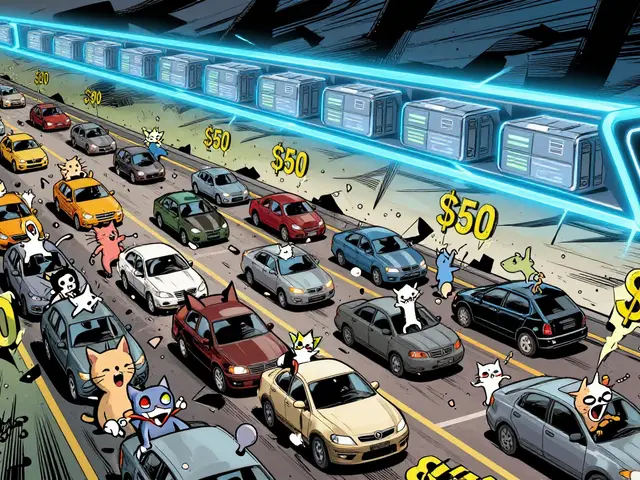

Blockchain networks like Ethereum were never built to handle millions of users. Back in 2017, when CryptoKitties flooded the network, transaction fees shot up to $50. People couldn’t send simple payments. The network choked. That’s when developers realized: Layer 2 solutions weren’t just nice to have-they were the only way forward.

What Exactly Is a Layer 2 Solution?

Think of Layer 1 as the main highway. It’s secure, decentralized, and slow. Layer 2 is like a parallel express lane built on top of it. Transactions happen off the main road, but their final results still get recorded back on Layer 1 for safety. This keeps the base chain from getting overloaded while keeping everything secure. Layer 2 doesn’t replace Ethereum or Bitcoin. It enhances them. It’s like adding more lanes to a highway without rebuilding the whole road. The core rules stay the same-no one can steal your money or fake a transaction. But now, thousands of transactions can happen in seconds, not minutes.The Three Main Types of Layer 2 Solutions

Not all Layer 2s work the same way. There are three big designs, each with trade-offs.- Rollups-The most popular today. They bundle hundreds of transactions into one single proof that gets sent back to Ethereum. There are two kinds: Optimistic Rollups and ZK-Rollups.

- State Channels-Like a private conversation between two people. You open a channel, do dozens of trades off-chain, then close it and settle once on the main chain. The Lightning Network for Bitcoin is the best-known example.

- Sidechains-These are separate blockchains that connect to Ethereum. They’re faster but don’t inherit Ethereum’s security. Polygon PoS is the biggest one, though some argue it’s not a true Layer 2.

Optimistic Rollups: The Easy Movers

Optimistic Rollups like Optimism and Arbitrum are the most used today. They assume all transactions are valid unless someone proves otherwise. If something looks fishy, anyone can challenge it within a 7-day window. That’s why withdrawals take about a week. They’re great because they’re fully compatible with Ethereum’s smart contracts. If you built a DeFi app on Ethereum, you can move it to Arbitrum with almost no changes. That’s why 65% of all Layer 2 activity happens here. But that 7-day wait? It’s a pain. And if you’re trying to move funds quickly, you’re stuck. Also, 87% of Optimism’s transactions are processed by a single sequencer node. That’s a centralization risk.ZK-Rollups: The Fast, Secure Option

ZK-Rollups like StarkNet and zkSync Era use math, not waiting. They generate a cryptographic proof (called a zk-SNARK) that proves all transactions are valid. That proof gets posted to Ethereum, and the network accepts it instantly. No 7-day wait. No fraud challenges. Transactions finalize in 10-15 minutes. Fees are as low as $0.0005. And because the proof is mathematically guaranteed, the security is stronger. The catch? Building apps for ZK-Rollups is harder. They don’t fully support Ethereum’s code yet. Developers need to learn new tools like Cairo or Zinc. That’s why they only handle about 32% of Layer 2 volume-but their growth is exploding. StarkNet hit 100,000 TPS in testnet. That’s over 6,000 times faster than Ethereum’s base layer.

State Channels: For Micropayments Only

State channels are perfect for tiny, repeated payments. Think of buying coffee with Bitcoin every day. You open a channel with the café, send 10 payments off-chain, then close it and settle one final transaction on Bitcoin. The Lightning Network does this for Bitcoin. Fees can be as low as one satoshi (a fraction of a cent). Speed? Instant. But you need to keep funds locked in the channel. And if your phone dies or you lose connection, you’re stuck. It’s not meant for NFTs, DeFi swaps, or complex smart contracts. It’s for micropayments-subscriptions, tipping, streaming payments. It’s elegant, but narrow.Sidechains: Fast, But Less Secure

Sidechains like Polygon PoS run their own blockchains with their own validators. They’re fast-7,000 transactions per second-and cheap. But they don’t use Ethereum’s security. If Polygon’s validators get hacked, your funds are at risk. That’s exactly what happened in March 2022. The Ronin sidechain (used by Axie Infinity) lost $625 million because hackers stole validator keys. It wasn’t a flaw in the sidechain’s design-it was a human failure. Sidechains are useful for gaming and apps that need speed over security. But if you’re moving large sums of money, stick with rollups.Performance Numbers: What’s Real?

Here’s how things stack up in real life as of late 2023:| Layer 2 | TPS | Avg Fee (USD) | Finality Time | EVM Compatible? |

|---|---|---|---|---|

| Ethereum (Layer 1) | 15-30 | $1.20 | 13 seconds | Yes |

| Arbitrum One | 4,000 | $0.002 | 1-2 hours | Yes |

| Optimism | 3,500 | $0.001 | 1-2 hours | Yes |

| StarkNet | 2,000 | $0.0008 | 10-15 minutes | Partial |

| zkSync Era | 1,800 | $0.0005 | 10 minutes | Partial |

| Polygon PoS | 7,000 | $0.0003 | 2 seconds | Yes |

| Lightning Network | 100-1,000 per channel | $0.00001 | Instant | No |

Why Everyone’s Moving to Layer 2

The numbers don’t lie. In early 2022, Layer 2 handled just 8% of Ethereum’s activity. By late 2023, it was 38%. That’s over 2 million daily transactions. DeFi apps like Uniswap now process 85% of their trades on Layer 2. OpenSea, the biggest NFT marketplace, sees 73% of sales there. Gamers on Axie Infinity pay $0.001 per transaction instead of $50. That’s not a tweak-it’s a revolution. Users notice it. One Reddit user said they did 50 Uniswap swaps for $0.03. On Ethereum, that same activity would’ve cost $75. That’s why 68% of users say fees are the #1 reason they use Layer 2.

The Big Problems Still Left

Layer 2 isn’t perfect. Here’s what still breaks:- Bridging is a nightmare. You need to move money from Ethereum to Arbitrum, then to StarkNet, then to Polygon. Each bridge is a different website, a different wallet setup. 42% of users report funds getting stuck. $1.2 billion has been lost in bridge hacks since 2021.

- Fragmentation. There are 17 different Ethereum Layer 2 bridges. Wallets like MetaMask support 97% of them, but you still have to manually switch networks. It’s confusing.

- Capital is spread too thin. Liquidity is split across dozens of chains. That makes DeFi yields lower and trading harder.

- Developer complexity. ZK-Rollups need new coding skills. Optimistic Rollups need to handle long withdrawal delays. It’s not easy to build on.

What’s Next? The Road Ahead

The future is getting clearer:- Proto-danksharding (coming in early 2024) will let Ethereum store Layer 2 data more efficiently. That could slash fees by 90%.

- Superchain (from Optimism) is trying to unify all Layer 2s into one shared ecosystem. Think of it as one highway with multiple exits.

- Polygon’s $1 billion investment in ZK-Rollups shows where the money’s going.

- Enterprise adoption is growing fast. JPMorgan processes $1 billion daily on its own Ethereum Layer 2 for institutional payments.

Should You Use Layer 2?

If you’re:- Trading DeFi tokens → Use Arbitrum or Optimism.

- Buying NFTs → OpenSea on Arbitrum is your best bet.

- Playing blockchain games → Check if the game runs on Polygon or zkSync.

- Doing micropayments → Try the Lightning Network on Bitcoin.

- Storing large sums → Stick to Ethereum mainnet until bridges get safer.

How to Get Started

1. Install MetaMask (it supports 97% of Layer 2s).Are Layer 2 solutions safe?

Yes, but with caveats. Rollups (Optimistic and ZK) inherit Ethereum’s security. ZK-Rollups are the safest-they use math to prove everything. Optimistic Rollups are secure too, but you must wait 7 days to withdraw. Sidechains like Polygon are less secure because they rely on their own validators. Bridge hacks are the biggest risk-not the Layer 2s themselves.

Do I need to buy a new token to use Layer 2?

No. You use ETH on all major Layer 2s. Some, like Polygon, have their own token (MATIC), but you don’t need it to send or receive ETH. The token is used for staking or paying gas on certain chains, but not for basic transfers.

Why are withdrawal times so long on Optimistic Rollups?

It’s a security feature. The 7-day delay gives anyone time to challenge a fraudulent transaction. If someone tries to cheat, they can be punished. ZK-Rollups don’t need this because they prove validity instantly with math. That’s why ZK-Rollups are faster to withdraw from.

Can I use my existing wallet on Layer 2?

Yes, if you use MetaMask, Coinbase Wallet, or Rainbow. These wallets automatically detect Layer 2 networks. Just add the network manually (like Arbitrum One or Optimism) using the network details from their official websites. You don’t need a new wallet.

Will Layer 2 make Ethereum obsolete?

No. Ethereum (Layer 1) is the foundation. Layer 2s depend on it for security and final settlement. Without Ethereum, Layer 2s would have no anchor. Think of Layer 1 as the bank vault and Layer 2 as the armored trucks moving cash around. The vault still holds everything secure.

Layer 2 solutions didn’t just fix Ethereum’s scaling problem-they made blockchain usable for everyday people. Fees dropped from $50 to pennies. Speed went from minutes to seconds. And the innovation is still accelerating. The future of blockchain isn’t on Layer 1. It’s on Layer 2.

Cormac Riverton

I'm a blockchain analyst and private investor specializing in cryptocurrencies and equity markets. I research tokenomics, on-chain data, and market microstructure, and advise startups on exchange listings. I also write practical explainers and strategy notes for retail traders and fund teams. My work blends quantitative analysis with clear storytelling to make complex systems understandable.

Popular Articles

21 Comments

Write a comment Cancel reply

About

DEX Maniac is your hub for blockchain knowledge, cryptocurrencies, and global markets. Explore guides on crypto coins, DeFi, and decentralized exchanges with clear, actionable insights. Compare crypto exchanges, track airdrop opportunities, and follow timely market analysis across crypto and stocks. Stay informed with curated news, tools, and insights for smarter decisions.

Layer 2s are just a bandaid on a broken system lol 🤡

The architectural distinction between rollups and sidechains is critical. Rollups inherit L1 security via cryptographic proofs or fraud proofs; sidechains delegate trust to independent validator sets. This is not semantics-it’s foundational to risk assessment in DeFi exposure.

Oh wow, so now we're supposed to trust some random zk-SNARKs instead of just using ETH? Classic crypto move. 😒

There’s an elegant philosophical symmetry here: Layer 2s don’t replace the foundation-they elevate the structure without altering its core integrity. This mirrors how civil infrastructure evolves: highways expand, but the bedrock remains unchanged. The real innovation isn’t technical-it’s epistemological. We’ve shifted from trusting nodes to trusting mathematical certainty. That’s not scaling. That’s enlightenment.

I've been using zkSync for 3 months now. Fees are near zero. Speed is insane. But the dev tools? Still in kindergarten. You need to learn Cairo, deal with weird memory constraints, and pray your contract compiles. It's like building a spaceship with LEGO bricks that sometimes melt. But when it works? Pure magic.

Optimistic rollups rely on a 7-day challenge window because they assume good faith. ZK rollups use zero-knowledge proofs to verify correctness without trust. One is a courtroom. The other is a theorem.

The data presented is largely accurate, though the characterization of Polygon PoS as a Layer 2 remains contentious within academic circles. Its consensus mechanism diverges significantly from Ethereum’s security model, rendering it a sidechain by conventional definition.

Everyone’s acting like Layer 2s are some miracle. Let’s be real: 87% of Optimism’s traffic goes through one sequencer. That’s not decentralization. That’s a single point of failure with a fancy name. And don’t get me started on bridge hacks. $1.2B gone because people thought ‘trustless’ meant ‘no one can steal from you’. Wake up.

I think the real win here is accessibility. Before Layer 2, crypto felt like a luxury. Now my cousin in rural India can swap tokens for less than the cost of a cup of tea. That’s not just tech progress. That’s human progress.

So you're telling me I have to wait a week to get my money out of Arbitrum... but I can move it to Polygon in 2 seconds? Sounds like someone’s trying to sell me a Ferrari with a broken gas pedal.

Been using Arbitrum for months. Fees are $0.002, transactions are instant, and I haven’t lost a cent. If you’re still on L1, you’re just paying for the privilege of being slow. No shame in upgrading.

ZK-Rollups? More like ZK-Rollups™. Mark my words: the government is already controlling the proving servers. They just let us think it’s decentralized. Watch them shut down StarkNet next year. 😈

You say ZK-Rollups are secure? Cool. Then why does every single one have a 3-month-old audit report? And why is the dev team always anonymous? Coincidence? I think not.

You missed the real issue: liquidity fragmentation. You can’t just swap ETH from Arbitrum to zkSync without losing 5% in slippage. And no one talks about how this kills yield farming. You’re not scaling-you’re creating a financial maze.

i just switched to optimism and my gas is like 1 cent now 😍 but why does my wallet keep saying ‘switch network’ like 7 times? why cant it just work??

The fact that you’re even calling Polygon a Layer 2 shows how low the bar has dropped. This isn’t innovation-it’s branding. Anyone who calls it a true L2 doesn’t understand blockchain architecture. Just say ‘sidechain’ and move on.

Start with Arbitrum. It’s the easiest. Bridge your ETH, switch networks, use Uniswap. Done. You’ll thank yourself later.

I just want to say... I’m so proud of how far we’ve come. From $50 fees to $0.0005? From 15 TPS to 7,000? It’s not just technology-it’s hope. Every time someone in a developing country uses crypto for the first time because it’s affordable, that’s a victory. We’re not just building chains-we’re building dignity.

This guide is 100% correct. I’m just here to say I didn’t read it.

Thank you for writing this so clearly! I shared it with my mom and she finally understands why I’m not just ‘gambling’ with crypto. 🙏❤️

Layer 2s are just a way for VC’s to rebrand their rug pulls as ‘innovation’. I’m still holding my ETH on mainnet. Let the peasants scale.